Please help with problem B. The 275,000 values are correct everything is incorrect. Here is a chart of accounts.

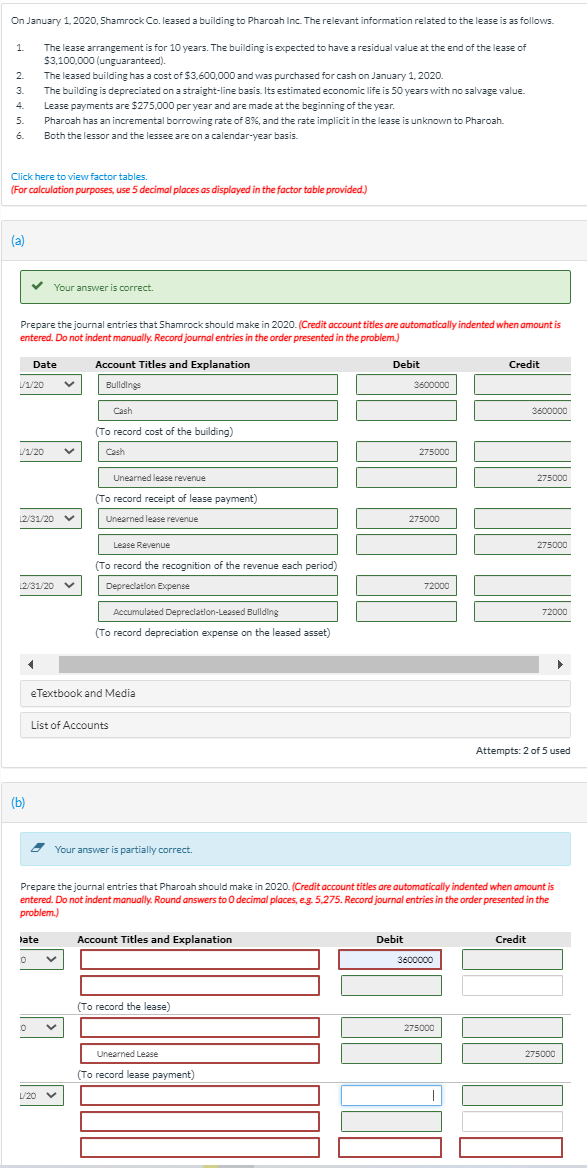

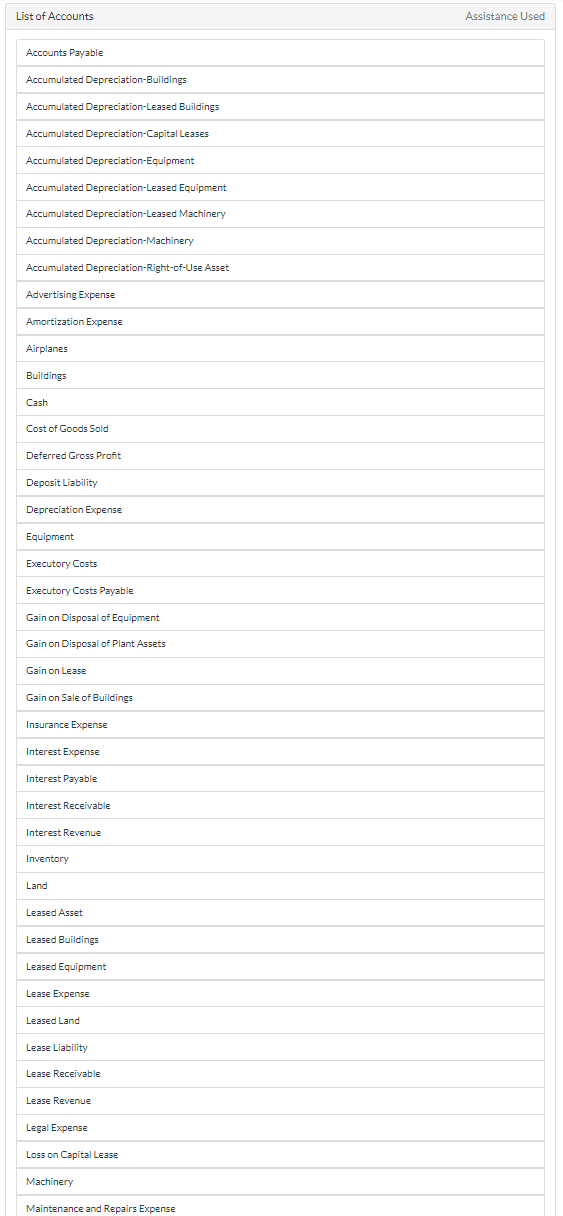

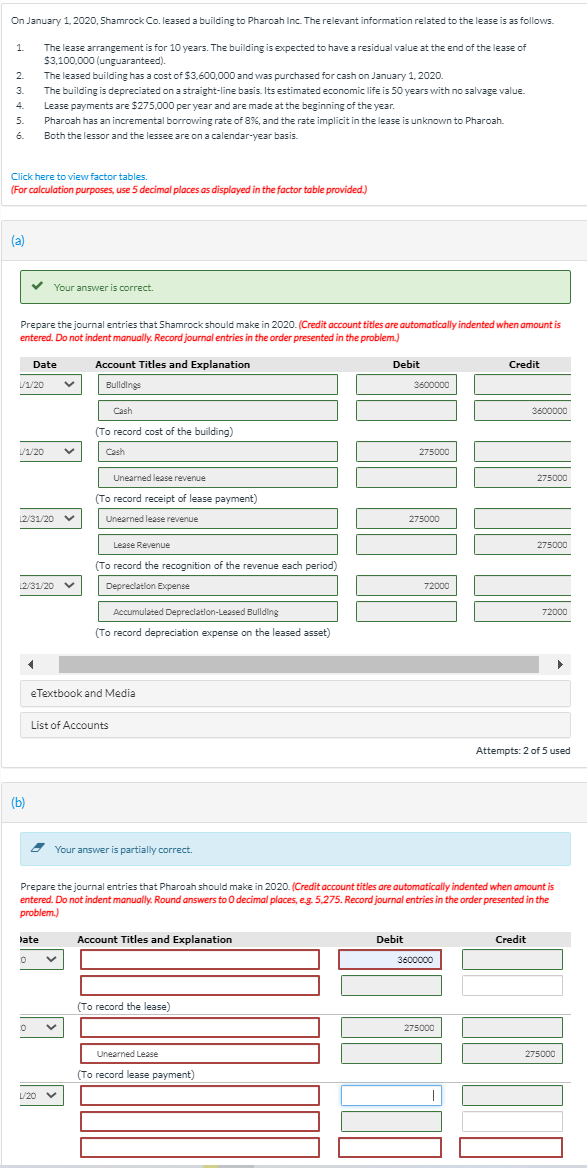

On January 1, 2020, Shamrock Co. leased a building to Pharoah Inc. The relevant information related to the lease is as follows. 1 2. 3. The lease arrangement is for 10 years. The building is expected to have a residual value at the end of the lease of $3,100,000 (unguaranteed). The leased building has a cost of $3,600,000 and was purchased for cash on January 1, 2020. The building is depreciated on a straight-line basis. Its estimated economic life is 50 years with no salvage value Lease payments are $275,000 per year and are made at the beginning of the year. Pharoah has an incremental borrowing rate of 896, and the rate implicit in the lease is unknown to Pharoah Both the lessor and the lessee are on a calendar-year basis. 5. 6. Click here to view factor tables. . (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Your answer is correct. Prepare the journal entries that Shamrock should make in 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Debit Credit Account Titles and Explanation Buildings 11/20 3600000 Cash 360000 (To record cost of the building) 1/1/20 275000 Unearned lease revenue 275000 (To record receipt of lease payment) 12/31/20 V Unearned lease revenue 275000 Lease Revenue 275000 (To record the recognition of the revenue each period) Depreciation Expense 12/31/20 V 72000 72000 Accumulated Deprecatlon-Leased Building (To record depreciation expense on the leased asset) 1 eTextbook and Media List of Accounts Attempts: 2 