Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with questions 1-11 The questions are as big as I can make them DIVIDEND POLICY In a way, this is a pleasant problem

Please help with questions 1-11

The questions are as big as I can make them

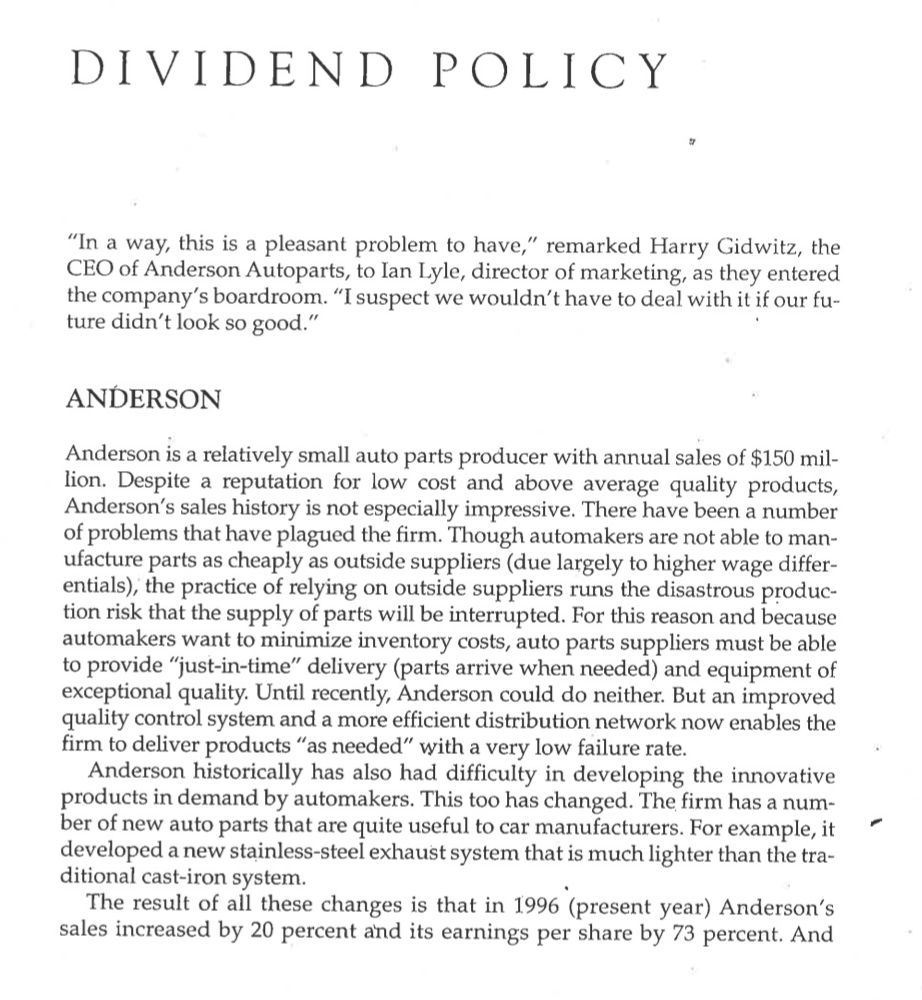

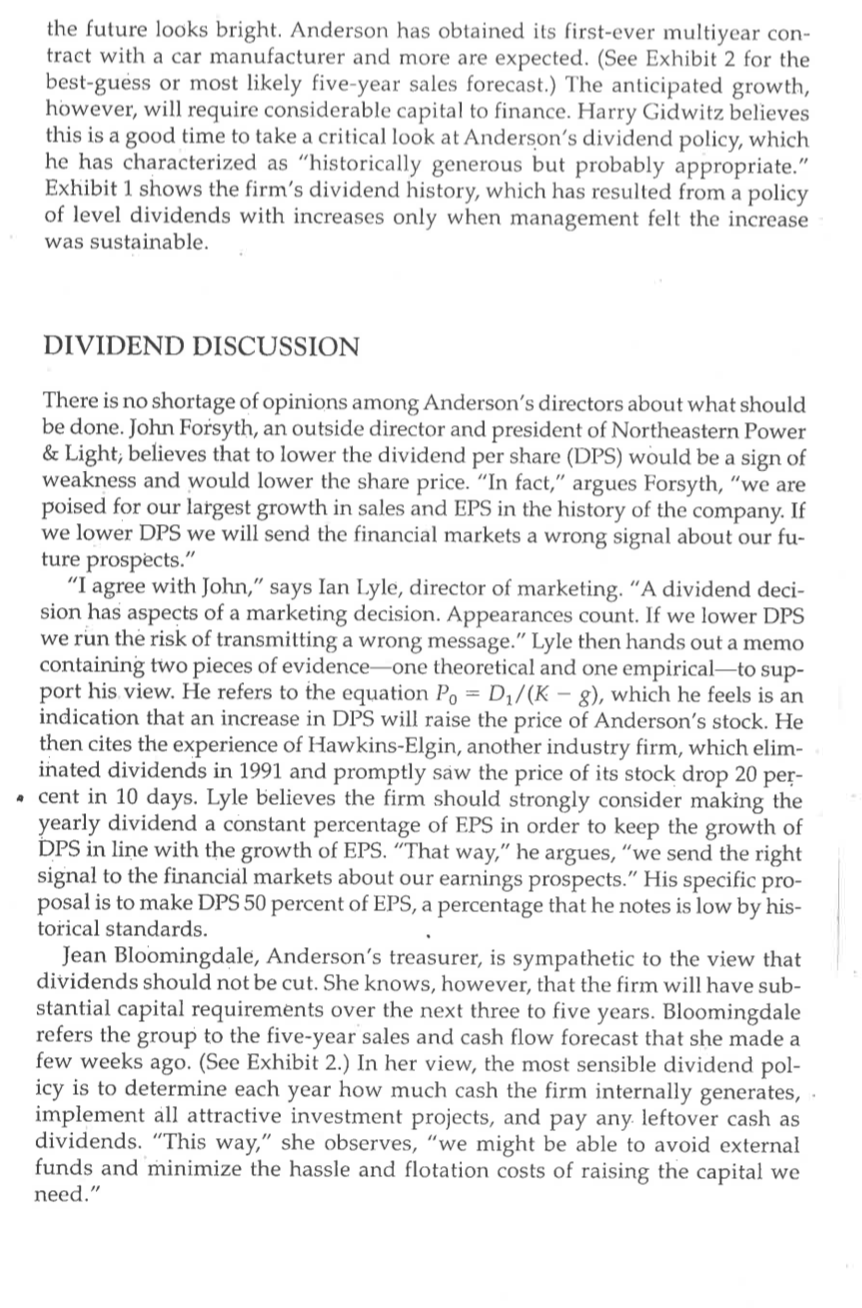

DIVIDEND POLICY "In a way, this is a pleasant problem to have," remarked Harry Gidwitz, the CEO of Anderson Autoparts, to lan Lyle, director of marketing, as they entered the company's boardroom. I suspect we wouldn't have to deal with it if our fu- ture didn't look so good." ANDERSON Anderson is a relatively small auto parts producer with annual sales of $150 mil- lion. Despite a reputation for low cost and above average quality products, Anderson's sales history is not especially impressive. There have been a number of problems that have plagued the firm. Though automakers are not able to man- ufacture parts as cheaply as outside suppliers (due largely to higher wage differ- entials), the practice of relying on outside suppliers runs the disastrous produc- tion risk that the supply of parts will be interrupted. For this reason and because automakers want to minimize inventory costs, auto parts suppliers must be able to provide "just-in-time" delivery (parts arrive when needed) and equipment of exceptional quality. Until recently, Anderson could do neither. But an improved quality control system and a more efficient distribution network now enables the firm to deliver products "as needed" with a very low failure rate. Anderson historically has also had difficulty in developing the innovative products in demand by automakers. This too has changed. The firm has a num- ber of new auto parts that are quite useful to car manufacturers. For example, it developed a new stainless-steel exhaust system that is much lighter than the tra- ditional cast-iron system. The result of all these changes is that in 1996 (present year) Anderson's sales increased by 20 percent and its earnings per share by 73 percent. And the future looks bright. Anderson has obtained its first-ever multiyear con- tract with a car manufacturer and more are expected. (See Exhibit 2 for the best-guess or most likely five-year sales forecast.) The anticipated growth, however, will require considerable capital to finance. Harry Gidwitz believes this is a good time to take a critical look at Anderson's dividend policy, which he has characterized as "historically generous but probably appropriate." Exhibit 1 shows the firm's dividend history, which has resulted from a policy of level dividends with increases only when management felt the increase was sustainable. DIVIDEND DISCUSSION There is no shortage of opinions among Anderson's directors about what should be done. John Forsyth, an outside director and president of Northeastern Power & Light; believes that to lower the dividend per share (DPS) would be a sign of weakness and would lower the share price. "In fact," argues Forsyth, "we are poised for our largest growth in sales and EPS in the history of the company. If we lower DPS we will send the financial markets a wrong signal about our fu- ture prospects." "I agree with John," says Ian Lyle, director of marketing. "A dividend deci- sion has aspects of a marketing decision. Appearances count. If we lower DPS we run the risk of transmitting a wrong message." Lyle then hands out a