please help with budget report, question 2&3!!!

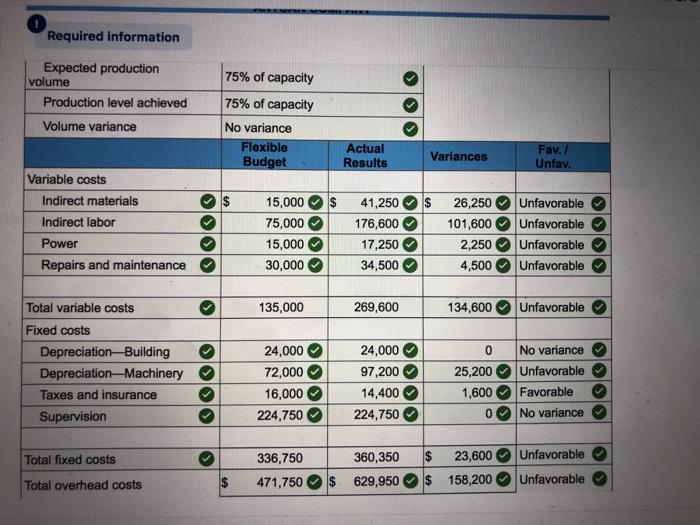

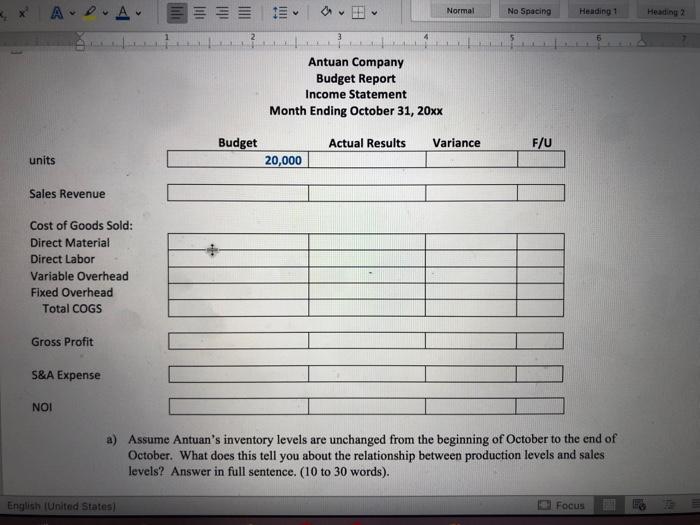

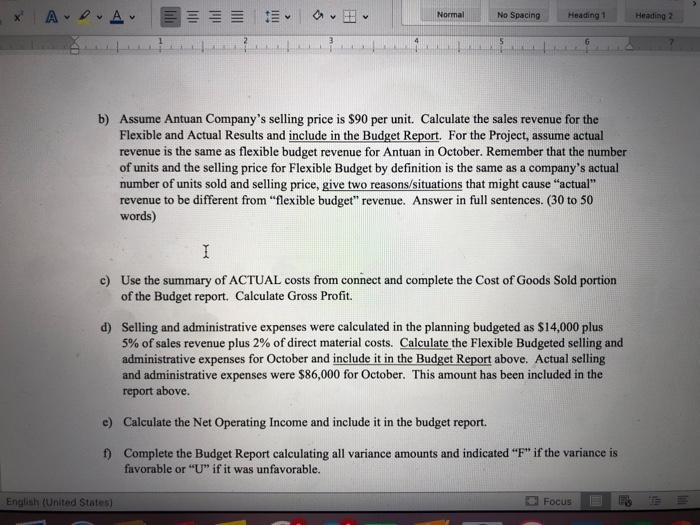

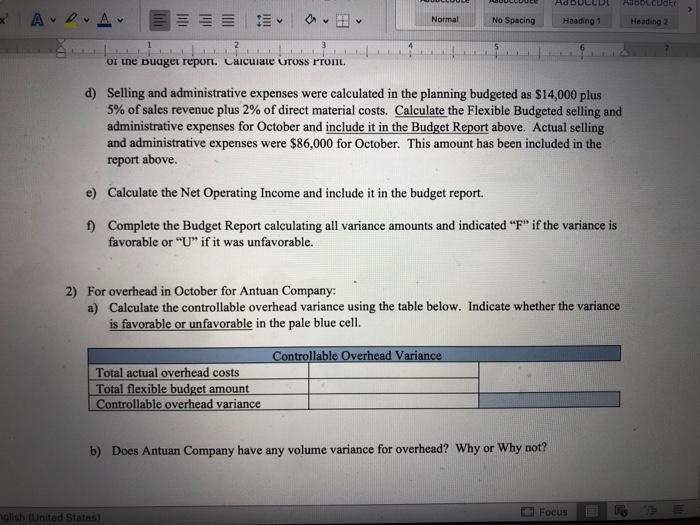

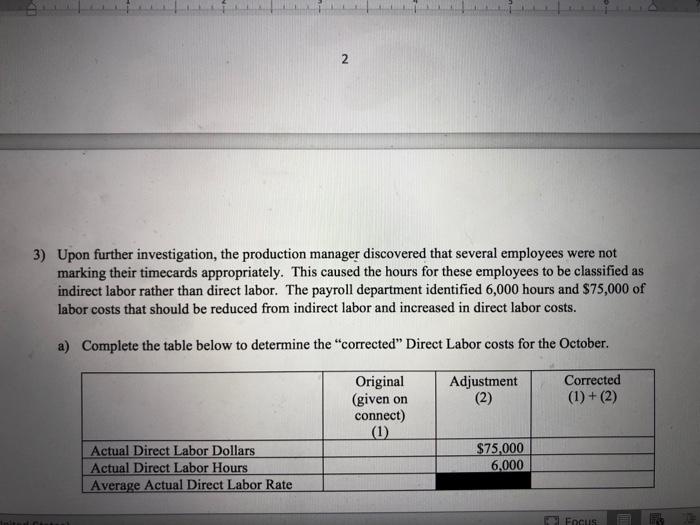

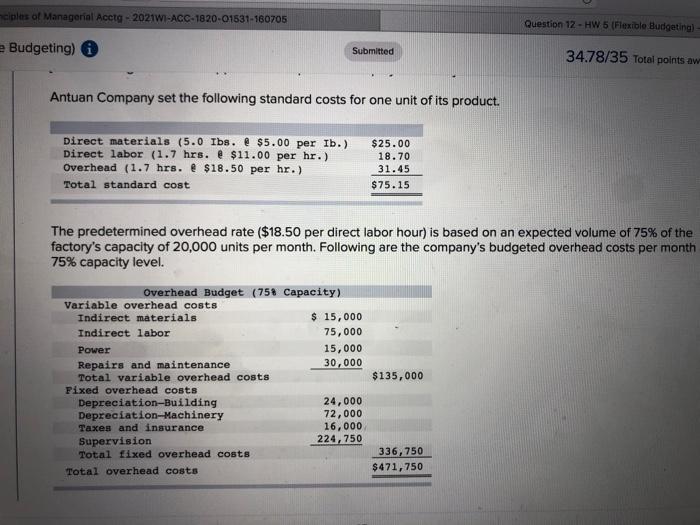

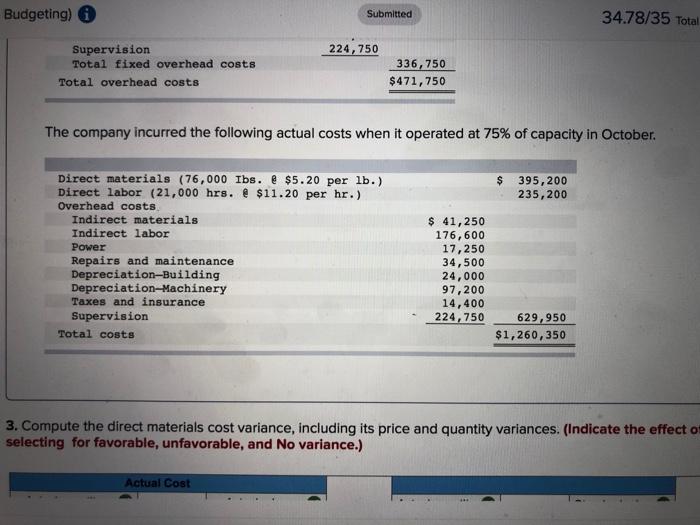

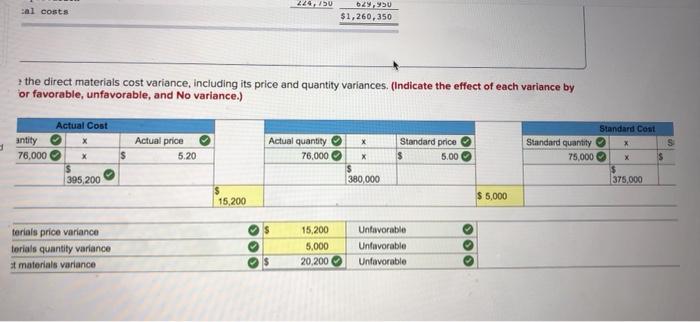

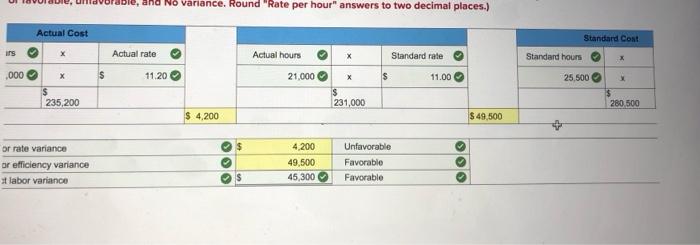

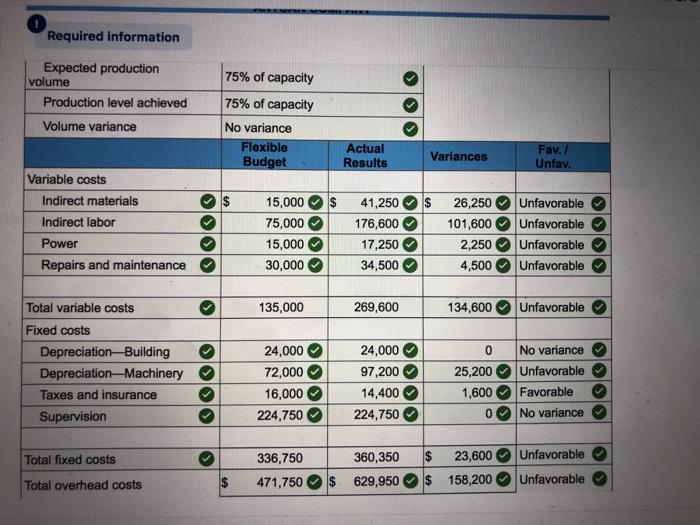

001 = = Normal No Spacing Heading 1 Heading 2 5 Antuan Company Budget Report Income Statement Month Ending October 31, 20xx Budget Actual Results Variance F/U units 20,000 Sales Revenue Cost of Goods Sold: Direct Material Direct Labor Variable Overhead Fixed Overhead Total COGS Gross Profit S&A Expense NOI Assume Antuan's inventory levels are unchanged from the beginning of October to the end of October. What does this tell you about the relationship between production levels and sales levels? Answer in full sentence. (10 to 30 words). English (United States Focus AA = = = =" Normal No Spacing Heading 1 Heading 2 b) Assume Antuan Company's selling price is $90 per unit. Calculate the sales revenue for the Flexible and Actual Results and include in the Budget Report. For the Project, assume actual revenue is the same as flexible budget revenue for Antuan in October. Remember that the number of units and the selling price for Flexible Budget by definition is the same as a company's actual number of units sold and selling price, give two reasons/situations that might cause actual" revenue to be different from "flexible budget" revenue. Answer in full sentences. (30 to 50 words) I c) Use the summary of ACTUAL costs from connect and complete the Cost of Goods Sold portion of the Budget report. Calculate Gross Profit. d) Selling and administrative expenses were calculated in the planning budgeted as $14,000 plus 5% of sales revenue plus 2% of direct material costs. Calculate the Flexible Budgeted selling and administrative expenses for October and include it in the Budget Report above. Actual selling and administrative expenses were $86,000 for October. This amount has been included in the report above. e) Calculate the Net Operating Income and include it in the budget report. Complete the Budget Report calculating all variance amounts and indicated "F" if the variance is favorable or "U" if it was unfavorable. English (United States) Focus ADOLED ALCUNI & . Normal No Spacing Heading 1 