Answered step by step

Verified Expert Solution

Question

1 Approved Answer

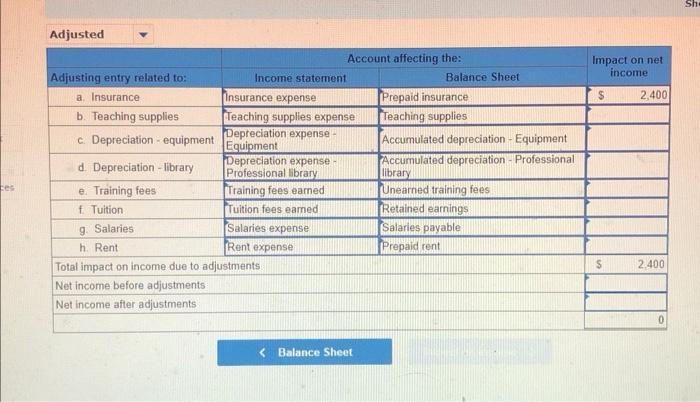

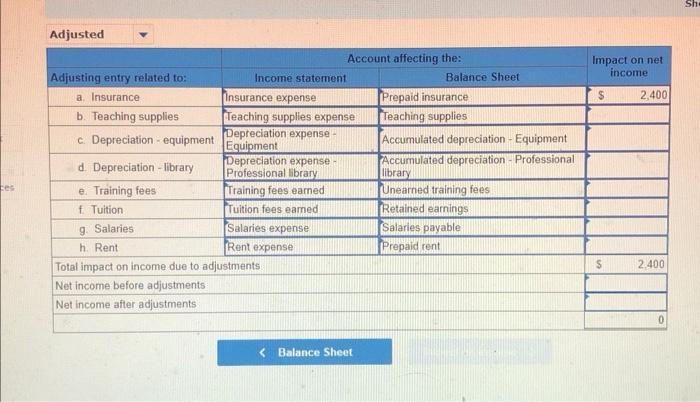

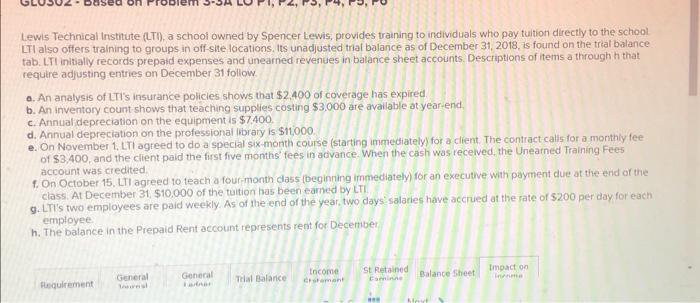

please help with impact on net income this is unajusted trial balance Sh. Impact on net income $ 2.400 Adjusted Account affecting the: Adjusting entry

