Please help with Question number 3 only! Refer to both pictures to see whats correct and incorrect

Please help with Question number 3 only! Refer to both pictures to see whats correct and incorrect

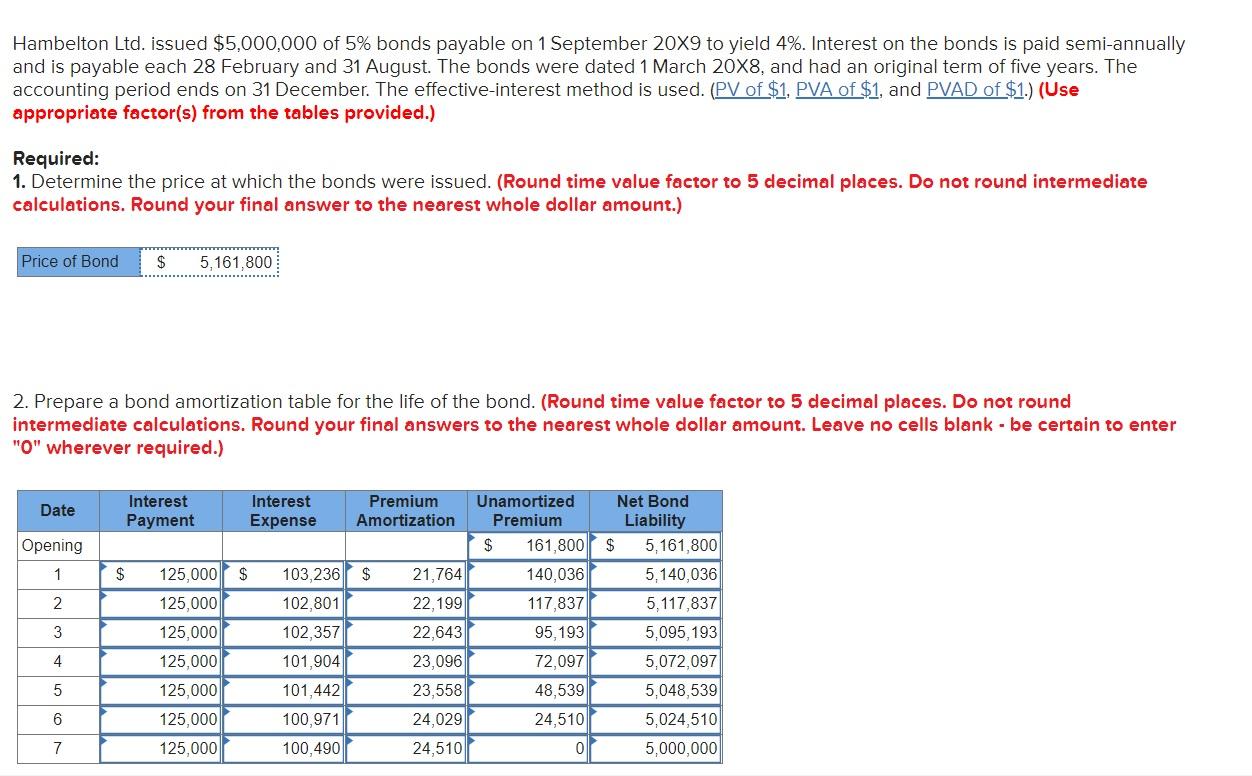

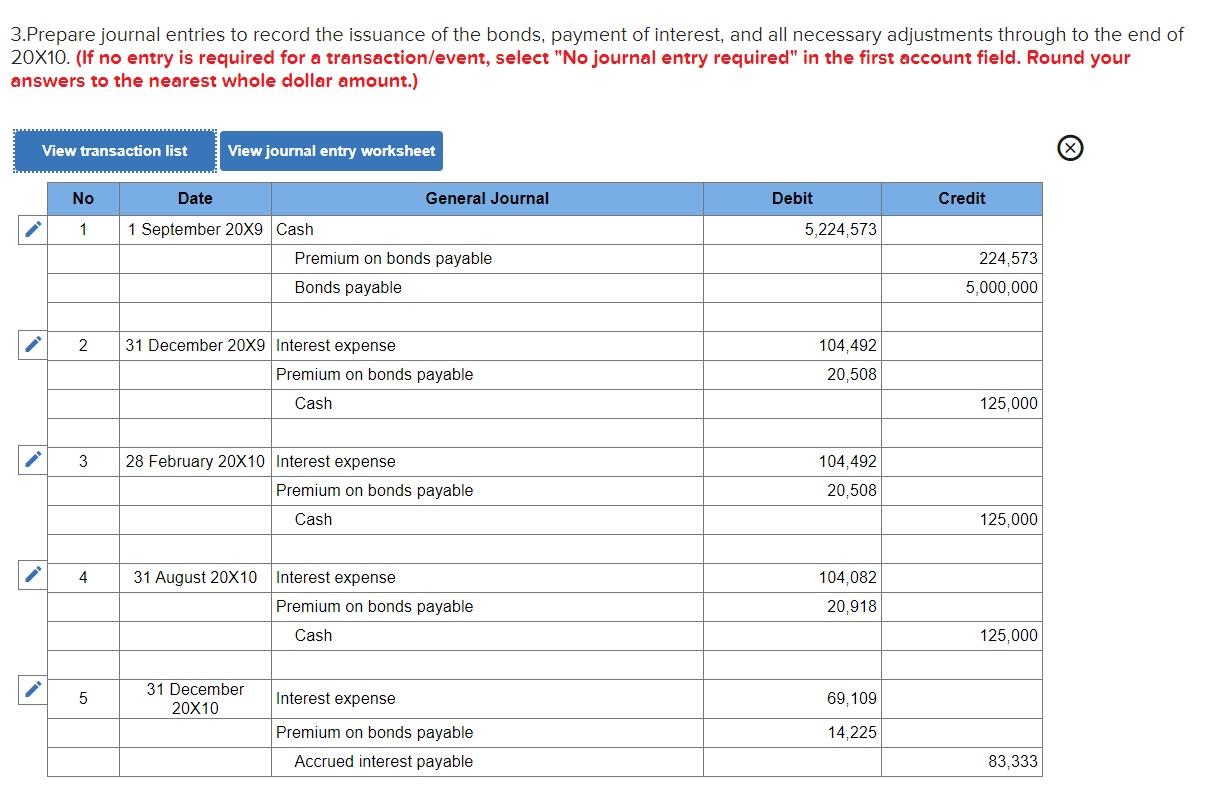

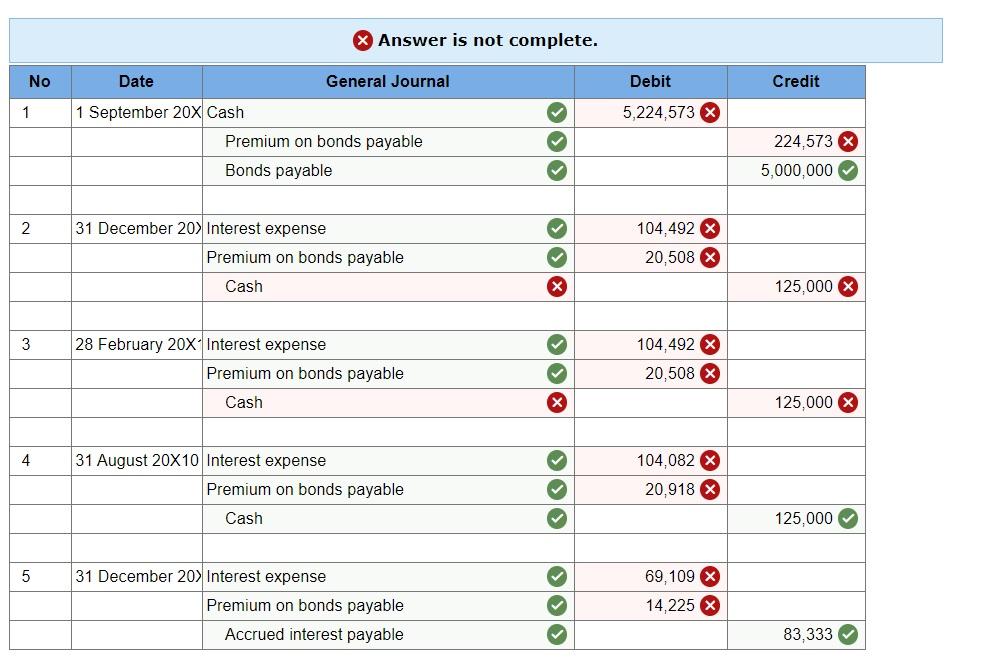

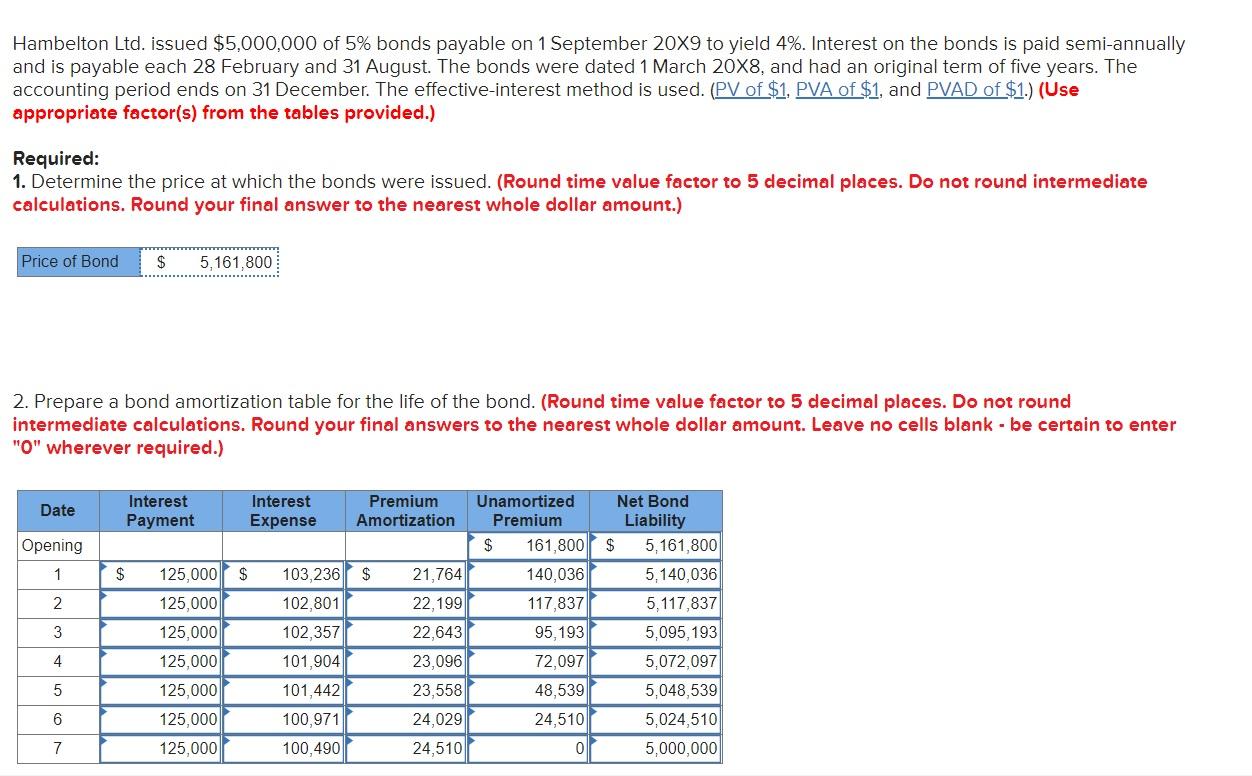

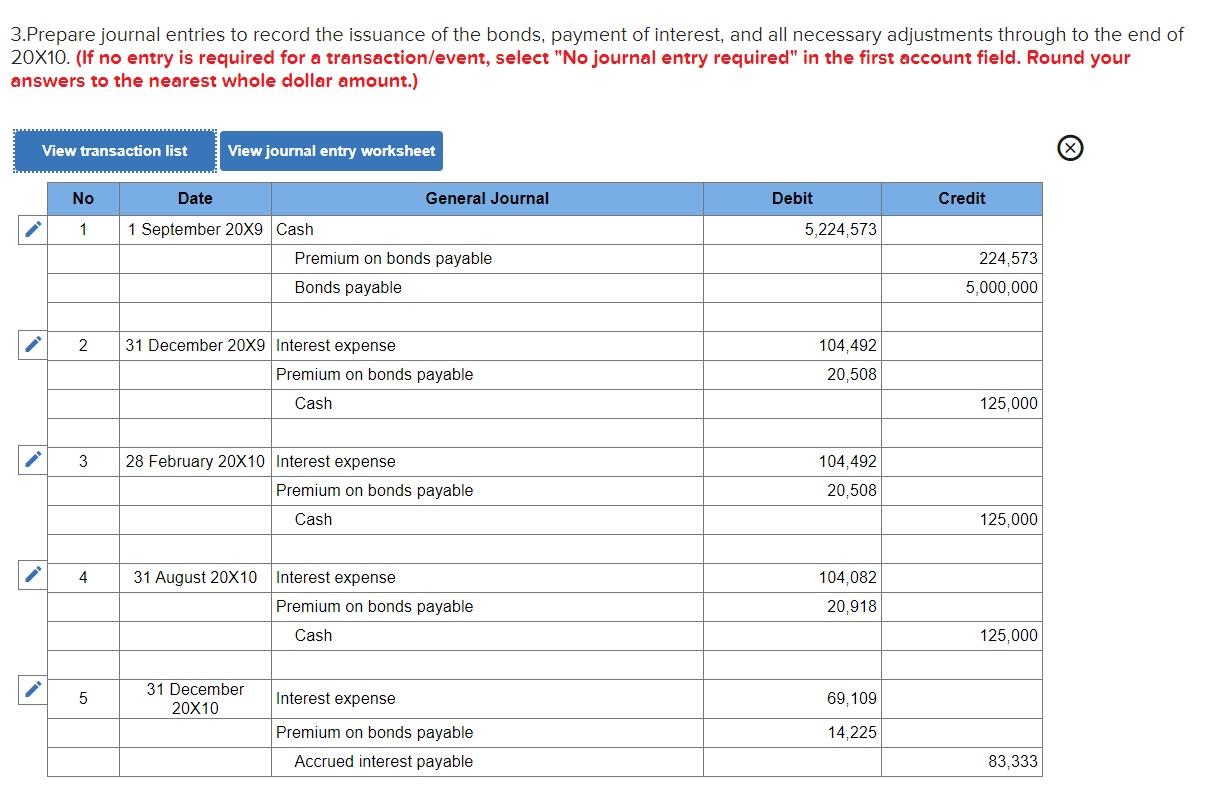

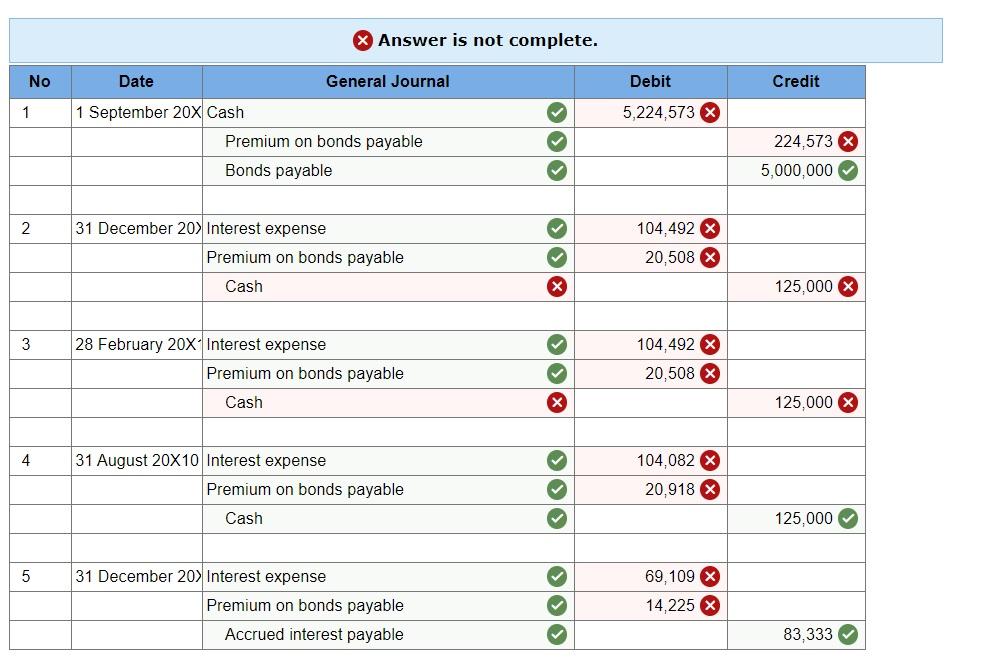

Hambelton Ltd. issued $5,000,000 of 5% bonds payable on 1 September 20X9 to yield 4%. Interest on the bonds is paid semi-annually and is payable each 28 February and 31 August. The