Heading 2 2 or ne budget report. Calculate UrOSS Prorit. d) Selling and administrative expenses were calculated in the planning budgeted as $14,000 plus 5% of sales revenue plus 2% of direct material costs. Calculate the Flexible Budgeted selling and administrative expenses for October and include it in the Budget Report above. Actual selling and administrative expenses were $86,000 for October. This amount has been included in the report above. e) Calculate the Net Operating Income and include it in the budget report ) Complete the Budget Report calculating all variance amounts and indicated "F" if the variance is favorable or "U" if it was unfavorable. 2) For overhead in October for Antuan Company: a) Calculate the controllable overhead variance using the table below. Indicate whether the variance is favorable or unfavorable in the pale blue cell. Controllable Overhead Variance Total actual overhead costs Total flexible budget amount Controllable overhead variance b) Does Antuan Company have any volume variance for overhead? Why or Why not? Focus glish (United States) 2 3) Upon further investigation, the production manager discovered that several employees were not marking their timecards appropriately. This caused the hours for these employees to be classified as indirect labor rather than direct labor. The payroll department identified 6,000 hours and $75,000 of labor costs that should be reduced from indirect labor and increased in direct labor costs. a) Complete the table below to determine the "corrected" Direct Labor costs for the October Adjustment (2) Corrected (1)+(2) Original (given on connect) (1) Actual Direct Labor Dollars Actual Direct Labor Hours Average Actual Direct Labor Rate $75,000 6,000 Focus nciples of Managerial Aceto - 2021W-ACC-1820-01531-160705 Question 12 - HW 5 (Flexible Budgeting) Budgeting) Submitted 34.78/35 Total points aw Antuan Company set the following standard costs for one unit of its product. Direct materials (5.0 Ibs. @ $5.00 per Ib.) Direct labor (1.7 hrs. @ $11.00 per hr.) Overhead (1.7 hrs. @ $18.50 per hr.) Total standard cost $25.00 18.70 31.45 $75.15 The predetermined overhead rate ($18.50 per direct labor hour) is based on an expected volume of 75% of the factory's capacity of 20,000 units per month. Following are the company's budgeted overhead costs per month 75% capacity level. Overhead Budget (757 Capacity) Variable overhead costs Indirect materials $ 15,000 Indirect labor 75,000 Power 