Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with homework! Required info provided & will give thumbs up! 3. Prepare an adjusted trial balance as of January 31, 2024. On January

Please help with homework! Required info provided & will give thumbs up!

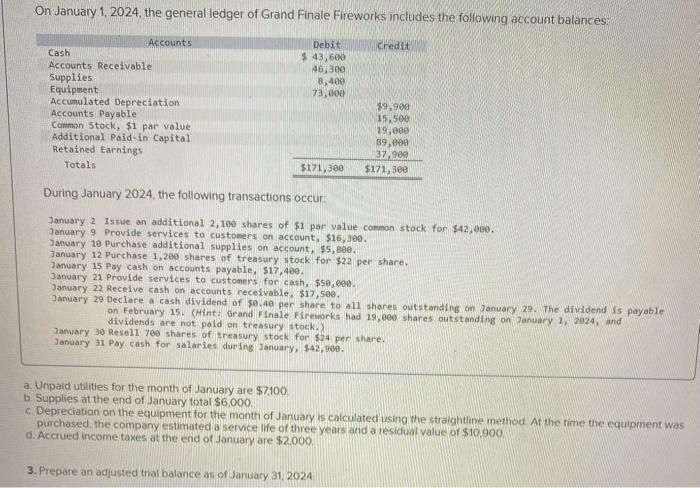

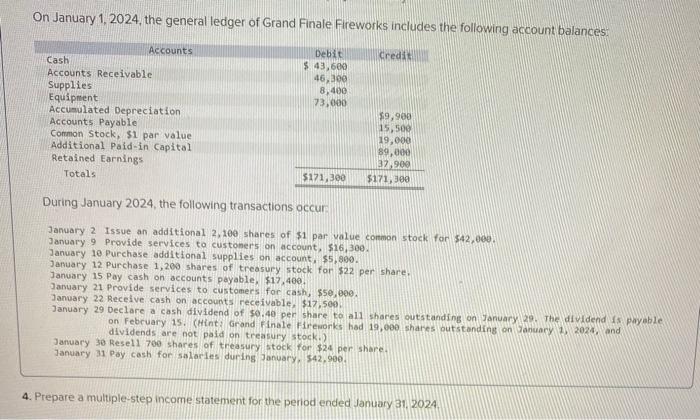

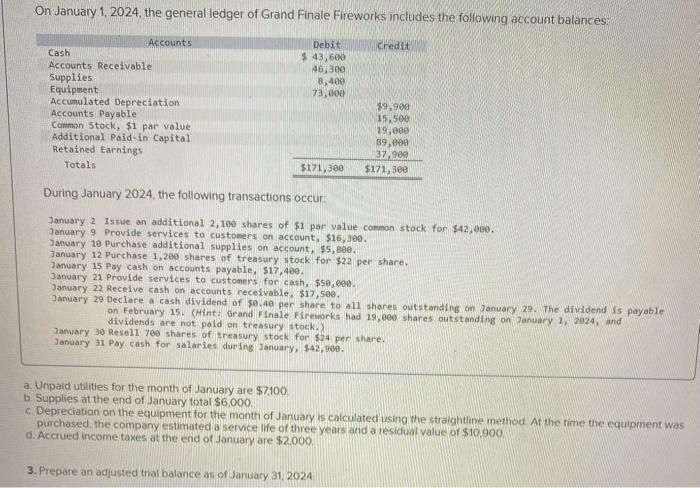

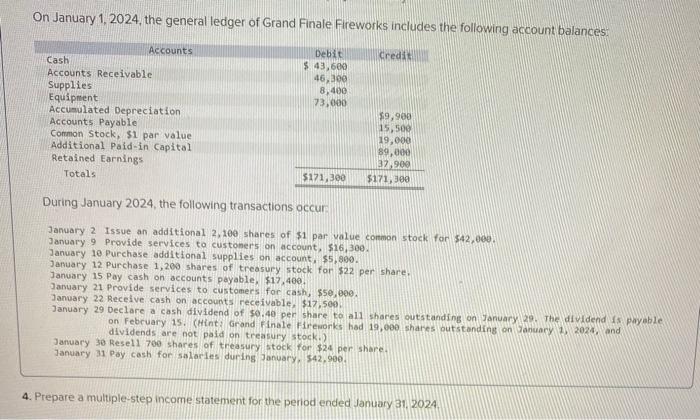

3. Prepare an adjusted trial balance as of January 31, 2024. On January 1, 2024, the general ledger of Grand Finale Fireworks includes the following account balances: During January 2024, the following transactions occur: January 2 Issue an additional 2,100 shares of $1 par value common stock for 542,000. January 9 Provide services to custoners on account, $16,300. January 18 purchase additional supplies on account, $5,800. January 12 purchase 1,200 shares of treasury stock for $22 per share. January 15 Pay cash on accounts payable, $17,400. January 21 Provide services to customers for cash, $59,000. Janvary 22 Receive cash on accounts receivable, \$17, 509. January 29 beclare a cash dividend of 50,40 per share to all shares outstanding on January 29. The dividend is. payable on February 15. (Hint? Grond FLnale Fireworks had 19, eoe shares butstanding on Zanuary 1, 2024. and dividends are not paid on treasury stock.) January 30 Resel1 700 shares of treasury stock for $24 per share. January 31 Pay cash for salarles during January, 542,900. 4. Prepare a multiple-step income statement for the period ended January 31.2024. 4. Prepare a multiple-step income statement for the period ended January 31. 2024. On January 1,2024 , the general ledger of Grand Finale Fireworks includes the following account balances: During January 2024, the following transactions occur: January 2 Issue an additiona1 2, 109 shares of \$1 par value coemon stock for \$42, 900. January 9 Provide services to customers on account, $16,300. January 10 Purchase additional supplies on account, $5,800. January 12 Purchase 1,200 shares of treasury stock for $22 per share. January 15 Pay cash on accounts payable, $17,400. Janiary 21 Provide services to customers for cash, $50,600. January 22 Recelve cash on accounts receivable, $17,500. January 29 Declare a cash dividend of 50.40 per share to all shares outstanding an 2anuary.29. The dividend is payable. on February. 15. (Hint; Grand Finale Ffreworks had 19,000 shares outstanding on 2 anuary 1 , 2024 , and dividends are not paid on treasury stock.) Janwary 30 Resel1 700 shares of treasury stock for $24 per share. January 31 Poy cash for salaries during January, $42,940. a. Unpaid utilities for the month of January are $7.100 b. Supplies at the end of January totar $6,000. c. Depreciation on the equipment for the month of January is calculated using the stralghtime methed. At the time the equipment was purchased, the company estimated a service life of three years and a residual value or $10,900 d. Accrued income taxes at the end of January are $2.000 3. Prepare an adjusted thal balance as of January 31,2024

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started