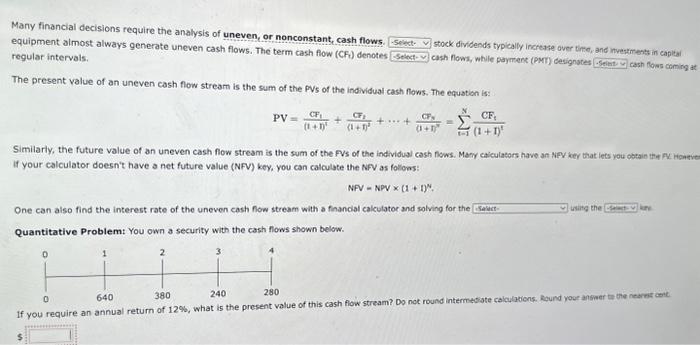

Question: please help with ones that say (select) too 1. preferred/common 2. equal/ uneven 3. equal/ uneven 4. net of future value(nfv)/ internal rate of return(irr)/

Many financial decisions require the analysis of uneven, or nonconstant, cash flows. Stock dividends typieally inctene over time, and nvestments in capleal equipment almost always generate uneven cash flows. The term cash flow (CF) denotes regular intervals. The present value of an uneven cash flow stream is the sum of the PVs of the individual cash flows. The equation is: PV=(t+D2CF1+(t+)2C2++(1+T2Cs=t=1N(1+T)2CFi If your calculator doesn't have a net future value (NFV) key, you can calculate the NPV as follows: NPV=NPV(1+1)4. One can also find the interest rate of the uneven cash fow stream with a francial calculator and solving for the wirie the Quantitative Problemt You own a security with the cash flows shown below. Many financial decisions require the analysis of uneven, or nonconstant, cash flows. stock dividends typieally increshe over time, and nvestrents in caplail equipment almost always generate uneven cash flows. The term cash flow (CF) denotes regular intervals. The present value of an uneven cash flow stream is the sum of the PVs of the individual cash flows. The equation is: PV=(1+D)2CF1+(1+)2CFi++(1+T2Cc=t=1N(1+T)2CFi Similarly, the future value of an uneven cash flow stream is the sum of the PVs of the individual cash fows. Mary caiculators have an Niev kee that lees you ostain the F. Henev If your calculator doesn't have a net future value (NFV) key, you can calculate the NFV as follows: NPV=NPV(1+1)4. One can also find the interest rate of the uneven cash flow stream with a foancial calculator and solving for the waing the Quantitative Problem: You own a security with the cash flows shown below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts