Please help with my accounting project...

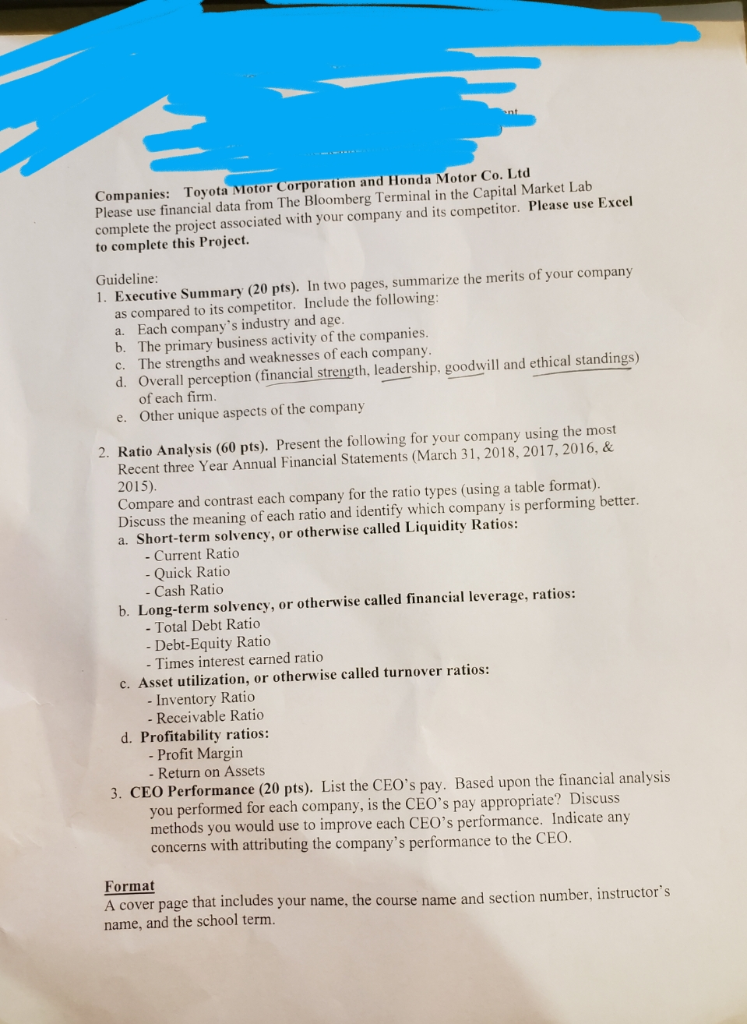

Companies: Toyota Motor Corporation and Honda Motor Co. Lt Please use financial data from The Bloomberg Terminal in the Capital Market Lab complete the project associated with your company and its competitor. Please use Excel to complete this Project Guideline: 1. Executive Summary (20 pts). In two pages, summarize the merits of your company as compared to its competitor. Include the following: a. Each company's industry and age b. The primary business activity of the companies. c. The strengths and weaknesses of each company d. Overall perception (financial strength, leadership, goodwill and ethical standings) of each firm Other unique aspects of the company e. 2. Ratio Analysis (60 pts). Present the following for your company using the most Recent three Year Annual Financial Statements (March 31, 2018, 2017, 2016, & 2015). Compare and contrast each company for the ratio types (using a table format). Discuss the meaning of each ratio and identify which company is performing better. a. Short-term solvency, or otherwise called Liquidity Ratios: - Current Ratio Quick Ratio - Cash Ratio b. Long-term solvency, or otherwise called financial leverage, ratios: - Total Debt Ratio - Debt-Equity Ratio Times interest earned ratio c. Asset utilization, or otherwise called turnover ratios: - Inventory Ratio Receivable Ratio d. Profitability ratios: Profit Margin Return on Assets 3. CEO Performance (20 pts). List the CEO's pay. Based upon the financial analysis you performed for each company, is the CEO's pay appropriate? Discuss methods you would use to improve each CEO's performance. Indicate any concerns with attributing the company's performance to the CEO Format A cover page that includes your name, the course name and section number, instructor's name, and the school term. Companies: Toyota Motor Corporation and Honda Motor Co. Lt Please use financial data from The Bloomberg Terminal in the Capital Market Lab complete the project associated with your company and its competitor. Please use Excel to complete this Project Guideline: 1. Executive Summary (20 pts). In two pages, summarize the merits of your company as compared to its competitor. Include the following: a. Each company's industry and age b. The primary business activity of the companies. c. The strengths and weaknesses of each company d. Overall perception (financial strength, leadership, goodwill and ethical standings) of each firm Other unique aspects of the company e. 2. Ratio Analysis (60 pts). Present the following for your company using the most Recent three Year Annual Financial Statements (March 31, 2018, 2017, 2016, & 2015). Compare and contrast each company for the ratio types (using a table format). Discuss the meaning of each ratio and identify which company is performing better. a. Short-term solvency, or otherwise called Liquidity Ratios: - Current Ratio Quick Ratio - Cash Ratio b. Long-term solvency, or otherwise called financial leverage, ratios: - Total Debt Ratio - Debt-Equity Ratio Times interest earned ratio c. Asset utilization, or otherwise called turnover ratios: - Inventory Ratio Receivable Ratio d. Profitability ratios: Profit Margin Return on Assets 3. CEO Performance (20 pts). List the CEO's pay. Based upon the financial analysis you performed for each company, is the CEO's pay appropriate? Discuss methods you would use to improve each CEO's performance. Indicate any concerns with attributing the company's performance to the CEO Format A cover page that includes your name, the course name and section number, instructor's name, and the school term