bonds were dated 1 March 20X8, and had an original term of five years. The accounting period ends on 31 December. The effective-interest method is used. (PV of $1, PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the price at which the bonds were issued. (Round time value factor to 5 decimal places. Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount.) Price of Bond $ 5,161,800 2. Prepare a bond amortization table for the life of the bond. (Round time value factor to 5 decimal places. Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no cells blank - be certain to enter "0" wherever required.) Date Interest Payment Interest Expense Premium Amortization Opening 1 $ $ $ 21,764 2 22,199 3 125,000 125,000 125,000 125,000 125,000 125,000 125,000 4 103,236 102,801 102,357 101,904 101,442 100,971 100,490 Unamortized Net Bond Premium Liability $ 161,800 $ 5,161,800 140,036 5,140,036 117,837 5,117,837 95,193 5,095,193 72,097 5,072,097 48,539 5,048,539 24,510 5,024,510 5,000,000 22,643 23,096 23,558 24.029 24,510 5 6 7 3.Prepare journal entries to record the issuance of the bonds, payment of interest, and all necessary adjustments through to the end of 20X10. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amount.) View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 5,224,573 1 September 20X9 Cash Premium on bonds payable Bonds payable 224,573 5,000,000 2 104,492 31 December 20X9 Interest expense Premium on bonds payable Cash 20.508 125,000 3 104,492 28 February 20X10 Interest expense Premium on bonds payable 20,508 Cash 125,000 4 31 August 20X10 Interest expense Premium on bonds payable 104,082 20,918 Cash 125,000 5 31 December 20X10 Interest expense 69,109 14,225 Premium on bonds payable Accrued interest payable 83,333 Answer is not complete. No Debit Credit 1 5,224,573 Date General Journal 1 September 20X Cash Premium on bonds payable Bonds payable 224,573 X 5,000,000 2 104.492 x 31 December 20) Interest expense Premium on bonds payable Cash 20,508 X x 125,000 X 3 28 February 20x Interest expense Premium on bonds payable 104,492 20,508 X Cash X 125,000 X 4 104,082 x 31 August 20X10 Interest expense Premium on bonds payable 20,918 X Cash 125,000 5 31 December 20) Interest expense Premium on bonds payable Accrued interest payable 69,109 X 14,225 83,333

Please help with Question number 3 only! Refer to both pictures to see whats correct and incorrect

Please help with Question number 3 only! Refer to both pictures to see whats correct and incorrect