Question: please help with balance sheet (green boxes only) in last 3 pictures. thank you! Excel File Edit View insert Format Tools Data Window Help 0

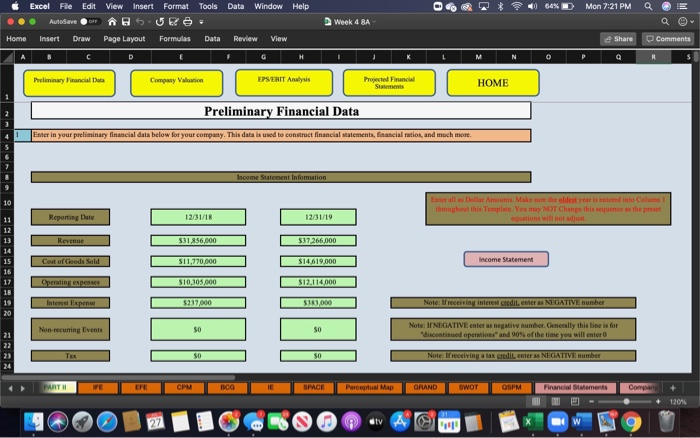

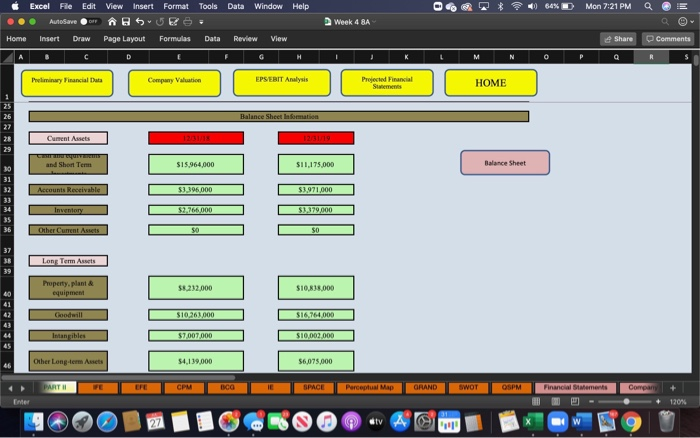

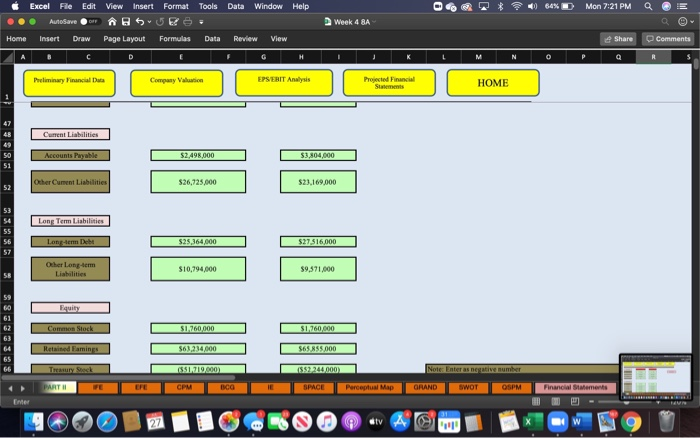

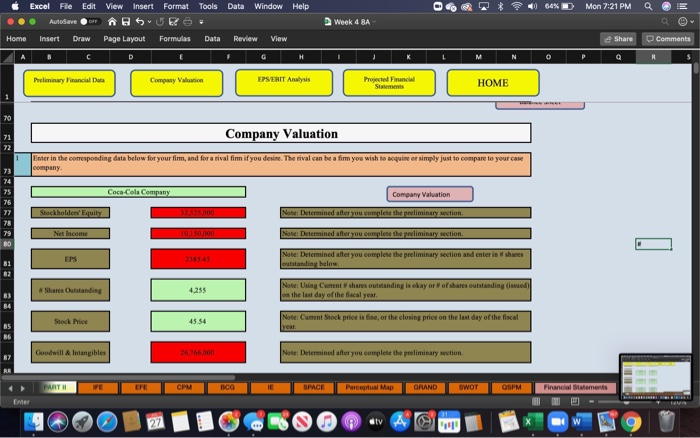

Excel File Edit View insert Format Tools Data Window Help 0 64% Mon 7:21 PM Q AutoSave DF Week 4 BA a Home Insert Draw Page Layout Formulas Data Review View Share Comments D G Q A Preliminary Financial Company Valuation EPSERIT Analysis Projected Financial Sweet HOME Preliminary Financial Data 1 Enter in your preliminary financial data below for your company. This data is used to construct financial statements, financial ratios, and much more. Income Statement Information 10 Pateralls Dollar Aments. Make sure the oldest year is entered into Column throughout this Template. You muy NOT Change this sequence as the pret equations will not adjust Reporting Date 12/31/18 12/31/19 Revenue $31.856,000 $37,266,000 Cost of Goods Sold $11,770,000 $14,619.000 Income Statement 11 12 13 14 15 16 17 18 19 20 BABARE Operating expenses $10,305,000 $12,114,000 $237,000 $180,000 Note: I receiving interest gredi, enters NEGATIVE number Non-recurring Events = 50 Note: I NEGATIVE enter as negative number. Generally this line is for discontinued operations and 90% of the time you will entero 21 22 21 SO $0 Note: If receiving a tax credit, enter as NEGATIVE number PART 1 CPM SPACE Perceptual Map GRAND SWOT OSPM Financial Statements Company 120% Data Window Help 64% Mon 7:21 PM Q Excel File Edit View Insert Format Tools AutoSave ASJE: Home Insert Draw Page Layout Formulas Data Week 4 BA Review View Share Comments H Q R Preliminary Financial Company Valuation EPSERIT Analysis Projected Financial Siemens HOME Balance Sheet Information 26 27 28 Cument Assets 1231/18 and Short Term $15.964,000 $11,175.000 Balance Sheet 31 32 Accounts Receivable $3.396,000 $3.971.000 Inventory $2.766,000 34 35 $1.179.000 Other Current Assets 90 Long Term Ats 38 39 Property, planta equipment $8.232.000 $10,838,000 Goodwill $10.263.000 $16.764,000 44 Intangibles $7.007.000 $10.002.000 Other Long-term Assets 54,139,000 56,075,000 PART CPM BCG SPACE Perceptual Map GRAND SWOT OSPM Financial Statements Company Data Window Help 64% Mon 7:21 PM Q Excel File Edit View Insert Format Tools Aurave ASE: Home Insert Draw Page Layout Formulas Data Week 4 BA Review View Share Comments B C D H R Preliminary Financial Company Valuation EPSERIT Analysis Projected Financial Stats HOME 47 Current Liabilities 49 50 Accounts Payable $2.498,000 $3,804,000 51 Other Cument Liabilities $26,725,000 $23,169,000 52 53 Long Term Liabilities 54 55 56 57 Long-term Debt $25,364,000 $27516,000 Other Long-term Liabilities $10,794,000 $9,571,000 59 GO Equity 61 62 63 Common Stock $1,760,000 51,760,000 Reine Famines $63,234,000 $65.855.000 65 66 (551,219.000 1552 244.000) Note Enteras negative number PART CPM SPACE Perceptual Map GRAND SWOT OSPM Financial Statements Data Window Help o 64% Mon 7:21 PM Q Excel File Edit View Insert Format Tools AutoSave