please help with impact on net income

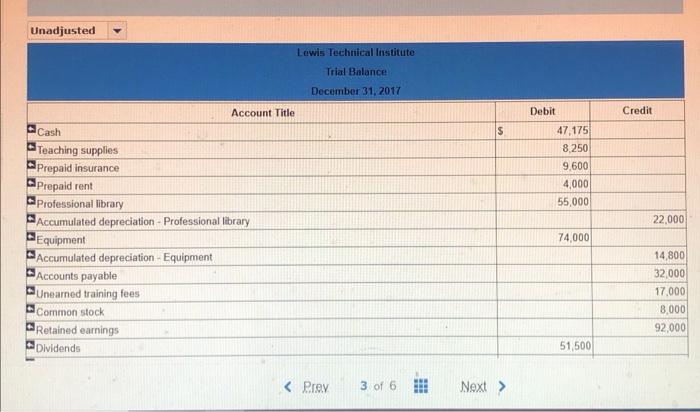

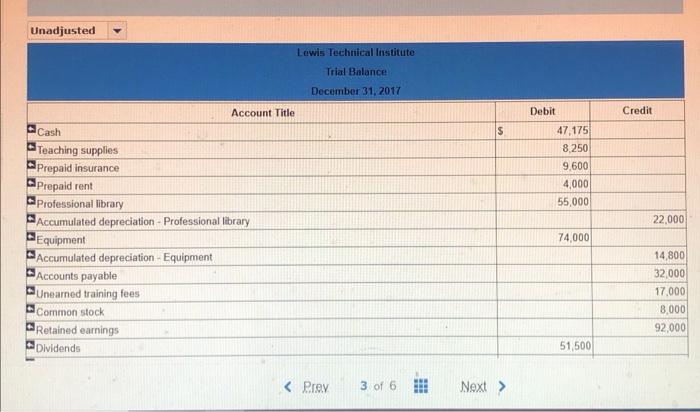

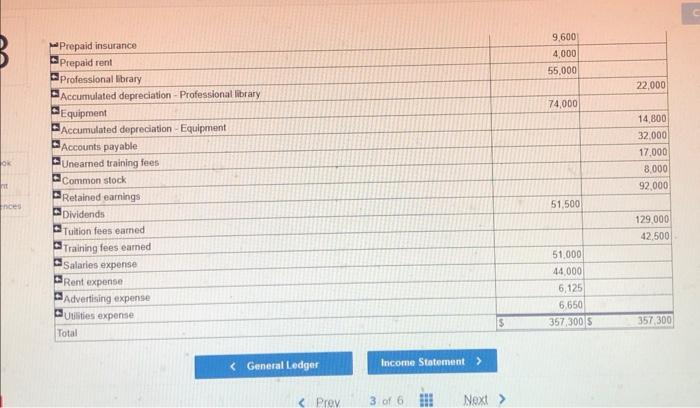

this is unajusted trial balance

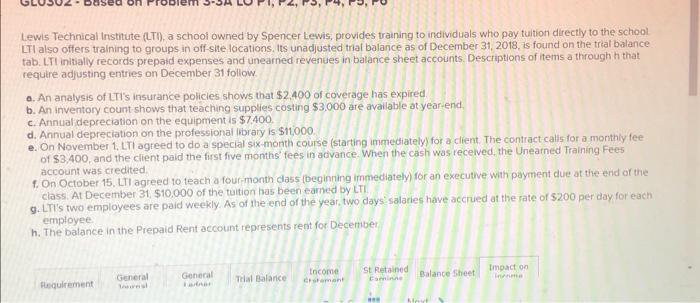

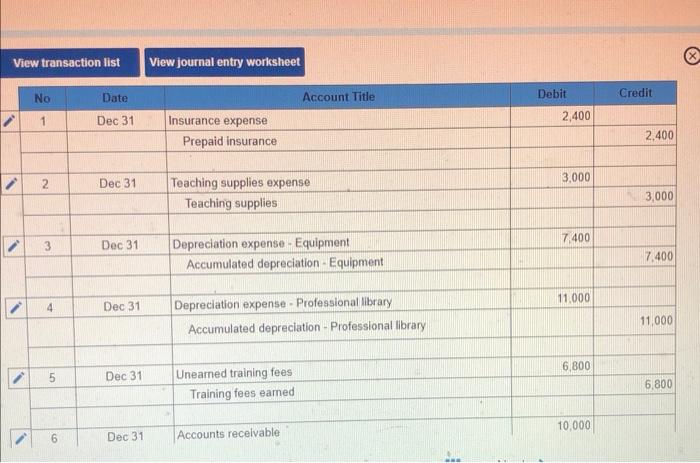

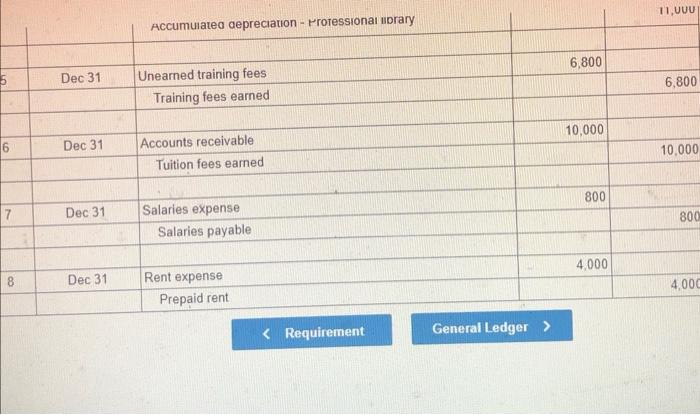

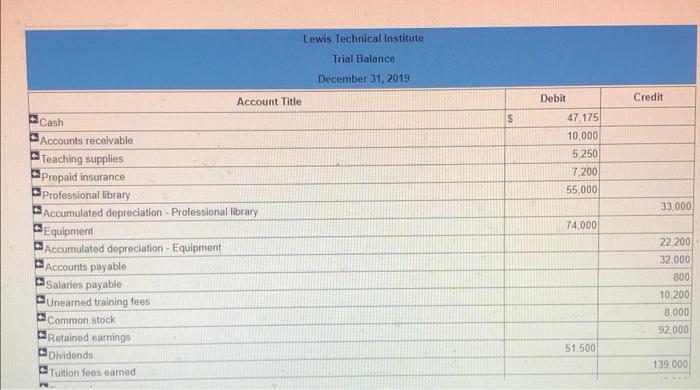

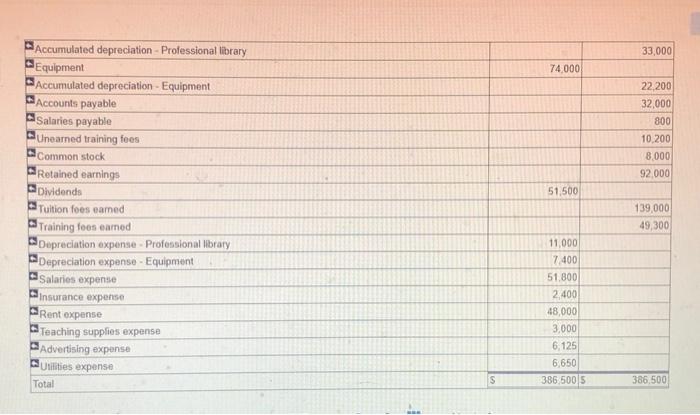

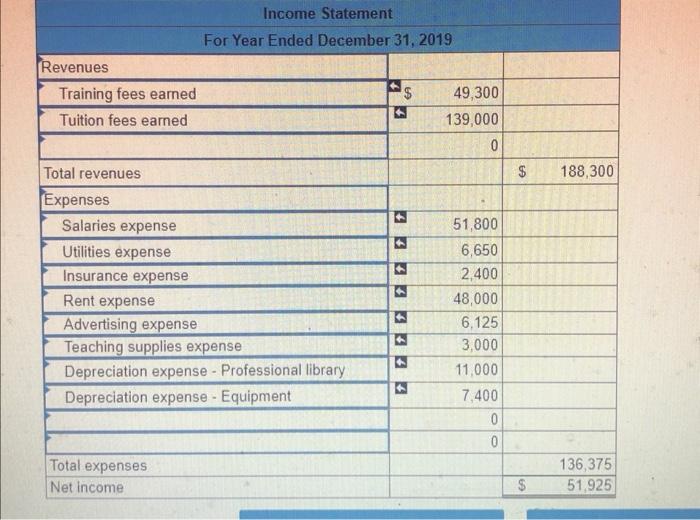

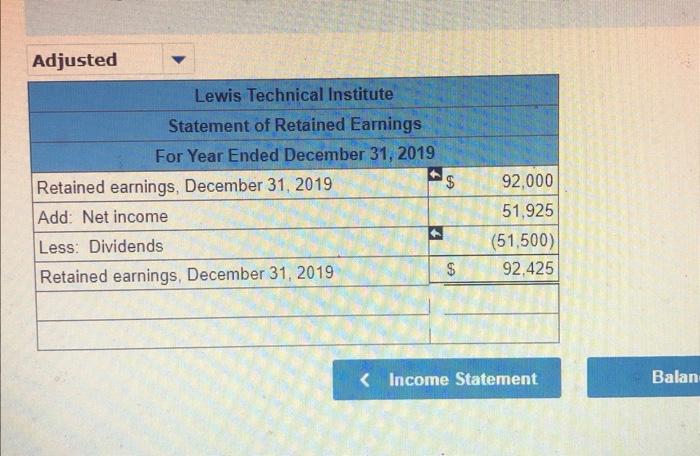

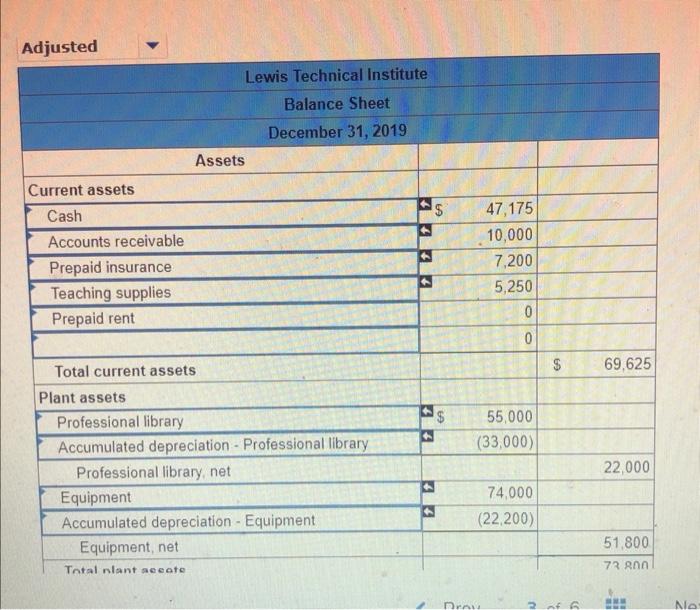

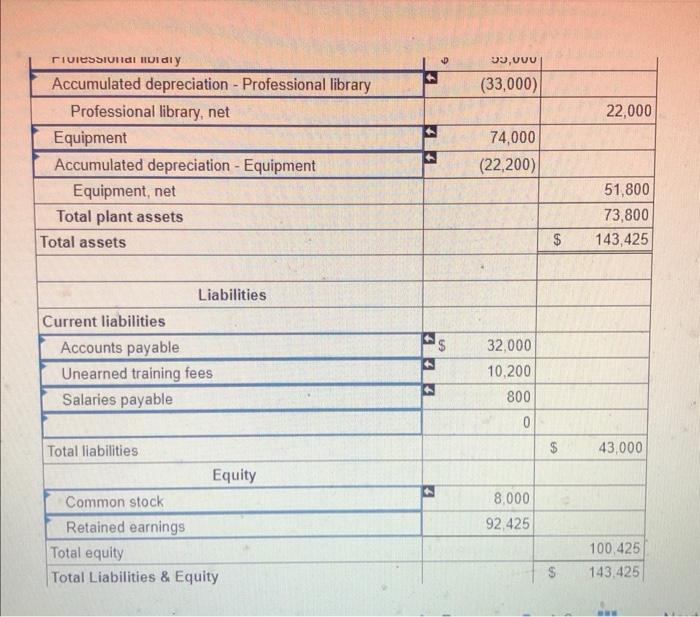

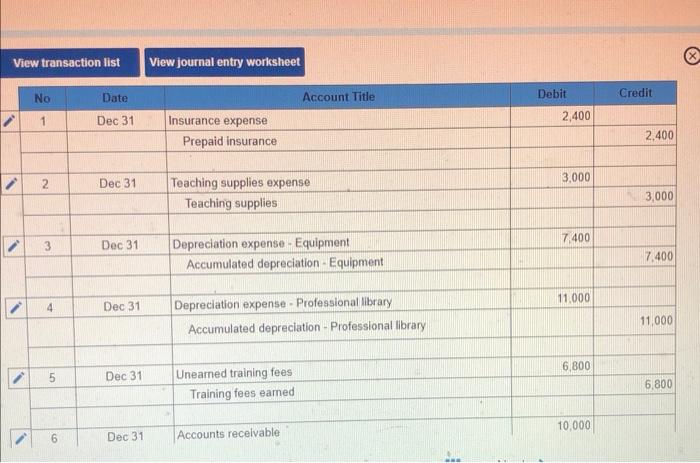

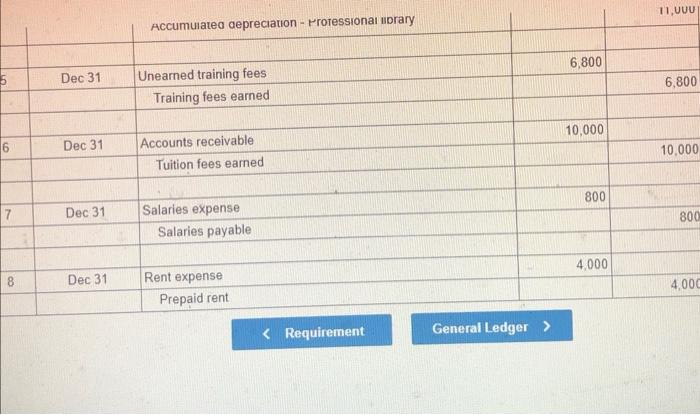

