Answered step by step

Verified Expert Solution

Question

1 Approved Answer

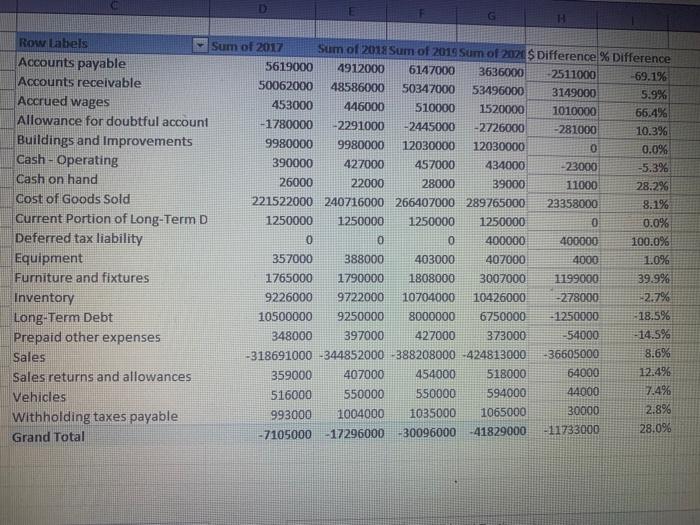

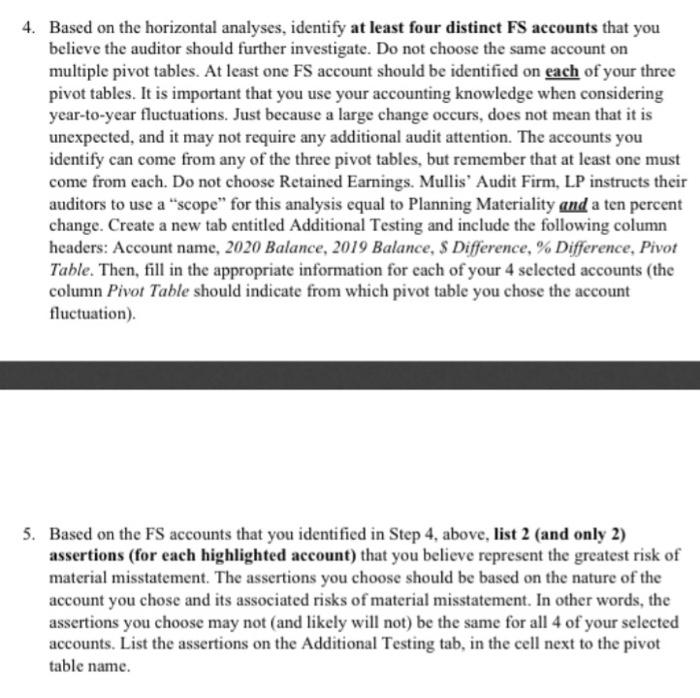

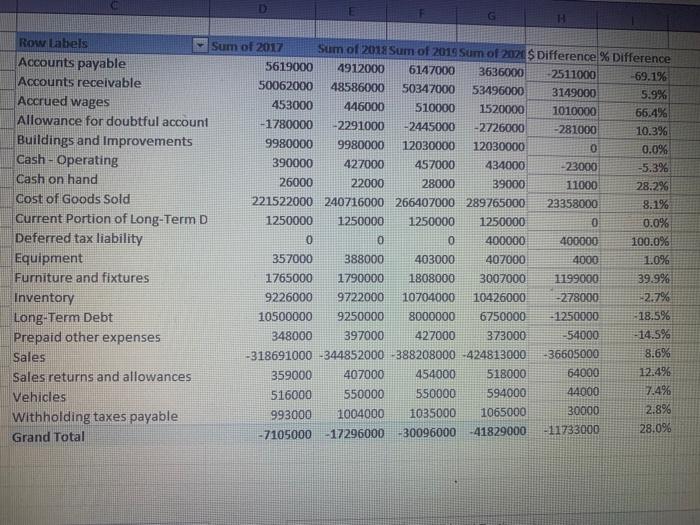

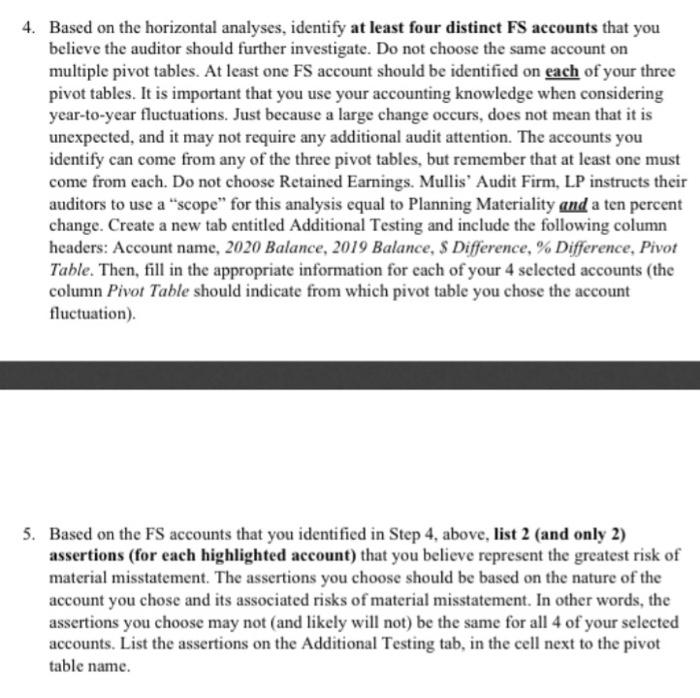

Please help with me to answer questions 4 and 5 using these Financial Statements 1 RowLabels Sum of 2017 Sum of 2018 Sum of 2019

Please help with me to answer questions 4 and 5 using these Financial Statements

1 RowLabels Sum of 2017 Sum of 2018 Sum of 2019 Sum of 2020 $ Difference % Difference Accounts payable 5619000 4912000 6147000 3636000 2511000 -69.1% Accounts receivable 50062000 48586000 50347000 53496000 3149000 5.9% Accrued wages 453000 446000 510000 1520000 1010000 66.4% Allowance for doubtful account -1780000 -2291000 -2445000 -2726000 -281000 10.3% Buildings and Improvements 9980000 9980000 12030000 12030000 0 0.0% Cash - Operating 390000 427000 457000 434000 -23000 -5.3% Cash on hand 26000 22000 28000 39000 11000 28.2% Cost of Goods Sold 221522000 240716000 266407000 289765000 23358000 8.1% Current Portion of Long-Term D 1250000 1250000 1250000 1250000 0 0.0% Deferred tax liability 0 0 0 400000 400000 100.0% Equipment 357000 388000 403000 407000 4000 1.0% Furniture and fixtures 1765000 1790000 1808000 3007000 1199000 39.9% Inventory 9226000 9722000 10704000 10426000 -278000 2.7% Long-Term Debt 10500000 9250000 8000000 6750000 -1250000 $18.5% Prepaid other expenses 348000 397000 427000 373000 -54000 14.5% Sales -318691000 -344852000 -388208000 -424813000 36605000 8.6% Sales returns and allowances 359000 407000 454000 518000 64000 12.4% 516000 Vehicles 550000 550000 594000 44000 7.4% 993000 1004000 1035000 1065000 Withholding taxes payable 2.8% 30000 7105000 28.096 Grand Total 17296000 -41829000 30096000 -11733000 4. Based on the horizontal analyses, identify at least four distinct FS accounts that you believe the auditor should further investigate. Do not choose the same account on multiple pivot tables. At least one FS account should be identified on each of your three pivot tables. It is important that you use your accounting knowledge when considering year-to-year fluctuations. Just because a large change occurs, does not mean that it is unexpected, and it may not require any additional audit attention. The accounts you identify can come from any of the three pivot tables, but remember that at least one must come from each. Do not choose Retained Earnings. Mullis' Audit Firm, LP instructs their auditors to use a "scope" for this analysis equal to Planning Materiality and a ten percent change. Create a new tab entitled Additional Testing and include the following column headers: Account name, 2020 Balance, 2019 Balance, $ Difference, % Difference, Pivot Table. Then, fill in the appropriate information for each of your 4 selected accounts (the column Pivot Table should indicate from which pivot table you chose the account fluctuation). 5. Based on the FS accounts that you identified in Step 4, above, list 2 (and only 2) assertions (for each highlighted account) that you believe represent the greatest risk of material misstatement. The assertions you choose should be based on the nature of the account you chose and its associated risks of material misstatement. In other words, the assertions you choose may not (and likely will not) be the same for all 4 of your selected accounts. List the assertions on the Additional Testing tab, in the cell next to the pivot table name

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started