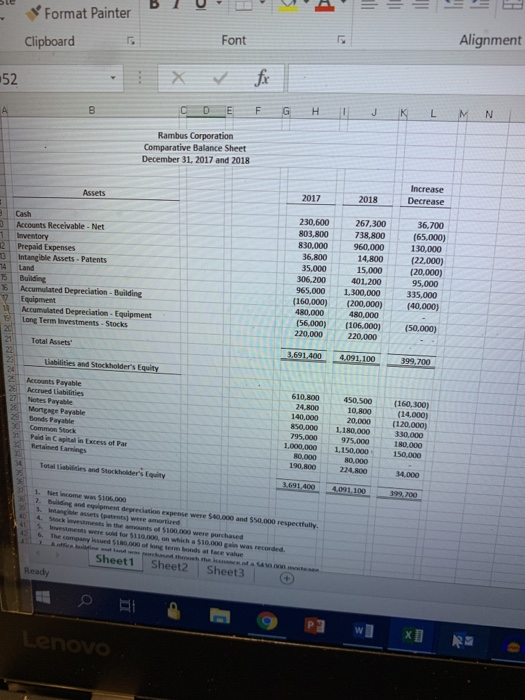

please help with statement of cash flows for the year ended 12/31/18

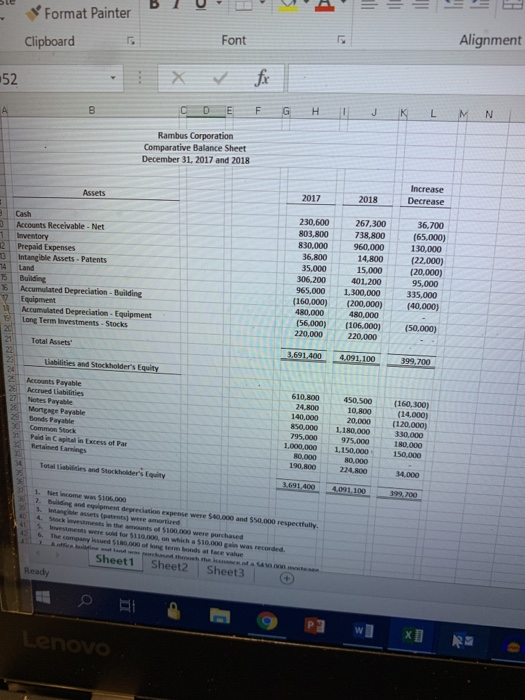

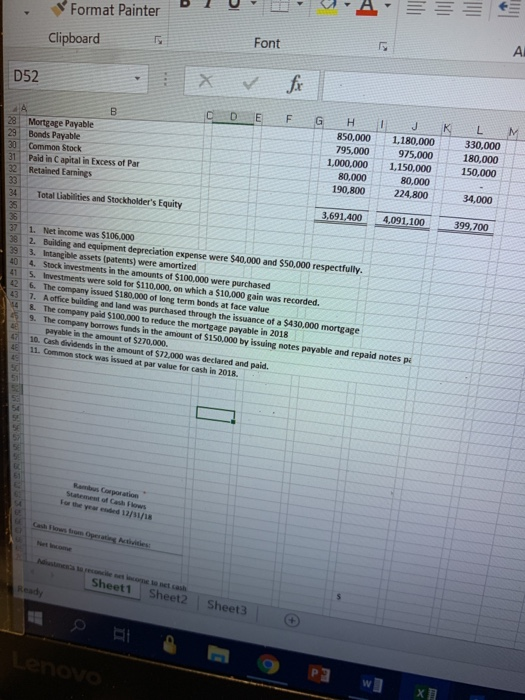

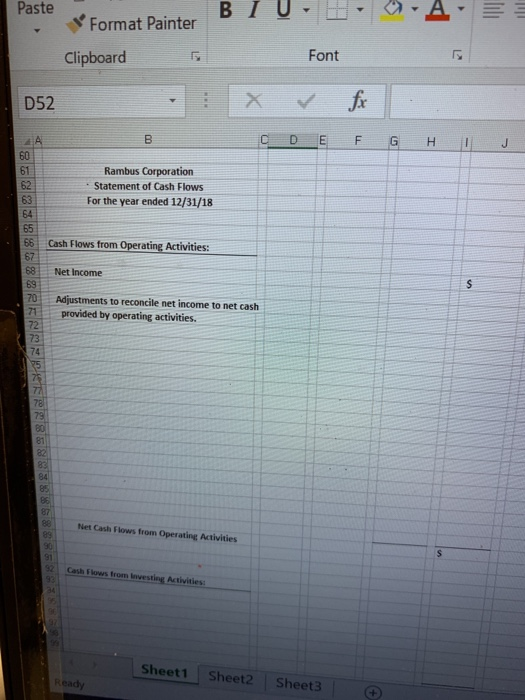

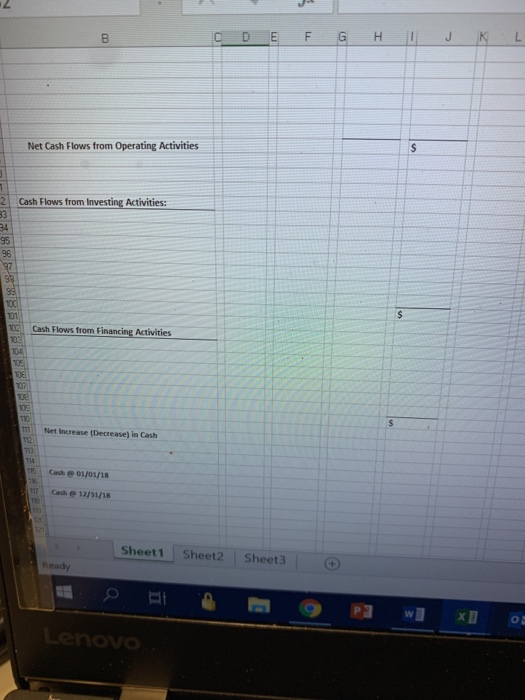

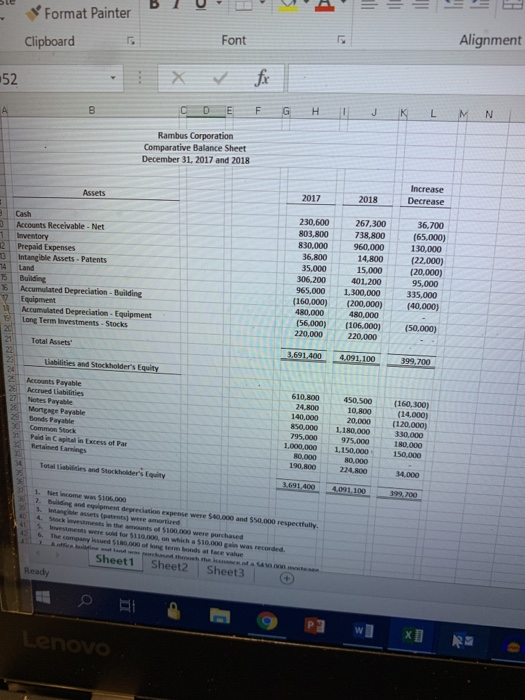

WA === SE stor BTU Format Painter Clipboard Font Alignment 52 C D E F G H I J K L M N Rambus Corporation Comparative Balance Sheet December 31, 2017 and 2018 2017 2018 Increase Decrease Cash 1 3 - 15 Accounts Receivable - Net Inventory Prepaid Expenses Intangible Assets - Patents Land Building Accumulated Depreciation - Building Equipment Accumulated Depreciation Equipment Long Term Investments - Stocks 230.600 803,800 830.000 36,800 35,000 306.200 965.000 (160.0001 480,000 (56.000) 220,000 267,300 738,800 960,000 14.800 15,000 401,200 1.300,000 (200,000) 480,000 (106.000) 220.000 36.700 (65.000) 130.000 (22,000) (20,000) 95,000 335.000 (40,000) (50.000) Total Assets 3.691.400 Labies and Stockholder's Equity 4.091 100 399,700 Accounts Payable Accrued abilities Mortgage Payable Bonds Payable Common Stock Paldin Capitalistess of Par Retained Larings 610.800 24.800 140,000 850,000 795,000 1.000.000 80,000 450.500 10.800 20,000 1.180.000 975.000 1,150,000 80.000 224,800 (160.300) (14.000) (120.000) 330.000 180.000 150,000 Tulb s and Stockholder's Equity 340.000 3.691 400 4,091,100 399,700 0 1. Het cows $106.000 2. B a ndement depreciation expense were $40.000 and $50.000 respectfully 4. So m ents in the amounts of $100.000 were purchased vestments were 6. The company issued SIRD.00 osong term beds a face wa for $110.000, on which a $10.000 was recorded Sheet1 Sheet2 Sheet3 Ready OPE p] wl Lenovo RY Format Painter B U D VA- = = Clipboard Font D52 ZA 28 