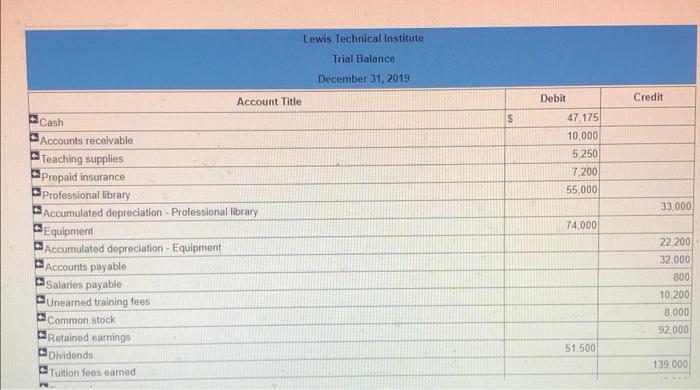

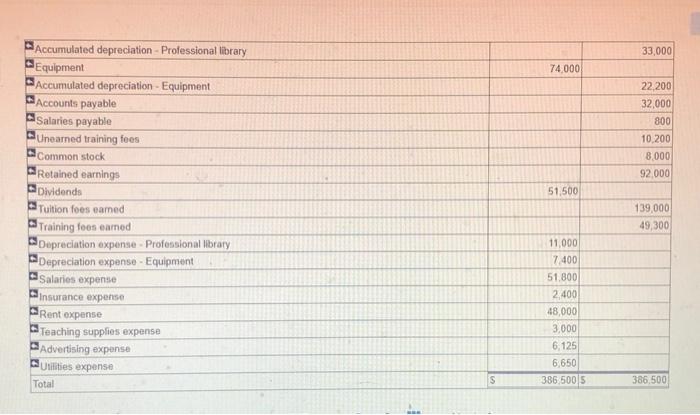

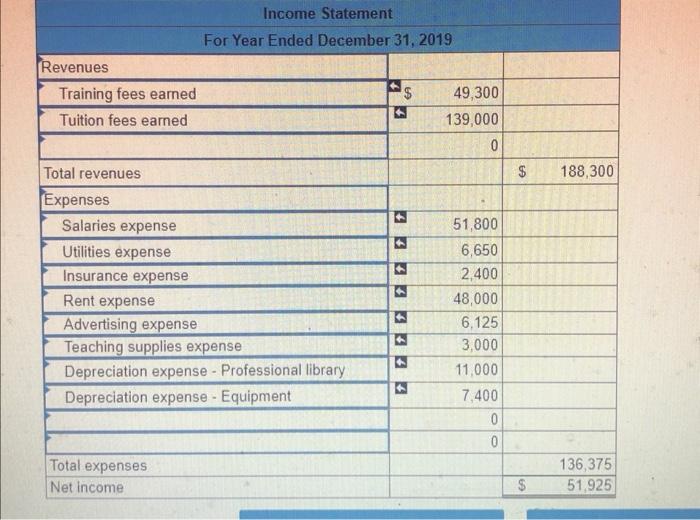

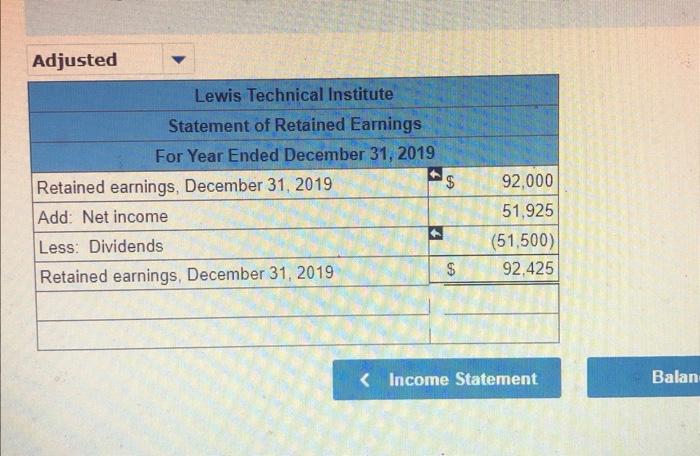

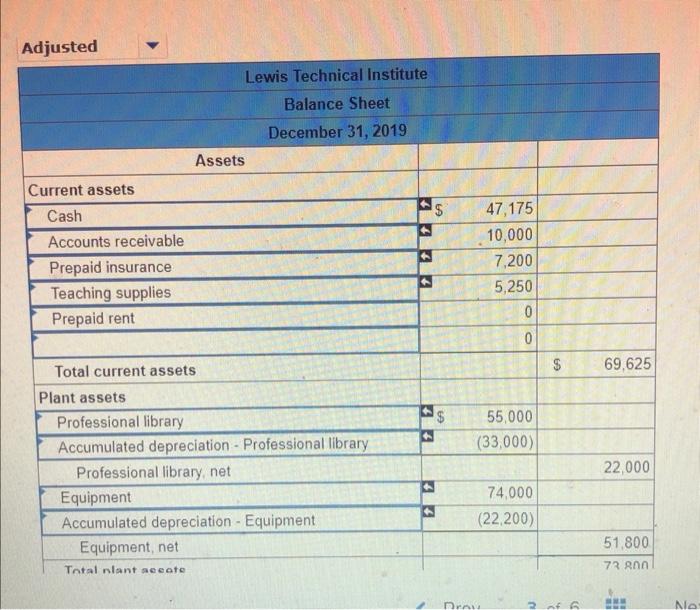

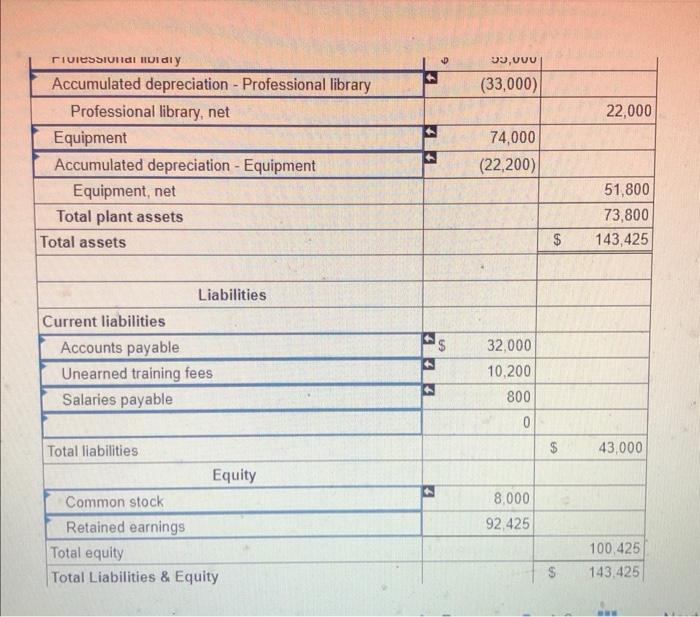

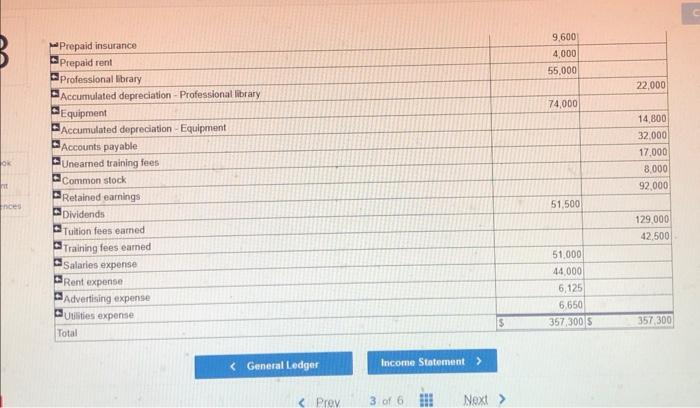

Sh. Impact on net income $ 2.400 Adjusted Account affecting the: Adjusting entry related to: Income statement Balance Sheet a Insurance Insurance expense Prepaid insurance b. Teaching supplies Teaching supplies expense Teaching supplies c Depreciation - equipment Equipment Depreciation expense Accumulated depreciation - Equipment Depreciation expense Accumulated depreciation - Professional d Depreciation - library Professional library library e. Training fees Training fees earned Unearned training fees f Tuition Tuition fees eamed Retained earnings g. Salaries Salaries expense Salarles payable h Rent Prepaid rent Total impact on income due to adjustments Net income before adjustments Net income after adjustments tes Rent expense S 2.400 0 Lewis Technical Institute Trial Balance December 31, 2019 Account Title Credit S Debit 47 175 10,000 5250 7,200 55 000 33.000 74,000 Cash Accounts receivable Teaching supplies Prepaid insurance Professional library Accumulated depreciation - Professional library Equipment Accumulated depreciation - Equipment Accounts payable Salaries payable Unearned training fees Common stock Retained earnings Dividends Tuition fees samed 22 200 32.000 800 10.200 8.000 92.000 51.500 2 222 139 000 33,000 PD 74.000 22,200 32,000 800 10 200 8,000 92.000 51500 Accumulated depreciation - Professional library Equipment Accumulated depreciation - Equipment Accounts payable Salaries payable Unearned training fees Common stock Retained earnings Dividends Tuition foes eamed Training foos eamed Depreciation expense Professional library Depreciation expense - Equipment Salaries expense Insurance expense Rent expense Teaching supplies expense Advertising expense Duities expense Total 139,000 49,300 11,000 7 400 51,800 2,400 48,000 3,000 6,125 6,650 386,500 5 S 386,500 Income Statement For Year Ended December 31, 2019 Revenues Training fees earned Tuition fees earned $ 49,300 139,000 0 UA $ 188,300 Total revenues Expenses Salaries expense Utilities expense Insurance expense Rent expense Advertising expense Teaching supplies expense Depreciation expense - Professional library Depreciation expense - Equipment 51,800 6,650 2,400 48,000 6,125 3,000 11,000 7,400 0 0 Total expenses Net Income 136,375 51.925 $ Adjusted Lewis Technical Institute Statement of Retained Earnings For Year Ended December 31, 2019 Retained earnings, December 31, 2019 Add: Net income Less: Dividends Retained earnings, December 31, 2019 $ 92,000 51,925 (51,500) 92,425 7 $ $ Prepaid insurance Prepaid rent Professional library Accumulated depreciation - Professional library 9,600 4,000 55,000 22,000 74,000 Equipment 14.800 32.000 17.000 8.000 92.000 O nces 51,500 Accumulated depreciation Equipment Accounts payable Unearned training fees Common stock Retained earnings Dividends Tuition fees eamed Training fees earned Salaries expense Rent expense Advertising expense Utistes expense Total 129,000 42,500 11 51.000 44,000 6,125 6.650 357,300 $ $ 357 300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started