memo containing two pieces of evidence-one theoretical and one empiricalto sup- port his view. He refers to the equation Po = D/(K - 8), which he feels is an indication that an increase in DPS will raise the price of Anderson's stock. He then cites the experience of Hawkins-Elgin, another industry firm, which elim- inated dividends in 1991 and promptly saw the price of its stock drop 20 per- cent in 10 days. Lyle believes the firm should strongly consider making the yearly dividend a constant percentage of EPS in order to keep the growth of DPS in line with the growth of EPS. "That way," he argues, "we send the right signal to the financial markets about our earnings prospects." His specific pro- posal is to make DPS 50 percent of EPS, a percentage that he notes is low by his- torical standards. Jean Bloomingdale, Anderson's treasurer, is sympathetic to the view that dividends should not be cut. She knows, however, that the firm will have sub- stantial capital requirements over the next three to five years. Bloomingdale refers the group to the five-year sales and cash flow forecast that she made a few weeks ago. (See Exhibit 2.) In her view, the most sensible dividend pol- icy is to determine each year how much cash the firm internally generates, implement all attractive investment projects, and pay any leftover cash as dividends. "This way," she observes, "we might be able to avoid external funds and minimize the hassle and flotation costs of raising the capital we need." Jesse Bergenfeld, an outside director and chief financial officer of the nation's largest toy manufacturer, seems amused by what he has heard to this point. Everything said so far ignores the risk of the industry you're in. Sales and EPS projections don't always work out, you know, especially in an industry heavily dependent on automobile sales." He cites the "erratic" sales history of Anderson over the last 15 years. (See Exhibit 1.) Moving quickly to the chalkboard, he scribbles what he thinks future sales could be (see Exhibit 2(a) and notes that these estimates are consistent with the expectation of higher sales yet take into account the fluctuations of Anderson's past sales. "And," Bergenfeld points out, "your firm needs financial flexibility to handle sudden shifts in production tech- nique and your product mix. All of this," he concludes, "argues for a conserva- tive DPS." Helen Carrol, a senior vice president, can see merit to all the arguments. She wonders, though, if dividends shouldn't be eliminated entirely until the firm's financial situation becomes more stable. Carrol then presents data (see Exhibit 3) that seem to contradict Lyle's evidence. "Within each industry there is an in- verse relationship between payout and the price to earnings (P/E) ratio. Note especially the automobile manufacturers where the two foreign producers have lower payouts and higher P/E's than the three American firms." THE CEO'S VIEW Gidwitz wonders how much all of this matters anyway. He's sure that Anderson will be able to raise money from external sources if necessary. "The important thing this company faces is the successful implementation of the commercial strategy we've begun in the last year or so. This is where we'll be judged by in- vestors." Still, he thinks it might be embarrassing for Anderson if it had to tap external sources when, say, the share price was unusually low. And he admits he likes the idea of avoiding external financing if possible in order to minimize the hassle and cost of raising the needed capital. At the same time, he believes the firm's stockholders "expect DPS to increase, especially in light of our bright future." He then refers to a company survey showing the vast majority of the stockholders are happy with the firm's present dividend policy. "Perhaps a rea- sonable compromise is an increase in DPS to $1.10, keeping it there until our growth levels and avoiding any new stock issues. That way, we keep our stock- holders happy and avoid the amusing situation of simultaneously paying divi- dends and selling new shares. If we need external funds, we borrow. Flotation costs are lower with a bond issue than a stock issue anyway." Discussion then centers on other points that are seen as relevant to the decision. At book values, the firm currently has $15 million of long-term debt and $60 million of equity. This is a debt/equity ratio of .25, which the firm feels is optimal. No one feels it is a good idea to pay any dividend if to do so means the firm would have to forego any of its planned investments, especially given the sub- stantial publicity surrounding Anderson's present situation. QUESTIONS 1. Evaluate John Forsyth's argument that a cut in dividends will cause the price of Anderson's stock to decline. 2. Evaluate the theoretical and empirical evidence presented by Ian Lyle. 3. How do the following factors affect the dividend decision: the business risk of the industry? the possibility that there may be a sudden change in pro- duction techniques or in the firm's product mix? 4. Evaluate the evidence presented by Helen Carrol in Exhibit 3. Specifically, is it reasonable to conclude that a low payout has caused a high P/E? Defend your answer. 5. Suppose the position of Jean Bloomingdale is adopted. That is, each year the firm determines the cash it has generated internally, implements all attrac- tive investment projects, and pays out any remaining funds in dividends. Using the information in Exhibit 2, calculate the expected annual amount of dividends. Discuss the desirability of such a policy, making sure you con- sider the impact on the firm's debt/equity mix and assuming any funds needed are borrowed. 6. Evaluate Ian Lyle's suggestion to make DPS 50 percent of EPS each year. The format of Exhibit 4 should be useful in the analysis. 7. Evaluate the following points made by Harry Gidwitz. (a) The firm's dividend decision is relatively unimportant and is unlikely to affect the price of the firm's stock one way or another. (b) It would be "amusing" to simultaneously pay dividends and sell stock, perhaps to the same stockholders. (Can you think of any reasons why it might be in the interest of existing stockholders for the firm to do this?) 8. Suppose Harry Gidwitz's position is adopted; that is, the firm implements all attractive investments, DPS is $1.10, and no new common stock is issued. Compute the firm's debt/equity ratio in each of the next five years. Discuss the desirability of such a policy. The format of Exhibit 4 can be used in the analysis. . 9. What DPS do you recommend if the dividends are treated as a long-run residual? The format of Exhibit 4 should be useful, and you may assume that any necessary borrowing occurs in year 1 (1997). 10. Play the role of a consultant. Based on your previous answers and other in- formation in the case, what dividend policy do you recommend? Defend your recommendation. 