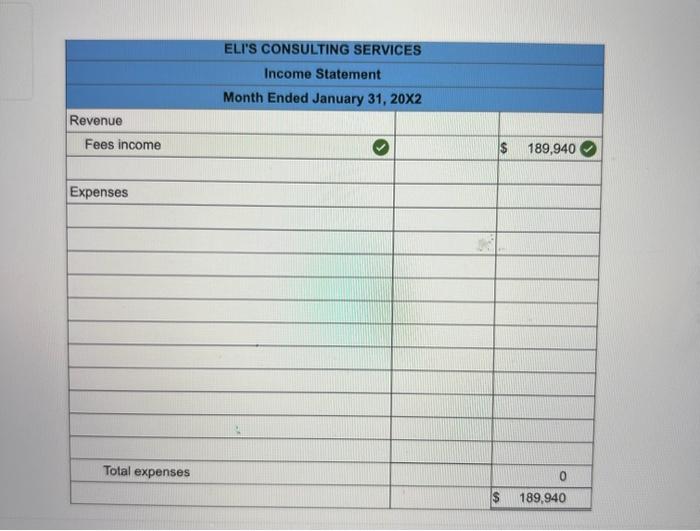

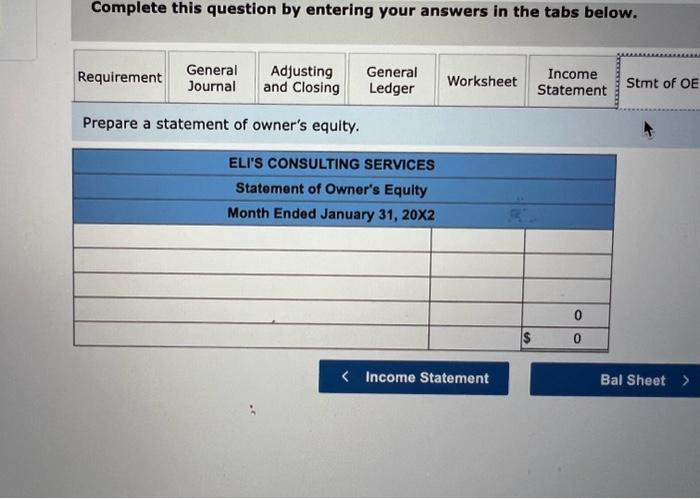

Please help with income statement and statement of owners equity!!, income statement