ASJE: Home Insert Draw Page Layout Formulas Data Week 4 BA Review View Share Comments G H Q A Preliminary Financial Company Vaio EPSERIT Analysis Projected Financial Stats HOME 70 71 72 Company Valuation 1 Enter in the corresponding data below for your firm, and for a rival firm if you desire. The rival can be a firm you wish to acquire or simply just to compare to your case company 73 74 75 76 Coca-Cola Company Company Valuation Stockholders' Equity Note: Determined after you complete the preliminary section 78 79 0 Net Income 10.150.000 Note: Determined after you complete the preliminary section. - EPS 2154 Note: Determined after you complete the preliminary section and enter in shares outstanding below 81 82 # Shares Outstanding 4.255 Note: Using Current shares outstanding is okay or of shares outstanding (sued) on the last day of the fiscal year. 83 84 Stock Price 45.54 Note: Current Stock price is fine, or the closing price on the last day of the fiscal year 86 Goodwill Intangibles Note: Determined after you complete the preliminary section RA EE PART CPM SPACE Perceptual Map GRAND SWOT OSPM Financial Statements Enter Excel File Edit Data Window Help 0 64% Mon 7:21 PM Q Aurave View Insert Format Tools ABSJE: Page Layout Formulas Data Week 4 BA Home Insert Draw Review View Share Comments C D Q Preliminary Financial Company Valuation EPSEBIT Analysis Projected Financial Statements HOME 1 107 108 EPS/EBIT Analysis Enter in the corresponding data below for your fim. 109 110 2 if you notice little to no change in EPS with stock vs debt financing the total amount of your recommendations is likely too low.Unless of course, you are recommending defensive strategies where you are not acquiring substantial new capital. 111 112 Pessimistic Realistic Optimistic 114 EPS/EBIT Analysis EBIT $7.000 $9,000 $11,000 116 117 118 EPSEBIT Data Amounted Needed $5,000 Note: This number is the total cost of your recommendations. 119 120 121 Interest Rate 005 Note: Enter as a decimal Tax Rate 021 Note Enteras decimal 123 124 125 126 Share Outstanding Note: Enter in under Company Valuation on this pare New Shares Outstanding Note: Calculated automatically 128 PART 1 CPM BCG IE SPACE Perceptual Map GRAND SWOT OSPM Financial Statements Enter Data Window Help 64% Mon 7:21 PM Q Excel File Edit View Insert Format Tools Autosave DF ASE: Home Insert Draw Page Layout Formulas Data Week 4 BA Review View Share Comments A C D G H R Preliminary Financial Data Company Valuation EPS EBIT Analysis Projected in Sa HOME 1 127 128 New Shares Outstanding Note: Calculated automatically 129 Stock Price Note: Enter in under Company Valuation on this page Combination Financing Data Percent Equity Used to Finance 50% Note: Enter as a decimal 130 131 132 133 134 135 136 137 138 Percent Debt Used to Finance 50% Note: Enter as a decimal Total Equity and Debt Note: Mustequal 1.0. Check the two line items above. 