Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with each question - 00:25 P ... #4 .4% 3.1 Rick is considering two different ways in which he could pay for a

please help with each question

-

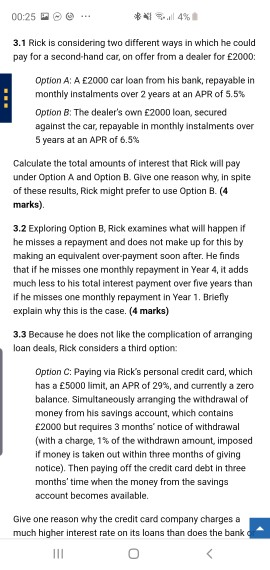

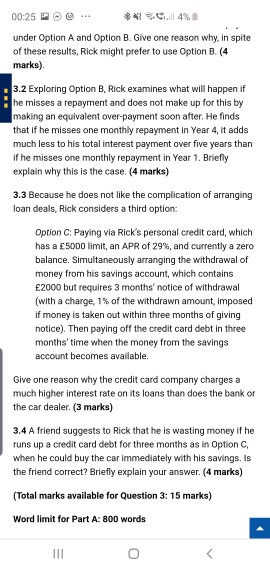

00:25 P ... #4 .4% 3.1 Rick is considering two different ways in which he could pay for a second-hand car, on offer from a dealer for 2000: Option A: A 2000 car loan from his bank, repayable in monthly instalments over 2 years at an APR of 5.5% Option B: The dealer's own 2000 loan, secured against the car, repayable in monthly instalments over 5 years at an APR of 6.5% Calculate the total amounts of interest that Rick will pay under Option A and Option B. Give one reason why, in spite of these results, Rick might prefer to use Option B. (4 marks). 3.2 Exploring Option B, Rick examines what will happen if he misses a repayment and does not make up for this by making an equivalent over-payment soon after. He finds that if he misses one monthly repayment in Year 4, it adds much less to his total interest payment over five years than if he misses one monthly repayment in Year 1. Briefly explain why this is the case. (4 marks) 3.3 Because he does not like the complication of arranging loan deals, Rick considers a third option: Option C: Paying via Rick's personal credit card, which has a 5000 limit, an APR of 29%, and currently a zero balance. Simultaneously arranging the withdrawal of money from his savings account, which contains 2000 but requires 3 months' notice of withdrawal (with a charge, 1% of the withdrawn amount, imposed if money is taken out within three months of giving notice). Then paying off the credit card debt in three months' time when the money from the savings account becomes available. Give one reason why the credit card company charges a much higher interest rate on its loans than does the bank 00:25 P ... #4 .4% 3.1 Rick is considering two different ways in which he could pay for a second-hand car, on offer from a dealer for 2000: Option A: A 2000 car loan from his bank, repayable in monthly instalments over 2 years at an APR of 5.5% Option B: The dealer's own 2000 loan, secured against the car, repayable in monthly instalments over 5 years at an APR of 6.5% Calculate the total amounts of interest that Rick will pay under Option A and Option B. Give one reason why, in spite of these results, Rick might prefer to use Option B. (4 marks). 3.2 Exploring Option B, Rick examines what will happen if he misses a repayment and does not make up for this by making an equivalent over-payment soon after. He finds that if he misses one monthly repayment in Year 4, it adds much less to his total interest payment over five years than if he misses one monthly repayment in Year 1. Briefly explain why this is the case. (4 marks) 3.3 Because he does not like the complication of arranging loan deals, Rick considers a third option: Option C: Paying via Rick's personal credit card, which has a 5000 limit, an APR of 29%, and currently a zero balance. Simultaneously arranging the withdrawal of money from his savings account, which contains 2000 but requires 3 months' notice of withdrawal (with a charge, 1% of the withdrawn amount, imposed if money is taken out within three months of giving notice). Then paying off the credit card debt in three months' time when the money from the savings account becomes available. Give one reason why the credit card company charges a much higher interest rate on its loans than does the bankStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started