Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with question # 6. Thanks please help with questions 1-6. thanks 2 3 A B C D E F G H J K

Please help with question # 6. Thanks

please help with questions 1-6. thanks

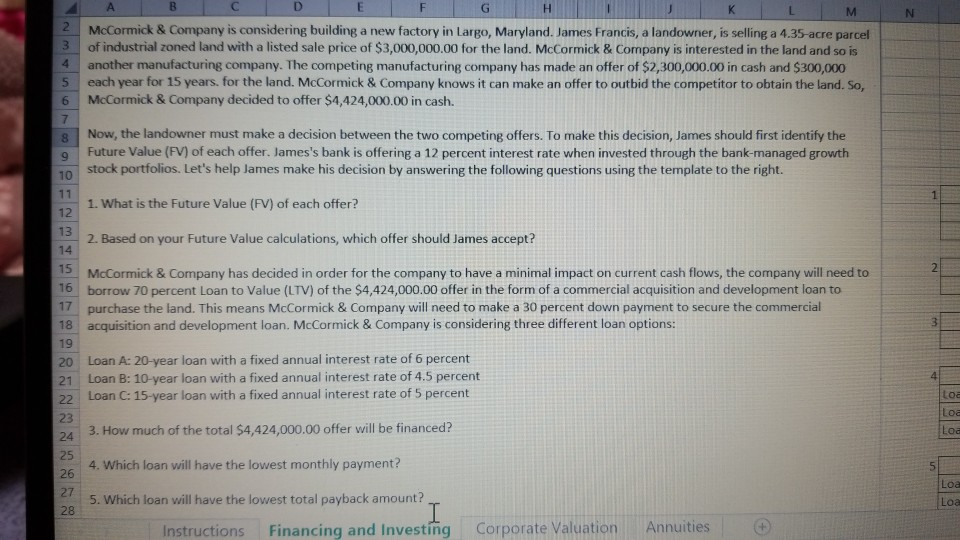

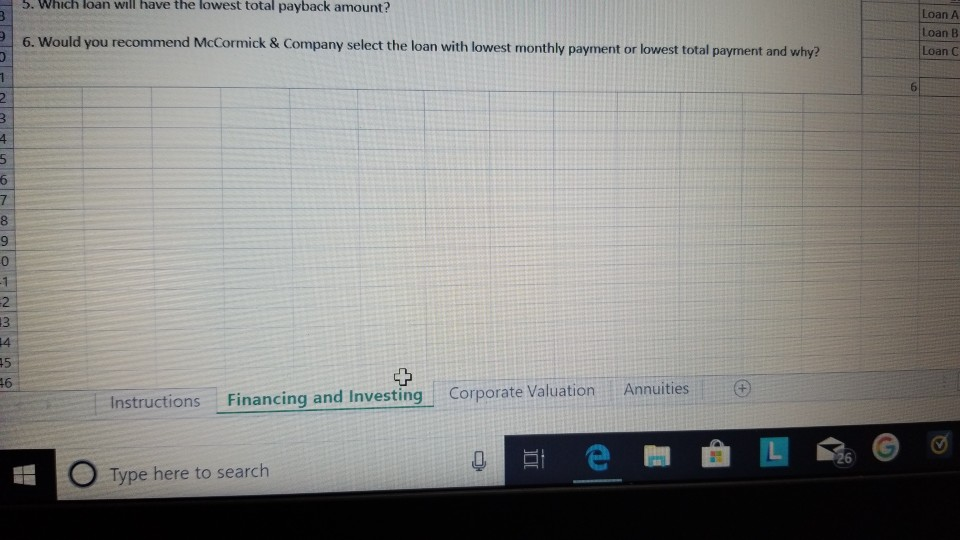

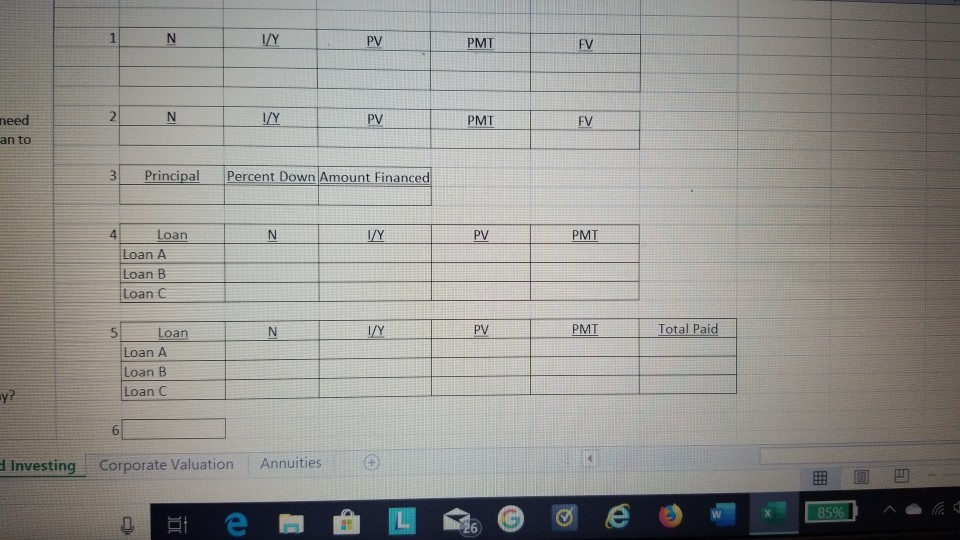

2 3 A B C D E F G H J K L M McCormick & Company is considering building a new factory in Largo, Maryland. James Francis, a landowner, is selling a 4.35-acre parcel of industrial zoned land with a listed sale price of $3,000,000.00 for the land. McCormick & Company is interested in the land and so is another manufacturing company. The competing manufacturing company has made an offer of $2,300,000.00 in cash and $300,000 each year for 15 years, for the land. McCormick & Company knows it can make an offer to outbid the competitor to obtain the land. So, McCormick & Company decided to offer $4,424,000.00 in cash. Now, the landowner must make a decision between the two competing offers. To make this decision, James should first identify the Future Value (FV) of each offer. James's bank is offering a 12 percent interest rate when invested through the bank-managed growth stock portfolios. Let's help James make his decision by answering the following questions using the template to the right. 1. What is the Future Value (FV) of each offer? 2. Based on your Future Value calculations, which offer should James accept? McCormick & Company has decided in order for the company to have a minimal impact on current cash flows, the company will need to borrow 70 percent Loan to Value (LTV) of the $4,424,000.00 offer in the form of a commercial acquisition and development loan to purchase the land. This means McCormick & Company will need to make a 30 percent down payment to secure the commercial acquisition and development loan. McCormick & Company is considering three different loan options: 18 19 20 Loan A: 20-year loan with a fixed annual interest rate of 6 percent Loan B: 10-year loan with a fixed annual interest rate of 4.5 percent Loan C: 15-year loan with a fixed annual interest rate of 5 percent 3. How much of the total $4,424,000.00 offer will be financed? 4. Which loan will have the lowest monthly payment? 5. Which loan will have the lowest total payback amount? Instructions Financing and Investing Corporate Valuation Annuities 5. Which toan will have the lowest total payback amount? Loan A Loan B Loan 6. Would you recommend McCormick & Company select the loan with lowest monthly payment or lowest total payment and why? ilm to ONIMO Corporate Valuation Annuities Instructions Financing and Investing O Type here to search PMT FV 2 N PV PMT need an to Principal Percent Down Amount Financed PMT Loan Loan A Loan B Loan C 5 Total Paid Loan Loan A Loan B Loan C Investing Corporate Valuation AnnuitiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started