139 140 Projected Financial Statements 141 Start with the income statement and work your way from top to bottom. Take extreme care to read and understand all notes provided by each line item. See Chapter 8 in the David & David textbook for examples and guidelines in developing projected financial statements 142 After completing the income statement, begin the balance sheet starting with the dividends to pay" line near the bottom, finish the equity section of the balance sheet first, then work your way up the statement to the liabilities section, then onto the assets, using the top row (Cash) as the plug figure. A detailed note beside the cash line mem explains further 10 144 1 Take care to read all notes to the right of the line items. Consult Chapter 8 of the David & David textbook for excellent explanations and tips for constructing projected 145 PART FE CPM BCG SPACE Perceptual Map GRAND SWOT OSPM Financial Siements Data Window Help 64% Mon 7:21 PM Q Excel File Edit View Insert Format Tools AutoSave ASJE: Home Insert Draw Page Layout Formulas Data Week 4 BA Review View Share Comments D G H Q R Preliminary Financial Company Valuation EPSERIT Analysis Projected Financial Stats HOME 1 REW TREE 150 Projected Years (earliest to latest) Income Statement Historical Numbers (see notes) 151 Projected Reporting Date 12/31/20 12/31/21 12/31/22 Historical Percent Notes Below. Enter you describe 152 153 Revenues 1795 Historical Note: Difference the two most expect based on your recommendations Enteras percent 154 155 Cost of Goods Sold Historical Note: Percent Sales in the me projected years unless you believe COGS percent 156 157 Operating Ixpenses Historical Note: Percent of Sales in the me projected years unless you believe Operat drastically. The 150 159 Historical Note: Dollar amount of interest dollar amounts of interest you will forecas payment was $500 and you plan on a $20 enteria 20 for Interest Expense 53000 PART 1 CPM SPACE Perceptual Map GRAND SWOT OSPM Financial Statements Ener Data Window Help 0 64% Mon 7:21 PM Q Excel File Edit View Insert Format Tools Autosave ASJE: Home Insert Draw Page Layout Formulas Data Week 4 BA Review View Share Comments D G H Q R Preliminary Financial Company Valuation EPSERIT Analysis Projected in Statements HOME Interest Expense 5161.000 Historical Note: Dollar amount of interest dollar amounts of interest you will forecas payment was $500 and you plan on a $20 enter in $20 for year one. If financing the more than if financing through equity. En expense than the year before enter as a ne 160 161 Tax Historical Note: Tax Rate in most recent y unless you expect a large increase/decreas per 163 Non-Recurring Hvem Historical Note: Dollar amount of Non-Re cumulative Safe to forecast this number a 164 165 166 167 168 Scroll Down for Balance Sheet 169 170 171 172 173 174 Work from the botom of the Projected Balance Sheet to the top 175 Prested cars fonds Perceptual Map GRAND PART 1 CPM BCO SPACE SWOT OSPM Financial Statements IMM Ener Data Window Help 64% Mon 7:21 PM Q Excel File Edit View Insert Format Tools AutoSave OF ASJE: Home Insert Draw Page Layout Formulas Data Week 4 BA Review View Share Comments D G H Q R Preliminary Financial Company Valuation EPSERIT Analysis Projected Financial Stats HOME 124 175 Projected Year (earliest to latest) Start Balance Sheet at the bottom