Answered step by step

Verified Expert Solution

Question

1 Approved Answer

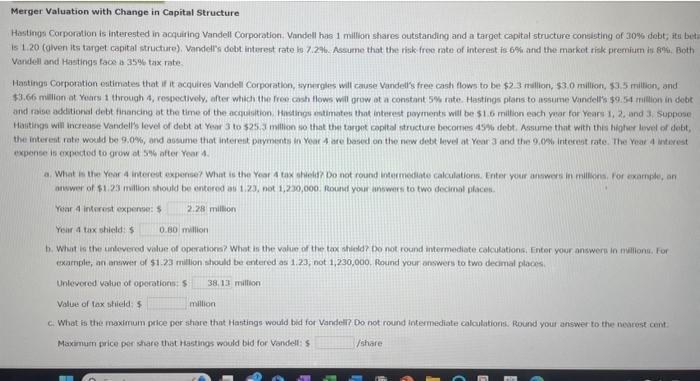

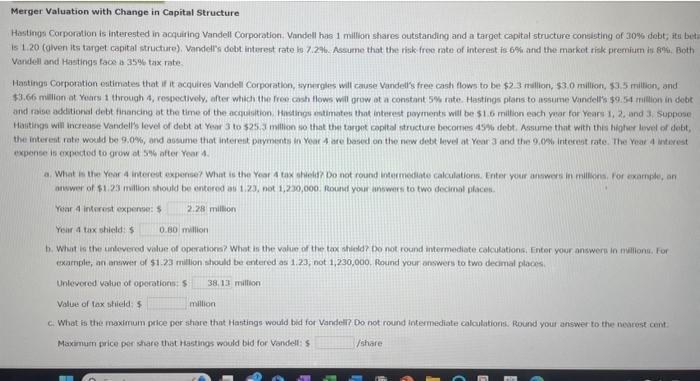

please help with b and c Merger Valuation with Change in Capital structure Hastinon Corporation is interested in acquiring Vandell Corporation. Vandall has 1 million

please help with b and c

Merger Valuation with Change in Capital structure Hastinon Corporation is interested in acquiring Vandell Corporation. Vandall has 1 million shares outstanding and a target, capital structure consisting of a09 debt; its bet Vandell and Hejstings face a 35% tax nate. Hastings Corporation eatimates that if it acquires Vandell Corporation, synargles will cause Vandells free cash flows to be $2.3 inallion, $3.0 million, $3.5 miltion, and \$3.66 milition at Yoacs 1 through 4 , respectivoly, after which the free cash flows will orow ot a constant 5% rate. Hastings plans to assurne Vandellis $9.54 million in debe the interent rate woxid be 9.0%, and aosume that interest piryments in Year 4 core based on the new debt level at Year 3 and the 9.0% interest rate. The Year 4 intivest expense is expected to grow of 546 after Year 4. anwer of $1.23 imaltion Nhould be entered as 1,23, not 1,200,000. Round your unswers to two decimal places. Yaar 4 interonst expenve: s million Yeir a tux ahield 5 mulilion exarnple, an answes of $1.23 milion should be entered as 1.23 , not 1,230,000. Pound your answers to two decimal places. Unlevered value of operations: $ miltion Value of tax shieid: 5 mallion c. What is the maximum palce per share that Hastings would bid for Vandell? Do not round intermediate calculations. Round youi answer to the nevrest cant Maxinum price per share that Hastines would bid for Vandell: $ /share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started