Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with part 1&2 A company had the following balances: - Beginning balance of accounts receivable of $1,000 on March 1st. - Ending balance

please help with part 1&2

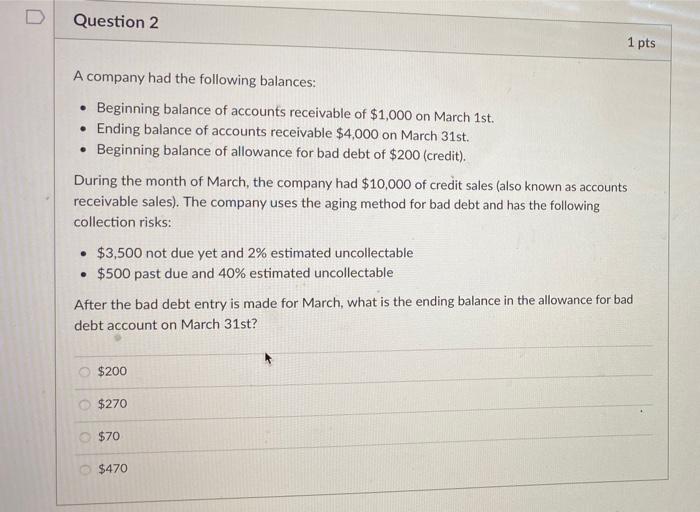

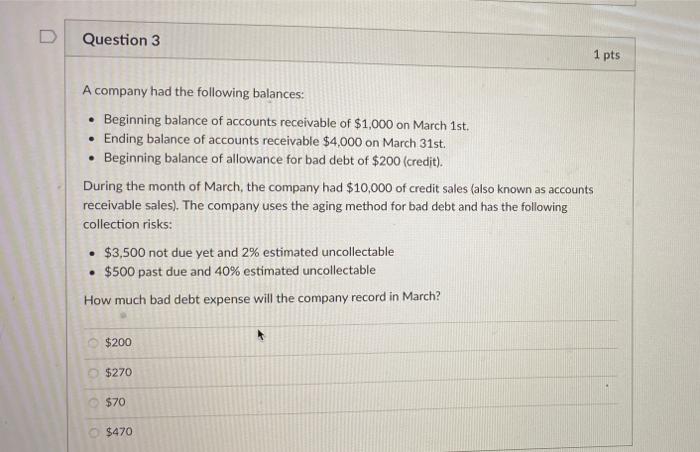

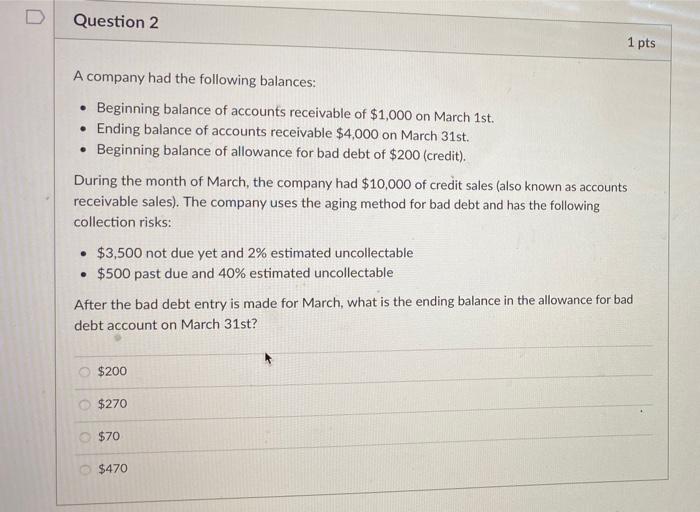

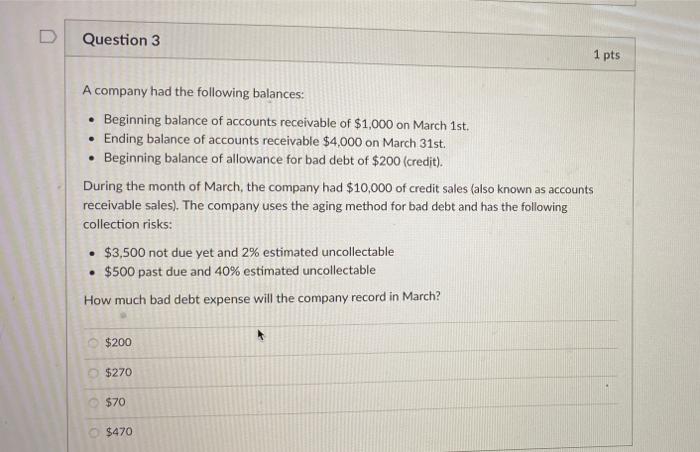

A company had the following balances: - Beginning balance of accounts receivable of $1,000 on March 1st. - Ending balance of accounts receivable $4,000 on March 31 st. - Beginning balance of allowance for bad debt of $200 (credit). During the month of March, the company had $10,000 of credit sales (also known as accounts receivable sales). The company uses the aging method for bad debt and has the following collection risks: - \$3,500 not due yet and 2% estimated uncollectable - $500 past due and 40% estimated uncollectable After the bad debt entry is made for March, what is the ending balance in the allowance for bad debt account on March 31st? $200 $270 $70 $470 A company had the following balances: - Beginning balance of accounts receivable of $1,000 on March 1 st. - Ending balance of accounts receivable $4,000 on March 31st. - Beginning balance of allowance for bad debt of $200 (credit). During the month of March, the company had $10,000 of credit sales (also known as accounts receivable sales). The company uses the aging method for bad debt and has the following collection risks: - $3,500 not due yet and 2% estimated uncollectable - $500 past due and 40% estimated uncollectable How much bad debt expense will the company record in March? $200 $270 $70 $470

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started