11. What additional information would you like to have to make a more in- formed decision in question 10? EXHIBIT 1 Selected Financial History of Anderson Autoparts ($ Millions) Sales P/E ratio EPS DPS $80.6 82.8 1982 1983 1984 1985 1986 $0.80 0.87 0.89 0.72 88.3 76.5 $0.50 0.50 0.50 0.50 0.60 0.60 90.1 0.88 1987 6.6 0.90 35 0.10 0.60 0.84 7.1 6.7 10 1988 1989 1990 1991 1992 1993 1994 1995 1996 (present) 95.3 78.4 100.1 106.2 107.3 100.7 115.6 122.4 125.6 150.1 0.60 0.60 0.70 0.70 0.70 0.80 0.90 1.00 0.90 0.89 0.46 0.98 1.12 1.10 1.90 7.7 8.3 8.2 13 The firm presently has 4 million shares of common stock outstanding. EXHIBIT 2 (a) Best-Guess (Most Likely) Sales and Financial Forecast of Anderson: 1997-2001 ($ Millions) t = 0 t = 1 t = 2 t = 3 t = 4 t = 5 1996 1997 1998 1999 2000 2001 Sales $150 $173 $198 $228 $262 $302 Net income 8.7 9. 9 1 1.4 13.1 15.1 Change in working capital 4.6 5 6 6.8 8 Capital spending" _10 -7 3_ 8_ 2 Funds needed $14.6 $12 $9 $14.8 $10 *Amount is over and above depreciation charges. The firm's DPS is presently $1 with 4 million shares outstanding EXHIBIT 2(b) Bergenfeld's Future Sales Scenario: 1997-2001 ($ Millions) t = 0 1996 $150 t = 1 1997 $170 t = 2 1998 $185 t = 3 1999 $170 t = 4 2000 $250 t = 5 2001 $230 Sales EXHIBIT 3 Financial Information Compiled by Helen Carrol Industry Firm P/E Payout (%)" Retail Retail Retail Brewing Brewing Auto Auto Auto Auto Auto Wal-Mart Sears Kmart Coors Anheuser-Busch Honda Volvo GM Chrysler Ford *Payout = (DPS/EPS) X 100. EXHIBIT 4 Worksheet to Analyze Anderson's Future Financial Position $ Millions) t=0 1996 t=1 1997 t = 2 1998 t = 3 1999 t = 4 2000 t = 5 2001 8.7 9.9 11.4 13.1 15.1 Net income (Dividends) To retained earnings Funds needed (Deficit) Debt Equity D/E 9 10 15 60 0.25 DIVIDEND POLICY "In a way, this is a pleasant problem to have," remarked Harry Gidwitz, the CEO of Anderson Autoparts, to lan Lyle, director of marketing, as they entered the company's boardroom. I suspect we wouldn't have to deal with it if our fu- ture didn't look so good." ANDERSON Anderson is a relatively small auto parts producer with annual sales of $150 mil- lion. Despite a reputation for low cost and above average quality products, Anderson's sales history is not especially impressive. There have been a number of problems that have plagued the firm. Though automakers are not able to man- ufacture parts as cheaply as outside suppliers (due largely to higher wage differ- entials), the practice of relying on outside suppliers runs the disastrous produc- tion risk that the supply of parts will be interrupted. For this reason and because automakers want to minimize inventory costs, auto parts suppliers must be able to provide "just-in-time" delivery (parts arrive when needed) and equipment of exceptional quality. Until recently, Anderson could do neither. But an improved quality control system and a more efficient distribution network now enables the firm to deliver products "as needed" with a very low failure rate. Anderson historically has also had difficulty in developing the innovative products in demand by automakers. This too has changed. The firm has a num- ber of new auto parts that are quite useful to car manufacturers. For example, it developed a new stainless-steel exhaust system that is much lighter than the tra- ditional cast-iron