Answered step by step

Verified Expert Solution

Question

1 Approved Answer

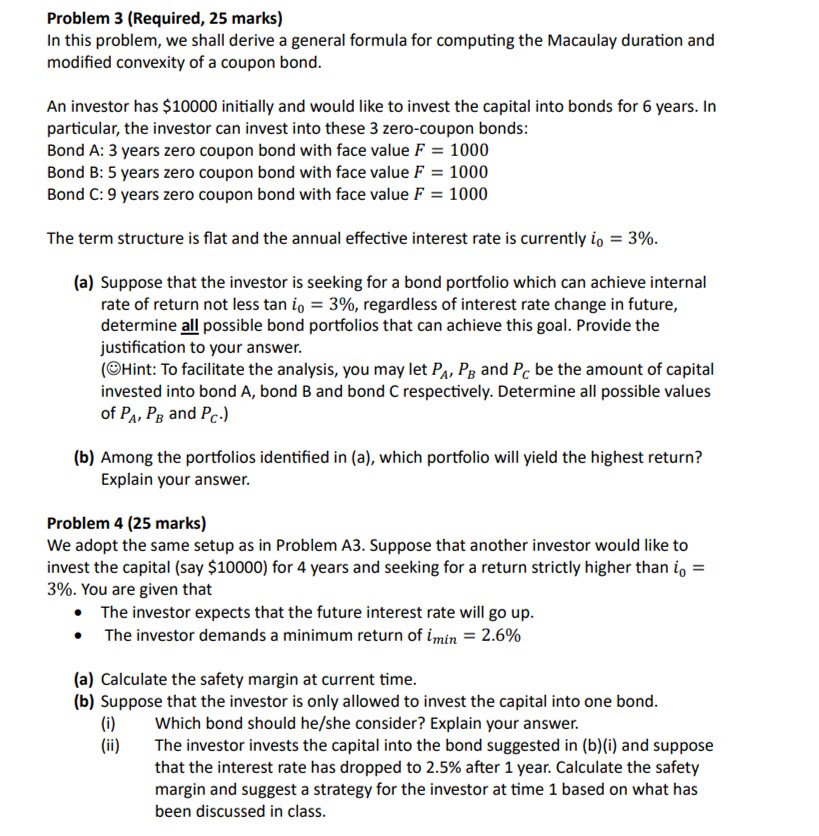

please help with simple explain or calculation, thanks Problem 4 ( 2 5 marks ) We adopt the same setup as in Problem A

please help with simple explain or calculation, thanks

Problem marks

We adopt the same setup as in Problem A Suppose that another investor would like to

invest the capital say $ for years and seeking for a return strictly higher than

You are given that

The investor expects that the future interest rate will go up

The investor demands a minimum return of

a Calculate the safety margin at current time.

b Suppose that the investor is only allowed to invest the capital into one bond.

i Which bond should heshe consider? Explain your answer.

ii The investor invests the capital into the bond suggested in bi and suppose

that the interest rate has dropped to after year. Calculate the safety

margin and suggest a strategy for the investor at time based on what has

been discussed in class.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started