15,000 Repairs and maintenance 30,000 Total variable overhead costs Fixed overhead costs Depreciation-Building 24,000 Depreciation-Machinery 72,000 Taxes and insurance 16,000 Supervision 224,750 Total fixed overhead costs Total overhead costs $135,000 336, 750 $471,750 Budgeting) 0 Submitted 34.78/35 Total 224,750 Supervision Total fixed overhead costs Total overhead costs 336,750 $471,750 The company incurred the following actual costs when it operated at 75% of capacity in October. $ 395,200 235, 200 Direct materials (76,000 Ibs. @ $5.20 per lb.) Direct labor (21,000 hrs. @ $11.20 per hr.) Overhead costs Indirect materials Indirect labor Power Repairs and maintenance Depreciation-Building Depreciation Machinery Taxes and insurance Supervision Total costs $ 41,250 176,600 17,250 34,500 24,000 97,200 14,400 224,750 629,950 $1,260,350 3. Compute the direct materials cost variance, including its price and quantity variances. (Indicate the effect o selecting for favorable, unfavorable, and No variance.) Actual Cost 224/50 al costs 629.90 $1,260,350 the direct materials cost variance, including its price and quantity variances. (Indicate the effect of each variance by or favorable, unfavorable, and No variance.) Actual Cost Standard Cont antity Actual price X Standard price $ 5.00 Actual quantity 76,000 $ 380,000 Standard quantity 75,000 76,000 5.20 $ 395,200 $ 375,000 15,200 $ 5,000 terials price variance terials quantity variance at materiais variance 15,200 5,000 20,200 Unfavorable Unfavorable Unfavorable OOO and No variance. Round "Rate per hour" answers to two decimal places.) Actual Cost Standard Cont ins S Actual rate Actual hours Standard rate Standard hours X ,000 $ 11.20 21.000 $ 11.00 25,500 235,200 $ 231,000 280.500 $ 4,200 $ 49,500 $ or rate variance or efficiency variance x labor variance 4,200 49,500 45,300 Unfavorable Favorable Favorable OO $ Required information Expected production volume Production level achieved Volume variance 75% of capacity 75% of capacity No variance Flexible Budget Actual Results Variances Fav. / Unfav. Variable costs Indirect materials Indirect labor Power Repairs and maintenance 15,000 75,000 15,000 30,000 $ 41,250 $ 26,250 176,600 101,600 17,250 2,250 34,500 4,500 Unfavorable Unfavorable Unfavorable Unfavorable 135,000 269,600 134,600 Unfavorable Total variable costs Fixed costs Depreciation Building Depreciation-Machinery Taxes and insurance Supervision 24,000 72,000 16,000 224,750 24,000 97,200 14,400 