Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with as much requirements as you can Gower, Inc., a manufacturer of plastic products, reports the following manufacturing costs and account analysis classification

Please help with as much requirements as you can

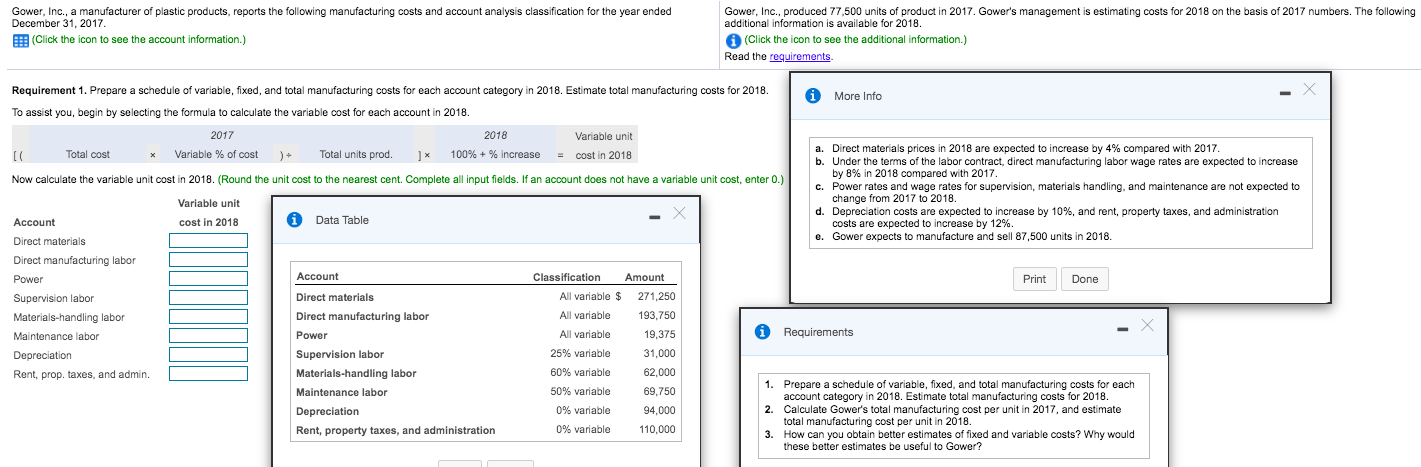

Gower, Inc., a manufacturer of plastic products, reports the following manufacturing costs and account analysis classification for the year ended December 31, 2017 (Click the icon to see the account information.) Gower, Inc., produced 77,500 units of product in 2017. Gower's management is estimating costs for 2018 on the basis of 2017 numbers. The following additional information is available for 2018. (Click the icon to see the additional information.) Read the requirements i More Info Requirement 1. Prepare a schedule of variable, fixed, and total manufacturing costs for each account category in 2018. Estimate total manufacturing costs for 2018. To assist you, begin by selecting the formula to calculate the variable cost for each account in 2018. 2017 2018 Variable unit Total cost * Variable % of cost )* Total units prod. * 100% + % increase cost in 2018 Now calculate the variable unit cost in 2018. (Round the unit cost to the nearest cent. Complete all input fields. If an account does not have a variable unit cost, enter O.) a. Direct materials prices in 2018 are expected to increase by 4% compared with 2017 b. Under the terms of the labor contract, direct manufacturing labor wage rates are expected to increase by 8% in 2018 compared with 2017 c. Power rates and wage rates for supervision, materials handling, and maintenance are not expected to change from 2017 to 2018. d. Depreciation costs are expected to increase by 10%, and rent, property taxes, and administration costs are expected to increase by 12%. e. Gower expects to manufacture and sell 87,500 units in 2018. Variable unit cost in 2018 i Data Table Print Done Account Direct materials Direct manufacturing labor Power Supervision labor Materials-handling labor Maintenance labor Depreciation Rent, prop. taxes, and admin. i Requirements Account Direct materials Direct manufacturing labor Power Supervision labor Materials-handling labor Maintenance labor Depreciation Rent, property taxes, and administration Classification All variable $ All variable All variable 25% variable 60% variable 50% variable 0% variable 0% variable Amount 271,250 193,750 19,375 31,000 62,000 69,750 94,000 110,000 L 1. Prepare a schedule of variable, fixed, and total manufacturing costs for each account category in 2018. Estimate total manufacturing costs for 2018. 2. Calculate Gower's total manufacturing cost per unit in 2017, and estimate total manufacturing cost per unit in 2018. 3. How can you obtain better estimates of fixed and variable costs? Why would these better estimates be useful to Gower? Gower, Inc., a manufacturer of plastic products, reports the following manufacturing costs and account analysis classification for the year ended December 31, 2017 (Click the icon to see the account information.) Gower, Inc., produced 77,500 units of product in 2017. Gower's management is estimating costs for 2018 on the basis of 2017 numbers. The following additional information is available for 2018. (Click the icon to see the additional information.) Read the requirements i More Info Requirement 1. Prepare a schedule of variable, fixed, and total manufacturing costs for each account category in 2018. Estimate total manufacturing costs for 2018. To assist you, begin by selecting the formula to calculate the variable cost for each account in 2018. 2017 2018 Variable unit Total cost * Variable % of cost )* Total units prod. * 100% + % increase cost in 2018 Now calculate the variable unit cost in 2018. (Round the unit cost to the nearest cent. Complete all input fields. If an account does not have a variable unit cost, enter O.) a. Direct materials prices in 2018 are expected to increase by 4% compared with 2017 b. Under the terms of the labor contract, direct manufacturing labor wage rates are expected to increase by 8% in 2018 compared with 2017 c. Power rates and wage rates for supervision, materials handling, and maintenance are not expected to change from 2017 to 2018. d. Depreciation costs are expected to increase by 10%, and rent, property taxes, and administration costs are expected to increase by 12%. e. Gower expects to manufacture and sell 87,500 units in 2018. Variable unit cost in 2018 i Data Table Print Done Account Direct materials Direct manufacturing labor Power Supervision labor Materials-handling labor Maintenance labor Depreciation Rent, prop. taxes, and admin. i Requirements Account Direct materials Direct manufacturing labor Power Supervision labor Materials-handling labor Maintenance labor Depreciation Rent, property taxes, and administration Classification All variable $ All variable All variable 25% variable 60% variable 50% variable 0% variable 0% variable Amount 271,250 193,750 19,375 31,000 62,000 69,750 94,000 110,000 L 1. Prepare a schedule of variable, fixed, and total manufacturing costs for each account category in 2018. Estimate total manufacturing costs for 2018. 2. Calculate Gower's total manufacturing cost per unit in 2017, and estimate total manufacturing cost per unit in 2018. 3. How can you obtain better estimates of fixed and variable costs? Why would these better estimates be useful to GowerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started