Please helP with the assignment..

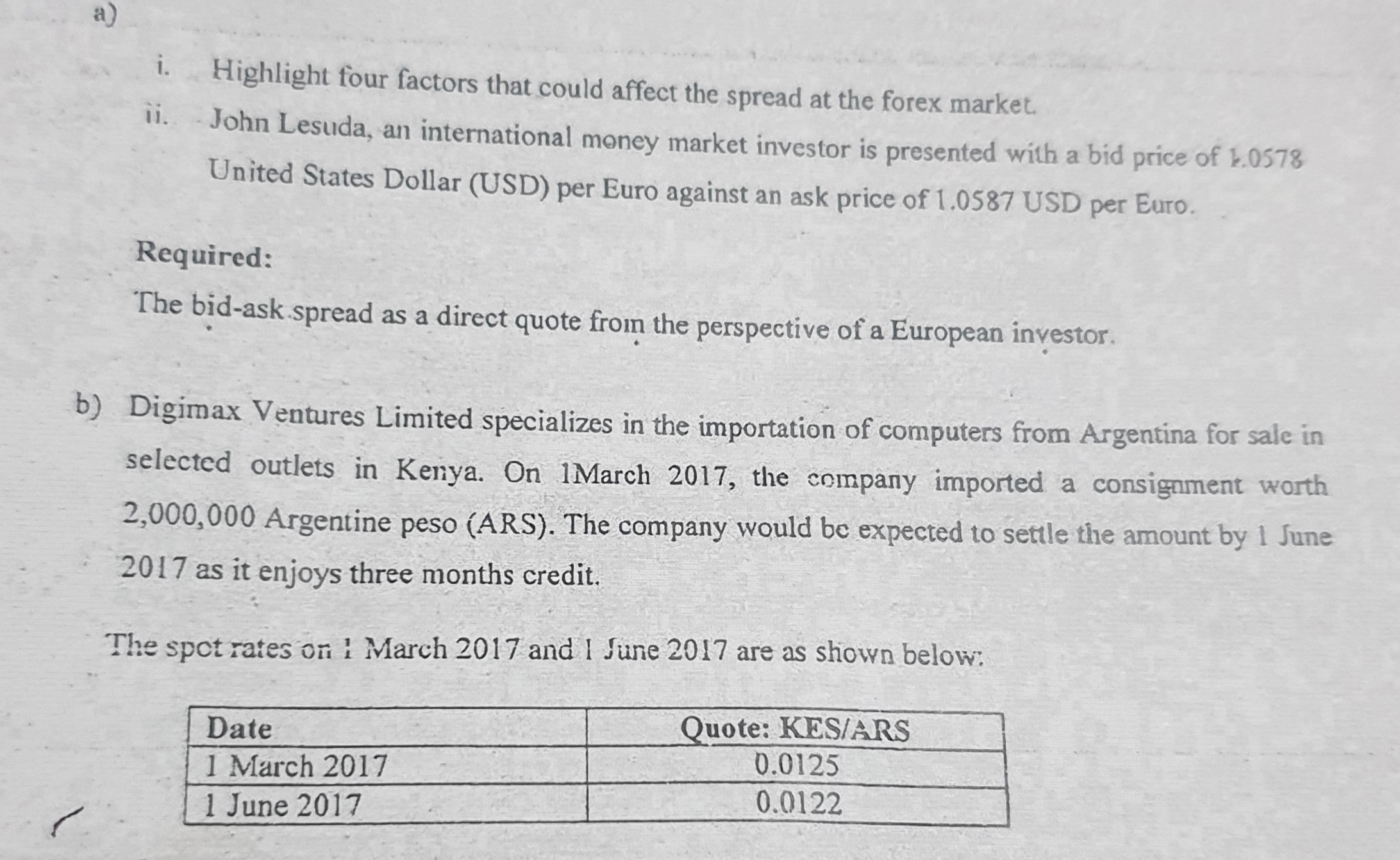

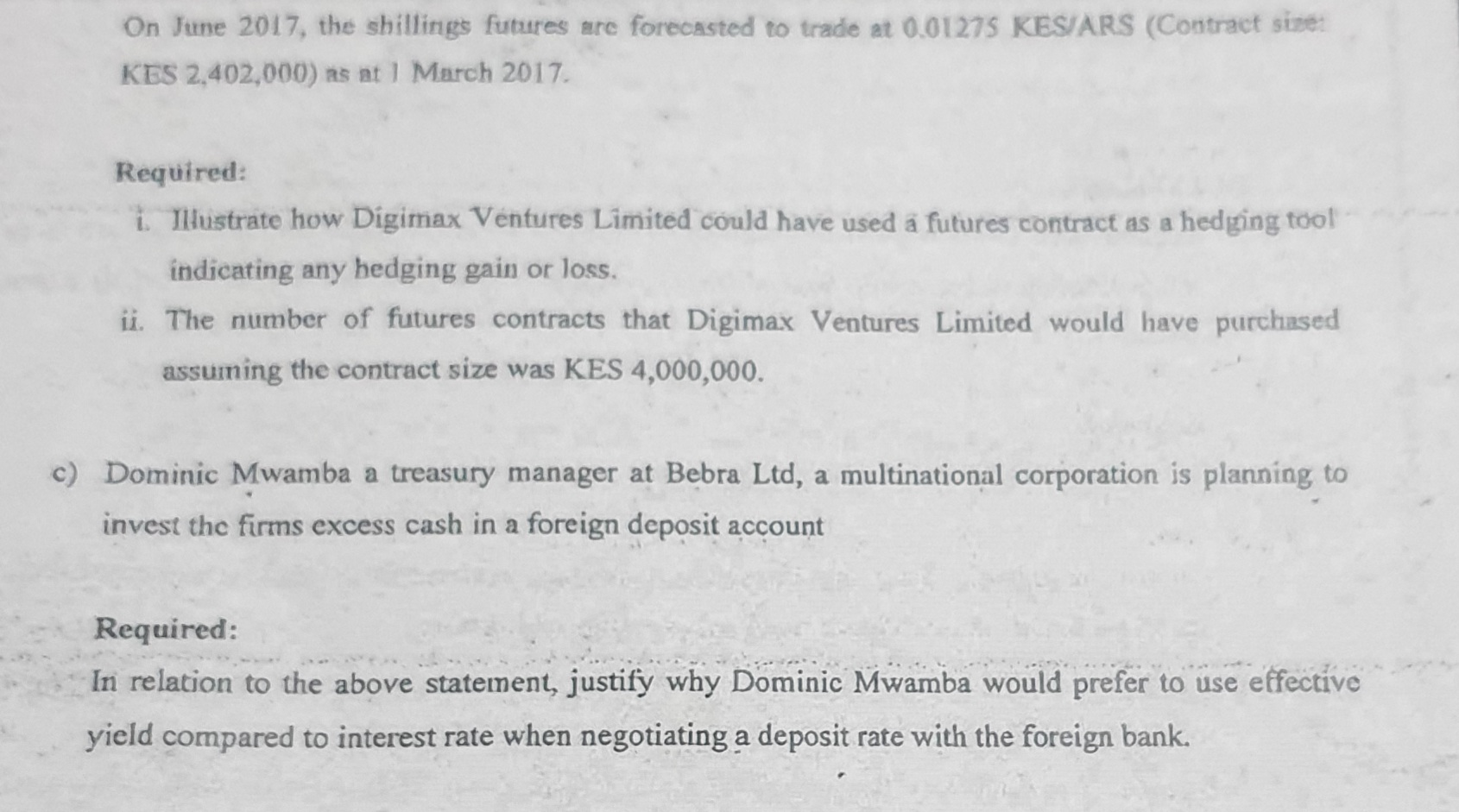

i. Highlight four factors that could affect the spread at the forex market. ii. John Lesuda, an international money market investor is presented with a bid price of 1.0578 United States Dollar (USD) per Euro against an ask price of 1.0587 USD per Euro. Required: The bid-ask spread as a direct quote from the perspective of a European investor. b) Digimax Ventures Limited specializes in the importation of computers from Argentina for sale in selected outlets in Kenya. On 1March 2017, the company imported a consignment worth 2,000,000 Argentine peso (ARS). The company would be expected to settle the amount by 1 June 2017 as it enjoys three months credit. The spot rates on 1 March 2017 and I June 2017 are as shown below: Date Quote: KES/ARS 1 March 2017 0.0125 1 June 2017 0.0122On June 2017, the shillings futures are forecasted to trade at 0.01275 KES/ARS (Contract size: KES 2,402,000) as at ] March 2017. Required: i. Illustrate how Digimax Ventures Limited could have used a futures contract as a hedging tool indicating any hedging gain or loss. ii. The number of futures contracts that Digimax Ventures Limited would have purchased assuming the contract size was KES 4,000,000. c) Dominic Mwamba a treasury manager at Bebra Lid, a multinational corporation is planning to invest the firms excess cash in a foreign deposit account Required: In relation to the above statement, justify why Dominic Mwamba would prefer to use effective yield compared to interest rate when negotiating a deposit rate with the foreign bank.d) Baraka Multinational Corporation (MNC) has excess cash of Sh.100 million which could be invested in Kenya at the prevailing interest rate of 8% per annum but is attracted to higher interest rates in Uganda. Required: The effective yield assuming that the Ugandan interest rate on deposit is 9.5% per annum and the exchange rate at the time of deposit is 30 Uganda Shillings per Kenya Shilling (UGS/KES) and that one year later the KES depreciates to 28.50 UGS/KES. e) : Winnie Leticia, a foreign exchange trader assesses the euro exchange rate for three months as shown below: Spot rate ($) Probability 1.10 0.25 1.13 0.50 1.15 0.25 The day 90-day forward rate is $ 1.12. Required: Determine whether Winnie Leticia should buy or sell Euros forward against the Dollar assuming that the trader is concerned solely with expected value