Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with the cash budget. Correct if I got any wrong please. & double check the income statement please. - - - A -

please help with the cash budget. Correct if I got any wrong please. & double check the income statement please.

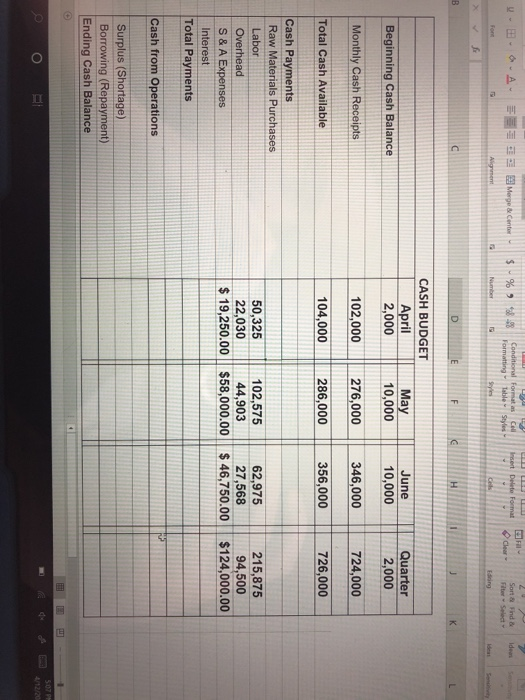

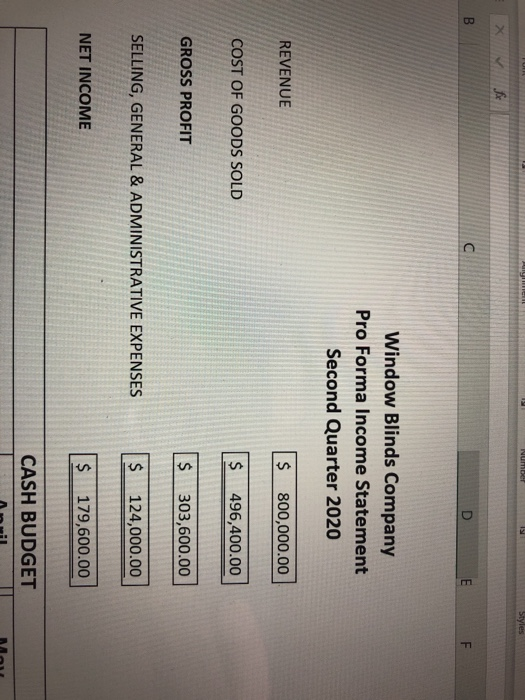

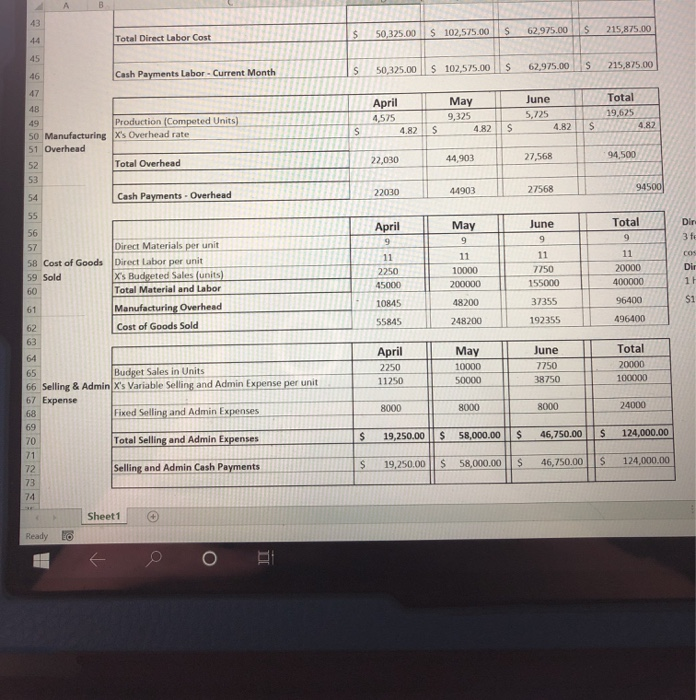

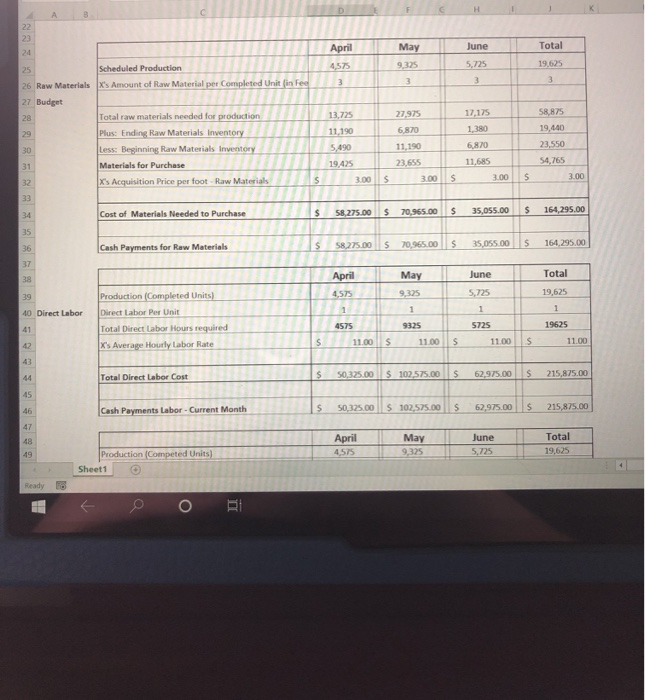

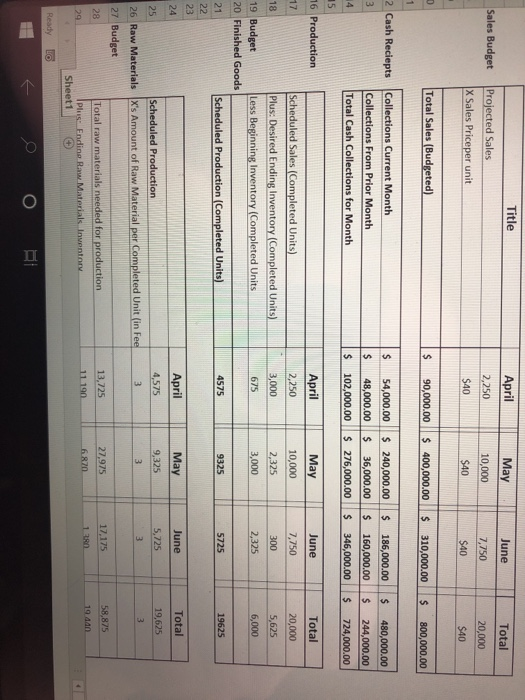

