Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with question 6. Thanks for your help. 6 Explain the significance of your ratio calculations. D. H. K. Solvency Ratios 1 Ability to

Please help with question 6. Thanks for your help.

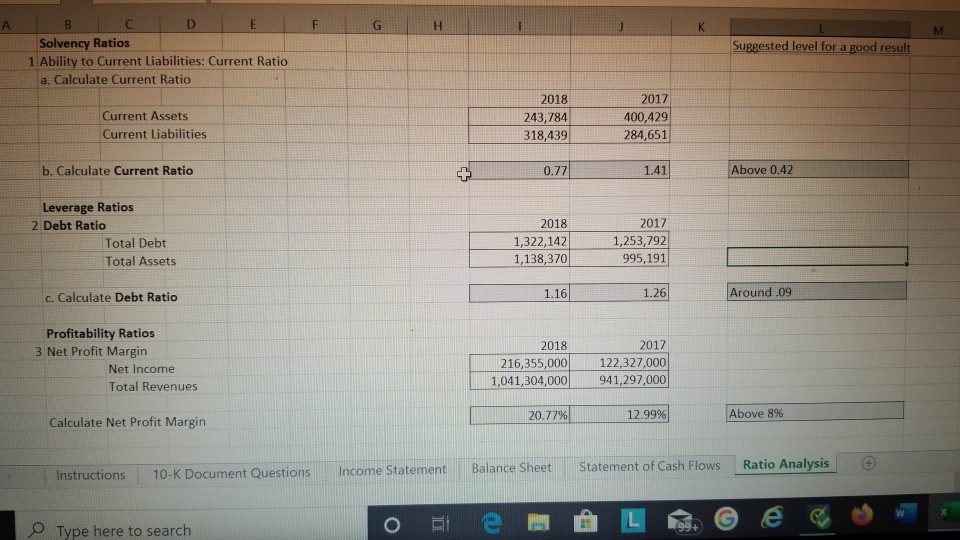

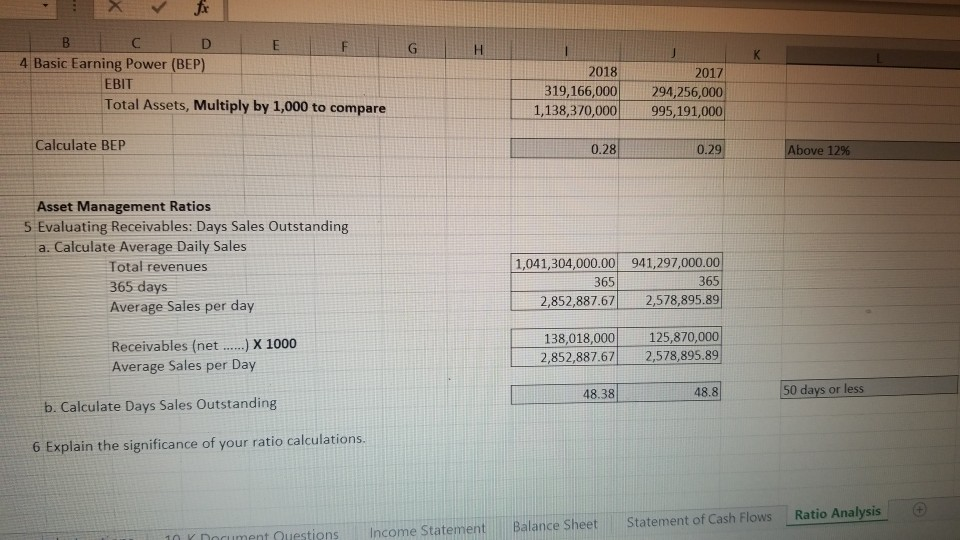

6 Explain the significance of your ratio calculations. D. H. K. Solvency Ratios 1 Ability to Current Liabilities: Current Ratio Suggested level for a good result a. Calculate Current Ratio 2018 2017 243,784 318,439 400,429 284,651 Current Assets Current Liabilities b. Calculate Current Ratio Above 0.42 0.77 1.41 Leverage Ratios 2 Debt Ratio 2017 2018 1,322,142 1,138,370 1,253,792 Total Debt 995,191 Total Assets Around .09 1.26 1.16 c. Calculate Debt Ratio Profitability Ratios 3 Net Profit Margin 2018 2017 216,355,000 1,041,304,000 122,327,000 Net Income 941,297,000 Total Revenues Above 8% 20.77% 12.99% Calculate Net Profit Margin Ratio Analysis Statement of Cash Flows Balance Sheet Income Statement 10-K Document Questions Instructions 99+ Type here to search B. H. 4 Basic Earning Power (BEP) 2018 2017 EBIT 294,256,000 995,191,000 319,166,000 Total Assets, Multiply by 1,000 to compare 1,138,370,000 Calculate BEP Above 12% 0.28 0.29 Asset Management Ratios 5 Evaluating Receivables: Days Sales Outstanding a. Calculate Average Daily Sales 1,041,304,000.00 941,297,000.00 Total revenues 365 365 days Average Sales per day 365 2,852,887.67 2,578,895.89 125,870,000 2,578,895.89 138,018,000 Receivables (net .) X 1000 Average Sales per Day 2,852,887.67 50 days or less 48.8 48.38 b. Calculate Days Sales Outstanding 6 Explain the significance of your ratio calculations. Ratio Analysis Statement of Cash Flows Balance Sheet Income Statement 10 K Document QuestionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started