Historical Dollar Amount Paid 176 177 Read the message to the right, then start at the bottom with dividends The projected Balance Sheet is desig DOLLAR VALUES (for PPE, Goodwi values to the existing numbers. For projected year 1, but you estimate you prior year) just enter in 5200 51,000 will use the equation (5200+ most rece yea 178 179 12/31/20 123122 180 Cash and Equivalente 511,175.000 595,201.000 5133.036.000 Historical Note: If your cash number textbook for more information. Also.com may need to make adjustments to your med is name for any firm to have accepta 182 183 184 Accounts Receivable 105 Historical Note:Percent of revenues in three projected years unless you believe drastica 186 187 188 Other Current Assets Property Plant 5.000 Historical Nord PART 1 CPM SPACE Perceptual Map GRAND SWOT OSPM Financial Statements Ener Data Window Help 0 64% Mon 7:21 PM Q Excel File Edit View Insert Format Tools Aurave ASJE: Home Insert Draw Page Layout Formulas Data Week 4 BA Review View Share Comments D G H Q R Preliminary Financial Company Vio EPSERIT Analysis Projected Financial Stats HOME 180 187 Other Cument Aucts 189 189 Property Plant Equipment 510,635.000 190 Goodwill Historical Note: The values are for the cumulative) dollar amounts for each iten Equivalents line). If you are purchasing Year 1, simply enter 200 into the fint PP&E by 5100, then you would enter in a still plan to purchase the other $200). Tak the numbers entered. Reread $16.764.000 OD! DIDO QILDI 191 192 Intangibles 510.002.000 194 Other Long-Term Assets Historical Note: Percent of revenues int three projected years unless you believe change dat 195 196 197 Liabilities 12/31/20 198 199 200 Accounts Payable Historical Note: Percent of revenues in three projected years unless you believe drasticall Other Curent Liabilities 201 202 Long-Term Date Historical Note: The values are for them cumulative) dollar amounts for each item plan to take $1.000 in deb 327.516.000 PART 1 CPM SPACE Perceptual Map GRAND SWOT OSPM Financial Statements Ener Data Window Help 64% Mon 7:21 PM Q Excel File Edit View Insert Format Tools AutoSave OF ABSJE: Home Insert Draw Page Layout Formulas Data Week 4 BA Review View Share Comments B D G H Q Preliminary Financial Company Valentin EPSERIT Analysis Projected in Stats HOME 1 204 Other Long-Term Liabilities Historical Note: Percent of revenues in three projected years unless you believe will change din 205 206 Equity 12/30/22 Common Stock 207 200 200 210 211 212 Treasury Stock Historical Note: The values are for the me not cumulative) Dollar amounts for each Stock, you may need to make an adjust negative her Read ever CH Paid in Capital & Other 213 214 Retained Faming 65,853,000 36.283.000 16.000 16.000 Historical Note: The Retained Famings va additional (not cumulative) Retained Ean 215 216 Total Nvidends to Pay SHER Bater the total del If none, enter. This line is not dividends. For example, in the firm paid payments, enters in projected year $1,100 inte projected year I box. Check START HERE 217 210 PART CPM SPACE Perceptual Map GRAND SWOT O5PM Financial Statements Ener Excel File Edit View insert