Please help with business law questions over corporations and answer questions one through six

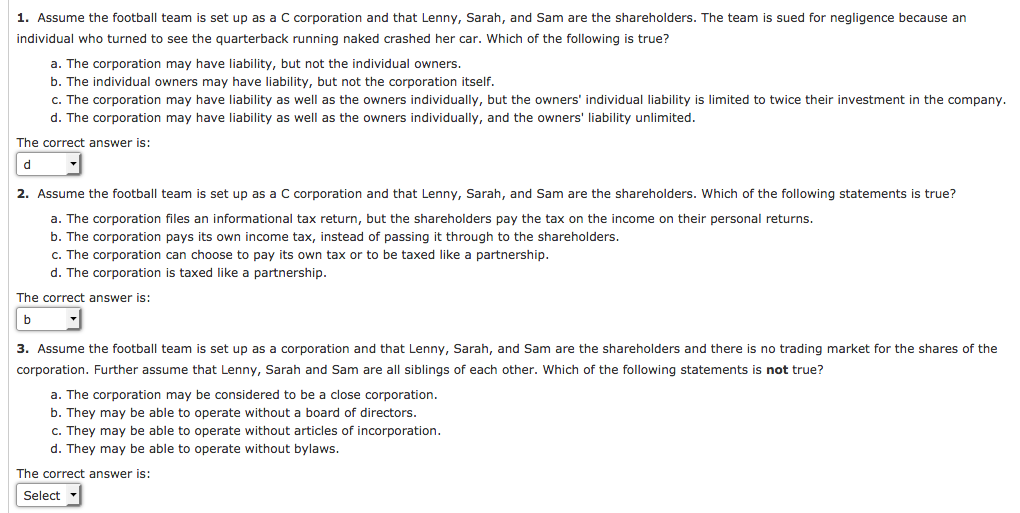

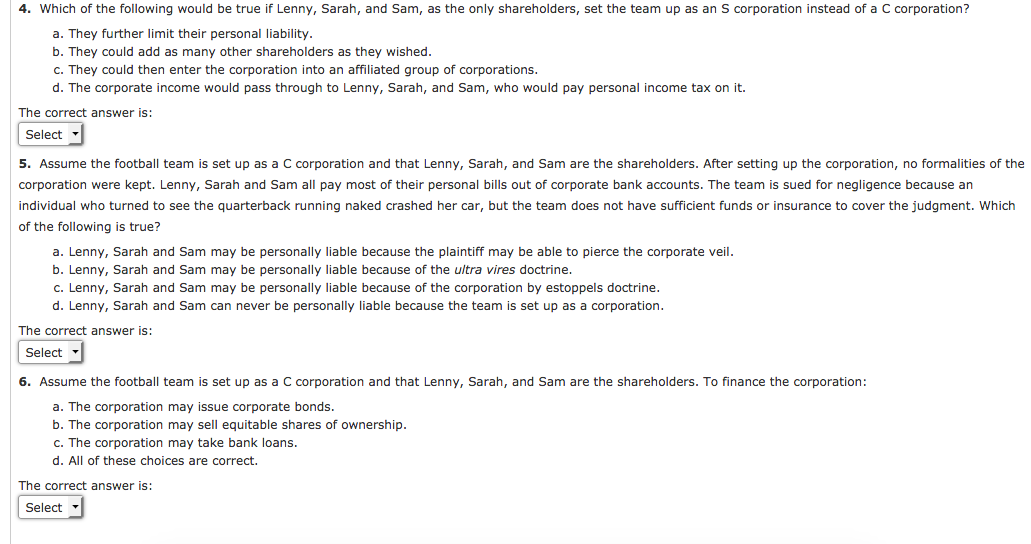

1. Assume the football team is set up as a C corporation and that Lenny, Sarah, and Sam are the shareholders. The team is sued for negligence because an individual who turned to see the quarterback mnning naked crashed her car. Which of the following is true? a. The corporation may have liability, but not the individual owners. b. The individual owners may have liability, but not the corporation itself. c. The corporation may have liability as well as the owners individually, but the owners' individual liability is limited to twice their investment in the company. d. The corporation may have liability as well as the owners individually, and the owners' liability unlimited. The correct answer is: 2. Assume the football team is set up as a C corporation and that Lenny, Sarah, and Sam are the shareholders. Which of the following statements is true? a. The corporation les an informational tax return, but the shareholders pay the tax on the income on their personal returns. b. The corporation pays its own income tax, instead of passing it through to the shareholders. c. The corporation can choose to pay its own tax or to be taxed like a partnership. d. The corporation is taxed like a partnership. The correct answer is: 3. Assume the football team is set up as a corporation and that Lenny. Sarah, and Sam are the shareholders and there is no trading market for the shares of the corporation. Further assume that Lenny. Sarah and Sam are all siblings of each other. Which of the following statements is not true? a. The corporation may be considered to be a close corporation. b. They may be able to operate without a board of directors. c. They may be able to operate without articles of incorporation. d. They may be able to operate without bylaws. The correct answer is: 4. Which of the following would be true if Lenny, Sarah, and Sam, as the only shareholders, set the team up as an S corporation instead of a C corporation? 3. They further limit their personal liability. b. They could add as many other shareholders as they wished. c. They could then enter the corporation into an afliated group of corporations. d. The corporate income would pass through to Lenny, Sarah, and Sam, who would pay personal income tax on it. The correct answer is: 5. Assume the football team is set up as a C oorporation and that Lenny, Sarah, and Sam are the shareholders. Aer setting up the oorporation, no formalities of the oorporation were kept. Lenny, Sarah and Sam all pay most of their personal bills out of corporate bank aocounts. The team is sued for negligence because an individual who turned to see the quarterback anhihg naked crashed her car, but the team does not have sufcient funds or insurance to cover the judgment. Which of the following is true? a. Lenny, Sarah and Sam may be personally liable because the plaintiff may be able to pierce the corporate veil. b. Lenny, Sarah and Sam may be personally liable because of the ultra Vires doctrine. c. Lenny, Sarah and Sam may be personally liable because of the corporation by estoppels doctrine. d. Lenny, Sarah and Sam can never be personally liable because the team is set up as a corporation. The correct answer is: 6. Assume the football team is set up as a C oorporation and that Lenny, Sarah, and Sam are the shareholders. To nance the oorporation: a. The corporation may issue corporate bonds. b. The corporation may sell equitable shares of ownership. c. The corporation may take bank loans. d. All of these choices are correct. The correct answer is