Answered step by step

Verified Expert Solution

Question

1 Approved Answer

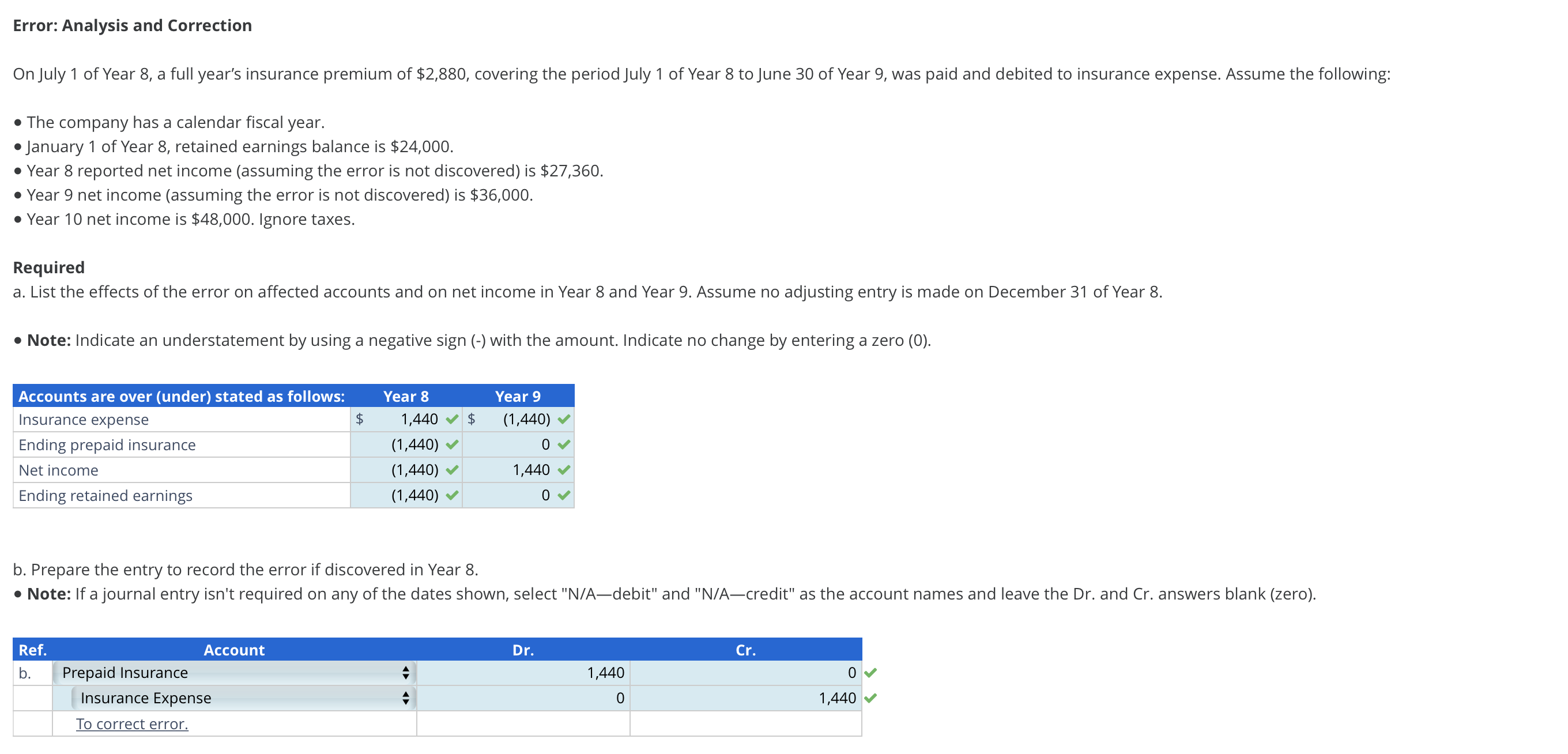

Please help with parts C and D!! Error: Analysis and Correction - The company has a calendar fiscal year. - January 1 of Year 8,

Please help with parts C and D!!