Format Tools Data Window Help 0 64% Mon 7:21 PM Q AutoSave DF Week 4 BA a Home Insert Draw Page Layout Formulas Data Review View Share Comments D G Q A Preliminary Financial Company Valuation EPSERIT Analysis Projected Financial Sweet HOME Preliminary Financial Data 1 Enter in your preliminary financial data below for your company. This data is used to construct financial statements, financial ratios, and much more. Income Statement Information 10 Pateralls Dollar Aments. Make sure the oldest year is entered into Column throughout this Template. You muy NOT Change this sequence as the pret equations will not adjust Reporting Date 12/31/18 12/31/19 Revenue $31.856,000 $37,266,000 Cost of Goods Sold $11,770,000 $14,619.000 Income Statement 11 12 13 14 15 16 17 18 19 20 BABARE Operating expenses $10,305,000 $12,114,000 $237,000 $180,000 Note: I receiving interest gredi, enters NEGATIVE number Non-recurring Events = 50 Note: I NEGATIVE enter as negative number. Generally this line is for discontinued operations and 90% of the time you will entero 21 22 21 SO $0 Note: If receiving a tax credit, enter as NEGATIVE number PART 1 CPM SPACE Perceptual Map GRAND SWOT OSPM Financial Statements Company 120% Data Window Help 64% Mon 7:21 PM Q Excel File Edit View Insert Format Tools AutoSave ASJE: Home Insert Draw Page Layout Formulas Data Week 4 BA Review View Share Comments H Q R Preliminary Financial Company Valuation EPSERIT Analysis Projected Financial Siemens HOME Balance Sheet Information 26 27 28 Cument Assets 1231/18 and Short Term $15.964,000 $11,175.000 Balance Sheet 31 32 Accounts Receivable $3.396,000 $3.971.000 Inventory $2.766,000 34 35 $1.179.000 Other Current Assets 90 Long Term Ats 38 39 Property, planta equipment $8.232.000 $10,838,000 Goodwill $10.263.000 $16.764,000 44 Intangibles $7.007.000 $10.002.000 Other Long-term Assets 54,139,000 56,075,000 PART CPM BCG SPACE Perceptual Map GRAND SWOT OSPM Financial Statements Company Data Window Help 64% Mon 7:21 PM Q Excel File Edit View Insert Format Tools Aurave ASE: Home Insert Draw Page Layout Formulas Data Week 4 BA Review View Share Comments B C D H R Preliminary Financial Company Valuation EPSERIT Analysis Projected Financial Stats HOME 47 Current Liabilities 49 50 Accounts Payable $2.498,000 $3,804,000 51 Other Cument Liabilities $26,725,000 $23,169,000 52 53 Long Term Liabilities 54 55 56 57 Long-term Debt $25,364,000 $27516,000 Other Long-term Liabilities $10,794,000 $9,571,000 59 GO Equity 61 62 63 Common Stock $1,760,000 51,760,000 Reine Famines $63,234,000 $65.855.000 65 66 (551,219.000 1552 244.000) Note Enteras negative number PART CPM SPACE Perceptual Map GRAND SWOT OSPM Financial Statements Data Window Help o 64% Mon 7:21 PM Q Excel File Edit View Insert Format Tools AutoSave ASJE: Home Insert Draw Page Layout Formulas Data Week 4 BA Review View Share Comments G H Q A Preliminary Financial Company Vaio EPSERIT Analysis Projected Financial Stats HOME 70 71 72 Company Valuation 1 Enter in the corresponding data below for your firm, and for a rival firm if you desire. The rival can be a firm you wish to acquire or simply