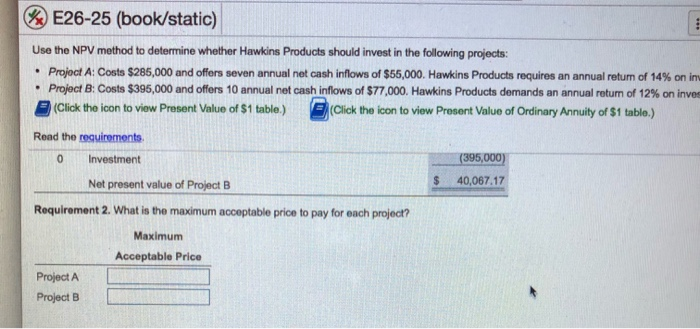

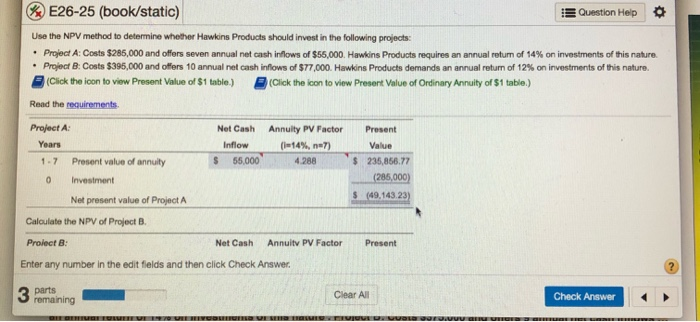

please help with part 2 and 3

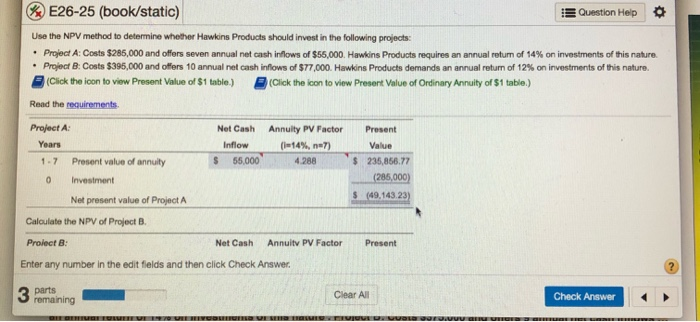

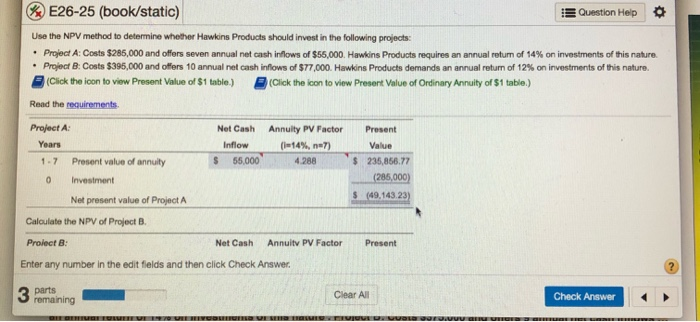

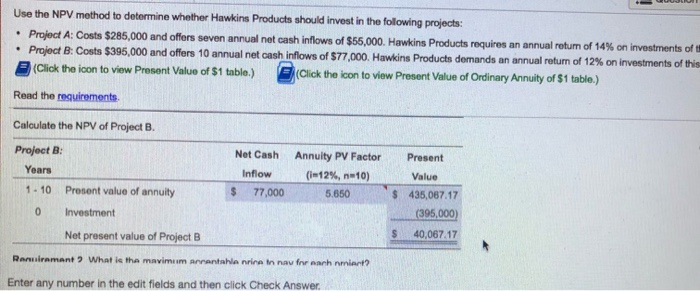

E26-25 (book/static) Question Help Use the NPV method to determine whether Hawkins Products should invest in the following projects: Project A: Costs $285,000 and offers seven annual net cash inflows of $55,000. Hawkins Products requires an annual return of 14% on investments of this nature Project B: Costs $395,000 and offers 10 annual net cash inflows of $77,000. Hawkins Products demands an annual return of 12% on investments of this nature. (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the resulrements Project A: Net Cash Annuity PV Factor Present Years Inflow (114%, n=7) Value 1.7 Prosent value of annuity $ 55,000 4.288 $ 235,856.77 0 Investment (285,000) $ (49.143.23) Net present value of Project A Calculate the NPV of Project B. Proiect : Net Cash Annuity PV Factor Present Enter any number in the edit fields and then click Check Answer. parts 3 remaining Clear All Check Answer DE BERGET TO VESTITI RIVIN VUOLD BUEUUUUGNO Use the NPV method to determine whether Hawkins Products should invest in the following projects: Project A: Costs $285,000 and offers seven annual net cash inflows of $55,000. Hawkins Products requires an annual rotum of 14% on investments of te Project B: Costs $395,000 and offers 10 annual net cash inflows of $77,000. Hawkins Products demands an annual return of 12% on investments of this (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements Calculate the NPV of Project B. Project B: Net Cash Annuity PV Factor Present Years Inflow (1-12%, n=10) Value 1.10 Prosent value of annuity 77,000 5.650 $ 435,067.17 Investment (395,000) $ 40,067.17 Net prosent value of Project B 0 Rannuairmant ? What is the mavimuimarantaa nina in naufr nanh nment? Enter any number in the edit fields and then click Check Answer. . . %E26-25 (book/static) Use the NPV method to determine whether Hawkins Products should invest in the following projects: Project A Costs $285,000 and offers seven annual net cash inflows of $55,000. Hawkins Products requires an annual retum of 14% on in Project B: Costs $396,000 and offers 10 annual net cash inflows of $77,000. Hawkins Products demands an annual return of 12% on inves (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements Investment (395,000) 40,067.17 Net present value of Project B Requirement 2. What is the maximum acceptable price to pay for each project? 0 $ Maximum Acceptable Price Project A Project B Click the icon to view Present 0 Requirements the requirements X Investment Net present value of Proj uirement 2. What is the maximu 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places 2. What is the maximum accptable price to pay for each project? 3. What is the profitability index of each project? Round to two decimal places. Maximum Acceptable Price Print ect ct B Done