224,750 0 25,200 1,600 No variance Unfavorable Favorable No variance 0 Total fixed costs $ Unfavorable 336,750 471,750 360,350 $ 629,950 23,600 158,200 Total overhead costs Unfavorable 001 = = Normal No Spacing Heading 1 Heading 2 5 Antuan Company Budget Report Income Statement Month Ending October 31, 20xx Budget Actual Results Variance F/U units 20,000 Sales Revenue Cost of Goods Sold: Direct Material Direct Labor Variable Overhead Fixed Overhead Total COGS Gross Profit S&A Expense NOI Assume Antuan's inventory levels are unchanged from the beginning of October to the end of October. What does this tell you about the relationship between production levels and sales levels? Answer in full sentence. (10 to 30 words). English (United States Focus AA = = = =" Normal No Spacing Heading 1 Heading 2 b) Assume Antuan Company's selling price is $90 per unit. Calculate the sales revenue for the Flexible and Actual Results and include in the Budget Report. For the Project, assume actual revenue is the same as flexible budget revenue for Antuan in October. Remember that the number of units and the selling price for Flexible Budget by definition is the same as a company's actual number of units sold and selling price, give two reasons/situations that might cause actual" revenue to be different from "flexible budget" revenue. Answer in full sentences. (30 to 50 words) I c) Use the summary of ACTUAL costs from connect and complete the Cost of Goods Sold portion of the Budget report. Calculate Gross Profit. d) Selling and administrative expenses were calculated in the planning budgeted as $14,000 plus 5% of sales revenue plus 2% of direct material costs. Calculate the Flexible Budgeted selling and administrative expenses for October and include it in the Budget Report above. Actual selling and administrative expenses were $86,000 for October. This amount has been included in the report above. e) Calculate the Net Operating Income and include it in the budget report. Complete the Budget Report calculating all variance amounts and indicated "F" if the variance is favorable or "U" if it was unfavorable. English (United States) Focus ADOLED ALCUNI & . Normal No Spacing Heading 1 Heading 2 2 or ne budget report. Calculate UrOSS Prorit. d) Selling and administrative expenses were calculated in the planning budgeted as $14,000 plus 5% of sales revenue plus 2% of direct material costs. Calculate the Flexible Budgeted selling and administrative expenses for