of 5 used (b) Your answer is partially correct. Prepare the journal entries that Pharoah should make in 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to decimal places, eg. 5,275. Record journal entries in the order presented in the problem.) late Account Titles and Explanation Credit Debit 3600000 (To record the lease) 275000 Unearned Lease 275000 (To record lease payment) List of Accounts Assistance Used Accounts Payable Accumulated Depreciation-Buildings Accumulated Depreciation-Leased Buildings Accumulated Depreciation-Capital Leases Accumulated Depreciation Equipment Accumulated Depreciation-Leased Equipment Accumulated Depreciation-Leased Machinery Accumulated Depreciation-Machinery Accumulated Depreciation-Right-of-Use Asset Advertising Expense Amortization Expense Airplanes Buildings Cash Cost of Goods Sold Deferred Gross Profit Deposit Liability Depreciation Expense Equipment Executory Costs Executory Costs Payable Gain on Disposal of Equipment Gain on Disposal of Plant Assets Gain on Lease Gain on Sale of Buildings Insurance Expense Interest Expense Interest Payable Interest Receivable Interest Revenue Inventory Land Leased Asset Leased Buildings Leased Equipment Lease Expense Leased Land Lease Liability Lease Receivable Lease Revenue Legal Expense Loss on Capital Lease Machinery Maintenance and Repairs Expense Notes Payable Prepaid Lease Executory Costs Prepaid Legal Fees Property Tax Expense Property Tax Payable Rent Expense Rent Payable Rent Receivable Rent Revenue Revenue from Sale-Leaseback Right-of-Use Asset Salaries and Wages Expense Sales Revenue Selling Expenses Trucks Unearned Profit on Sale-Leaseback Unearned Lease Revenue Unearned Service Revenue