Please help with part a!

Please help with part a!

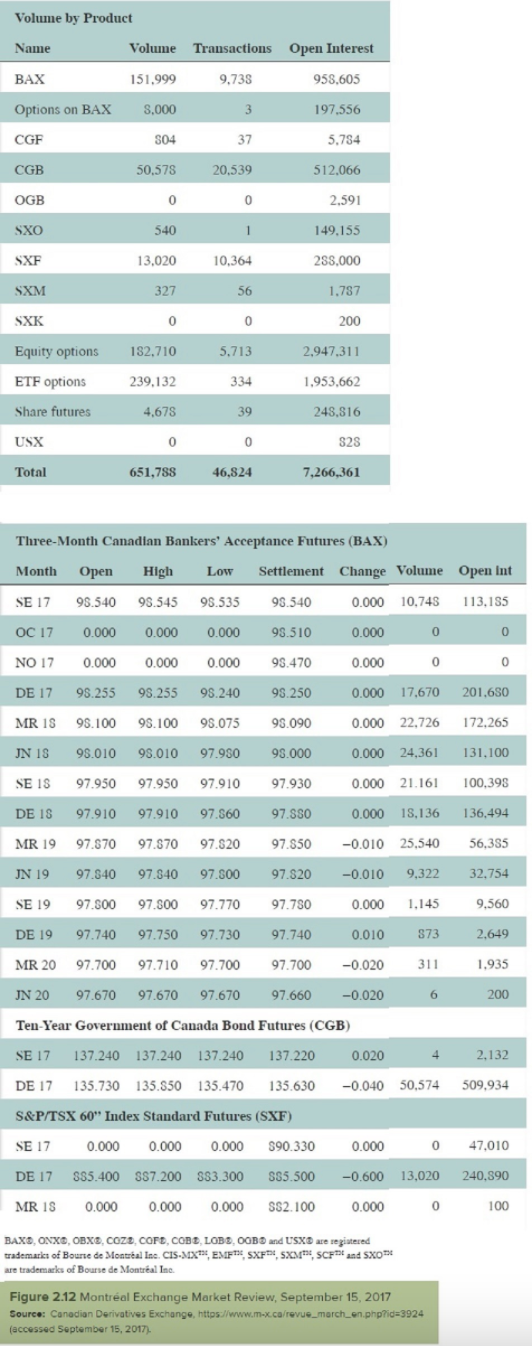

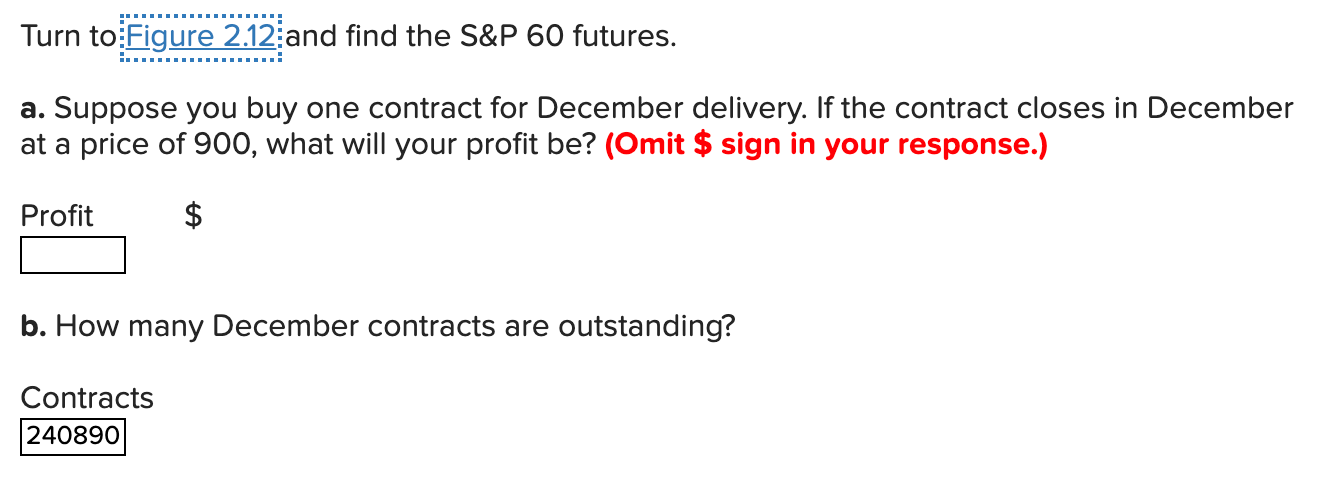

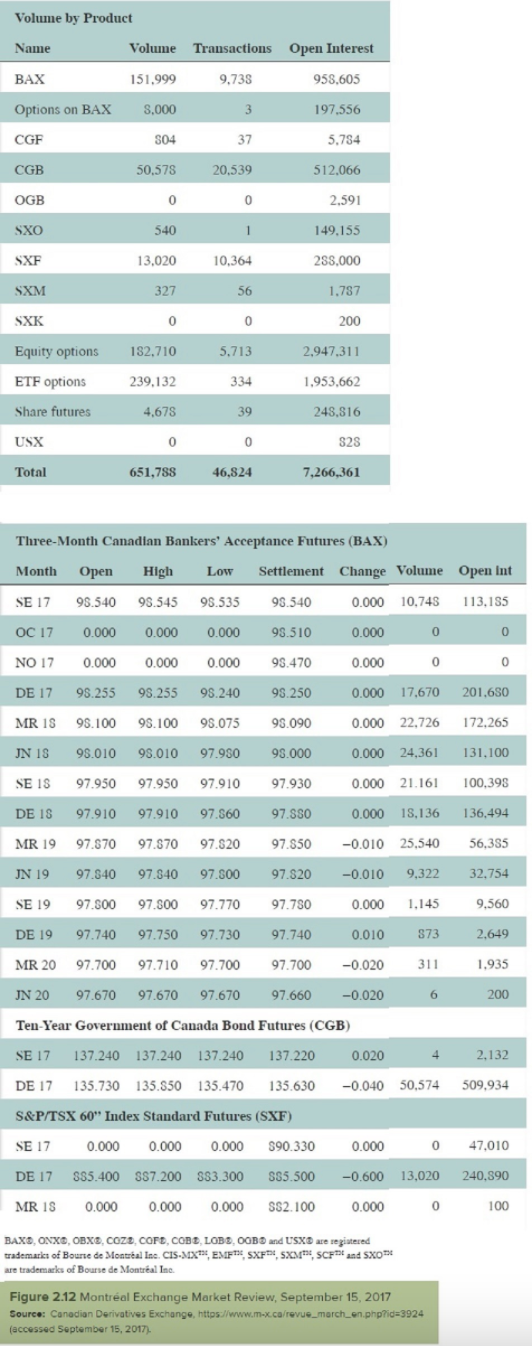

Volume by Product Name Volume Transactions Open Interest 151.999 9,735 958.605 BAX Options on BAX 8.000 3 197,556 CGF S04 37 5.784 CGB 20.539 512.066 50,578 0 OGB 0 2.591 SXO 540 1 149.155 SXF 13.020 10,364 288,000 SXM 327 56 1.787 SXK 0 0 200 Equity options 5,713 2,947.311 182,710 239,132 ETF options 334 1.953,662 Share futures 4,678 39 248,816 USX 0 0 828 Total 651,788 46,824 7,266,361 Three-Month Canadian Bankers' Acceptance Futures (BAX) Month Open High Low Settlement Change Volume Open int SE 17 95.540 95.545 95.535 98.540 0.000 10,748 113,155 OC 17 0.000 0.000 0.000 98.510 0.000 0 0 NO 17 0.000 0.000 0.000 98.470 0.000 0 0 DE 17 95.255 95.255 95.240 95.250 0.000 17,670 201,650 MR18 95.100 98.100 98.075 98.090 0.000 22,726 172,265 JN 1S 98.010 93.010 97.980 95.000 0.000 24,361 131,100 SE S 97.950 97.950 97.910 97.930 0.000 21.161 100,395 DE 18 97.910 97.910 97.560 97.SSO 0.000 18,136 136,494 MR 1997.870 97.570 97.520 97.850 -0.010 25,540 56,385 JN 19 97.840 97.840 97.800 97.820 -0.0109,322 32.754 SE 1997.800 97.800 97.770 