Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with problem 1 thru 3 with calculation formula and the Analysis 1-3. Thank you. Problems 1. For Apple Pies only, compute the variable

Please help with problem 1 thru 3 with calculation formula and the Analysis 1-3. Thank you.

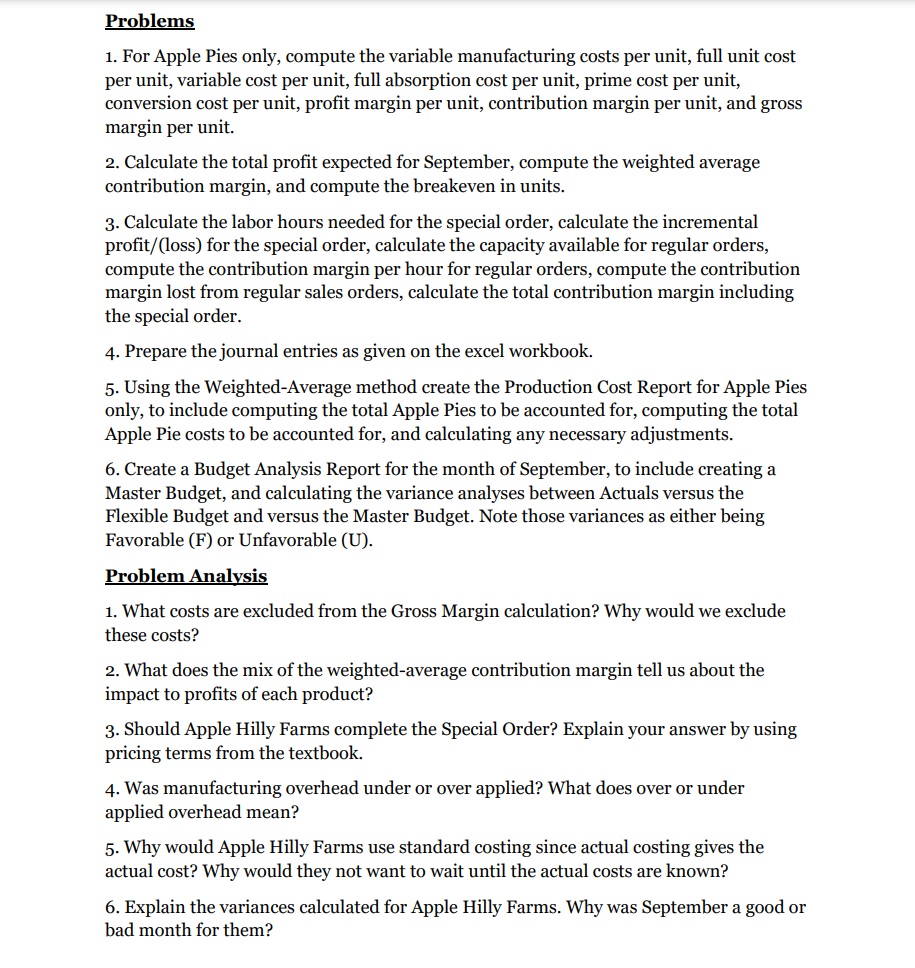

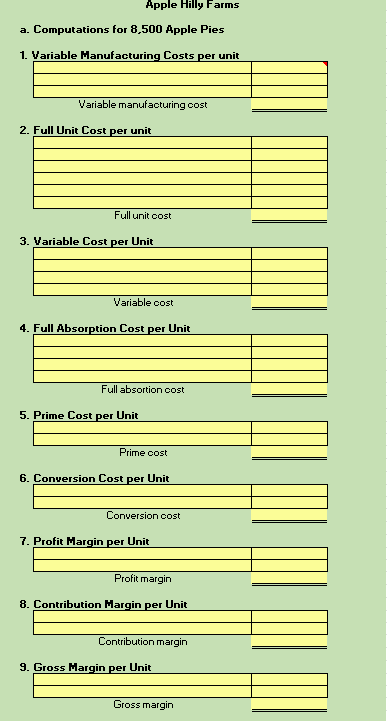

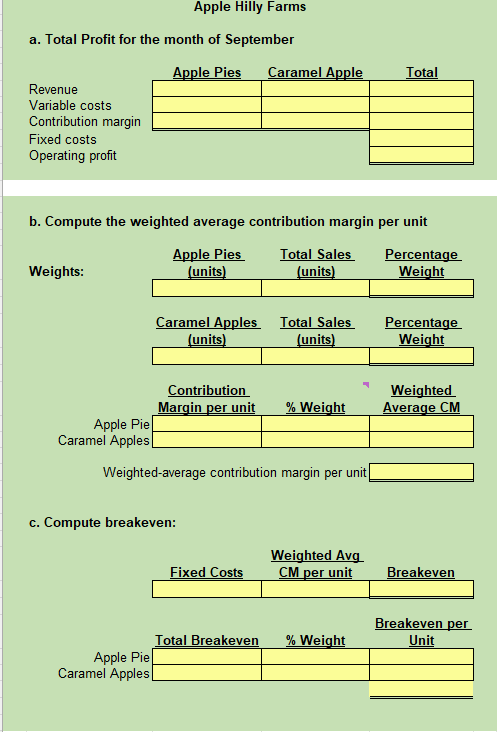

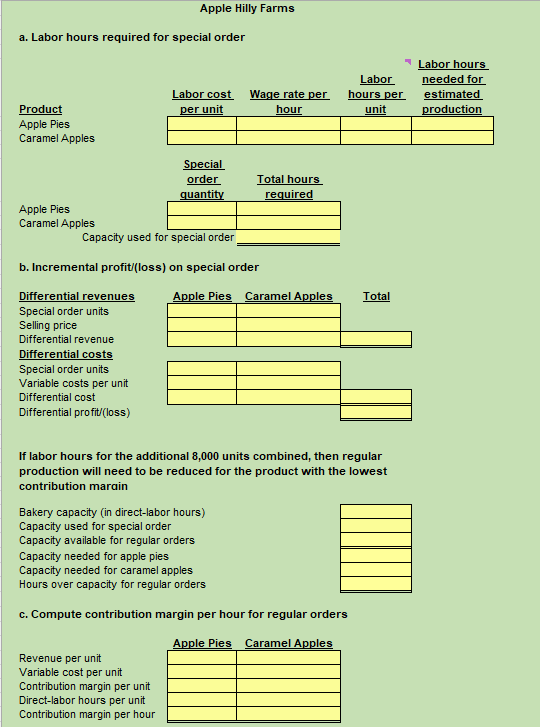

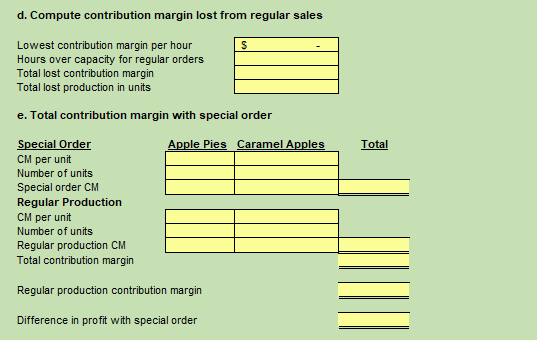

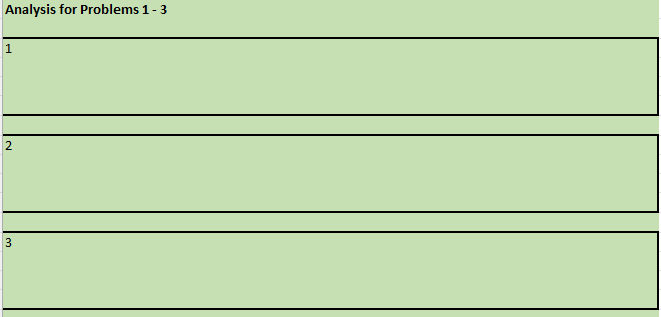

Problems 1. For Apple Pies only, compute the variable manufacturing costs per unit, full unit cost per unit, variable cost per unit, full absorption cost per unit, prime cost per unit, conversion cost per unit, profit margin per unit, contribution margin per unit, and gross margin per unit. 2. Calculate the total profit expected for September, compute the weighted average contribution margin, and compute the breakeven in units. 3. Calculate the labor hours needed for the special order, calculate the incremental profit/(loss) for the special order, calculate the capacity available for regular orders, compute the contribution margin per hour for regular orders, compute the contribution margin lost from regular sales orders, calculate the total contribution margin including the special order. 4. Prepare the journal entries as given on the excel workbook. 5. Using the Weighted-Average method create the Production Cost Report for Apple Pies only, to include computing the total Apple Pies to be accounted for, computing the total Apple Pie costs to be accounted for, and calculating any necessary adjustments. 6. Create a Budget Analysis Report for the month of September, to include creating a Master Budget, and calculating the variance analyses between Actuals versus the Flexible Budget and versus the Master Budget. Note those variances as either being Favorable (F) or Unfavorable (U). Problem Analysis 1. What costs are excluded from the Gross Margin calculation? Why would we exclude these costs? 2. What does the mix of the weighted-average contribution margin tell us about the impact to profits of each product? 