Answered step by step

Verified Expert Solution

Question

1 Approved Answer

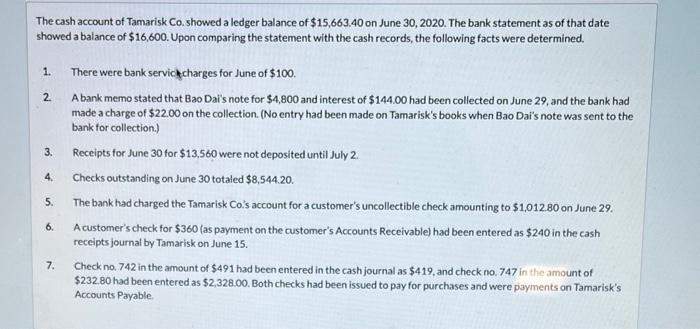

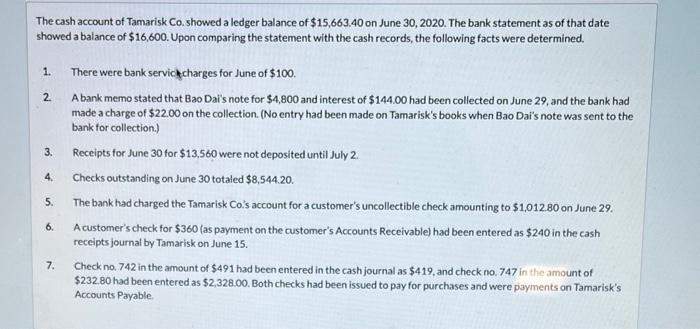

please help with last part The cash account of Tamarisk Co. showed a ledger balance of $15,663.40 on June 30,2020 . The bank statement as