97.750 0.000 1.145 9,560 DE 1997.740 97.750 97.730 97.740 0.010 373 2.649 MR 20 97.700 97.710 97.700 97.700 -0.020 311 1.935 JN 20 97.670 97.670 97.670 97.660 -0.020 6 200 Ten-Year Government of Canada Bond Futures (CGB) SE 17 137.240 137.240 137.240 137.220 0.020 4. 2.132 DE 17 135.730 135.850 135.470 135.630 -0.040 50,574 509,934 S&P/TSX 60" Index Standard Futures (SXF) SE 17 0.000 0.000 0.000 590.330 0.000 0 47,010 DE 17 885.400 $87.200 $83.300 SS5.500 -0.600 13,020 240,590 MR IS 0.000 0.000 0.000 SS2.100 0.000 0 100 BAXD, ONXO, OBXB.COZD COFD, COBO, LOBO, OBS and USX are registered trademarks of Bourse de Montral In CIS-MXT" EM SX SXM, SCF and SXO are trademarks of Bourse de Montral Inc. Figure 2.12 Montral Exchange Market Review, September 15, 2017 Source: Canadian Derivatives Exchange, https://www.m-x.ca/revue_march_en.php?id=3924 (accessed September 15, 2017). Turn to Figure 2.12 and find the S&P 60 futures. a. Suppose you buy one contract for December delivery. If the contract closes in December at a price of 900, what will your profit be? (Omit $ sign in your response.) Profit $ b. How many December contracts are outstanding? Contracts 240890

Please help with part a!

Please help with part a!