Answered step by step

Verified Expert Solution

Question

1 Approved Answer

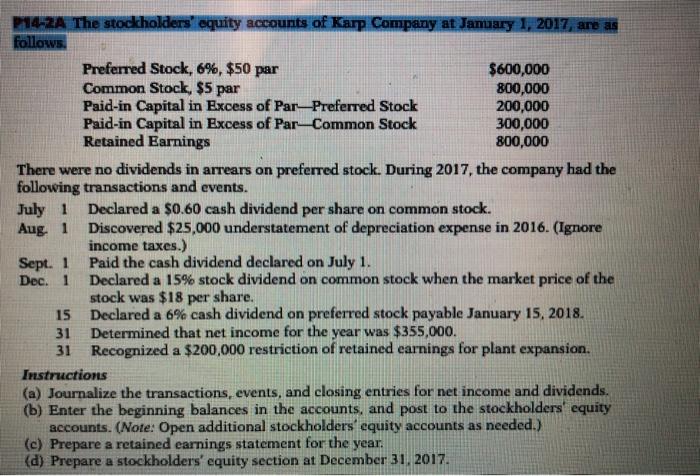

Please help with parts B,C and D P14-2A The stockholders' equity accounts of Karp Company at Jamuary 1, 2017, are as follows. Preferred Stock, 6%,

Please help with parts B,C and D

P14-2A The stockholders' equity accounts of Karp Company at Jamuary 1, 2017, are as follows. Preferred Stock, 6%, $50 par $600,000 Common Stock, $5 par 800,000 Paid-in Capital in Excess of ParPreferred Stock 200,000 Paid-in Capital in Excess of Par_Common Stock 300,000 Retained Earnings 800,000 There were no dividends in arrears on preferred stock. During 2017, the company had the following transactions and events. July 1 Declared a $0.60 cash dividend per share on common stock. Aug 1 Discovered $25,000 understatement of depreciation expense in 2016. (Ignore income taxes.) Sept. 1 Paid the cash dividend declared on July 1. Dec. 1 Declared a 15% stock dividend on common stock when the market price of the stock was $18 per share. 15 Declared a 6% cash dividend on preferred stock payable January 15, 2018. 31 Determined that net income for the year was $355,000. 31 Recognized a $200,000 restriction of retained earnings for plant expansion. Instructions (a) Journalize the transactions, events, and closing entries for net income and dividends. (b) Enter the beginning balances in the accounts, and post to the stockholders' equity accounts. (Note: Open additional stockholders equity accounts as needed.) (c) Prepare a retained earnings statement for the year. (d) Prepare a stockholders' equity section at December 31, 2017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started