Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with chapter 8 for accounting Exercise 8-14A (Algo) Effect of cash dividends on financial statements LO 8-6 On May 1, Year 3, Love

please help with chapter 8 for accounting

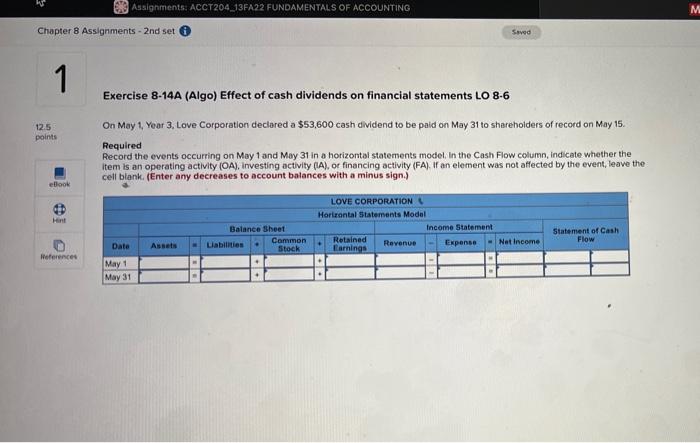

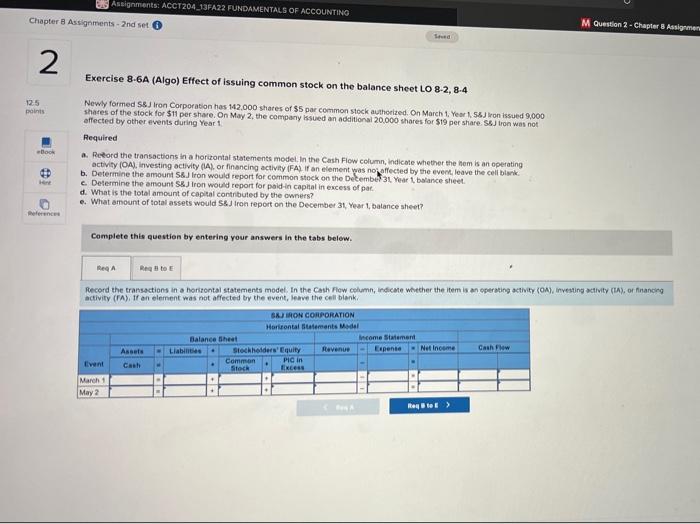

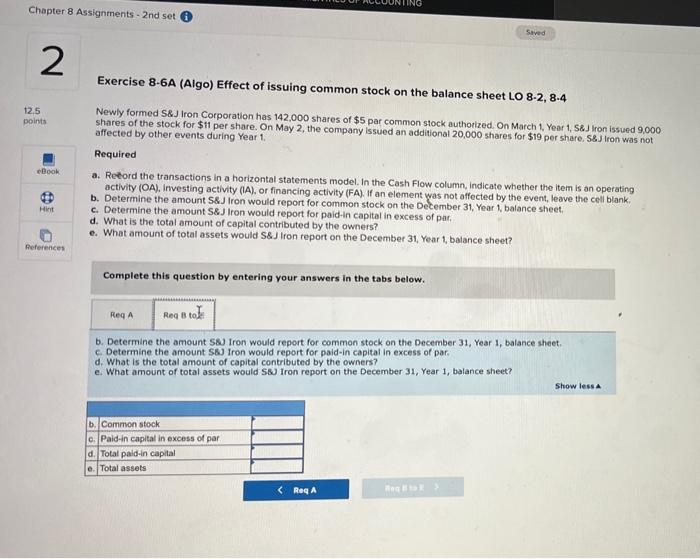

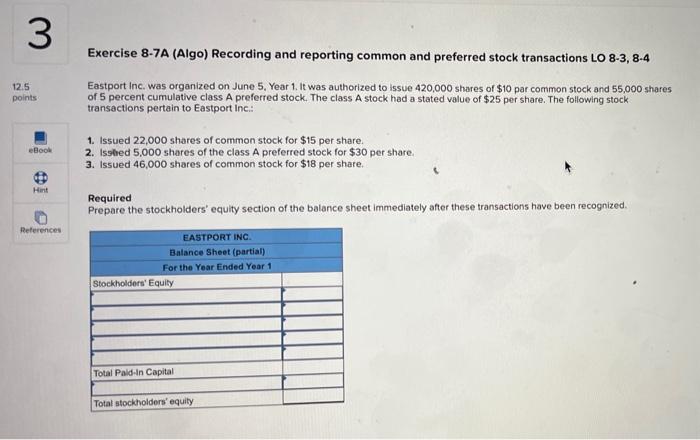

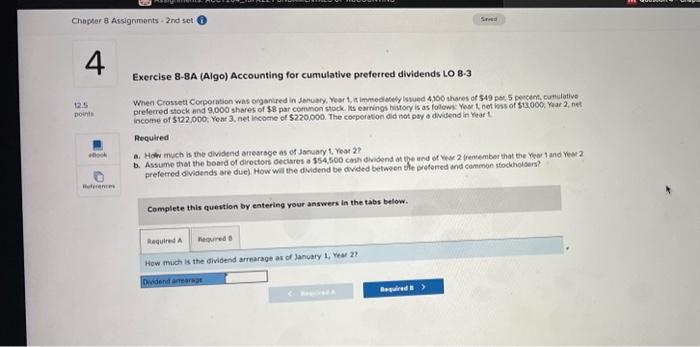

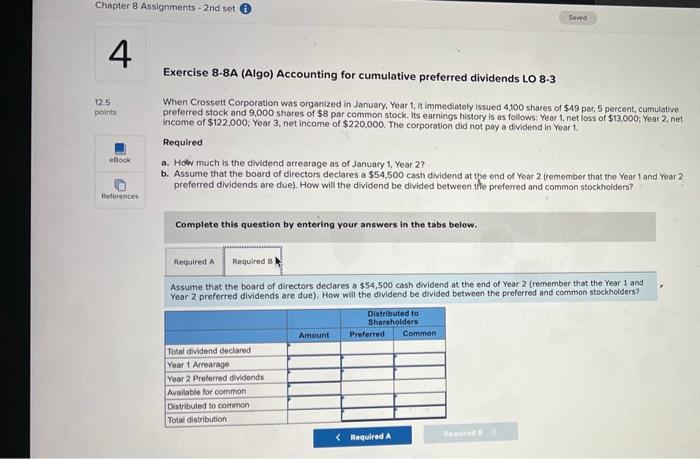

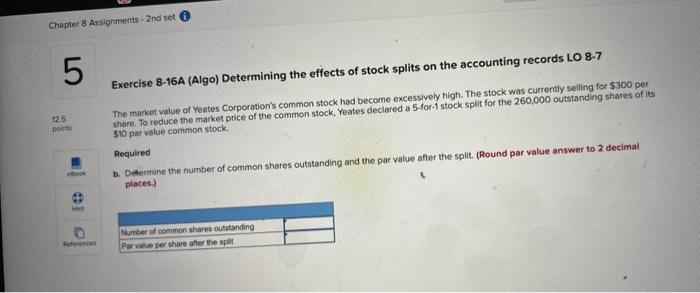

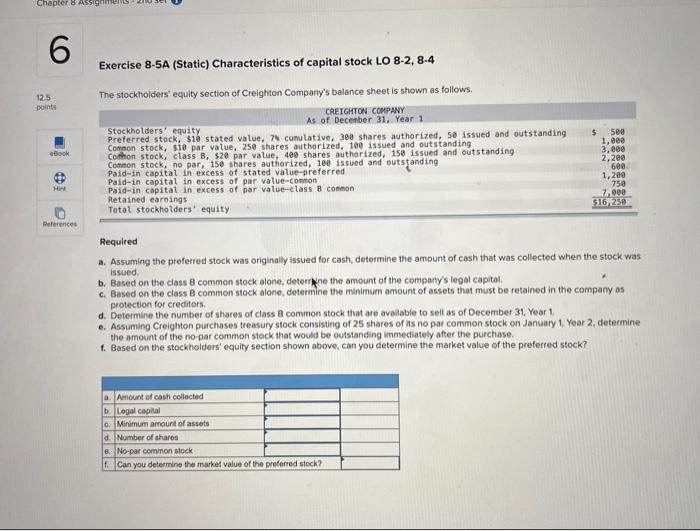

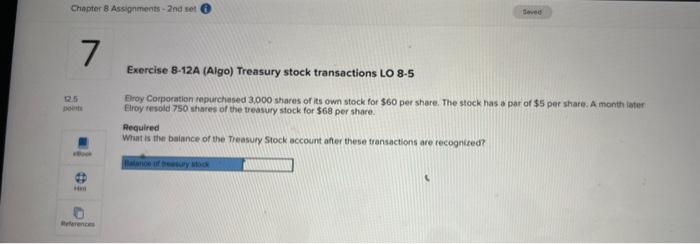

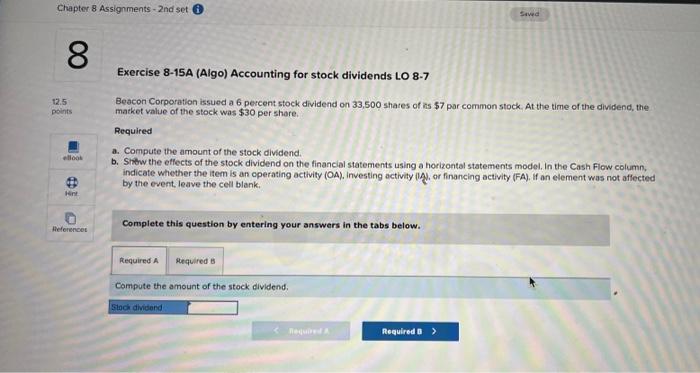

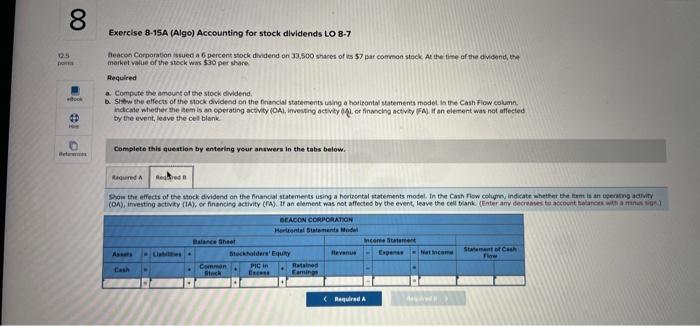

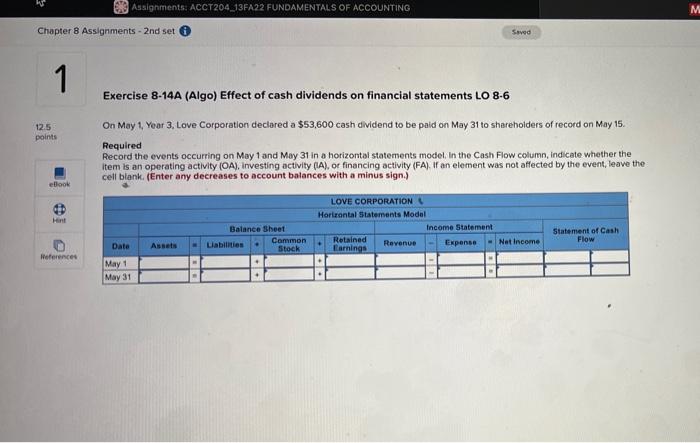

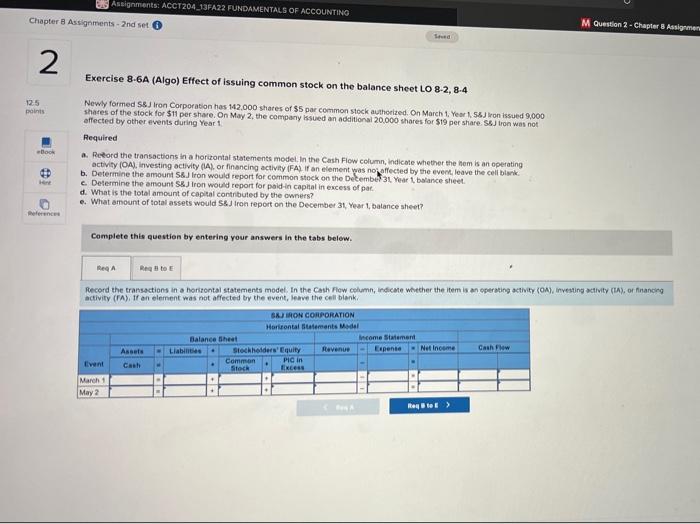

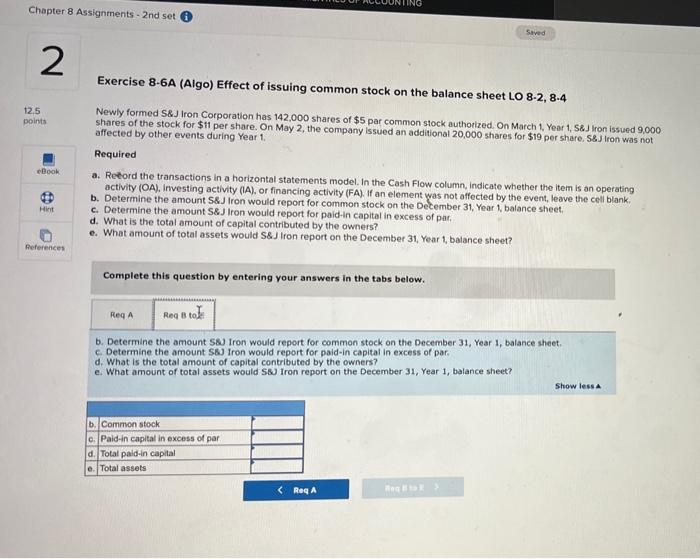

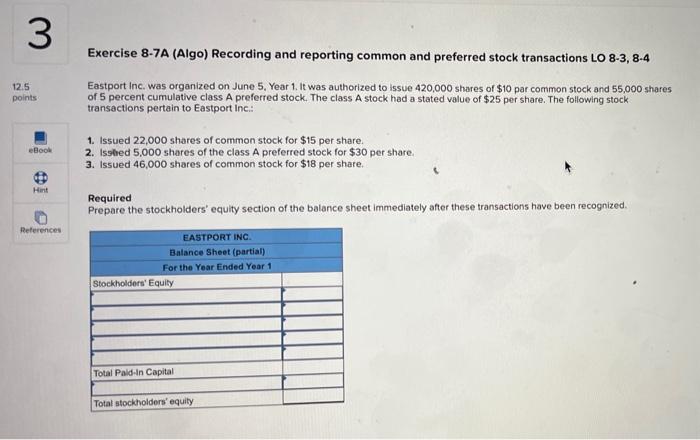

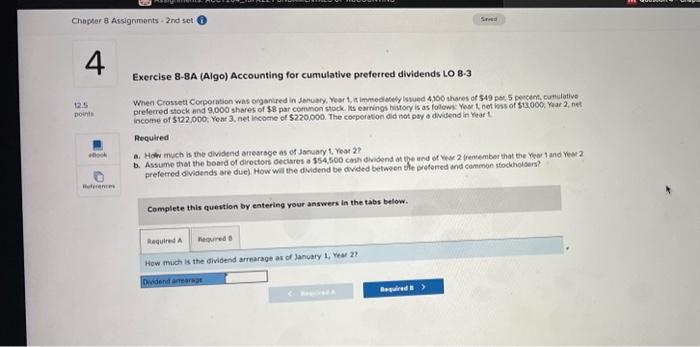

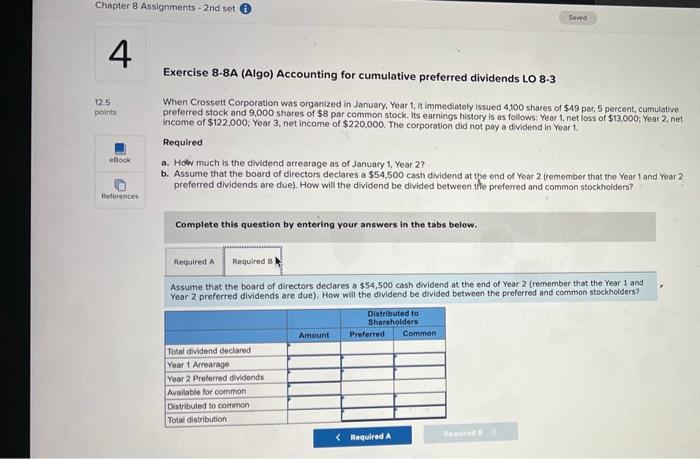

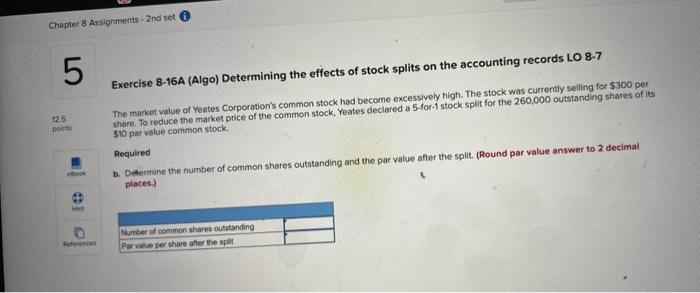

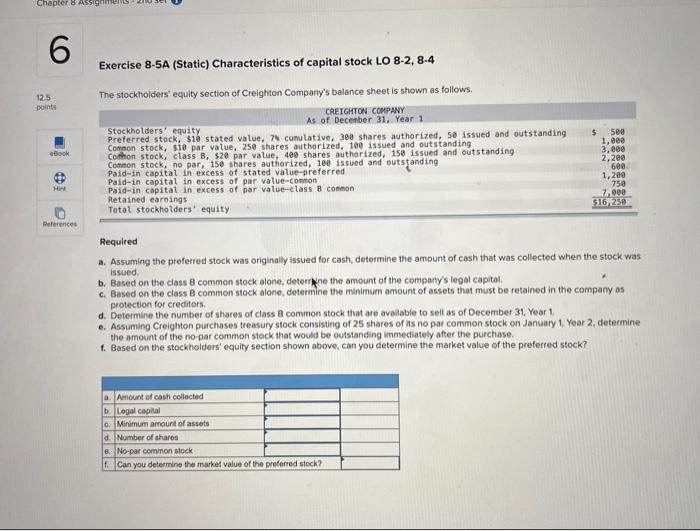

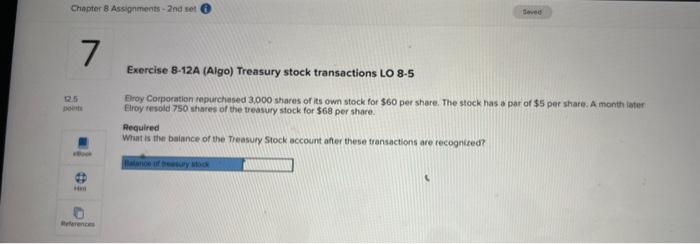

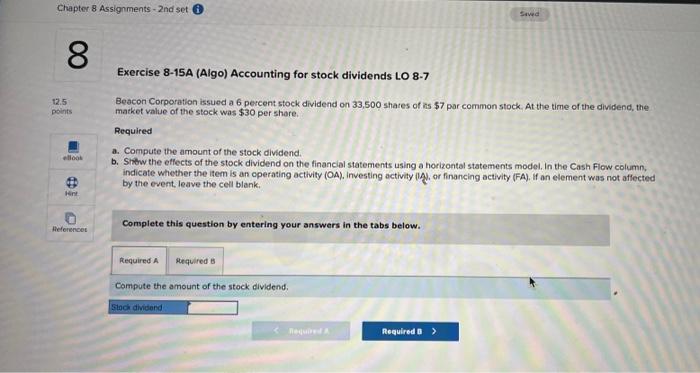

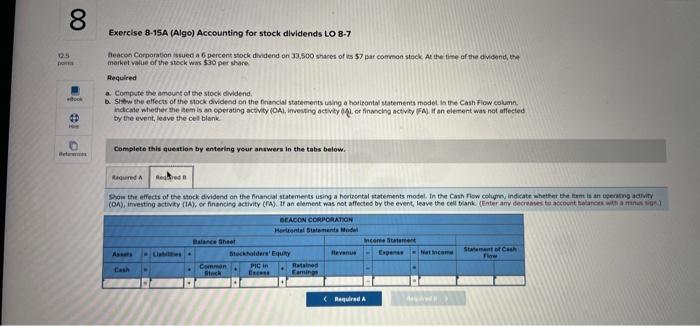