system. The result of all these changes is that in 1996 (present year) Anderson's sales increased by 20 percent and its earnings per share by 73 percent. And the future looks bright. Anderson has obtained its first-ever multiyear con- tract with a car manufacturer and more are expected. (See Exhibit 2 for the best-guess or most likely five-year sales forecast.) The anticipated growth, however, will require considerable capital to finance. Harry Gidwitz believes this is a good time to take a critical look at Anderson's dividend policy, which he has characterized as "historically generous but probably appropriate." Exhibit 1 shows the firm's dividend history, which has resulted from a policy of level dividends with increases only when management felt the increase was sustainable. DIVIDEND DISCUSSION There is no shortage of opinions among Anderson's directors about what should be done. John Forsyth, an outside director and president of Northeastern Power & Light; believes that to lower the dividend per share (DPS) would be a sign of weakness and would lower the share price. "In fact," argues Forsyth, "we are poised for our largest growth in sales and EPS in the history of the company. If we lower DPS we will send the financial markets a wrong signal about our fu- ture prospects." "I agree with John," says Ian Lyle, director of marketing. "A dividend deci- sion has aspects of a marketing decision. Appearances count. If we lower DPS we run the risk of transmitting a wrong message." Lyle then hands out a memo containing two pieces of evidence-one theoretical and one empiricalto sup- port his view. He refers to the equation Po = D/(K - 8), which he feels is an indication that an increase in DPS will raise the price of Anderson's stock. He then cites the experience of Hawkins-Elgin, another industry firm, which elim- inated dividends in 1991 and promptly saw the price of its stock drop 20 per- cent in 10 days. Lyle believes the firm should strongly consider making the yearly dividend a constant percentage of EPS in order to keep the growth of DPS in line with the growth of EPS. "That way," he argues, "we send the right signal to the financial markets about our earnings prospects." His specific pro- posal is to make DPS 50 percent of EPS, a percentage that he notes is low by his- torical standards. Jean Bloomingdale, Anderson's treasurer, is sympathetic to the view that dividends should not be cut. She knows, however, that the firm will have sub- stantial capital requirements over the next three to five years. Bloomingdale refers the group to the five-year sales and cash flow forecast that she made a few weeks ago. (See Exhibit 2.) In her view, the most sensible dividend pol- icy is to determine each year how much cash the firm internally generates, implement all attractive investment projects, and pay any leftover cash as dividends. "This way," she observes, "we might be able to avoid external funds and minimize the hassle and flotation costs of raising the capital we need." Jesse Bergenfeld, an outside director and chief financial officer of the nation's largest toy manufacturer, seems amused by what he has heard to this point. Everything said so far ignores the risk of the industry you're in. Sales and EPS projections don't always work out, you know, especially in an industry heavily dependent on automobile sales." He cites the "erratic" sales history of Anderson over the last 