Answered step by step

Verified Expert Solution

Question

1 Approved Answer

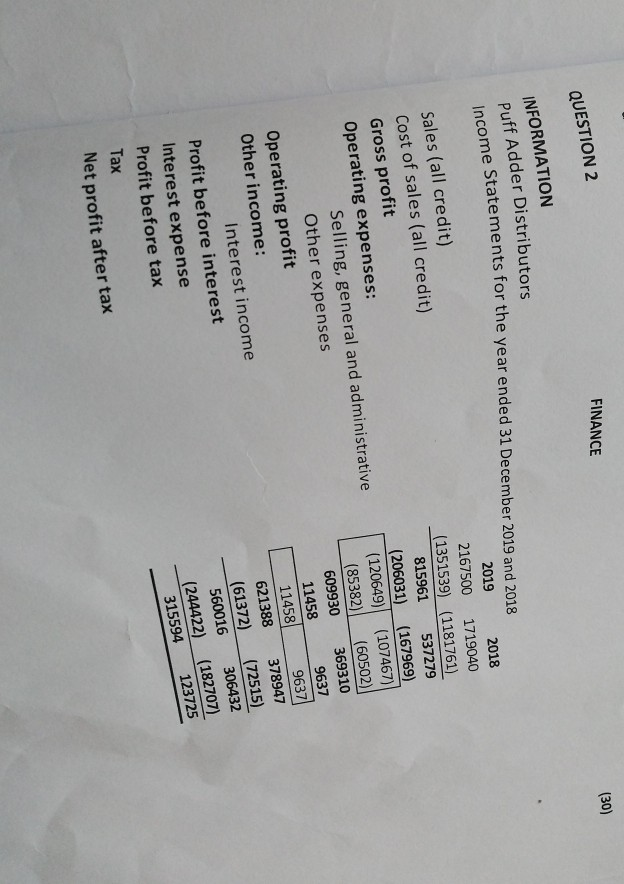

Please help with questions FINANCE (30) QUESTION 2 INFORMATION Puff Adder Distributors 2019 2167500 Sales (all credit) Cost of sales (all credit) Gross profit Operating

Please help with questions

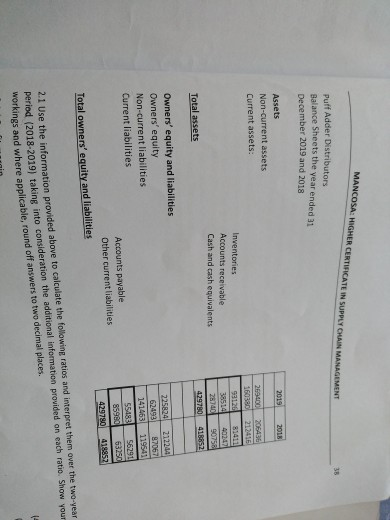

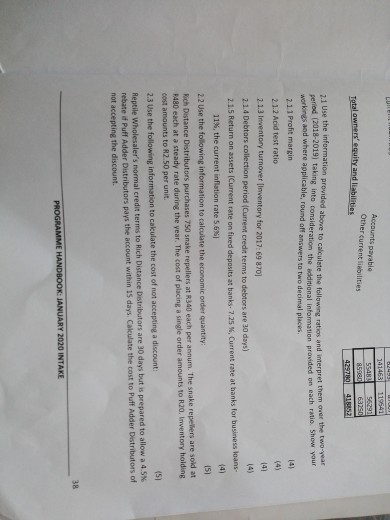

FINANCE (30) QUESTION 2 INFORMATION Puff Adder Distributors 2019 2167500 Sales (all credit) Cost of sales (all credit) Gross profit Operating expenses: Selling, general and administrative Other expenses Operating profit Other income: Interest income Profit before interest Interest expense Profit before tax 2018 1719040 (1351539) (1181761) 815961 537279 (206031) (167969) (120649) (107467) (85382) (60502) 609930 369310 11458 9637 11458 9637 621388 378947 (61372) (72515) 560016 306432 (244422) (182707) 315594 123725 Tax Net profit after tax Income Statements for the year ended 31 December 2019 and 2018 MANCOSA: HIGHER CERTIFICATE IN SUPPLY CHAIN MANAGEMENT 33 Puff Adder Distributors Balance Sheets the year ended 31 December 2019 and 2018 2019 2015 Assets Non-current assets Current assets: 260000 160380 93126 Inventories Accounts receivable Cash and cash equivalents 2064 212416 81411 40247 90758 418852 Total assets 429780 225824 21224 87067 Owners' equity and liabilities Owners' equity Non-current liabilities Current liabilities Accounts payable Other current liabilities Total owners' equity and liabilities 141463 55483 85980 429780 119543 562911 53250 418852 2.1 Use the information provided above to calculate the following ratios and interpret them over the two-year period (2018-2019) taking into consideration the additional information provided on each ratio. Show your workings and where applicable, round off answers to two decimal places. LUM 119541 Accounts payable Other Currenties 3414631 55484 85 429280 Total owners' equity and liabilities 63250 41BRS 14) (4) 2.1 Use the information provided above to calculate the following ratios and interpret them over the two your period (2018-2019) taking into consideration the additional information provided on each mio. Show your workings and where applicable, round off answers to two decimal places 2.11 Profit margin 2.1.2 Acid test ratio 2.1.3 Inventory turnover Inventory for 2017: 69 870] 14) 2.1.4 Debtors collection period (Current credit terms to debtors are 30 days) 14 2.1.5 Return on assets Current rate on fixed deposits at banks-7.25 %. Current rate at banks for business loans 11%, the current inflation rate 5,6% (4) 2.2 Use the following information to calculate the economic order quantity: 151 Rich Distance Distributors purchases 750 snake repellers at R300 each per annum. The snake repellers are sold at R480 each at a steady rate during the year. The cost of placing a single order amounts to R20 Inventory holding cost amounts to R250 per unit 2.3 Use the following information to calculate the cost of not accepting a discount: (5) Reptile Wholesaler's normal credit terms to Rich Distance Distributors are 30 days but is prepared to allow a 4.5% rebate if Puff Adder Distributors pays the account within 15 days. Calculate the cost to Puff Adder Distributors of not accepting the discount. 38 PROGRAMME HANDBOOK: JANUARY 2020 INTAKEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started