Question: Fin 445/545 1. Consider the following quotes on the 3-month Eurodollar Futures contract as of Dec 2, 2016. March 2017 98.95 June 2017 98.815

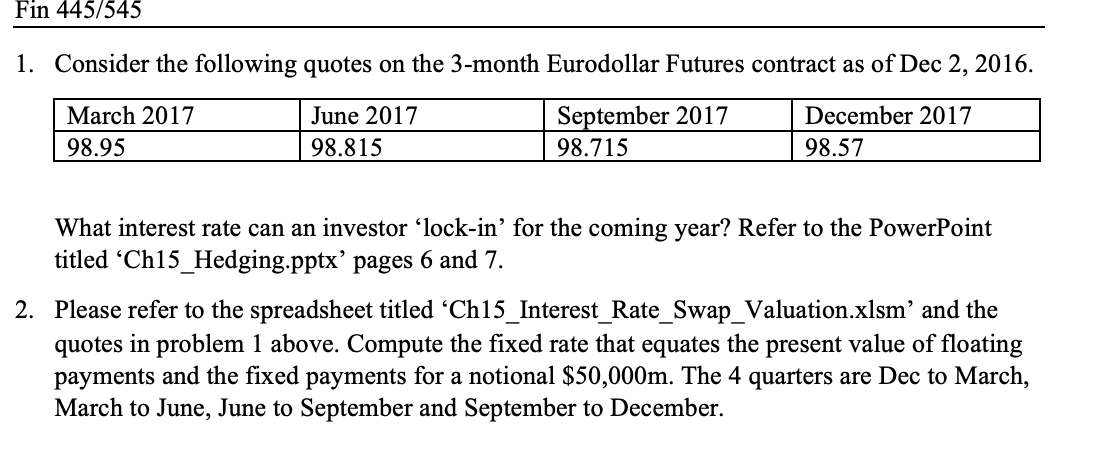

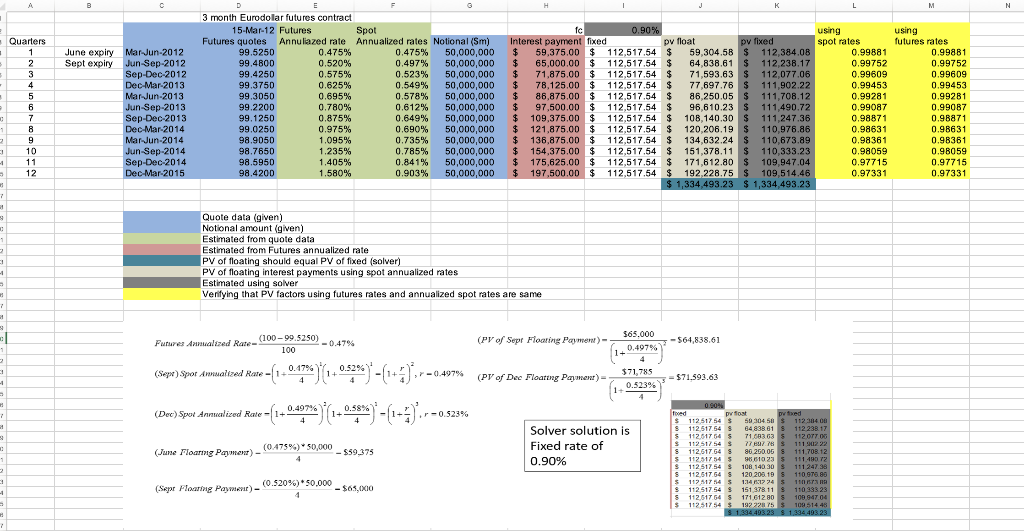

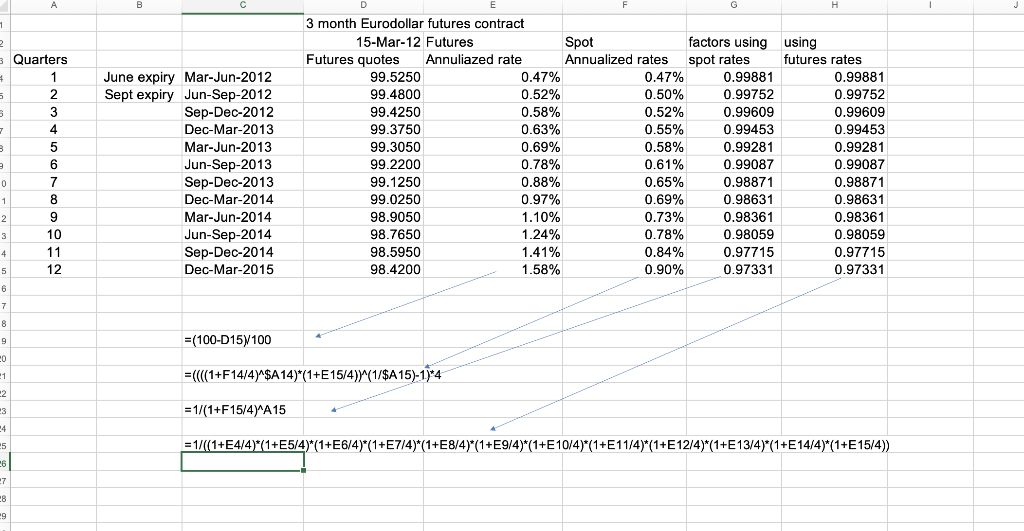

Fin 445/545 1. Consider the following quotes on the 3-month Eurodollar Futures contract as of Dec 2, 2016. March 2017 98.95 June 2017 98.815 September 2017 98.715 December 2017 98.57 What interest rate can an investor 'lock-in' for the coming year? Refer to the PowerPoint titled 'Ch15_Hedging.pptx' pages 6 and 7. 2. Please refer to the spreadsheet titled 'Ch15_Interest_Rate_Swap_Valuation.xlsm' and the quotes in problem 1 above. Compute the fixed rate that equates the present value of floating payments and the fixed payments for a notional $50,000m. The 4 quarters are Dec to March, March to June, June to September and September to December. A B D E F G H M N Quarters Futures quotes 3 month Eurodollar futures contract 15-Mar-12 Futures Spot Annuliazed rate Annualized rates Notional (Sm) fc 0.90% using using 1 June expiry Mar-Jun-2012 99.5250 0.475% 2 Sept expiry Jun-Sep-2012 99.4800 0.520% 3 Sep-Dec-2012 99.4250 0.575% 4 Dec-Mar-2013 99.3750 0.625% 5 Mar-Jun-2013 99.3050 0.695% 6 Jun-Sep-2013 99.2200 0.780% 0 7 Sep-Dec-2013 99.1250 0.875% 1 8 Dec-Mar-2014 99.0250 0.975% 0.690% 2 9 Mar-Jun-2014 98.9050 1.095% 0.735% 3 10 Jun-Sep-2014 98.7650 1.235% 0.785% 4 11 Sep-Dec-2014 98.5950 1.405% = 12 Dec-Mar-2015 98.4200 1.580% 0.841% 0.903% Interest payment fixed 0.475% 50,000,000 $ 59,375.00 $ 0.497% 50,000,000 $ 65,000.00 $ 0.523% 50,000,000 $ 71,875.00 $ 0.549% 50,000,000 $ 78,125.00 $ 0.578% 50,000,000 $ 86,875.00 $ 0.612% 50,000,000 $ 97,500.00 $ 