please help with the attached photo! I'm stuck

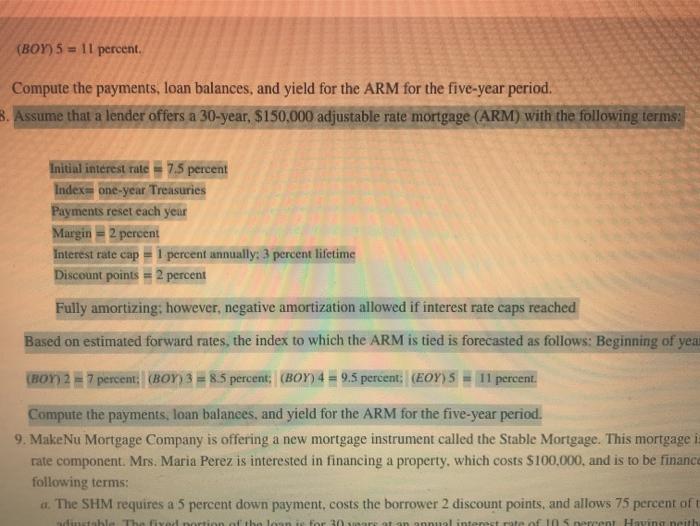

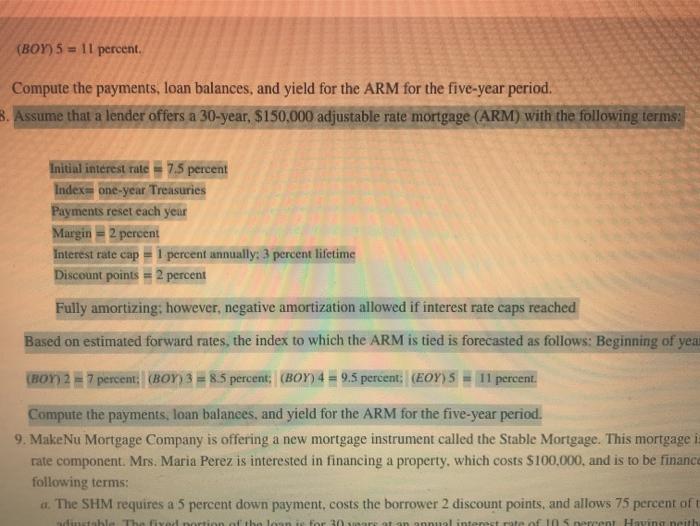

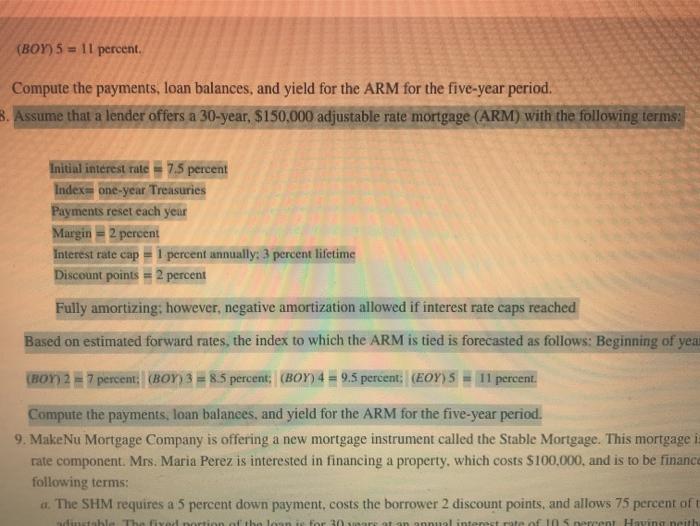

(BOY) 5 = 11 percent. Compute the payments, loan balances, and yield for the ARM for the five-year period. 8. Assume that a lender offers a 30-year, $150,000 adjustable rate mortgage (ARM) with the following terms: Initial interest rate 75 percent Index= one-year Treasures Payments reset each year Margin = 2 percent Interest rate cap = 1 percent annually: 3 percent lifetime Discount points = 2 percent Fully amortizing: however, negative amortization allowed if interest rate caps reached Based on estimated forward rates, the index to which the ARM is tied is forecasted as follows: Beginning of yea (BOY 27 percent: (BOY 3 = 8.5 percent; (BOY) 4 = 9.5 percent (EY) 5 = 11 percent. Compute the payments, loan balances, and yield for the ARM for the five-year period. 9. MakeNu Mortgage Company is offering a new mortgage instrument called the Stable Mortgage. This mortgage i rate component. Mrs. Maria Perez is interested in financing a property, which costs $100,000, and is to be finance following terms: a. The SHM requires a 5 percent down payment, costs the borrower 2 discount points, and allows 75 percent of dableThe fiyadari bahan For 30 annual interest rate final Having neith (BOY) 5 = 11 percent. Compute the payments, loan balances, and yield for the ARM for the five-year period. 8. Assume that a lender offers a 30-year, $150,000 adjustable rate mortgage (ARM) with the following terms: Initial interest rate 75 percent Index= one-year Treasures Payments reset each year Margin = 2 percent Interest rate cap = 1 percent annually: 3 percent lifetime Discount points = 2 percent Fully amortizing: however, negative amortization allowed if interest rate caps reached Based on estimated forward rates, the index to which the ARM is tied is forecasted as follows: Beginning of yea (BOY 27 percent: (BOY 3 = 8.5 percent; (BOY) 4 = 9.5 percent (EY) 5 = 11 percent. Compute the payments, loan balances, and yield for the ARM for the five-year period. 9. MakeNu Mortgage Company is offering a new mortgage instrument called the Stable Mortgage. This mortgage i rate component. Mrs. Maria Perez is interested in financing a property, which costs $100,000, and is to be finance following terms: a. The SHM requires a 5 percent down payment, costs the borrower 2 discount points, and allows 75 percent of dableThe fiyadari bahan For 30 annual interest rate final Having neith