3. Should Apple Hilly Farms complete the Special Order? Explain your answer by using pricing terms from the textbook. 4. Was manufacturing overhead under or over applied? What does over or under applied overhead mean? 5. Why would Apple Hilly Farms use standard costing since actual costing gives the actual cost? Why would they not want to wait until the actual costs are known? 6. Explain the variances calculated for Apple Hilly Farms. Why was September a good or bad month for them? a. Computations for 8,500 Apple Pies 1. .,,= 2 3 N--:LI- 4 a. Total Profit for the month of September b. Compute the weighted average contribution margin per unit Weights: Weighted-average contribution margin per unit c. Compute breakeven: Apple Hilly Farms a. Labor hours required for special order Product Apple Pies Caramel Apples b. Incremental profit/(loss) on special order If labor hours for the additional 8,000 units combined, then regular production will need to be reduced for the product with the lowest contribution marain c. Compute contribution margin per hour for regular orders d. Compute contribution margin lost from regular sales e. Total contribution margin with special order Regular production contribution margin Difference in profit with special order Analysis for Problems 1 - 3 1 2 3 Problems 1. For Apple Pies only, compute the variable manufacturing costs per unit, full unit cost per unit, variable cost per unit, full absorption cost per unit, prime cost per unit, conversion cost per unit, profit margin per unit, contribution margin per unit, and gross margin per unit. 2. Calculate the total profit expected for September, compute the weighted average contribution margin, and compute the breakeven in units. 3. Calculate the labor hours needed for the special order, calculate the incremental profit/(loss) for the special order, calculate the capacity available for regular orders, compute the contribution margin per hour for regular orders, compute the contribution margin lost from regular sales orders, calculate the total contribution margin including the special order. 4. Prepare the journal entries as given on the excel workbook. 