Answered step by step

Verified Expert Solution

Question

1 Approved Answer

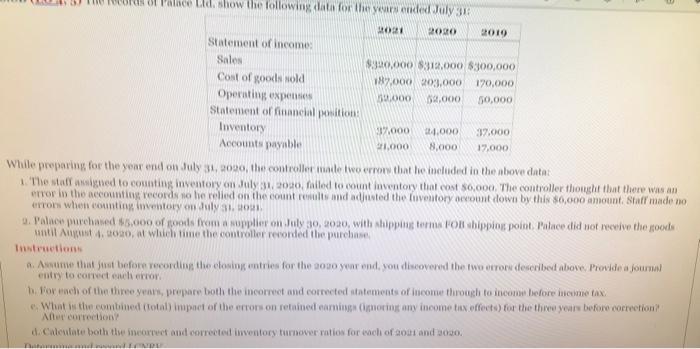

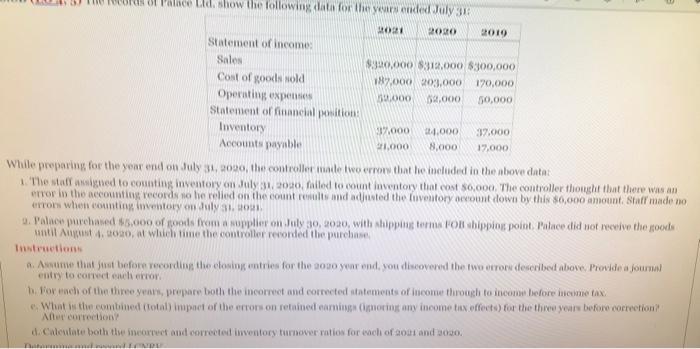

please help with calculation of both screenshots While preparing for the year end on July 31, 2020 , the controller inade two errow that he

please help with calculation of both screenshots

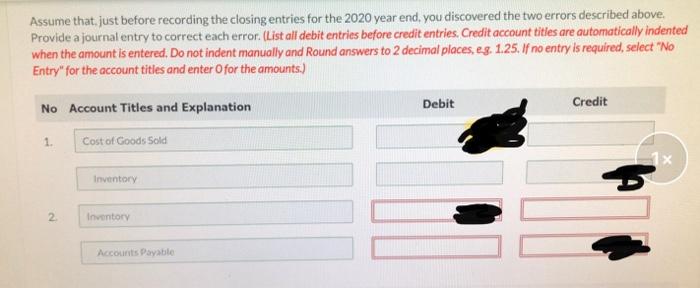

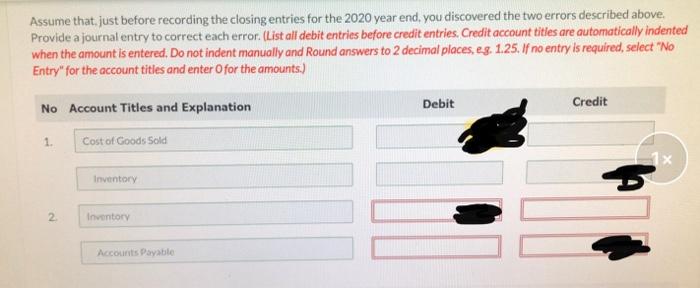

While preparing for the year end on July 31, 2020 , the controller inade two errow that he ineluded is the above datat 1. The staff asigned to countimg insentory ou July 31, 2020, failed to eount inventory that cast 50,000 . The controller thought that there was an nrror in the accounfing records no he relied on the count reailts mud adiuted the fiventory occount dotvo by this s 80,000 amount. Staff made no erron when counting inventory on duly 31,4021 . 9. Falace purchaved 56,000 of gonds from a supplier on July 30,2020 , with ahipping terms Foll shippiog point. Palace did not receive the goods Mutil Amgust 4. do20, at which time the controller recorded the purchase. Instruetion a. Avane that just before recording the elosing entries for the 2020 year end, you discovered the two errore described above. Provide a jourus entry to corpect eucli erion. b. For eaeb of the three yeans, prepare both the incorret and corrected atatements of income through to incoun before iuceme tax. 6. What is the eombined (lotal) impoet of the erron on retained earmings (ignoring any ineome tix effects) for the thinee years before correction? After eorrection? d. Caleulate both the incortect and corrected imventory turnower ratios for each of aour and aozo. Assume that, just before recording the closing entries for the 2020 year end, you discovered the two errors described above. Provide a journal entry to correct each error. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually and Round answers to 2 decimal places, eg. 1.25. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) While preparing for the year end on July 31, 2020 , the controller inade two errow that he ineluded is the above datat 1. The staff asigned to countimg insentory ou July 31, 2020, failed to eount inventory that cast 50,000 . The controller thought that there was an nrror in the accounfing records no he relied on the count reailts mud adiuted the fiventory occount dotvo by this s 80,000 amount. Staff made no erron when counting inventory on duly 31,4021 . 9. Falace purchaved 56,000 of gonds from a supplier on July 30,2020 , with ahipping terms Foll shippiog point. Palace did not receive the goods Mutil Amgust 4. do20, at which time the controller recorded the purchase. Instruetion a. Avane that just before recording the elosing entries for the 2020 year end, you discovered the two errore described above. Provide a jourus entry to corpect eucli erion. b. For eaeb of the three yeans, prepare both the incorret and corrected atatements of income through to incoun before iuceme tax. 6. What is the eombined (lotal) impoet of the erron on retained earmings (ignoring any ineome tix effects) for the thinee years before correction? After eorrection? d. Caleulate both the incortect and corrected imventory turnower ratios for each of aour and aozo. Assume that, just before recording the closing entries for the 2020 year end, you discovered the two errors described above. Provide a journal entry to correct each error. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually and Round answers to 2 decimal places, eg. 1.25. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started