Answered step by step

Verified Expert Solution

Question

1 Approved Answer

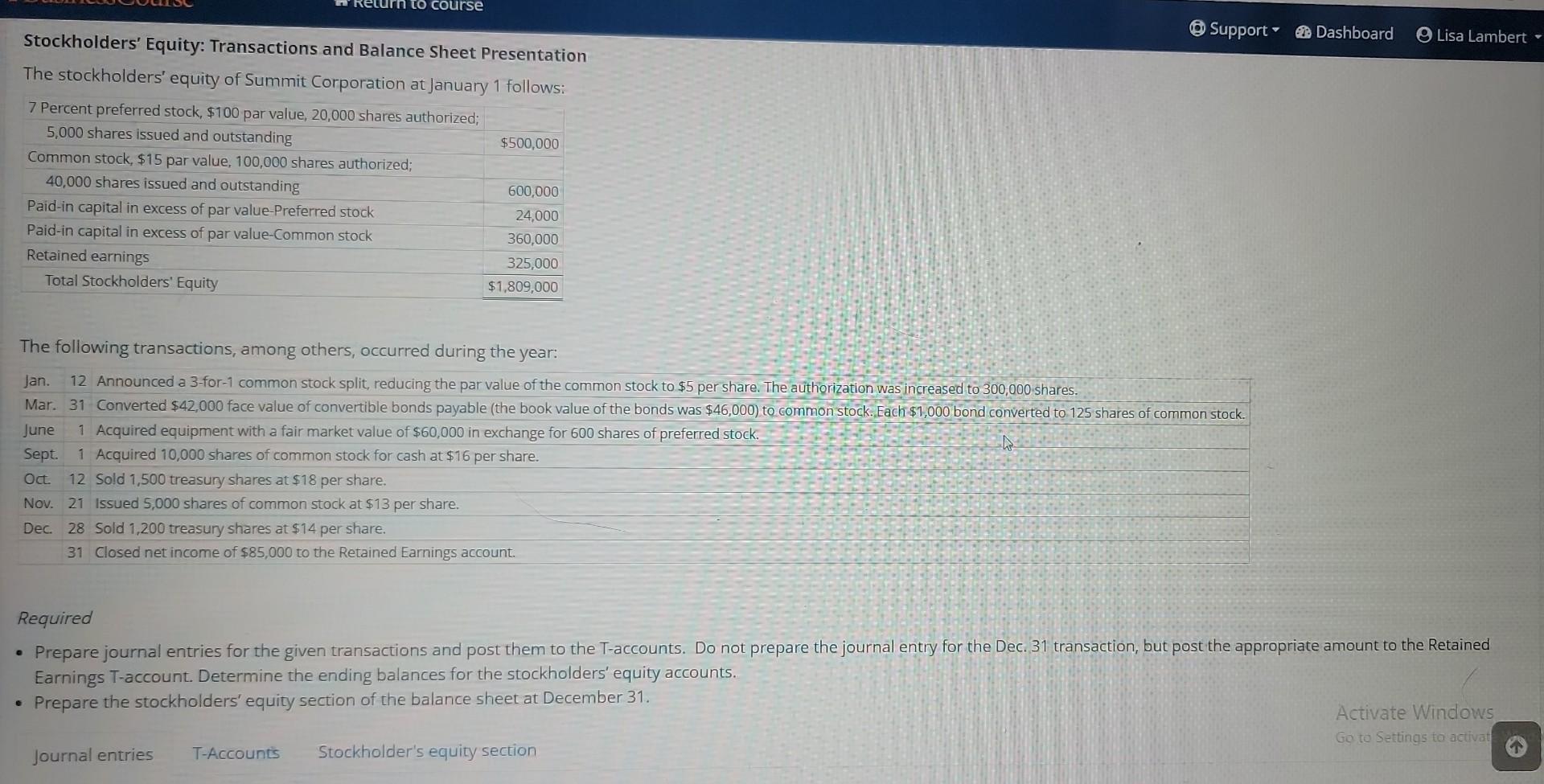

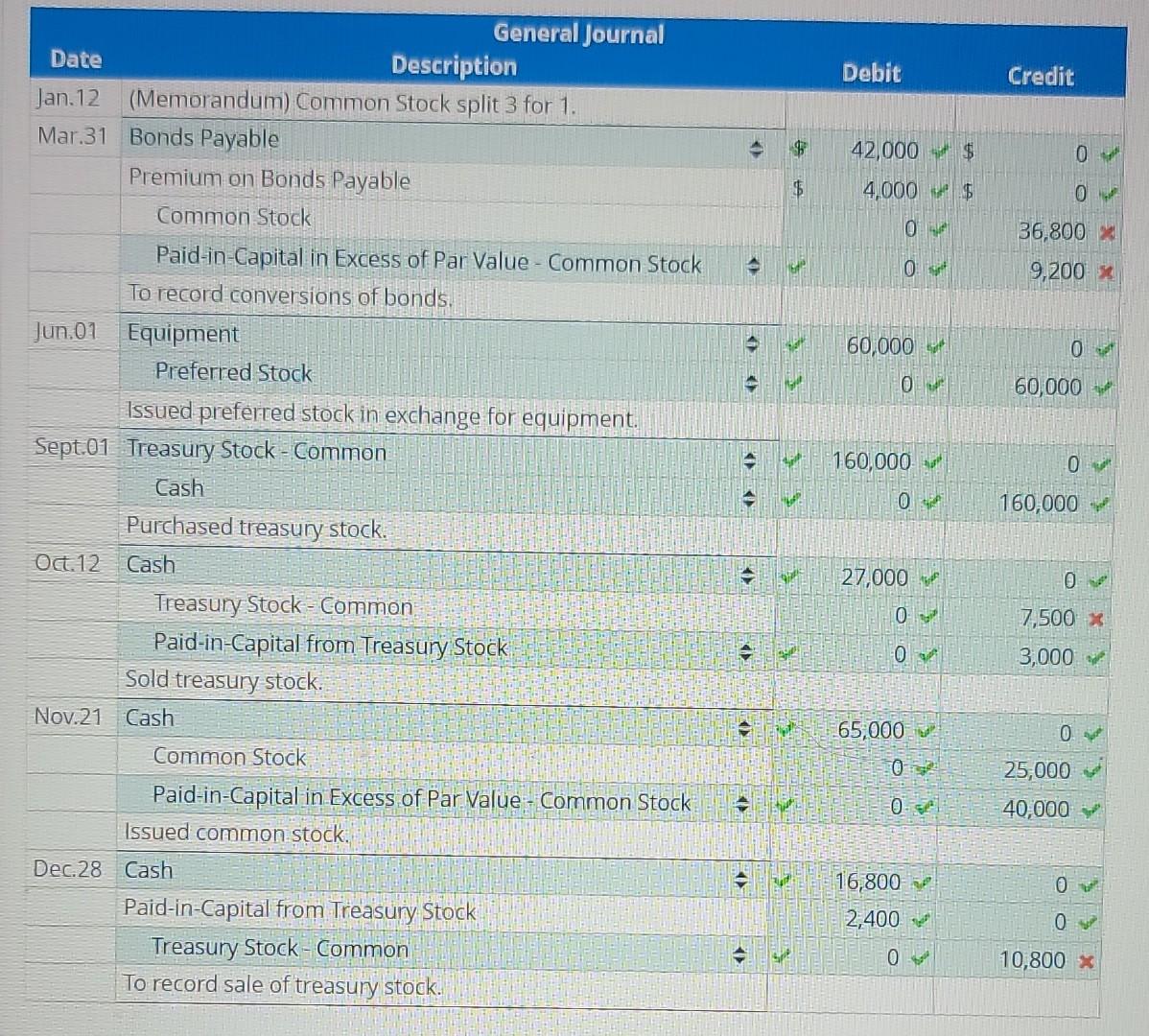

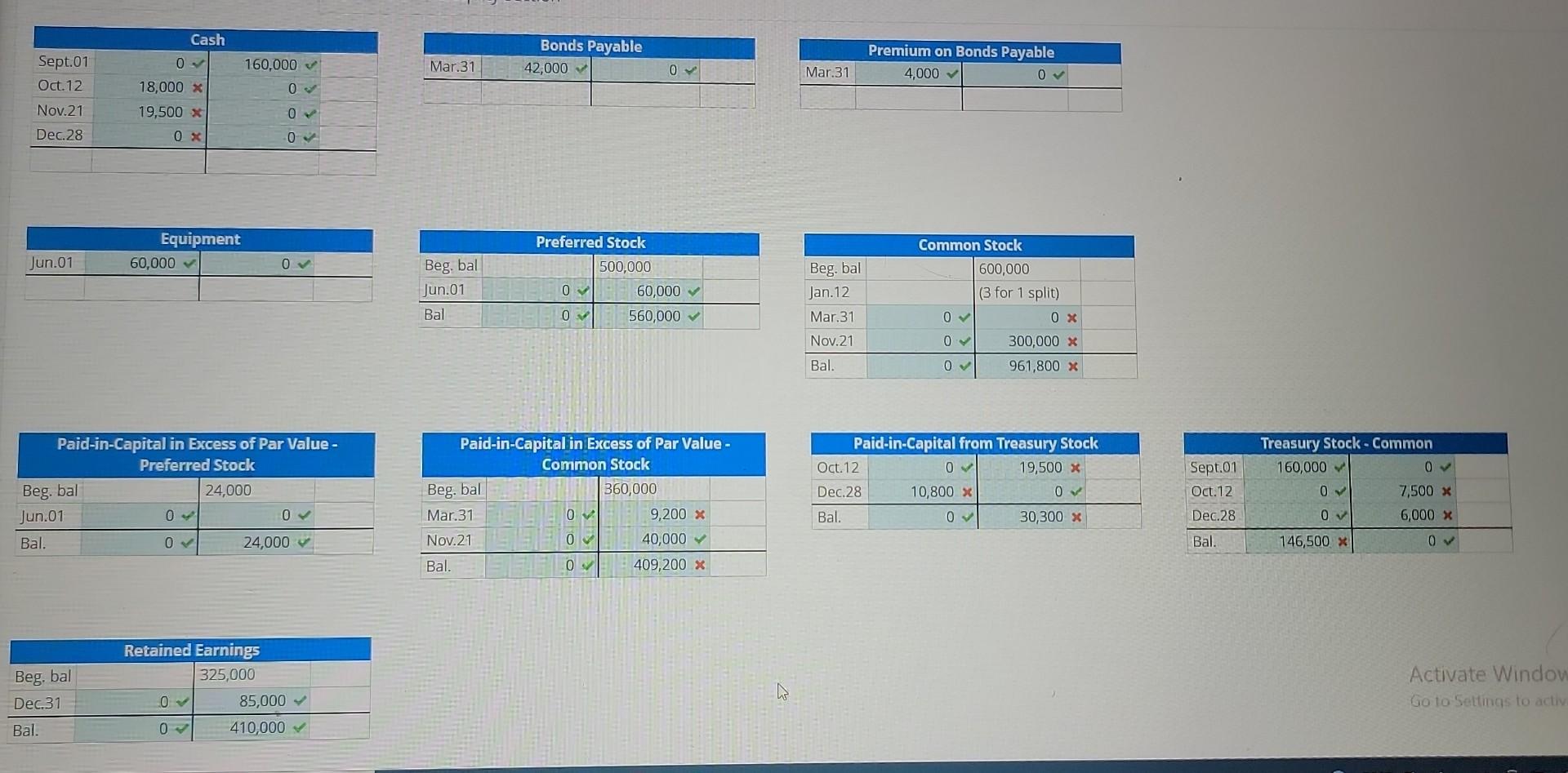

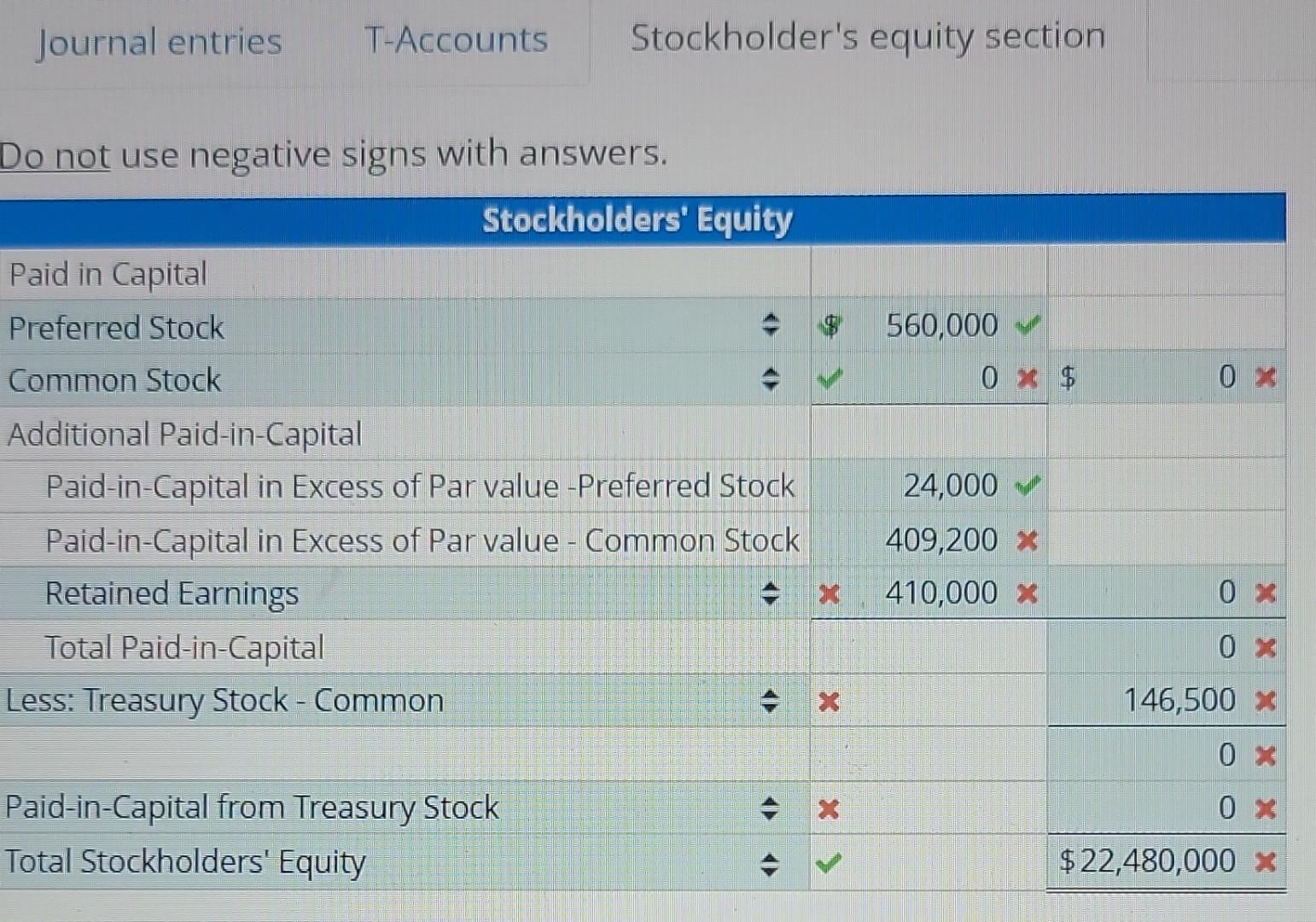

please help with incorrect/ missing answers Stockholders' Equity: Transactions and Balance Sheet Presentation The stockholders' equity of Summit Corporation at January 1 follows: The following

please help with incorrect/ missing answers

Stockholders' Equity: Transactions and Balance Sheet Presentation The stockholders' equity of Summit Corporation at January 1 follows: The following transactions, among others, occurred during the year: Jan. 12 Announced a 3-for-1 common stock split, reducing