Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with part c Hall & Elliott LLC (H&E) is budgeting for next year. Much of the work that H&E does relates to repeat

please help with part c

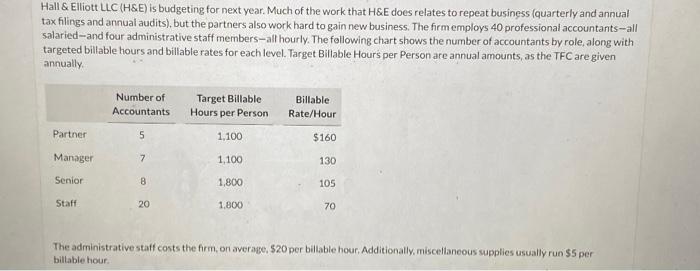

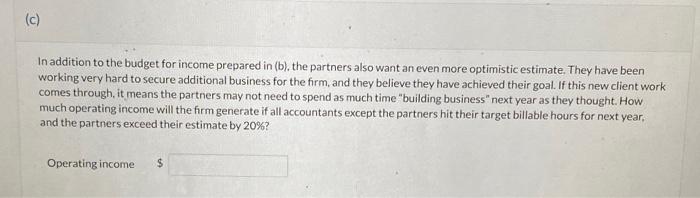

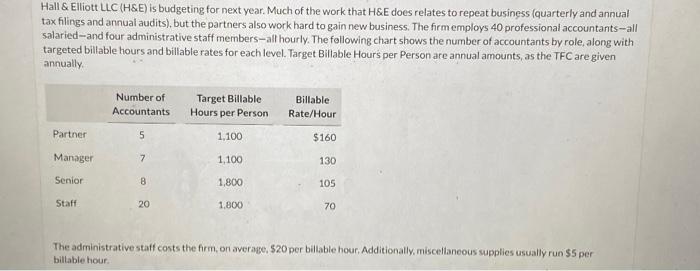

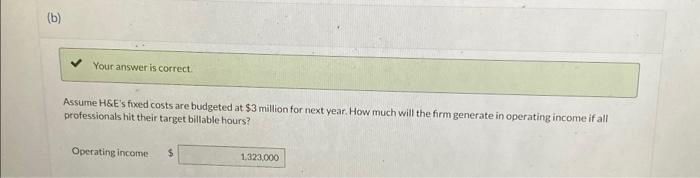

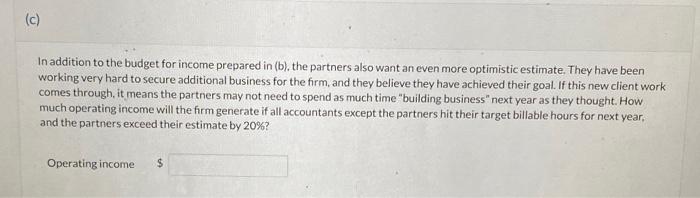

Hall \& Elliott LLC (H\&E) is budgeting for next year. Much of the work that H\&E does relates to repeat business (quarterly and annual tax filings and annual audits), but the partners also work hard to gain new business. The firm employs 40 professional accountants-all salaried-and four administrative staff members-all hourly. The following chart shows the number of accountants by role, along with targeted billable hours and billable rates for each level. Target Billable Hour's per Person are annual amounts, as the TFC are given annually. The administrative staff conts the firm, on average, $20 per billable hour. Additionally, miscellaneous supplies usually run $5 per billable hour. Assume H\&E's fixed costs are budgeted at $3 million for next year. How much will the firm generate in operating income if all professionals hit their target billable hours? Operating income In addition to the budget for income prepared in (b), the partners also want an even more optimistic estimate. They have been working very hard to secure additional business for the firm, and they believe they have achieved their goal. If this new client work comes through, it means the partners may not need to spend as much time "building business " next year as they thought. How much operating income will the firm generate if all accountants except the partners hit their target billable hours for next year, and the partners exceed their estimate by 20%

Hall \& Elliott LLC (H\&E) is budgeting for next year. Much of the work that H\&E does relates to repeat business (quarterly and annual tax filings and annual audits), but the partners also work hard to gain new business. The firm employs 40 professional accountants-all salaried-and four administrative staff members-all hourly. The following chart shows the number of accountants by role, along with targeted billable hours and billable rates for each level. Target Billable Hour's per Person are annual amounts, as the TFC are given annually. The administrative staff conts the firm, on average, $20 per billable hour. Additionally, miscellaneous supplies usually run $5 per billable hour. Assume H\&E's fixed costs are budgeted at $3 million for next year. How much will the firm generate in operating income if all professionals hit their target billable hours? Operating income In addition to the budget for income prepared in (b), the partners also want an even more optimistic estimate. They have been working very hard to secure additional business for the firm, and they believe they have achieved their goal. If this new client work comes through, it means the partners may not need to spend as much time "building business " next year as they thought. How much operating income will the firm generate if all accountants except the partners hit their target billable hours for next year, and the partners exceed their estimate by 20%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started