Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with the breakdowns text states Module 3 Assignment: Bonds and Stock Valuations Snowbirds Resort, Inc. has a chain of facilities located in the

please help with the breakdowns

text states

Snowbirds Resart, inc. has a chain of facilties located in the southem part of the Uaiged 9 user that caters to dients who generally live in northern states who want to excape the cold of winter. To finance their operatons, the company alfers a mix of irvestinerat bonds and stock offerings. in order to entice investors to the company, manapement needs to provide information on the performance of the bonds offered, as well as predictions for stock valuation. Directions: Using the outlined data, calculated the required information for each scenana. Enter your data to the blue cells. Use Excel to aid you with your calculations and refer to the provided "Hints" for your caloulatont. Answer the Aralynis Question once all caloulatioes have been completed. Snowbirds Resort, Inc. currently iasves dividends at a rate of $2.00 per share. it has cost of equity of TXS and a dividend growth rate of 1.5\%. With this data, calculate the current value of Senowbirat's stock price. Assume that Snowbirds Resort, line, starts diving dvisendi at a rate of 52.25 per thare. if the compaty can lewer its cest of equity to 4.5% and maintain a dividend growth rate of 1.5\%, what will be the new walue of Snowbirat' stack price? Management wants to evaluate the projected thare price for Snowbirds Resort, inc, based on the projected future cach fows of the camparm. These cash flows are outlined below. The company anticipased a 4% growth race per year after the 5 th year, and has a weighted average cost of capital of 12%. The company has no excess cash, debt of 5275 milion, and 30 mition shares outstandirg. Use the discounted free cash flow model to determine the share price for Snowbirds'. (follows example 9.7 from text) \begin{tabular}{|l|c|c|ccc} Year & 1 & 2 & 3 & 4 & 5 \\ \hline Free Cash Flow & 53 & 68 & 78 & 75 & 52 \end{tabular} What is the Terminal Enterprise Vatue of Snowbirds Resart, inc Module 3 Assignment: Bonds and Stock Valuations

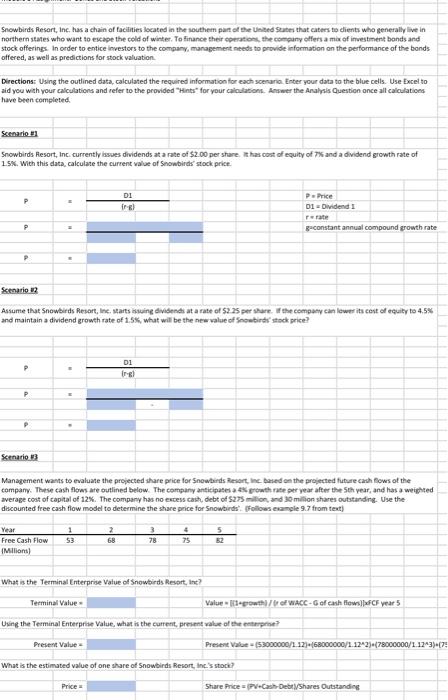

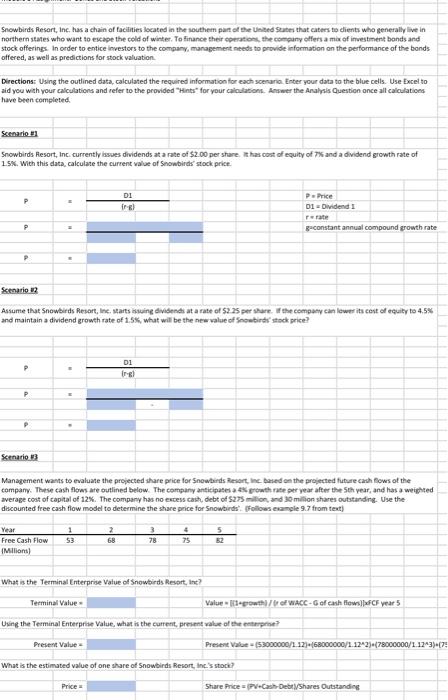

Snowbirds Resort, Inc. has a chain of facilities located in the southern part of the United States that caters to clients who generally live ir

northern states who want to escape the cold of winter. To tinance their operations, the company offers a mix of inupstment hands and

stock offerinas, In order to enuce investors to the companv, management needs to provide intormation on the pertormance orthe bonds

ofered. as well as predictions for stock valuation

Directions: Using the outlined data, calculated the required intormation for each scenario. Enter your data to the blue cells. Use Excel to

aid vou with your calculations and refer to the provided "Hints" for vour calculations. Answer the Analvsis Question once all calculations

have been completed

Scenario #1

Snowbirds Resort, Inc. currently issues dividends at a rate of $2.00 per share. It has cost of equity of 7% and a dividend growth rate of

1 cv With this data calculate the curront value of Snowbirds stock orice

Pa Price

D1 = Dividend 1

esconstant annual compound growth rate

Scenario #2

Assume that Snowbirds Resort, Inc, starts issuing dividends at a rate of $2.25 per share. If the company can lower its cost of equity to

4.5% and maintain a dividend growth rate of 1.5%, what will be the new value of Snowbirds' stock price?

Scenario #3

Management wants to evaluate the projected share price for Snowbirds Resort, Inc. based on the projected future cash flows of the

These casn tlows are outlined be low. The companv anticipates a 4 growth rate per vear atter the sth year, and has a

weighted averace cost of capital of 12. The company has no excess cash. debt of $275 million, and 30 million shares outstandine. Use

the discounted free cash flow model to determine the share price for Snowbirds', (Follows example 9.7 from text

I Free cash Flow

(Millions)

53

68

78

75

82

What is the Terminal Enterprise Value of Snowbirds Resort, Inc?

Terminal Value =

Using the Terminal Enterprise Value, what is the current, present value of the enterprise?

Prpsent Valup

What is the estimatpd value of one share a- Samuniras Resort Ine's stock?

F-

Value = ((1+growth) / (r of WACC - G of cash flows)]xFCF year 5

Present Value = (53000000/1.12)+(68000000/1.12^2)+(78000000/1.12^3)+(75000000/1.12^4)+((82000000

Char Pricp=(PV+Cash.Debt Shares Outstanding

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started