Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with homework! Required info provided & will give thumbs up! Required information [The following information applies to the questions displayed below] On January

Please help with homework! Required info provided & will give thumbs up!

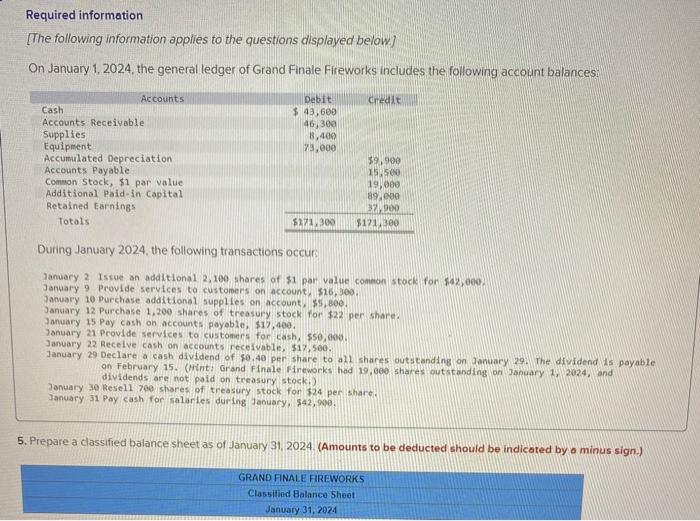

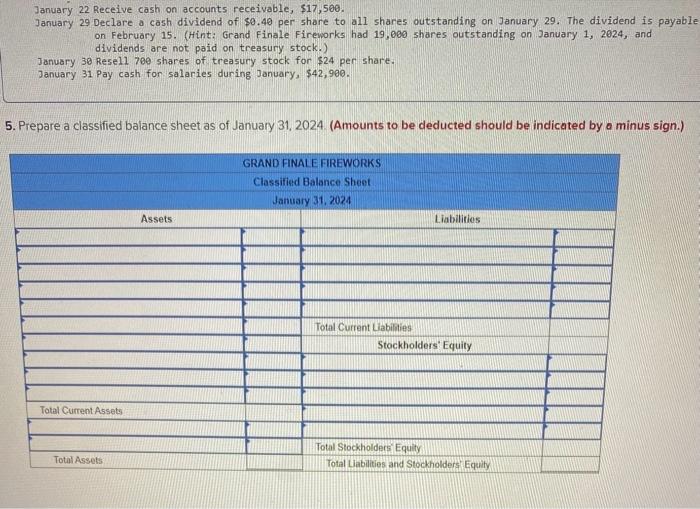

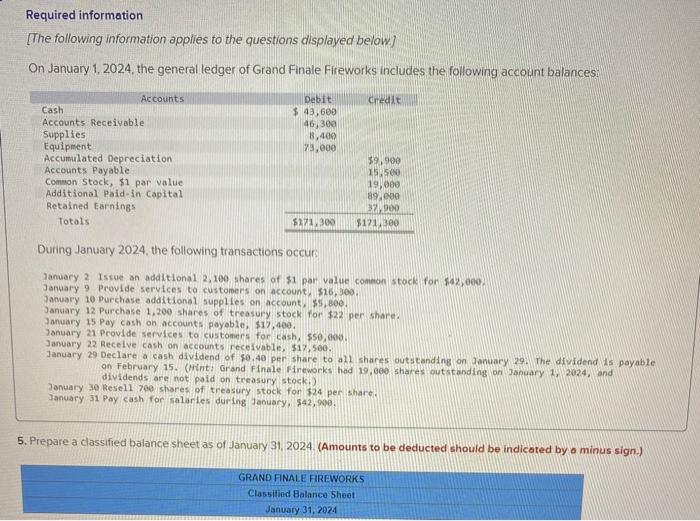

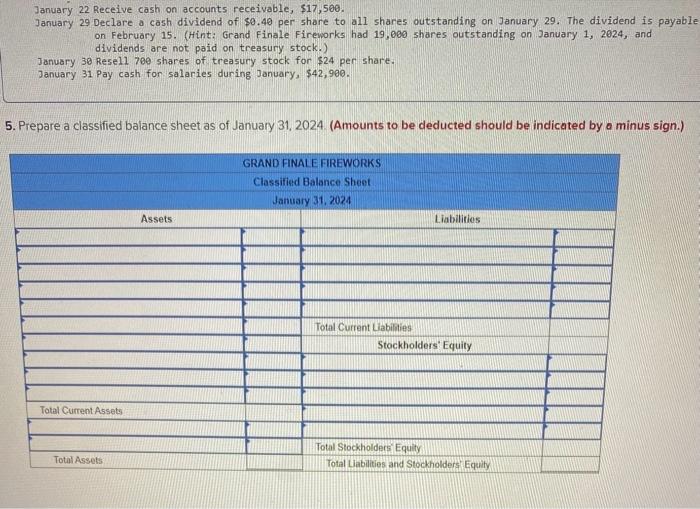

Required information [The following information applies to the questions displayed below] On January 1, 2024, the general ledger of Grand Finale Fireworks includes the following account balances: During January 2024, the following transactions occur January 2 Issue an additional 2,100 shares of $1 por value comen stock for $42,000. January 9 Provide services to custopers on pccount. $16,100. January 10 Purchase additional supplies on account, $5,800. January 12 Purchase 1,200 shares of treasury stock for $22 per share. January 15 Pay cash on accounts payable, $17,400. January 21 Provlde services to custoners for cash, $50,000. January 22 Receive cash on accounts receivable, $17,500. January 29 Declare a cash dividend of 80.40 per share to all shares outstanding on janury 291 The dividend 1s payabie on February 15. (Hint: Grand Finale Fireworks had 19,000 shares outstanding on 3anuary12,2024, and dividends are not poid on treasury stock.) January 30 Resel1 700 stuares of treasury stock for $24 per share. January 31 Pay cash for salarles during January, 542,000. 5. Prepare a classified balance sheet as of January 31, 2024. (Amounts to be deducted should be indicoted by a minus sign.) January 22 Receive cash on accounts receivable, $17,500. January 29 Declare a cash dividend of $0.40 per share to all shares outstanding on January 29 . The dividend is payable on February 15. (Hint: Grand Finale Fireworks had 19,000 shares outstanding on January 1, 2024, and dividends are not paid on treasury stock.) January 30 Resel1 700 shares of treasury stock for $24 per share. January 31 Pay cash fon salaries during January, $42,900. 5. Prepare a classified balance sheet as of January 31, 2024. (Amounts to be deducted should be indicated by a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started