total= 189940 balance sheet total = 206,960

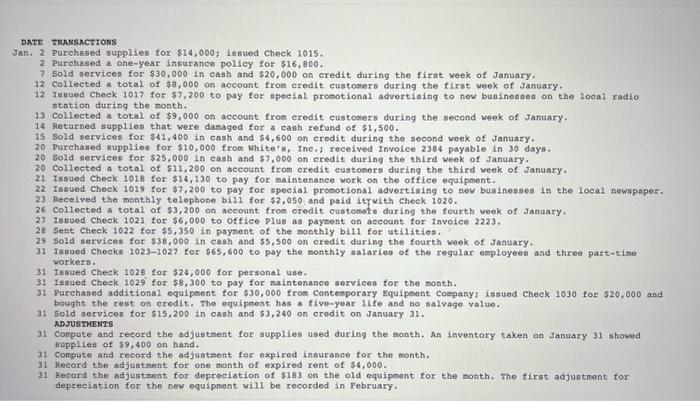

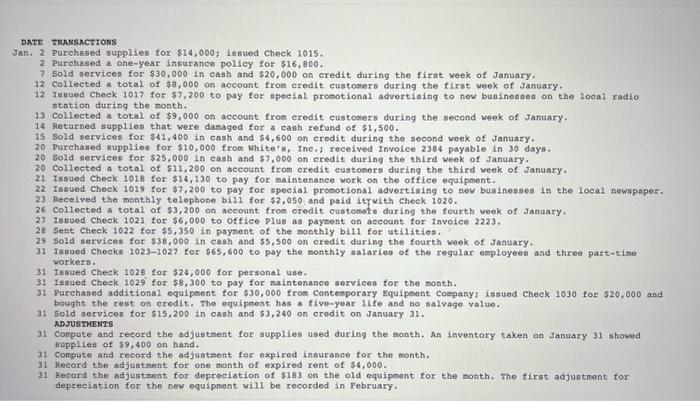

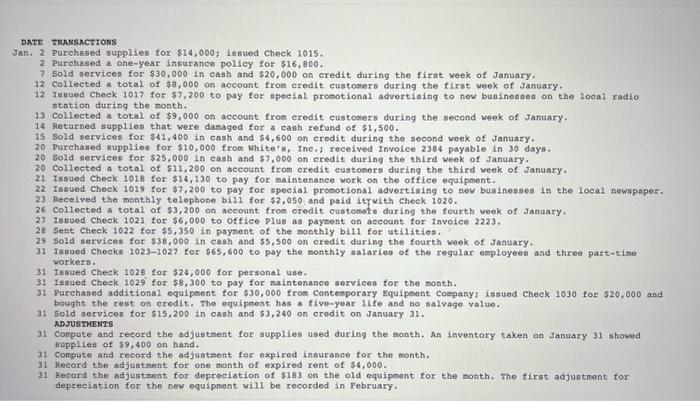

DATE TRANSACTIONS Jan. 2 Purchased supplies for $14,000; issued Check 1015 . 2. Purchased a one-year insurance policy for $16,800. 7 sold sorvices for $30,000 in cash and $20,000 on credit during the first veek of January. 12 Collected a total of $8,000 on account fron credit customers during the first week of January. 12 Isnaed Cheek 1017 for $7,200 to pay for spoeial promotional advertising to new buainedeed on the local radio stotion during the month. 13 collected a total of $9,000 on account fron eredit customers during the second week of January. 14 Returned eapplies that were danaged for a cash retund of 51,500 . 15 Sold services for $41,400 in cash and $4,600 on eredit during the second veek of January. 20 purchaned nupplies for $10,000 from white', 5 , Ine. $ received Involce 2384 payable in 30 dayb. 20 Sold servicen for $25,000 in cash and $7,000 on oredit during the third week of January. 20 Collected a total of $11,200 on aecount from eredit customert during the third week of January. 21 Issued Check 1018 for $14,130 to pay for maintenance work on the office equipment. 22 Tesued cheek 1019 for $7,200 to pay for special promotional advertiaing to new buinesses 1n the 1 ocal newapaper. 23 Received the monthly telephone bili for $2,050 and paid ityuith cheek 1020. 26 Collected a total of $3,200 on account from oredit oustomets during the fourth week of january. 27 Ieved Cheok 1021 for $6,000 to ot fice Plus as payzent on account for Invoice 2223. 26 Sent check 1022 for $5,350 in payment of the monthly bil1 for utilities. 29 Sold services for $38,000 in cash and $5,500 on eredit during the fourth woek of January. 31 Issued Check 10231027 for $65,600 to pay the monthly inalariou of the rogular employees and three part-tino vorkers. 31 issued Check 1028 for $24,000 for personal utse. 31 Issued check 1029 for $8,300 to pay for maintenance services for the month. 31 Purehased additional equipment for $30,000 from Contemporary Equipment coepany; iasued cheok 1030 for $20,000 and bought the rest on eredit. The equipment has a five-yoar life and no salvage value. 31 sold gervices for $15,200 in cash and $3,240 on credit on January 31 . ADJUszNEnT 31 Compute and record the adjustment for supplies used during the nonth. An inventory taken on January 31 showzd aupplies of $9,400 on hand. 31 Corpute and record the adjuetment for expired ineurance tor the month. 31 Record the adjustment for one month of expired rent of $4,000. 31 Record the adjustment for depreciation of $183 on the old equipment for the month. The first adjustment for depreciation for the new equipmont vill be recorded in Pebruary. Complete this question by entering your answers in the tabs below. Prepare a statement of owner's equity. DATE TRANSACTIONS Jan. 2 Purchased supplies for $14,000; issued Check 1015 . 2. Purchased a one-year insurance policy for $16,800. 7 sold sorvices for $30,000 in cash and $20,000 on credit during the first veek of January. 12 Collected a total of $8,000 on account fron credit customers during the first week of January. 12 Isnaed Cheek 1017 for $7,200 to pay for spoeial promotional advertising to new buainedeed on the local radio stotion during the month. 13 collected a total of $9,000 on account fron eredit customers during the second week of January. 14 Returned eapplies that were danaged for a cash retund of 51,500 . 15 Sold services for $41,400 in cash and $4,600 on eredit during the second veek of January. 20 purchaned nupplies for $10,000 from white', 5 , Ine. $ received Involce 2384 payable in 30 dayb. 20 Sold servicen for $25,000 in cash and $7,000 on oredit during the third week of January. 20 Collected a total of $11,200 on aecount from eredit customert during the third week of January. 21 Issued Check 1018 for $14,130 to pay for maintenance work on the office equipment. 22 Tesued cheek 1019 for $7,200 to pay for special promotional advertiaing to new buinesses 1n the 1 ocal newapaper. 23 Received the monthly telephone bili for $2,050 and paid ityuith cheek 1020. 26 Collected a total of $3,200 on account from oredit oustomets during the fourth week of january. 27 Ieved Cheok 1021 for $6,000 to ot fice Plus as payzent on account for Invoice 2223. 26 Sent check 1022 for $5,350 in payment of the monthly bil1 for utilities. 29 Sold services for $38,000 in cash and $5,500 on eredit during the fourth woek of January. 31 Issued Check 10231027 for $65,600 to pay the monthly inalariou of the rogular employees and three part-tino vorkers. 31 issued Check 1028 for $24,000 for personal utse. 31 Issued check 1029 for $8,300 to pay for maintenance services for the month. 31 Purehased additional equipment for $30,000 from Contemporary Equipment coepany; iasued cheok 1030 for $20,000 and bought the rest on eredit. The equipment has a five-yoar life and no salvage value. 31 sold gervices for $15,200 in cash and $3,240 on credit on January 31 . ADJUszNEnT 31 Compute and record the adjustment for supplies used during the nonth. An inventory taken on January 31 showzd aupplies of $9,400 on hand. 31 Corpute and record the adjuetment for expired ineurance tor the month. 31 Record the adjustment for one month of expired rent of $4,000. 31 Record the adjustment for depreciation of $183 on the old equipment for the month. The first adjustment for depreciation for the new equipmont vill be recorded in Pebruary. Complete this question by entering your answers in the tabs below. Prepare a statement of owner's equity