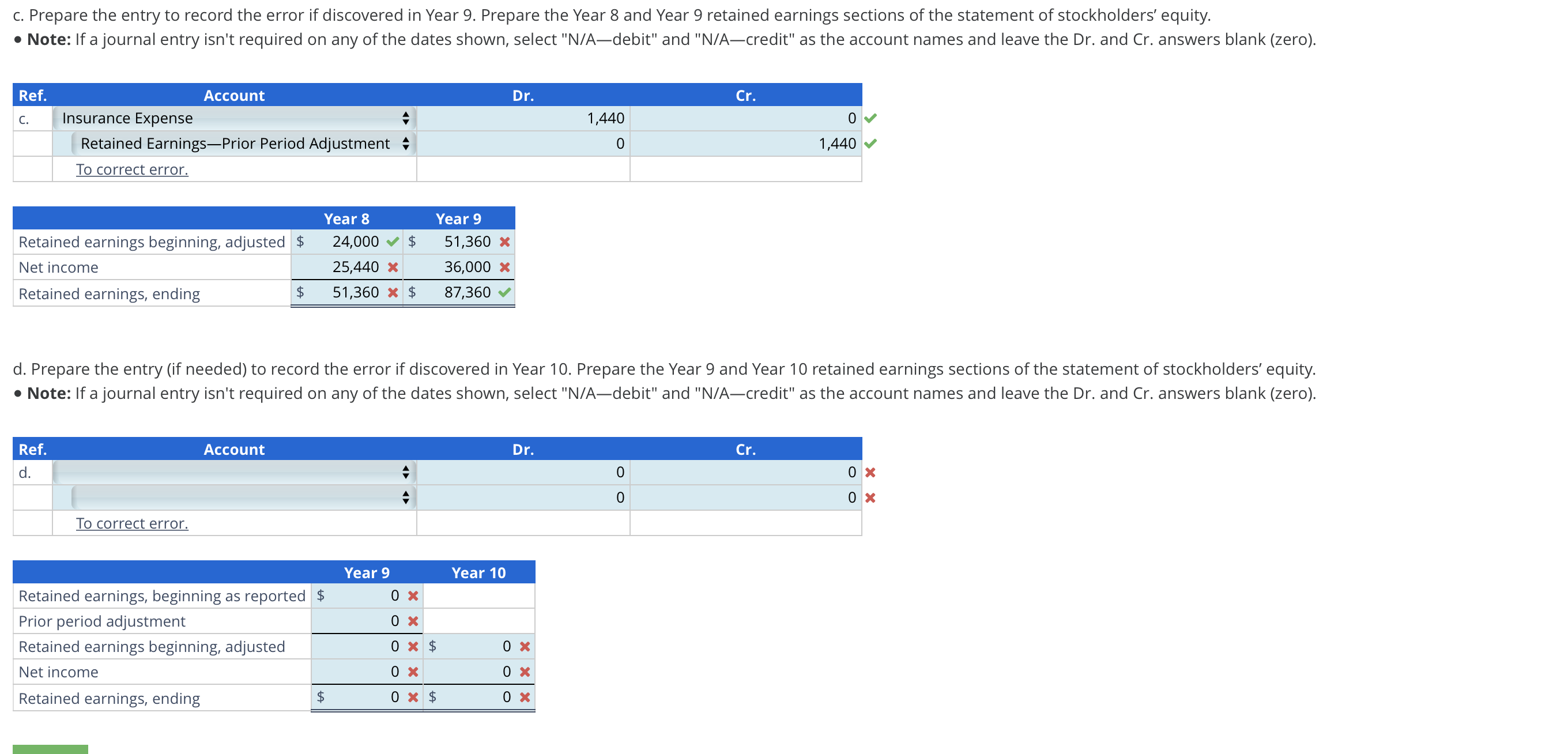

Error: Analysis and Correction - The company has a calendar fiscal year. - January 1 of Year 8, retained earnings balance is $24,000. - Year 8 reported net income (assuming the error is not discovered) is $27,360. - Year 9 net income (assuming the error is not discovered) is $36,000. - Year 10 net income is $48,000. Ignore taxes. Required a. List the effects of the error on affected accounts and on net income in Year 8 and Year 9. Assume no adjusting entry is made on December 31 of Year 8. - Note: Indicate an understatement by using a negative sign (-) with the amount. Indicate no change by entering a zero (0). b. Prepare the entry to record the error if discovered in Year 8. c. Prepare the entry to record the error if discovered in Year 9. Prepare the Year 8 and Year 9 retained earnings sections of the statement of stockholders' equity. - Note: If a journal entry isn't required on any of the dates shown, select "N/Adebit" and "N/Acredit" as the account names and leave the Dr. and Cr. answers blank (zero). d. Prepare the entry (if needed) to record the error if discovered in Year 10. Prepare the Year 9 and Year 10 retained earnings sections of the statement of stockholders' equity. - Note: If a journal entry isn't required on any of the dates shown, select "N/Adebit" and "N/Acredit" as the account names and leave the Dr. and Cr. answers blank (zero)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started