October and include it in the Budget Report above. Actual selling and administrative expenses were $86,000 for October. This amount has been included in the report above. e) Calculate the Net Operating Income and include it in the budget report ) Complete the Budget Report calculating all variance amounts and indicated "F" if the variance is favorable or "U" if it was unfavorable. 2) For overhead in October for Antuan Company: a) Calculate the controllable overhead variance using the table below. Indicate whether the variance is favorable or unfavorable in the pale blue cell. Controllable Overhead Variance Total actual overhead costs Total flexible budget amount Controllable overhead variance b) Does Antuan Company have any volume variance for overhead? Why or Why not? Focus glish (United States) 2 3) Upon further investigation, the production manager discovered that several employees were not marking their timecards appropriately. This caused the hours for these employees to be classified as indirect labor rather than direct labor. The payroll department identified 6,000 hours and $75,000 of labor costs that should be reduced from indirect labor and increased in direct labor costs. a) Complete the table below to determine the "corrected" Direct Labor costs for the October Adjustment (2) Corrected (1)+(2) Original (given on connect) (1) Actual Direct Labor Dollars Actual Direct Labor Hours Average Actual Direct Labor Rate $75,000 6,000 Focus nciples of Managerial Aceto - 2021W-ACC-1820-01531-160705 Question 12 - HW 5 (Flexible Budgeting) Budgeting) Submitted 34.78/35 Total points aw Antuan Company set the following standard costs for one unit of its product. Direct materials (5.0 Ibs. @ $5.00 per Ib.) Direct labor (1.7 hrs. @ $11.00 per hr.) Overhead (1.7 hrs. @ $18.50 per hr.) Total standard cost $25.00 18.70 31.45 $75.15 The predetermined overhead rate ($18.50 per direct labor hour) is based on an expected volume of 75% of the factory's capacity of 20,000 units per month. Following are the company's budgeted overhead costs per month 75% capacity level. Overhead Budget (757 Capacity) Variable overhead costs Indirect materials $ 15,000 Indirect labor 75,000 Power 15,000 Repairs and maintenance 30,000 Total variable overhead costs Fixed overhead costs Depreciation-Building 24,000 Depreciation-Machinery 72,000 Taxes and insurance 16,000 Supervision 224,750 Total fixed overhead costs Total overhead costs $135,000 336, 750 $471,750 Budgeting) 0 