Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with q2. Will upvote if helpful show steps please Question 2 [24 A new pharmaceutical plant is expected to cost (Fixed capital investment)

Please help with q2. Will upvote if helpful show steps please

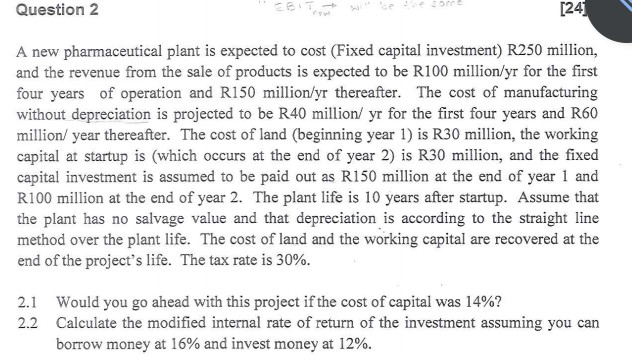

Question 2 [24 A new pharmaceutical plant is expected to cost (Fixed capital investment) R250 million, and the revenue from the sale of products is expected to be R100 million/yr for the first four years of operation and R150 million/yr thereafter. The cost of manufacturing without depreciation is projected to be R40 million/ yr for the first four years and R60 million/ year thereafter. The cost of land (beginning year 1) is R30 million, the working capital at startup is (which occurs at the end of year 2) is R30 million, and the fixed capital investment is assumed to be paid out as R150 million at the end of year 1 and R100 million at the end of year 2. The plant life is 10 years after startup. Assume that the plant has no salvage value and that depreciation is according to the straight line method over the plant life. The cost of land and the working capital are recovered at the end of the project's life. The tax rate is 30%. 2.1 Would you go ahead with this project if the cost of capital was 14%? 2.2 Calculate the modified internal rate of return of the investment assuming you can borrow money at 16% and invest money at 12%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started