Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with solution different from the one available on chegg which is quite wrong... Question 2 (18 marks) At a meeting of the board

please help with solution different from the one available on chegg which is quite wrong...

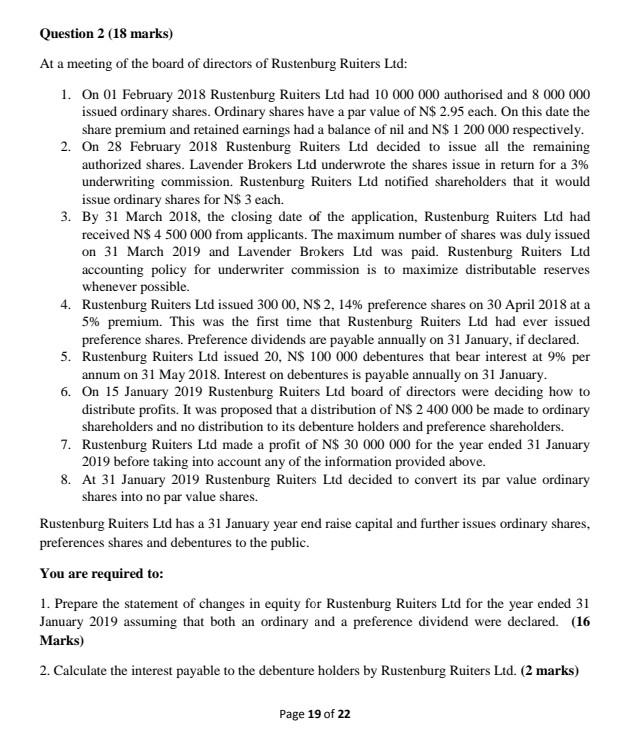

Question 2 (18 marks) At a meeting of the board of directors of Rustenburg Ruiters Ltd: 1. On 01 February 2018 Rustenburg Ruiters Ltd had 10 000 000 authorised and 8 000 000 issued ordinary shares. Ordinary shares have a par value of N$ 2.95 each. On this date the share premium and retained earnings had a balance of nil and N$ 1 200 000 respectively. 2. On 28 February 2018 Rustenburg Ruiters Ltd decided to issue all the remaining authorized shares. Lavender Brokers Ltd underwrote the shares issue in return for a 3% underwriting commission. Rustenburg Ruiters Ltd notified shareholders that it would issue ordinary shares for N$ 3 each. 3. By 31 March 2018, the closing date of the application, Rustenburg Ruiters Ltd had received N$ 4 500 000 from applicants. The maximum number of shares was duly issued on 31 March 2019 and Lavender Brokers Ltd was paid. Rustenburg Ruiters Ltd accounting policy for underwriter commission is to maximize distributable reserves whenever possible. 4. Rustenburg Ruiters Ltd issued 300 00, N$ 2, 14% preference shares on 30 April 2018 at a 5% premium. This was the first time that Rustenburg Ruiters Ltd had ever issued preference shares. Preference dividends are payable annually on 31 January, if declared. 5. Rustenburg Ruiters Ltd issued 20, N$ 100 000 debentures that bear interest at 9% per annum on 31 May 2018. Interest on debentures is payable annually on 31 January. 6. On 15 January 2019 Rustenburg Ruiters Ltd board of directors were deciding how to distribute profits. It was proposed that a distribution of N$ 2 400 000 be made to ordinary shareholders and no distribution to its debenture holders and preference shareholders. 7. Rustenburg Ruiters Ltd made a profit of N$ 30 000 000 for the year ended 31 January 2019 before taking into account any of the information provided above. 8. At 31 January 2019 Rustenburg Ruiters Ltd decided to convert its par value ordinary shares into no par value shares. Rustenburg Ruiters Ltd has a 31 January year end raise capital and further issues ordinary shares, preferences shares and debentures to the public. You are required to: 1. Prepare the statement of changes in equity for Rustenburg Ruiters Ltd for the year ended 31 January 2019 assuming that both an ordinary and a preference dividend were declared. (16 Marks) 2. Calculate the interest payable to the debenture holders by Rustenburg Ruiters Ltd. (2 marks) Page 19 of 22Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started