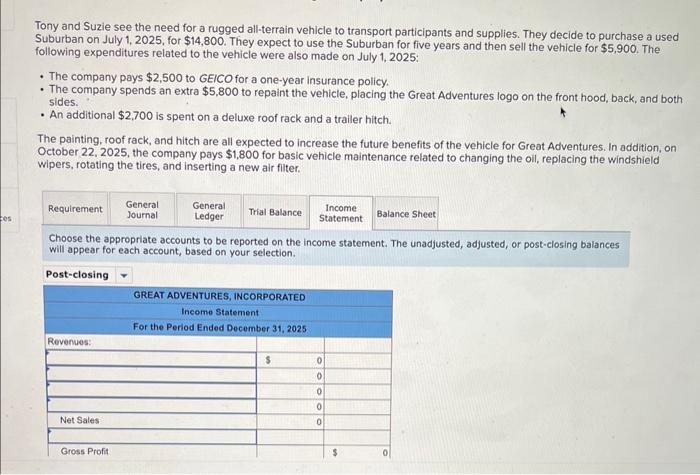

please help with income statement and balance sheet!

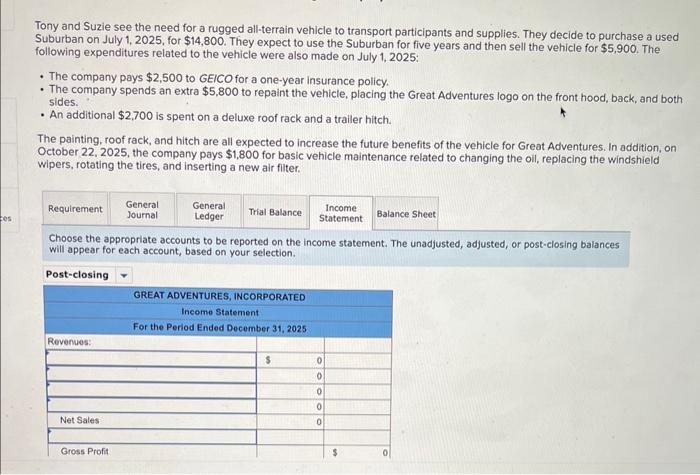

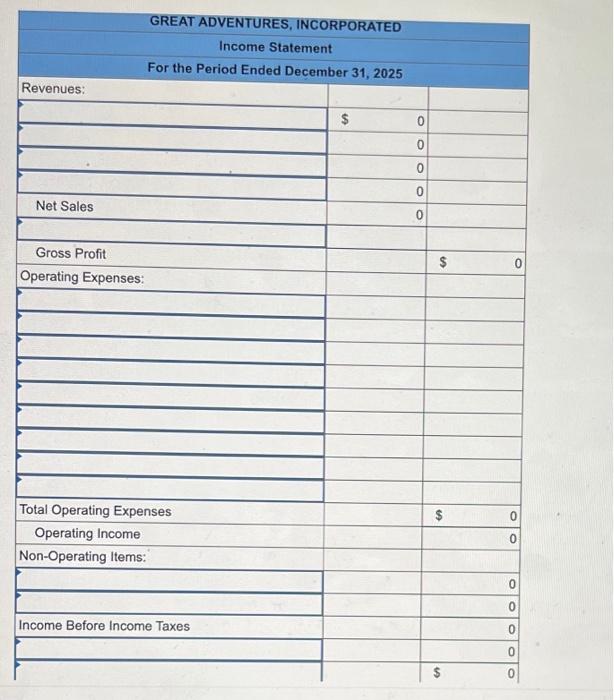

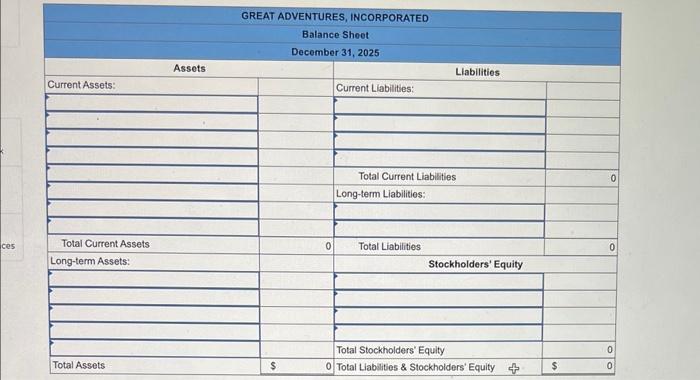

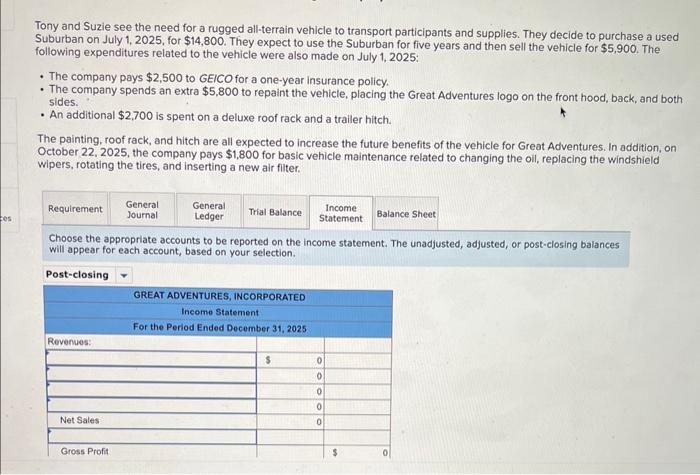

Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1, 2025, for $14,800. They expect to use the Suburban for five years and then sell the vehicle for $5,900. The following expenditures related to the vehicle were also made on July 1, 2025: - The company pays $2,500 to GEICO for a one-year insurance policy. - The company spends an extra $5,800 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. - An additional $2,700 is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures, In addition, on October 22,2025 , the company pays $1,800 for basic vehicle maintenance related to changing the oil, replacing the windshield wipers, rotating the tires, and inserting a new air filter. Choose the appropriate accounts to be reported on the income statement. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. GREAT ADVENTURES, INCORPORATED Income Statement For the Period Ended December 31, 2025 Revenues: GREAT ADVENTURES, INCORPORATED Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1, 2025, for $14,800. They expect to use the Suburban for five years and then sell the vehicle for $5,900. The following expenditures related to the vehicle were also made on July 1, 2025: - The company pays $2,500 to GEICO for a one-year insurance policy. - The company spends an extra $5,800 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. - An additional $2,700 is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures, In addition, on October 22,2025 , the company pays $1,800 for basic vehicle maintenance related to changing the oil, replacing the windshield wipers, rotating the tires, and inserting a new air filter. Choose the appropriate accounts to be reported on the income statement. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. GREAT ADVENTURES, INCORPORATED Income Statement For the Period Ended December 31, 2025 Revenues: GREAT ADVENTURES, INCORPORATED