just to compare to your case company 73 74 75 76 Coca-Cola Company Company Valuation Stockholders' Equity Note: Determined after you complete the preliminary section 78 79 0 Net Income 10.150.000 Note: Determined after you complete the preliminary section. - EPS 2154 Note: Determined after you complete the preliminary section and enter in shares outstanding below 81 82 # Shares Outstanding 4.255 Note: Using Current shares outstanding is okay or of shares outstanding (sued) on the last day of the fiscal year. 83 84 Stock Price 45.54 Note: Current Stock price is fine, or the closing price on the last day of the fiscal year 86 Goodwill Intangibles Note: Determined after you complete the preliminary section RA EE PART CPM SPACE Perceptual Map GRAND SWOT OSPM Financial Statements Enter Excel File Edit Data Window Help 0 64% Mon 7:21 PM Q Aurave View Insert Format Tools ABSJE: Page Layout Formulas Data Week 4 BA Home Insert Draw Review View Share Comments C D Q Preliminary Financial Company Valuation EPSEBIT Analysis Projected Financial Statements HOME 1 107 108 EPS/EBIT Analysis Enter in the corresponding data below for your fim. 109 110 2 if you notice little to no change in EPS with stock vs debt financing the total amount of your recommendations is likely too low.Unless of course, you are recommending defensive strategies where you are not acquiring substantial new capital. 111 112 Pessimistic Realistic Optimistic 114 EPS/EBIT Analysis EBIT $7.000 $9,000 $11,000 116 117 118 EPSEBIT Data Amounted Needed $5,000 Note: This number is the total cost of your recommendations. 119 120 121 Interest Rate 005 Note: Enter as a decimal Tax Rate 021 Note Enteras decimal 123 124 125 126 Share Outstanding Note: Enter in under Company Valuation on this pare New Shares Outstanding Note: Calculated automatically 128 PART 1 CPM BCG IE SPACE Perceptual Map GRAND SWOT OSPM Financial Statements Enter Data Window Help 64% Mon 7:21 PM Q Excel File Edit View Insert Format Tools Autosave DF ASE: Home Insert Draw Page Layout Formulas Data Week 4 BA Review View Share Comments A C D G H R Preliminary Financial Data Company Valuation EPS EBIT Analysis Projected in Sa HOME 1 127 128 New Shares Outstanding Note: Calculated automatically 129 Stock Price Note: Enter in under Company Valuation on this page Combination Financing Data Percent Equity Used to Finance 50% Note: Enter as a decimal 130 131 132 133 134 135 136 137 138 Percent Debt Used to Finance 50% Note: Enter as a decimal Total Equity and Debt Note: Mustequal 1.0. Check the two line items above. 139 140 Projected Financial Statements 141 Start with the income statement and work your way from top to bottom. Take extreme care to read and understand all notes provided by each line item. See Chapter 8 in the David & David textbook for examples and guidelines in developing projected financial statements 142 After completing the income statement, begin the balance sheet starting with the dividends to pay" line near the bottom, finish the equity section of the balance sheet first, then work your way up the statement to the liabilities section, then onto the assets, using