5. Using the Weighted-Average method create the Production Cost Report for Apple Pies only, to include computing the total Apple Pies to be accounted for, computing the total Apple Pie costs to be accounted for, and calculating any necessary adjustments. 6. Create a Budget Analysis Report for the month of September, to include creating a Master Budget, and calculating the variance analyses between Actuals versus the Flexible Budget and versus the Master Budget. Note those variances as either being Favorable (F) or Unfavorable (U). Problem Analysis 1. What costs are excluded from the Gross Margin calculation? Why would we exclude these costs? 2. What does the mix of the weighted-average contribution margin tell us about the impact to profits of each product? 3. Should Apple Hilly Farms complete the Special Order? Explain your answer by using pricing terms from the textbook. 4. Was manufacturing overhead under or over applied? What does over or under applied overhead mean? 5. Why would Apple Hilly Farms use standard costing since actual costing gives the actual cost? Why would they not want to wait until the actual costs are known? 6. Explain the variances calculated for Apple Hilly Farms. Why was September a good or bad month for them? a. Computations for 8,500 Apple Pies 1. .,,= 2 3 N--:LI- 4 a. Total Profit for the month of September b. Compute the weighted average contribution margin per unit Weights: Weighted-average contribution margin per unit c. Compute breakeven: Apple Hilly Farms a. Labor hours required for special order Product Apple Pies Caramel Apples b. Incremental profit/(loss) on special order If labor hours for the additional 8,000 units combined, then regular production will need to be reduced for the product with the lowest contribution marain c. Compute contribution margin per hour for regular orders d. Compute contribution margin lost from regular sales e. Total contribution margin with special order Regular production contribution margin Difference in profit with special order Analysis for Problems 1 - 3 1 2 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started