15 years. (See Exhibit 1.) Moving quickly to the chalkboard, he scribbles what he thinks future sales could be (see Exhibit 2(a) and notes that these estimates are consistent with the expectation of higher sales yet take into account the fluctuations of Anderson's past sales. "And," Bergenfeld points out, "your firm needs financial flexibility to handle sudden shifts in production tech- nique and your product mix. All of this," he concludes, "argues for a conserva- tive DPS." Helen Carrol, a senior vice president, can see merit to all the arguments. She wonders, though, if dividends shouldn't be eliminated entirely until the firm's financial situation becomes more stable. Carrol then presents data (see Exhibit 3) that seem to contradict Lyle's evidence. "Within each industry there is an in- verse relationship between payout and the price to earnings (P/E) ratio. Note especially the automobile manufacturers where the two foreign producers have lower payouts and higher P/E's than the three American firms." THE CEO'S VIEW Gidwitz wonders how much all of this matters anyway. He's sure that Anderson will be able to raise money from external sources if necessary. "The important thing this company faces is the successful implementation of the commercial strategy we've begun in the last year or so. This is where we'll be judged by in- vestors." Still, he thinks it might be embarrassing for Anderson if it had to tap external sources when, say, the share price was unusually low. And he admits he likes the idea of avoiding external financing if possible in order to minimize the hassle and cost of raising the needed capital. At the same time, he believes the firm's stockholders "expect DPS to increase, especially in light of our bright future." He then refers to a company survey showing the vast majority of the stockholders are happy with the firm's present dividend policy. "Perhaps a rea- sonable compromise is an increase in DPS to $1.10, keeping it there until our growth levels and avoiding any new stock issues. That way, we keep our stock- holders happy and avoid the amusing situation of simultaneously paying divi- dends and selling new shares. If we need external funds, we borrow. Flotation costs are lower with a bond issue than a stock issue anyway." Discussion then centers on other points that are seen as relevant to the decision. At book values, the firm currently has $15 million of long-term debt and $60 million of equity. This is a debt/equity ratio of .25, which the firm feels is optimal. No one feels it is a good idea to pay any dividend if to do so means the firm would have to forego any of its planned investments, especially given the sub- stantial publicity surrounding Anderson's present situation. QUESTIONS 1. Evaluate John Forsyth's argument that a cut in dividends will cause the price of Anderson's stock to decline. 2. Evaluate the theoretical and empirical evidence presented by Ian Lyle. 3. How do the following factors affect the dividend decision: the business risk of the industry? the possibility that there may be a sudden change in pro- duction techniques or in the firm's product mix? 4. Evaluate the evidence presented by Helen Carrol in Exhibit 3. Specifically, is it reasonable to conclude that a low payout has caused a high P/E? Defend your answer. 