the top row (Cash) as the plug figure. A detailed note beside the cash line mem explains further 10 144 1 Take care to read all notes to the right of the line items. Consult Chapter 8 of the David & David textbook for excellent explanations and tips for constructing projected 145 PART FE CPM BCG SPACE Perceptual Map GRAND SWOT OSPM Financial Siements Data Window Help 64% Mon 7:21 PM Q Excel File Edit View Insert Format Tools AutoSave ASJE: Home Insert Draw Page Layout Formulas Data Week 4 BA Review View Share Comments D G H Q R Preliminary Financial Company Valuation EPSERIT Analysis Projected Financial Stats HOME 1 REW TREE 150 Projected Years (earliest to latest) Income Statement Historical Numbers (see notes) 151 Projected Reporting Date 12/31/20 12/31/21 12/31/22 Historical Percent Notes Below. Enter you describe 152 153 Revenues 1795 Historical Note: Difference the two most expect based on your recommendations Enteras percent 154 155 Cost of Goods Sold Historical Note: Percent Sales in the me projected years unless you believe COGS percent 156 157 Operating Ixpenses Historical Note: Percent of Sales in the me projected years unless you believe Operat drastically. The 150 159 Historical Note: Dollar amount of interest dollar amounts of interest you will forecas payment was $500 and you plan on a $20 enteria 20 for Interest Expense 53000 PART 1 CPM SPACE Perceptual Map GRAND SWOT OSPM Financial Statements Ener Data Window Help 0 64% Mon 7:21 PM Q Excel File Edit View Insert Format Tools Autosave ASJE: Home Insert Draw Page Layout Formulas Data Week 4 BA Review View Share Comments D G H Q R Preliminary Financial Company Valuation EPSERIT Analysis Projected in Statements HOME Interest Expense 5161.000 Historical Note: Dollar amount of interest dollar amounts of interest you will forecas payment was $500 and you plan on a $20 enter in $20 for year one. If financing the more than if financing through equity. En expense than the year before enter as a ne 160 161 Tax Historical Note: Tax Rate in most recent y unless you expect a large increase/decreas per 163 Non-Recurring Hvem Historical Note: Dollar amount of Non-Re cumulative Safe to forecast this number a 164 165 166 167 168 Scroll Down for Balance Sheet 169 170 171 172 173 174 Work from the botom of the Projected Balance Sheet to the top 175 Prested cars fonds Perceptual Map GRAND PART 1 CPM BCO SPACE SWOT OSPM Financial Statements IMM Ener Data Window Help 64% Mon 7:21 PM Q Excel File Edit View Insert Format Tools AutoSave OF ASJE: Home Insert Draw Page Layout Formulas Data Week 4 BA Review View Share Comments D G H Q R Preliminary Financial Company Valuation EPSERIT Analysis Projected Financial Stats HOME 124 175 Projected Year (earliest to latest) Start Balance Sheet at the bottom Historical Dollar Amount Paid 176 177 Read the message to the right, then start at the bottom with dividends The projected Balance Sheet is desig DOLLAR VALUES (for PPE, Goodwi values to the existing numbers. For projected year 1, but you estimate you prior year) just enter in 5200 51,000 will use the equation (5200+ most rece yea 178 179 12/31/20 