Submitted 34.78/35 Total 224,750 Supervision Total fixed overhead costs Total overhead costs 336,750 $471,750 The company incurred the following actual costs when it operated at 75% of capacity in October. $ 395,200 235, 200 Direct materials (76,000 Ibs. @ $5.20 per lb.) Direct labor (21,000 hrs. @ $11.20 per hr.) Overhead costs Indirect materials Indirect labor Power Repairs and maintenance Depreciation-Building Depreciation Machinery Taxes and insurance Supervision Total costs $ 41,250 176,600 17,250 34,500 24,000 97,200 14,400 224,750 629,950 $1,260,350 3. Compute the direct materials cost variance, including its price and quantity variances. (Indicate the effect o selecting for favorable, unfavorable, and No variance.) Actual Cost 224/50 al costs 629.90 $1,260,350 the direct materials cost variance, including its price and quantity variances. (Indicate the effect of each variance by or favorable, unfavorable, and No variance.) Actual Cost Standard Cont antity Actual price X Standard price $ 5.00 Actual quantity 76,000 $ 380,000 Standard quantity 75,000 76,000 5.20 $ 395,200 $ 375,000 15,200 $ 5,000 terials price variance terials quantity variance at materiais variance 15,200 5,000 20,200 Unfavorable Unfavorable Unfavorable OOO and No variance. Round "Rate per hour" answers to two decimal places.) Actual Cost Standard Cont ins S Actual rate Actual hours Standard rate Standard hours X ,000 $ 11.20 21.000 $ 11.00 25,500 235,200 $ 231,000 280.500 $ 4,200 $ 49,500 $ or rate variance or efficiency variance x labor variance 4,200 49,500 45,300 Unfavorable Favorable Favorable OO $ Required information Expected production volume Production level achieved Volume variance 75% of capacity 75% of capacity No variance Flexible Budget Actual Results Variances Fav. / Unfav. Variable costs Indirect materials Indirect labor Power Repairs and maintenance 15,000 75,000 15,000 30,000 $ 41,250 $ 26,250 176,600 101,600 17,250 2,250 34,500 4,500 Unfavorable Unfavorable Unfavorable Unfavorable 135,000 269,600 134,600 Unfavorable Total variable costs Fixed costs Depreciation Building Depreciation-Machinery Taxes and insurance Supervision 24,000 72,000 16,000 224,750 24,000 97,200 14,400 224,750 0 25,200 1,600 No variance Unfavorable Favorable No variance 0 Total fixed costs $ Unfavorable 336,750 471,750 360,350 $ 629,950 23,600 158,200 Total overhead costs Unfavorable

please help with budget report, question 2&3!!!

please help with budget report, question 2&3!!!