Answered step by step

Verified Expert Solution

Question

1 Approved Answer

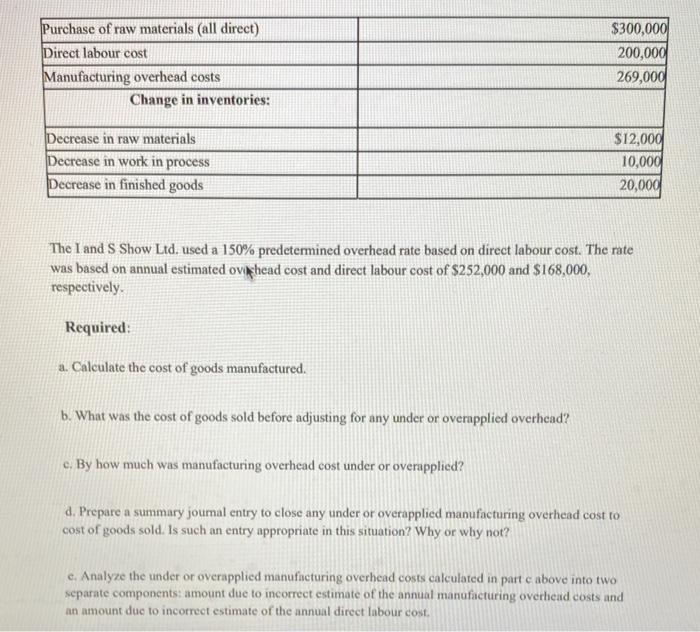

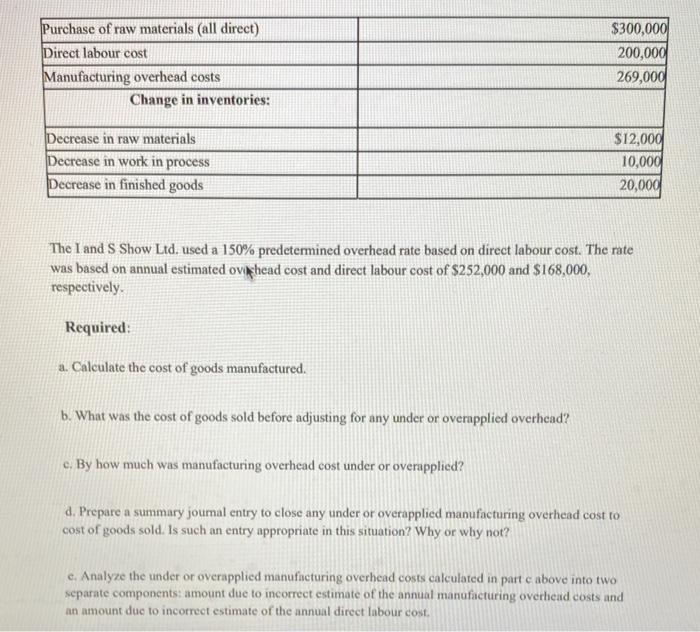

please help with part E !! Purchase of raw materials (all direct) Direct labour cost Manufacturing overhead costs Change in inventories: $300,000 200,000 269,000 Decrease

please help with part E !!

Purchase of raw materials (all direct) Direct labour cost Manufacturing overhead costs Change in inventories: $300,000 200,000 269,000 Decrease in raw materials Decrease in work in process Decrease in finished goods $12,000 10,0001 20,000 The I and S Show Ltd. used a 150% predetermined overhead rate based on direct labour cost. The rate was based on annual estimated oviy head cost and direct labour cost of $252,000 and $168,000, respectively. Required: a. Calculate the cost of goods manufactured. b. What was the cost of goods sold before adjusting for any under or overapplied overhead? e. By how much was manufacturing overhead cost under or overapplied? 4. Prepare a summary journal entry to close any under or overapplied manufacturing overhead cost to cost of goods sold. Is such an entry appropriate in this situation? Why or why not? e. Analyze the under or overapplied manufacturing overhead costs calculated in part cabove into two separate components: amount due to incorrect estimate of the annual manufacturing overhead costs and an amount due to incorrect estimate of the annual direct labour cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started