5. Suppose the position of Jean Bloomingdale is adopted. That is, each year the firm determines the cash it has generated internally, implements all attrac- tive investment projects, and pays out any remaining funds in dividends. Using the information in Exhibit 2, calculate the expected annual amount of dividends. Discuss the desirability of such a policy, making sure you con- sider the impact on the firm's debt/equity mix and assuming any funds needed are borrowed. 6. Evaluate Ian Lyle's suggestion to make DPS 50 percent of EPS each year. The format of Exhibit 4 should be useful in the analysis. 7. Evaluate the following points made by Harry Gidwitz. (a) The firm's dividend decision is relatively unimportant and is unlikely to affect the price of the firm's stock one way or another. (b) It would be "amusing" to simultaneously pay dividends and sell stock, perhaps to the same stockholders. (Can you think of any reasons why it might be in the interest of existing stockholders for the firm to do this?) 8. Suppose Harry Gidwitz's position is adopted; that is, the firm implements all attractive investments, DPS is $1.10, and no new common stock is issued. Compute the firm's debt/equity ratio in each of the next five years. Discuss the desirability of such a policy. The format of Exhibit 4 can be used in the analysis. . 9. What DPS do you recommend if the dividends are treated as a long-run residual? The format of Exhibit 4 should be useful, and you may assume that any necessary borrowing occurs in year 1 (1997). 10. Play the role of a consultant. Based on your previous answers and other in- formation in the case, what dividend policy do you recommend? Defend your recommendation. 11. What additional information would you like to have to make a more in- formed decision in question 10? EXHIBIT 1 Selected Financial History of Anderson Autoparts ($ Millions) Sales P/E ratio EPS DPS $80.6 82.8 1982 1983 1984 1985 1986 $0.80 0.87 0.89 0.72 88.3 76.5 $0.50 0.50 0.50 0.50 0.60 0.60 90.1 0.88 1987 6.6 0.90 35 0.10 0.60 0.84 7.1 6.7 10 1988 1989 1990 1991 1992 1993 1994 1995 1996 (present) 95.3 78.4 100.1 106.2 107.3 100.7 115.6 122.4 125.6 150.1 0.60 0.60 0.70 0.70 0.70 0.80 0.90 1.00 0.90 0.89 0.46 0.98 1.12 1.10 1.90 7.7 8.3 8.2 13 The firm presently has 4 million shares of common stock outstanding. EXHIBIT 2 (a) Best-Guess (Most Likely) Sales and Financial Forecast of Anderson: 1997-2001 ($ Millions) t = 0 t = 1 t = 2 t = 3 t = 4 t = 5 1996 1997 1998 1999 2000 2001 Sales $150 $173 $198 $228 $262 $302 Net income 8.7 9. 9 1 1.4 13.1 15.1 Change in working capital 4.6 5 6 6.8 8 Capital spending" _10 -7 3_ 8_ 2 Funds needed $14.6 $12 $9 $14.8 $10 *Amount is over and above depreciation charges. The firm's DPS is presently $1 with 4 million shares outstanding EXHIBIT 2(b) Bergenfeld's Future Sales Scenario: 1997-2001 ($ Millions) t = 0 1996 $150 t = 1 1997 $170 t = 2 1998 $185 t = 3 1999 $170 t = 4 2000 $250 t = 5 2001 $230 Sales EXHIBIT 3 Financial Information Compiled by Helen Carrol Industry Firm P/E Payout (%)" Retail Retail Retail Brewing Brewing Auto Auto Auto Auto Auto Wal-Mart Sears Kmart Coors Anheuser-Busch Honda Volvo GM Chrysler Ford *Payout = (DPS/EPS) X 100. EXHIBIT 4 Worksheet to Analyze Anderson's Future Financial Position $ Millions) t=0 1996 t=1 1997 t = 2 1998 t = 3 1999 t = 4 2000 t = 5 2001 8.7 9.9 11.4 13.1 15.1 Net income (Dividends) To retained earnings Funds needed (Deficit) Debt Equity D/E 9 10 15 60 0.25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started