Mortgage Payable 29 Bonds Payable Common Stock Paid in Capital in Excess of Par 32 Retained Earnings CDEFGHJKLM 850,000 1.180,000 795.000 3 30,000 975.000 1,000,000 180,000 1,150,000 80,000 150,000 80,000 190,800 224.800 34.000 Total Liabilities and Stockholder's Equity 3.691.400 4.091.100 399,700 37 1. Net income was $106,000 38 2. Building and equipment depreciation expense were $40,000 and $50,000 respectfully. 39 3. Intangible assets (patents) were amortized 40 4. Stock investments in the amounts of $100,000 were purchased 5. Investments were sold for $110,000, on which a $10,000 pain was recorded. 12 6. The company issued $180,000 of long term bonds at face value 43 7. A office building and land was purchased through the issuance of a $430,000 mortgage & The company paid $100.000 to reduce the mortgage payable in 2018 5. The company borrows funds in the amount of $150,000 by issuing notes payable and repaid notes payable in the amount of $270.000 10. Cash dividends in the amount of $72,000 was declared and paid. 1 11. Common stock was issued at par value for cash in 2018. For the year ended 12/31/18 Sheet1 Sheet2 Sheet3 Plwl XI Paste BI U. EA Format Painter Clipboard Font D52 C D E F G H I Rambus Corporation Statement of Cash Flows For the year ended 12/31/18 Cash Flows from Operating Activities: Net Income Adjustments to reconcile net income to net cash provided by operating activities. 8228882 RENOR 868686888588RSES Net Cash Flows from Operating Activities Cash Flows from investing Activities: Sheet1 Sheet2 Reach Sheet3 C D E F G H I J K L Net Cash Flows from Operating Activities Cash Flows from Investing Activities: Cash Flows from Financing Activities 11 Net Increase (Decrease) in Cash 115 Ch 01/01/18 10 Cash 12/31/18 19 Sheet1 Sheet2 Sheet3 Ready Lenovo