Exercise 8-14A (Algo) Effect of cash dividends on financial statements LO 8-6 On May 1, Year 3, Love Corporation declared a \$53,600 cash dividend to be paid on May 31 to sharehoiders of record on May 15. Required Record the events occurring on May 1 and May 31 in a horizontal statements model, In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (A), ot financing activity (FA). If an element was not aflected by the event, leave the cell blank. (Enter any decreases to account balances with a minus sign.) Exercise B.6A (Algo) Effect of issuing common stock on the balance sheet LO 8-2, 8.4 Newly formed SsJ Iron Corporation has 142.000 shares of $5 par common stock authorized. On March 1, Year h, 5.J lron issued 9.000 shares of the stock for $11 per share. On May 2, the company haved an additional 20,000 shares for $19 per share. S6J tron was not effected by other events during Year 1 . Required a. Petord the transoctions in a horizontal statements model. In the Cash Flow column, indicate whether the hem is an operating activity (OA). Investing octivity (LA), or financing activity (FA) if an element was nojaffected by the evem, leave the cell bisnk. b. Deterimine the amouns 58.J fron would report for common stock on the Decembef 31 , Year 1 bslance sheet. c. Determine the amount \( \$ \& J \)amp;Jamp;J Iron would report for paidin caplat in excess of pac. d. What is the total amount of copital contributed by the owners? e. What amount of total assets would 5$J Iron report on the December 31 , Year 1, batance sheet? Complete this