Answered step by step

Verified Expert Solution

Question

1 Approved Answer

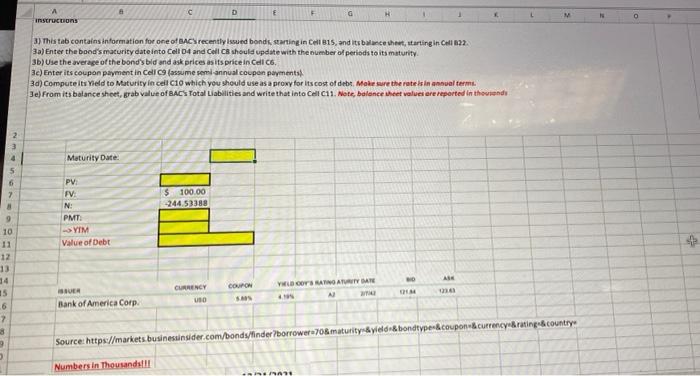

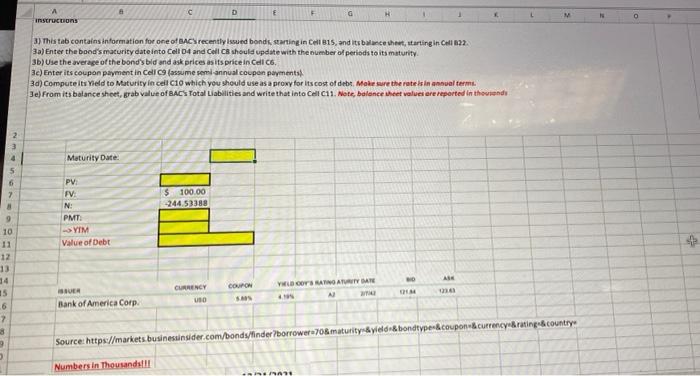

please help with formulas and answer c D E A instructions F G H M O 3.) This tab contains information for one of BACS

please help with formulas and answer

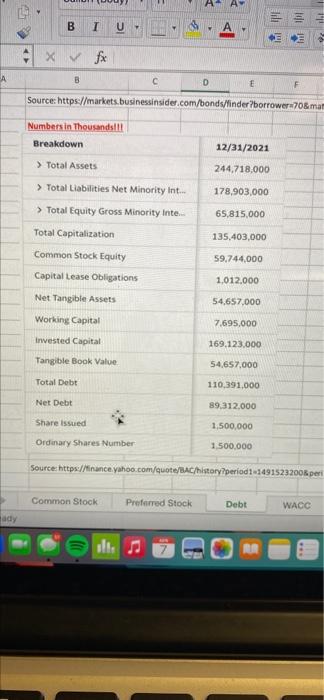

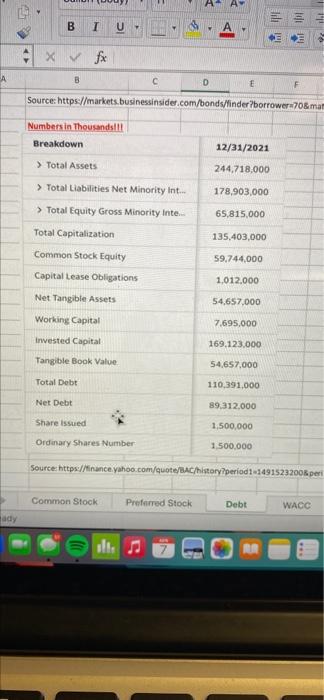

c D E A instructions F G H M O 3.) This tab contains information for one of BACS recently wed bonds, surtingin Cell B15, and its blanchest, startingin Cell 22. 3a) Enter the bood's maturity date into Cell 4 and Cell Cashould update with the number of periods to its maturity 3b) Use the average of the bond's bid and ask prices as its price in Cell 6. 30) Enter its coupon payment in Cell C (assume semi-annual coupon payments 3d) Compute its Yield to Maturity in cell C10 which you should use as a proxy for its cost of debt, Make sure the rates in annual term. Je) From its balance sheet, grab value of BACS Total Liabilities and write that into Cell C11. Note, balance sheet values are reported in the end 2 3 4 Maturity Date 6 7 $ 100.00 -244.53388 PV FV N: PMT - YIM Value of Debt 9 10 11 12 13 34 15 .6 7 3 9 BOOTS RATIO ATVIRI MTE CURRENCY USO COUPON SA CH Bank of America Corp Source: https://markets businessinsider.com/bonds/finder/borrower-708 maturityield bondtype-coupon currency Brating country Numbers in Thousands!!! 1.A B I U Vell 1 x fx B C D Source: https://markets businessinsider.com/bonds/linder borrower70 man Numbers in Thousands!!! Breakdown 12/31/2021 > Total Assets 244,718.000 > Total Liabilities Net Minority Int. 178,903,000 > Total Equity Gross Minority Inte. 65,815,000 Total Capitalization 135.403,000 Common Stock Equity 59.744,000 Capital Lease Obligations 1,012.000 54,657,000 Net Tangible Assets Working Capital 7,695.000 Invested Capital 169,123.000 Tangible Book Value 54,657,000 Total Debt 110,391,000 Net Debt 89.312,000 Share issued 1,500,000 Ordinary Shares Number 1.500,000 Source: https://finance.yahoo.com/quote/BAC/history period 11491523200 per Common Stock Preferred Stock Debt WACC ady ali. RA c D E A instructions F G H M O 3.) This tab contains information for one of BACS recently wed bonds, surtingin Cell B15, and its blanchest, startingin Cell 22. 3a) Enter the bood's maturity date into Cell 4 and Cell Cashould update with the number of periods to its maturity 3b) Use the average of the bond's bid and ask prices as its price in Cell 6. 30) Enter its coupon payment in Cell C (assume semi-annual coupon payments 3d) Compute its Yield to Maturity in cell C10 which you should use as a proxy for its cost of debt, Make sure the rates in annual term. Je) From its balance sheet, grab value of BACS Total Liabilities and write that into Cell C11. Note, balance sheet values are reported in the end 2 3 4 Maturity Date 6 7 $ 100.00 -244.53388 PV FV N: PMT - YIM Value of Debt 9 10 11 12 13 34 15 .6 7 3 9 BOOTS RATIO ATVIRI MTE CURRENCY USO COUPON SA CH Bank of America Corp Source: https://markets businessinsider.com/bonds/finder/borrower-708 maturityield bondtype-coupon currency Brating country Numbers in Thousands!!! 1.A B I U Vell 1 x fx B C D Source: https://markets businessinsider.com/bonds/linder borrower70 man Numbers in Thousands!!! Breakdown 12/31/2021 > Total Assets 244,718.000 > Total Liabilities Net Minority Int. 178,903,000 > Total Equity Gross Minority Inte. 65,815,000 Total Capitalization 135.403,000 Common Stock Equity 59.744,000 Capital Lease Obligations 1,012.000 54,657,000 Net Tangible Assets Working Capital 7,695.000 Invested Capital 169,123.000 Tangible Book Value 54,657,000 Total Debt 110,391,000 Net Debt 89.312,000 Share issued 1,500,000 Ordinary Shares Number 1.500,000 Source: https://finance.yahoo.com/quote/BAC/history period 11491523200 per Common Stock Preferred Stock Debt WACC ady ali. RA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started