the par value of the common stock to $5 per share. The authorization was increased to 300,000 shares. Mar. 31 Converted $42,000 face value of convertible bonds payable (the book value of the bonds was $46,000 ) to common stock. Each $1,000 bond converted to 125 shares of common stock. June 1 Acquired equipment with a fair market value of $60,000 in exchange for 600 shares of preferred stock. Sept. 1 Acquired 10,000 shares of common stock for cash at $16 per share. Oct. 12 Sold 1,500 treasury shares at $18 per share. Nov. 21 Issued 5,000 shares of common stock at $13 per share Dec. 28 Sold 1,200 treasury shares at $14 per share. 31 Closed net income of $85,000 to the Retained Earnings account. Required Earnings T-account. Determine the ending balances for the stockholders' equity accounts. - Prepare the stockholders' equity section of the balance sheet at December 31. Stockholder's equity section An nnt use negative signs with answers. Stockholders' Equity: Transactions and Balance Sheet Presentation The stockholders' equity of Summit Corporation at January 1 follows: The following transactions, among others, occurred during the year: Jan. 12 Announced a 3-for-1 common stock split, reducing the par value of the common stock to $5 per share. The authorization was increased to 300,000 shares. Mar. 31 Converted $42,000 face value of convertible bonds payable (the book value of the bonds was $46,000 ) to common stock. Each $1,000 bond converted to 125 shares of common stock. June 1 Acquired equipment with a fair market value of $60,000 in exchange for 600 shares of preferred stock. Sept. 1 Acquired 10,000 shares of common stock for cash at $16 per share. Oct. 12 Sold 1,500 treasury shares at $18 per share. Nov. 21 Issued 5,000 shares of common stock at $13 per share Dec. 28 Sold 1,200 treasury shares at $14 per share. 31 Closed net income of $85,000 to the Retained Earnings account. Required Earnings T-account. Determine the ending balances for the stockholders' equity accounts. - Prepare the stockholders' equity section of the balance sheet at December 31. Stockholder's equity section An nnt use negative signs with answersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started