questien by entering your answers In the tabs belew. feecord the transactions in a horitontal statements model. In the Cash flow column, indicale witecher the item is an operating attivity (OM), investing activity (in), of financing adivity ( ( ). If on blement was not affected try the event, leave the cell blenk; Exercise 8.6A (Algo) Effect of issuing common stock on the balance sheet LO 8-2, 8.4 Newly formed S\&J Iron Corporation has 142,000 shares of $5 par common stock authoized. On March 1, Year 1, S\&.J lron issued 9,000 shares of the stock for \$11 per share. On May 2, the company is sued an additional 20,000 shares for $19 per share. S\&J lron was not affected by other events during Year 1 . Required a. Retord the transactions in a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA). Investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. b. Determine the amount S\&.J Iron would report for common stock on the December 31, Year 1, balance sheet, c. Determine the amount \( \$ \& J \) Iron would report for paid in capital in excess of par. d. What is the total amount of capital contributed by the owners? e. What amount of total assets would S\&.J Iron report on the December 31 , Year 1 , balance sheet? Complete this question by entering your answers in the tabs below. b. Determine the amount S8) Iron would report for common stock on the December 31, Year 1, balance sheet. c. Determine the amount $3 Iron would report for paid-in capital in excess of par. d. What is the total amount of capital contributed by the owners? e. What amount of total assets would 58I Iron report on the December 31, Year 1 , balance sheet? Exercise 8-7A (Algo) Recording and reporting common and preferred stock transactions LO 8-3, 8-4 Eastport inc. was organized on June 5, Year 1. It was authorized to issue 420,000 shares of $10 par common stock and 55,000 shares of 5 percent cumulative class A preferred stock. The class A stock had a stated value of $25 per share. The following stock transactions pertain to Eastport inc:: 1. Issued 22,000 shares of common stock for $15 per share. 2. Isshed 5,000 shares of the class A preferred stock for $30 per share. 3. Issued 46,000 shares of common stock for $18 per share. Required Prepare the stockholders' equity section of the balance sheet immediately after these transactions have been recognized. Exercise 8-BA (Algo) Accounting for cumulative preferred dividends LO 8-3 income of $122.000, Year 3, net income of 5220.000. The coeporetion did not poy a dividend in Year 1 . Required a. How much is the dividend arearage as of January 1 , Year 2? Complete this question by entering your answers in the tabs below. How much is the dividend