112,517.54 $ 0.649% 50,000,000 $ 109,375.00 $ 112,517.54 $ 50,000,000 $ 121,875.00 $ 112,517.54 $ 120,206.19 $ 110,976.86 50,000,000 $ 136,875.00 $ 112,517.54 $ 134,632.24 $ 110,673.89 50,000,000 $ 154,375.00 $ 112,517.54 $ 151,378.11 $ 110,333.23 50,000,000 $ 175,625.00 $ 112,517.54 $ 171,612.80 $ 109,947.04 50,000,000 $ 197,500.00 $ 112,517.54 $ 192,228.75 $ 109,514.46 $ 1,334,493.23 $ 1,334,493.23 pv float pv fixed 112,517.54 $ 59,304.58 $ 112,384.08 112,517.54 $ 64,838.61 $ 112,238.17 112,517.54 $ 71,593.63 $ 112,077.06 112,517.54 $ spot rates futures rates 0.99881 0.99881 0.99752 0.99752 0.99609 0.99609 112,517.54 $ 77,697.76 $ 111,902.22 86,250.05 $ 111,708.12 96,610.23 $ 111,490.72 0.99453 0.99453 0.99281 0.99281 0.99087 0.99087 108,140.30 $ 111,247.36 0.98871 0.98871 0.98631 0.98631 0.98361 0.98361 0.98059 0.98059 0.97715 0.97715 0.97331 0.97331 7 1 3 1 2 a 7 Quote data (given) Notional amount (given) Estimated from quote data Estimated from Futures annualized rate PV of floating should equal PV of fixed (solver) PV of floating interest payments using spot annualized rates Estimated using solver Verifying that PV factors using futures rates and annualized spot rates are same (100-99.5250) Futures Annualized Rate- -0.47% 1 100 2 (PV of Sept Floating Payment) $65,000 0.497% 4 -$64,838.61 -0.497% (PV of Dec Floating Payment)= $71,785 0.523% -$71,593.63 4 = 7 (Dec) Spot Annualized Rate 1+ (Sept) Spot Annualized Rate *(1+0.47%) (1+ 0.52%)' - (1+4)*.. (D)(1)-(1-2). 