Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with questions thank you 1. Which of the following accounts would be decreased with a credit entry? a. Rent Revenue c. Accounts Payable

please help with questions thank you

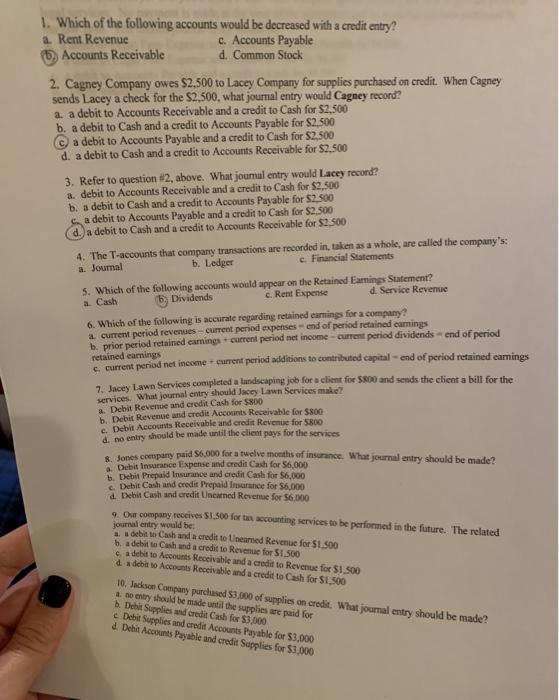

1. Which of the following accounts would be decreased with a credit entry? a. Rent Revenue c. Accounts Payable Accounts Receivable d. Common Stock 2. Cagney Company owes $2,500 to Lacey Company for supplies purchased on credit. When Cagney sends Lacey a check for the $2,500, what journal entry would Cagney record? a. a debit to Accounts Receivable and a credit to Cash for $2,500 b. a debit to Cash and a credit to Accounts Payable for $2,500 a debit to Accounts Payable and a credit to Cash for $2,500 d. a debit to Cash and a credit to Accounts Receivable for $2,500 3. Refer to question #2, above. What journal entry would Lacey record? a. debit to Accounts Receivable and a credit to Cash for $2,500 b. a debit to Cash and a credit to Accounts Payable for $2,500 sa debit to Accounts Payable and a credit to Cash for $2,500 d.) a debit to Cash and a credit to Accounts Receivable for $2.500 4. The T-accounts that company transactions are recorded in, taken as a whole, are called the company's: a. Journal b. Ledger c. Financial Statements a. Cash 5. Which of the following accounts would appear on the Retained Earnings Statement? Dividends c. Rent Expense d. Service Revenue 6. Which of the following is accurate regarding retained earnings for a company? a. current period revenues - current period expenses - end of period retained carings b. prior period retained earnings + current period net income - current period dividends - end of period retained earnings c. current period net income + current period addition to contributed capital - end of period retained earnings 7. Jacey Lawn Services completed a landscaping job for a client for $800 and sends the client a bill for the services. What journal entry should Jacey Lawn Services make? a Debit Revenue and credit Cash for SRDO b. Debit Revenue and credit Accounts Receivable for $800 c. Debit Accounts Receivable and credit Revenue for 5800 d. no entry should be made until the client pays for the services & Jones company paid $6,000 for a twelve months of insurance. What journal entry should be made? Debit Insurance Expense and credit Cash for $6,000 b. Debit Prepaid Insurance and credit Cash for $6,000 c. Debit Cash and credit Prepaid Insurance for $6,000 d. Debit Cash and credit Unearned Revenue for $6,000 9. Our company receives $1.500 for tax accounting services to be performed in the future. The related journal entry would be: a debit to Cash and a credit to Uneamed Revenue for $1,500 b. a debit to Cash and a credit to Revenue for $1,500 c. a debit to Accounts Receivable and a credit to Revenue for $1.500 d. a debit to Accounts Receivable and a credit to Cash for $1.500 10. Jackson Company purchased $3,000 of supplies on credit. What journal entry should be made? no entry should be made until the supplies are paid for b. Debil Supplies and credit Cash for $3,000 c. Debit Supplies and credit Accounts Payable for $3,000 d. Debit Accounts Payable and credit Supplies for $3,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started