Answered step by step

Verified Expert Solution

Question

1 Approved Answer

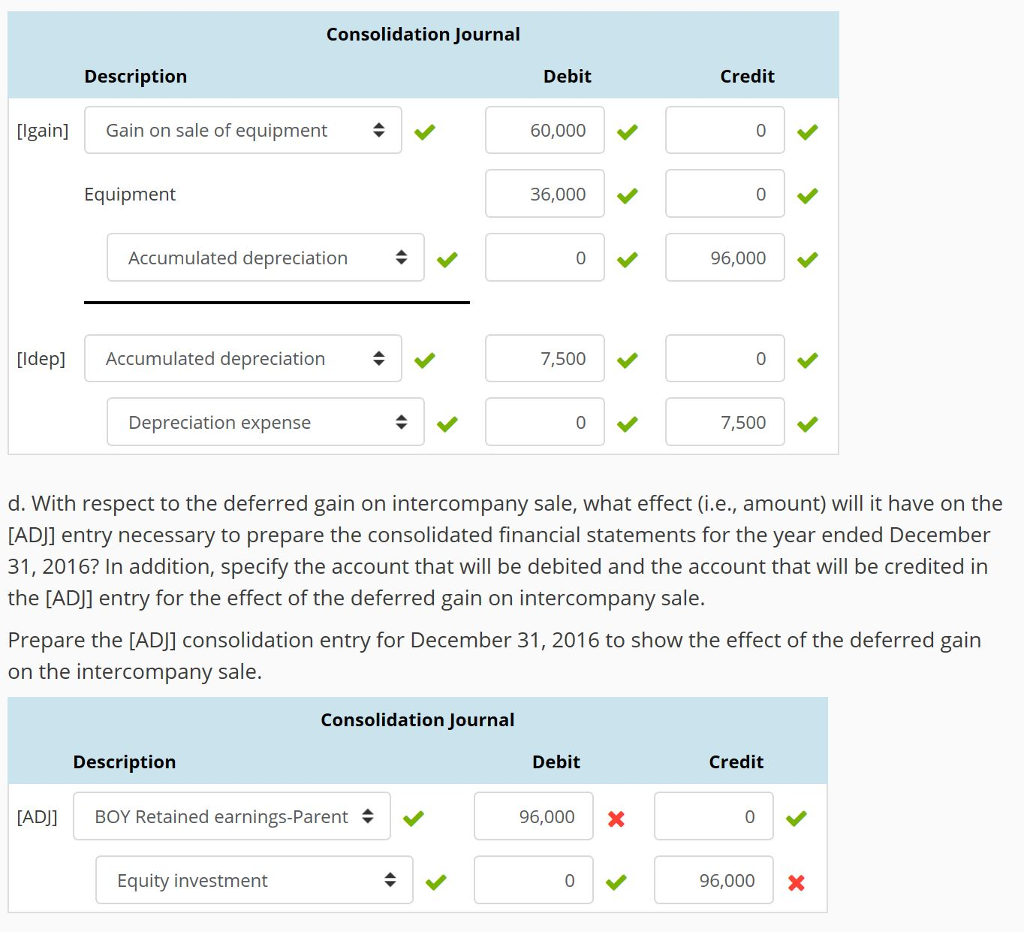

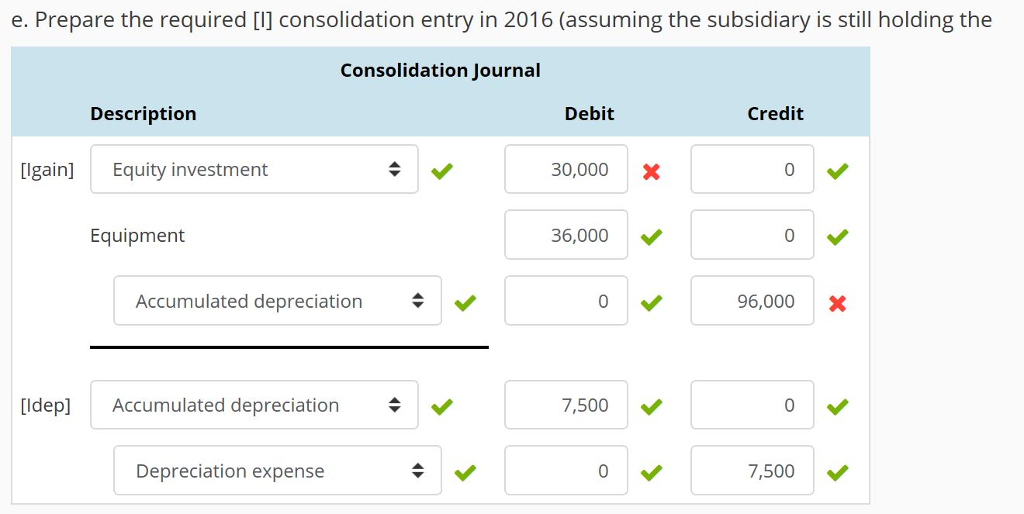

Please help with part D and E. NOTE: $60,000, $96,000 and $30,000 were INCORRECT answers for both part D and E. Accumulated Depreciation did NOT

Please help with part D and E. NOTE: $60,000, $96,000 and $30,000 were INCORRECT answers for both part D and E. Accumulated Depreciation did NOT add to $96,000 or $66,000. Likewise, the missing answers to any of part E or D is also NOT $60,000 or $96,000 or $30,000.

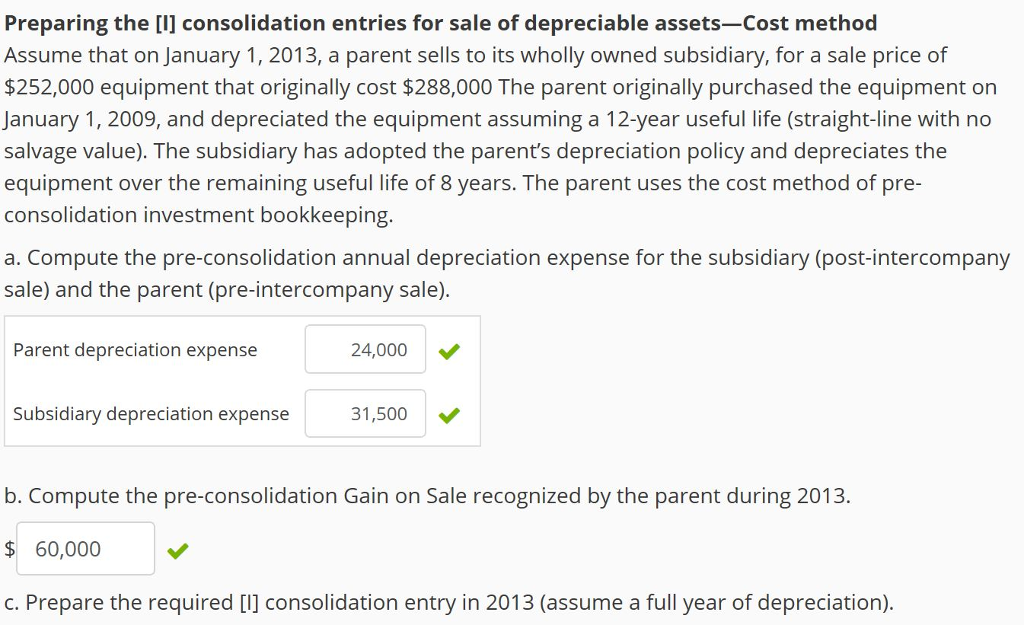

Preparing the [I] consolidation entries for sale of depreciable assets-Cost method Assume that on January 1, 2013, a parent sells to its wholly owned subsidiary, for a sale price of $252,000 equipment that originally cost $288,000 The parent originally purchased the equipment orn January 1, 2009, and depreciated the equipment assuming a 12-year useful life (straight-line with no salvage value). The subsidiary has adopted the parent's depreciation policy and depreciates the equipment over the remaining useful life of 8 years. The parent uses the cost method of pre- consolidation investment bookkeeping. a. Compute the pre-consolidation annual depreciation expense for the subsidiary (post-intercompany sale) and the parent (pre-intercompany sale) Parent depreciation expense 24,000 Subsidiary depreciation expense b. Compute the pre-consolidation Gain on Sale recognized by the parent during 2013. 60,000 c. Prepare the required [l] consolidation entry in 2013 (assume a full year of depreciation)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started