0.497% 0.58% 1+ 3 (June Floaring Payment)- (0.475%) 50,000 $59,375 1 4 2 3 (0.520%) 50,000 (Sept Floating Payment)= -$65,000 4 4 = 7 -0.523% 0.90% Solver solution is Fixed rate of 0.90% foxed pv fost $ 112,517.54 $ 112,517.54 $ 112,617.64 $ 112,517.54 $ 8 112,617.64 S 112,51754 $ 112,517.54 S 112.517.64 $ 112,517 54 S 112,517.54 $ pvxed 112,238 17 112.077.06 111,902 22 111.708.12 111,490.72 111247.38 50,304.50 $ 112,384.00 64.838.61 S 71,683.63 $ 7780776 $ 86.250.00 $ 96610235 108,140 30 S 120.200.10 S 134 63724 S 151.378 11 S 171,612.80 S 110,976.86 110,673 110 333 23 S $ S S 112,617.64 $ $ 112,517 54 $ 192 228 75 $ 109 514 45 $ 1,334,493.23 $ 1,334,493.23 109.947.04 A B C 1 2 D 3 month Eurodollar futures contract 15-Mar-12 Futures F G H 1 Spot factors using using Quarters Futures quotes Annuliazed rate Annualized rates spot rates futures rates 4 1 5 2 June expiry Mar-Jun-2012 Sept expiry Jun-Sep-2012 99.5250 0.47% 0.47% 0.99881 0.99881 99.4800 0.52% 0.50% 0.99752 0.99752 8 3 Sep-Dec-2012 99.4250 0.58% 0.52% 0.99609 0.99609 7 4 Dec-Mar-2013 99.3750 0.63% 0.55% 0.99453 0.99453 8 5 Mar-Jun-2013 99.3050 0.69% 0.58% 0.99281 0.99281 9 6 Jun-Sep-2013 99.2200 0.78% 0.61% 0.99087 0.99087 0 7 Sep-Dec-2013 99.1250 0.88% 0.65% 0.98871 0.98871 1 8 Dec-Mar-2014 99.0250 0.97% 0.69% 0.98631 0.98631 2 9 Mar-Jun-2014 98.9050 1.10% 0.73% 0.98361 0.98361 3 10 Jun-Sep-2014 98.7650 1.24% 0.78% 0.98059 0.98059 4 11 Sep-Dec-2014 98.5950 1.41% 0.84% 0.97715 0.97715 5 12 Dec-Mar-2015 98.4200 1.58% 0.90% 0.97331 0.97331 6 7 8 9 =(100-D15)/100 20 21 22 23 =((((1+F14/4)^$A14)*(1+E15/4))^(1/$A15)-1)*4 =1/(1+F15/4)^A15 24 25 |=1/((1+E4/4)*(1+E5/4)*(1+E6/4)*(1+E7/4)*(1+E8/4)*(1+E9/4)*(1+E10/4)*(1+E11/4)*(1+E12/4)*(1+E13/4)*(1+E14/4)*(1+E15/4)) 26 27 28 9

Step by Step Solution

There are 3 Steps involved in it

To solve the problem well go through the two parts stepbystep 1 Determine the LockIn Interest Rate Y... View full answer

Get step-by-step solutions from verified subject matter experts