arrearage as of January is, Vear 2? Exercise 8-8A (Algo) Accounting for cumulative preferred dividends LO 8-3 When Crossett Corporation was organized in January, Year 1 , it immediately issued 4,100 shares of $49 par, 5 percent, cumulative preferred stock and 9,000 shares of $8 par common stock, Its earnings history is as follows: Yeer 1 , net loss of $13.000; Year 2 , net income of $122.000; Year 3, net income of $220.000. The corporation did not poy a dividend in Year 1 . Required a. Holv mach is the dividend arrearage as of January 1, Year 2 ? b. Assume that the board of directors declares a $54,500 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 . preferred dividends are due). How will the dividend be divided between the preferred and common stockholders? Complete this question by entering your answers in the tabs below. Assume that the board of directors declares a $54,500 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided between the preferred and common stockholders? Exercise 8-16A (Algo) Determining the effects of stock splits on the accounting records LO 87 The market value of Yeates Corporation's common stock had become excessively high. The stock was currently selling for $300 pet The market value of Ycates Corporation's common stock had become excessively high. The stock was curfently selling for 5300 pet of $10 par value common stock. Required b. Determine the number of common shares outstanding and the par value after the split. (Round par value answer to 2 decimal places.) Exercise 8-5A (Static) Characteristics of capital stock LO 8-2, 8-4 The stockholders' equity section of Creighton Company's balance sheet is shown as follows. Required a. Assuming the preferred stock was originally issued for cash, determine the amount of cash that was collected when the stock was issued. b. Based on the class B common stock alone, deterrhne the amount of the company's legal capital, c. Based on the class B common stock alone, determine the minimum amount of assets that must be retained in the company as protection for creditors. d. Determine the number of shares of class B common stock that are available to sell as of December 31, Year 1 . e. Assuming Creighton purchases treasury stock consisting of 25 shares of its no par common stock on Januery 1, Year 2, determine the amount of the no-par common stock that would be outstanding immediately after the purchase. f. Based on the stockholders' equity section shown above, can you determine the market value of the preferred stock? Exercise 8-12A (Algo) Treasury stock transactions LO 8-5 Elroy Corpocation repurchesed 3,000 shares of its own stock for $60 per share. The stock has a par of $5 per share. A month later Elroy resold 750 shares of the treasury sfock for $68 per share. Required What is tim bsiance of the Theasury Stock account after these transactions are recognired? Exercise 8-15A (Algo) Accounting for stock dividends LO 8-7 Beacon Corporation issued a 6 percent stock dividend on 33,500 shares of is $7 par common stock. At the time of the dividend, the matket value of the stock was $30 per share. Required a. Compute the amount of the stock dividend. b. Sittw the effects of the stock dividend on the linancial statements using a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA). Investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. Complete this question by entering your answers in the tabs below. Compute the amount of the stock dividend. Exercise 8-15A (Algo) Accounting for stock dividends LO B-7 Heacon Corparation ssued a 6 percent stock dividend on 33,500 shares of is 57 par common stack At the tife of the dicend, the market value of the stock was $30 pert thare Alequired a. Compute the amount of the stock dividend. b. Slaw the effects of the s1ock dividead on the foancial statements uang a hotirontal watements model in the Cash ficw column. to the event, leave the cell blank Complete this quention by entering your answers in the tabs below

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started