123122 180 Cash and Equivalente 511,175.000 595,201.000 5133.036.000 Historical Note: If your cash number textbook for more information. Also.com may need to make adjustments to your med is name for any firm to have accepta 182 183 184 Accounts Receivable 105 Historical Note:Percent of revenues in three projected years unless you believe drastica 186 187 188 Other Current Assets Property Plant 5.000 Historical Nord PART 1 CPM SPACE Perceptual Map GRAND SWOT OSPM Financial Statements Ener Data Window Help 0 64% Mon 7:21 PM Q Excel File Edit View Insert Format Tools Aurave ASJE: Home Insert Draw Page Layout Formulas Data Week 4 BA Review View Share Comments D G H Q R Preliminary Financial Company Vio EPSERIT Analysis Projected Financial Stats HOME 180 187 Other Cument Aucts 189 189 Property Plant Equipment 510,635.000 190 Goodwill Historical Note: The values are for the cumulative) dollar amounts for each iten Equivalents line). If you are purchasing Year 1, simply enter 200 into the fint PP&E by 5100, then you would enter in a still plan to purchase the other $200). Tak the numbers entered. Reread $16.764.000 OD! DIDO QILDI 191 192 Intangibles 510.002.000 194 Other Long-Term Assets Historical Note: Percent of revenues int three projected years unless you believe change dat 195 196 197 Liabilities 12/31/20 198 199 200 Accounts Payable Historical Note: Percent of revenues in three projected years unless you believe drasticall Other Curent Liabilities 201 202 Long-Term Date Historical Note: The values are for them cumulative) dollar amounts for each item plan to take $1.000 in deb 327.516.000 PART 1 CPM SPACE Perceptual Map GRAND SWOT OSPM Financial Statements Ener Data Window Help 64% Mon 7:21 PM Q Excel File Edit View Insert Format Tools AutoSave OF ABSJE: Home Insert Draw Page Layout Formulas Data Week 4 BA Review View Share Comments B D G H Q Preliminary Financial Company Valentin EPSERIT Analysis Projected in Stats HOME 1 204 Other Long-Term Liabilities Historical Note: Percent of revenues in three projected years unless you believe will change din 205 206 Equity 12/30/22 Common Stock 207 200 200 210 211 212 Treasury Stock Historical Note: The values are for the me not cumulative) Dollar amounts for each Stock, you may need to make an adjust negative her Read ever CH Paid in Capital & Other 213 214 Retained Faming 65,853,000 36.283.000 16.000 16.000 Historical Note: The Retained Famings va additional (not cumulative) Retained Ean 215 216 Total Nvidends to Pay SHER Bater the total del If none, enter. This line is not dividends. For example, in the firm paid payments, enters in projected year $1,100 inte projected year I box. Check START HERE 217 210 PART CPM SPACE Perceptual Map GRAND SWOT O5PM Financial Statements Ener

Step by Step Solution

There are 3 Steps involved in it

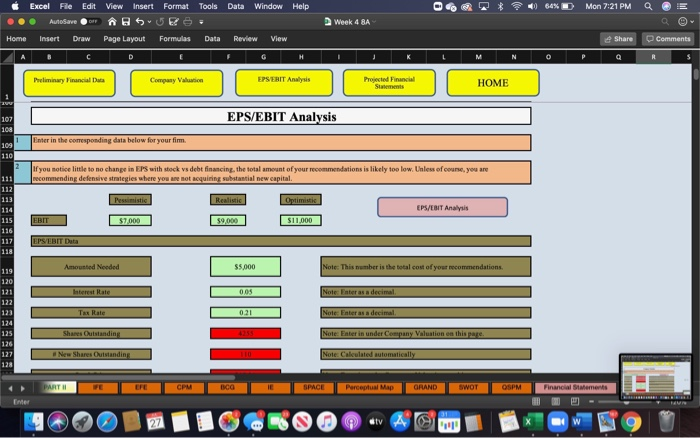

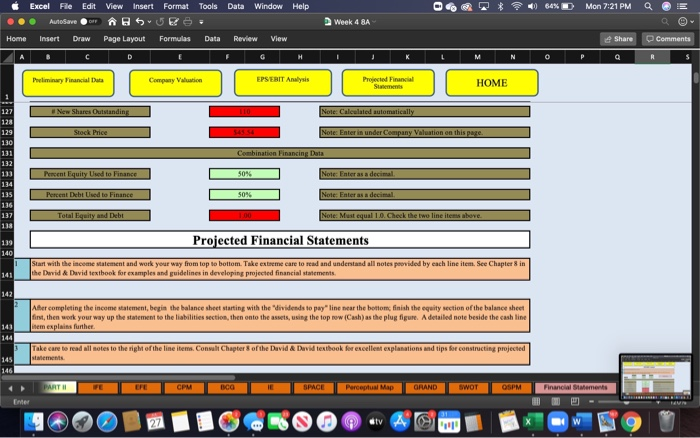

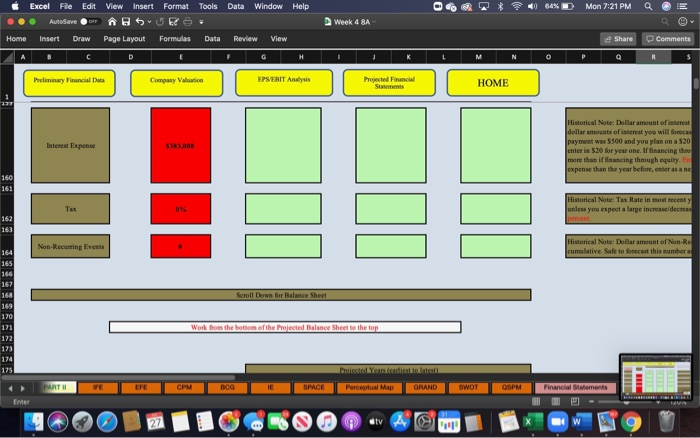

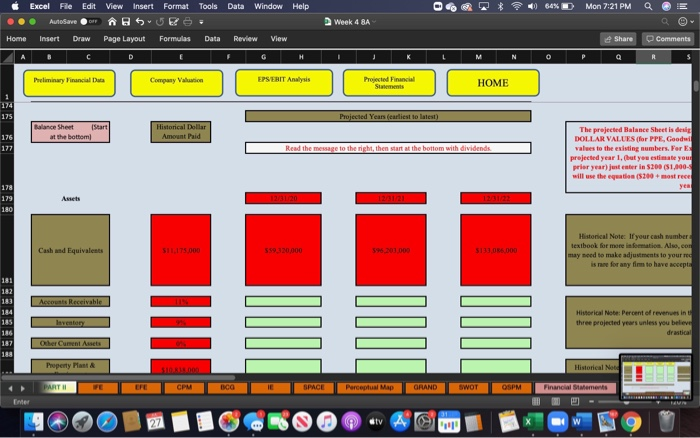

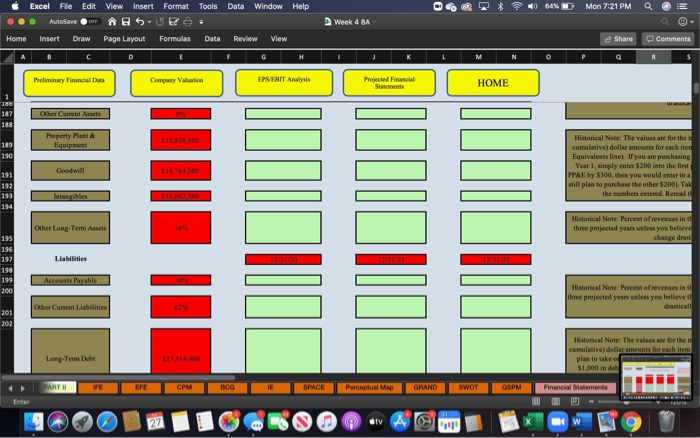

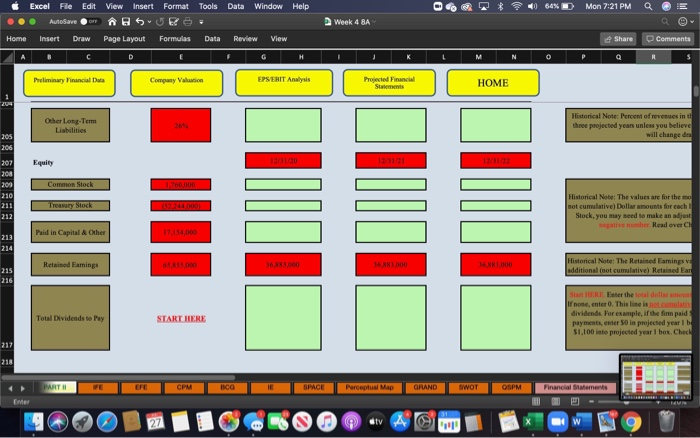

Get step-by-step solutions from verified subject matter experts