please help with last part

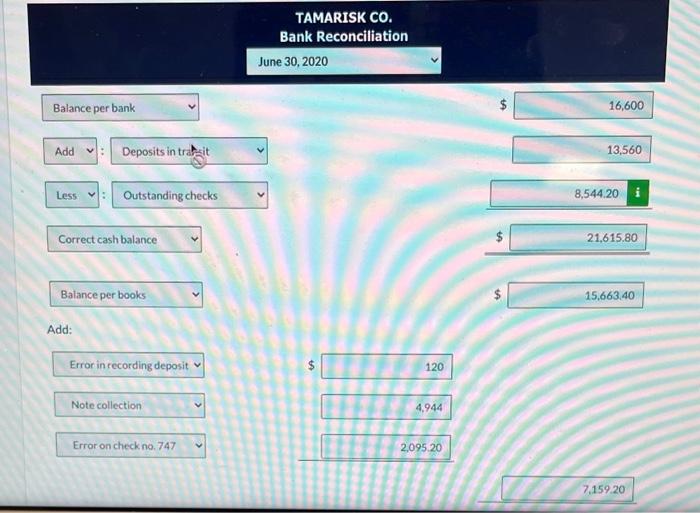

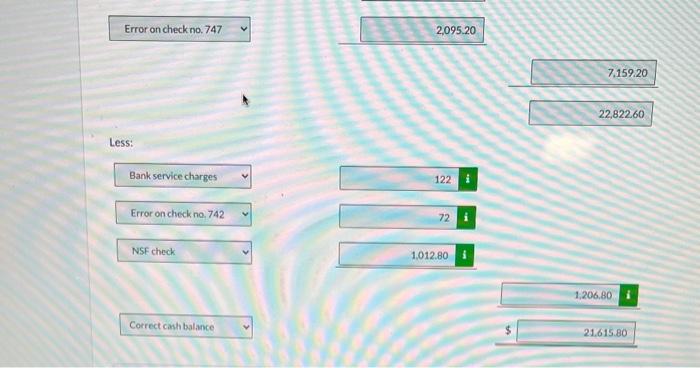

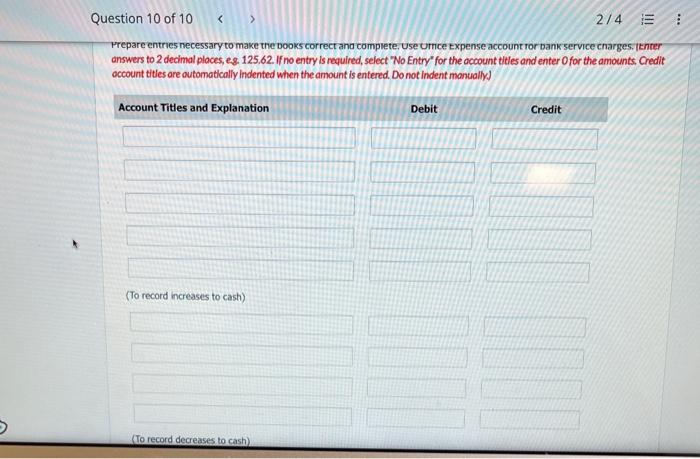

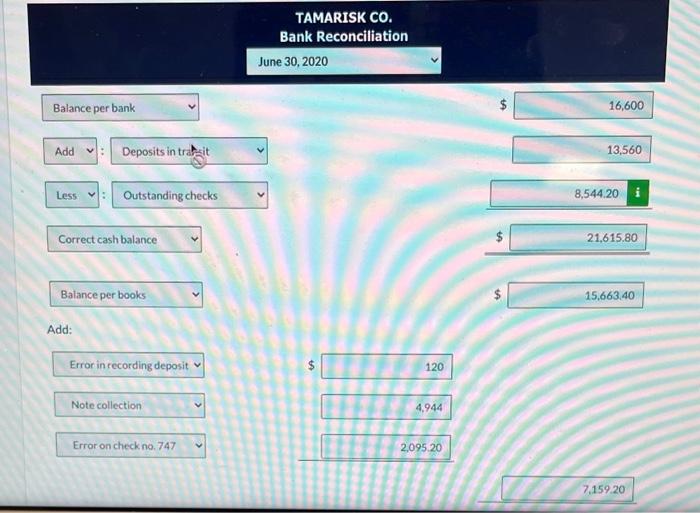

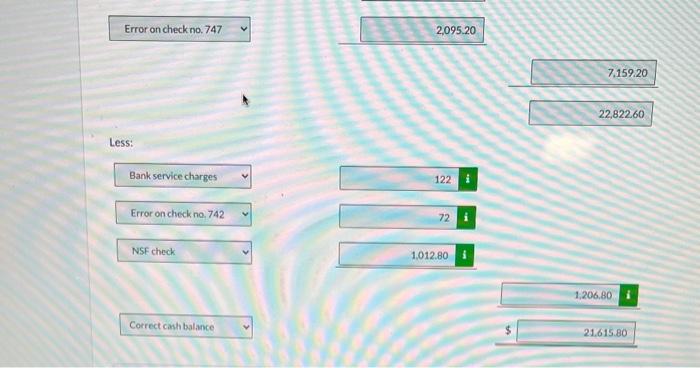

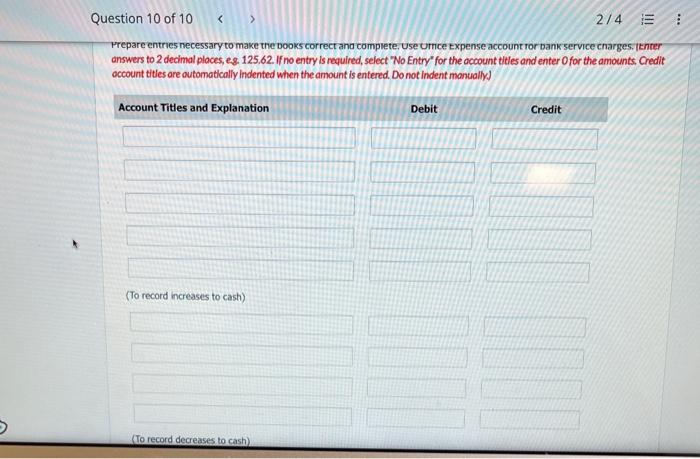

The cash account of Tamarisk Co. showed a ledger balance of $15,663.40 on June 30,2020 . The bank statement as of that date showed a balance of $16,600. Upon comparing the statement with the cash records, the following facts were determined. 1. There were bank servichcharges for June of $100, 2. A bank memo stated that Bao Dai's note for $4,800 and interest of $144.00 had been collected on June 29 , and the bank had made a charge of $22.00 on the collection. (No entry had been made on Tamarisk's books when Bao Dai's note was sent to the bank for collection.) 3. Receipts for June 30 for $13,560 were not deposited until July 2. 4. Checks outstanding on June 30 totaled $8,544.20. 5. The bank had charged the Tamarisk Co.'s account for a customer's uncollectible check amounting to $1,012.80 on June 29. 6. A customer's check for $360 (as payment on the customer's Accounts Receivable) had been entered as $240 in the cash receipts journal by Tamarisk on June 15. 7. Check no. 742 in the amount of $491 had been entered in the cash journal as $419, and check no. 747 in the amount of $232,80 had been entered as $2,328.00. Both checks had been issued to pay for purchases and were payments on Tamarisk's Accounts Payable. TAMARISK CO. Bank Reconciliation June 30,2020 Balance per bank $16,600 $15.663.40 Add: Error in recording deposit 2,095.20 7,159.20 Error on check no. 747 2.095.20 Less: Prepare entries necessary to make the books correct and complete, use umce txpense account tor bank service charges. Itnter answers to 2 decimal places, es. 125,62. If no entry is required, select "No Entry" for the occount titles and enter 0 for the amounts. Credit occount tities are outomatically indented when the amount is entered. Do not indent manually

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started