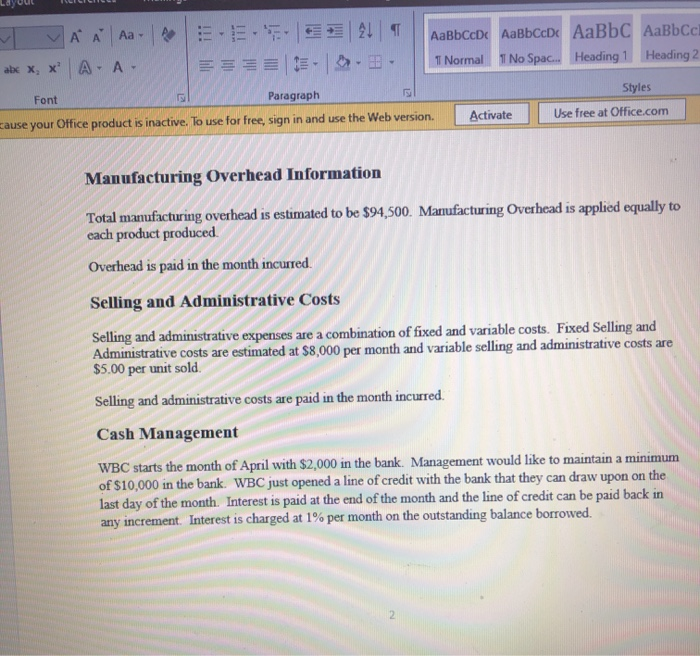

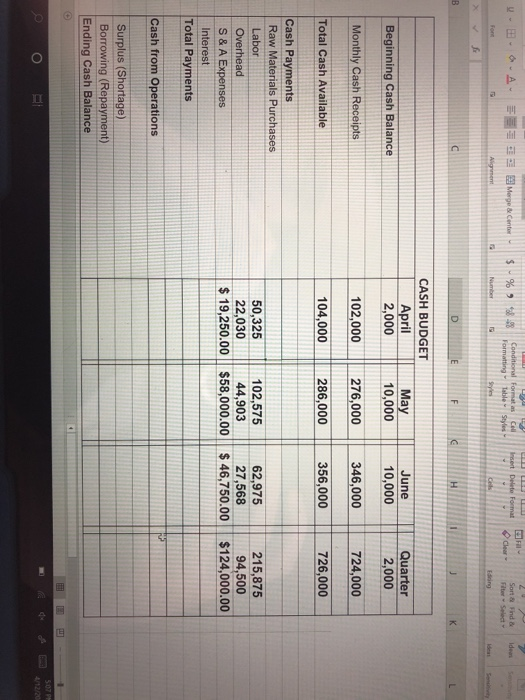

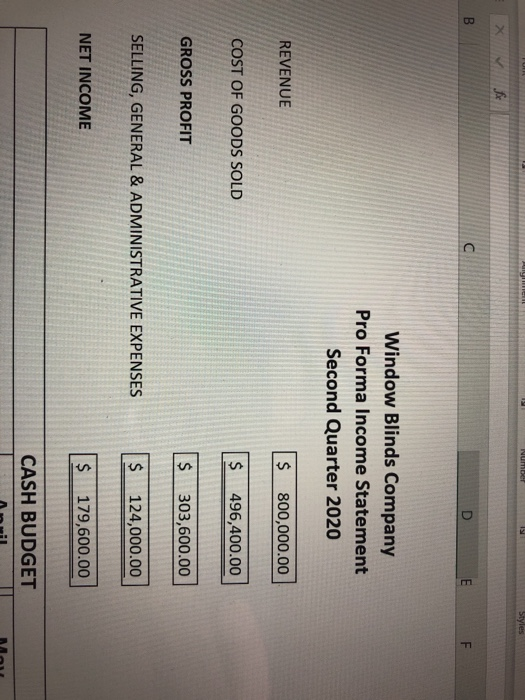

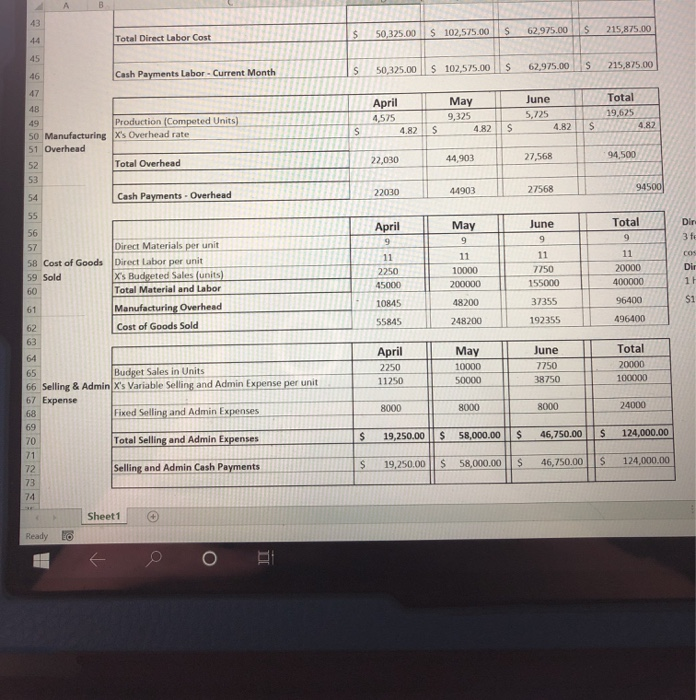

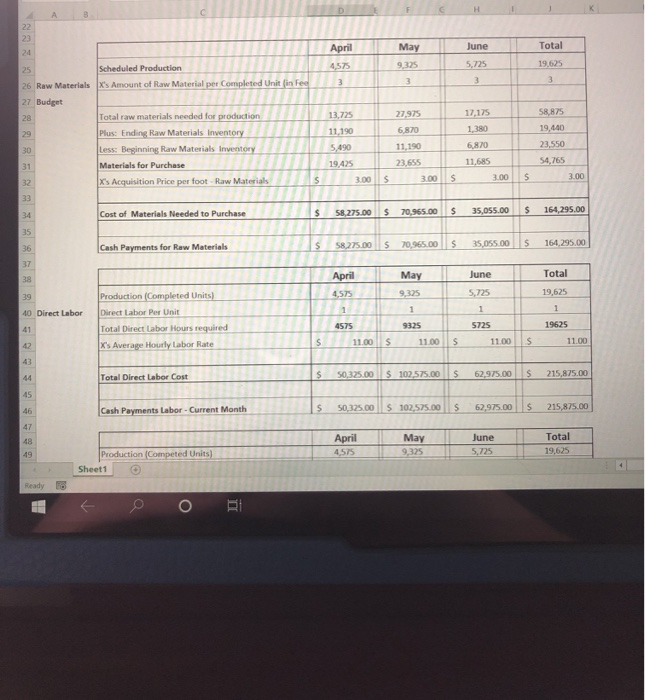

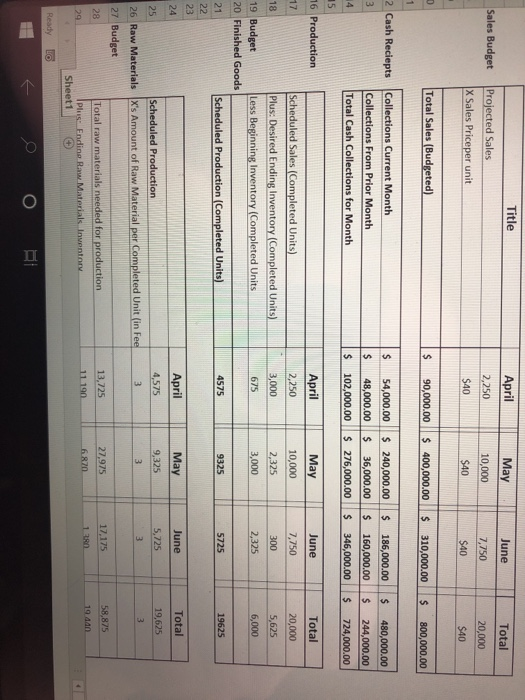

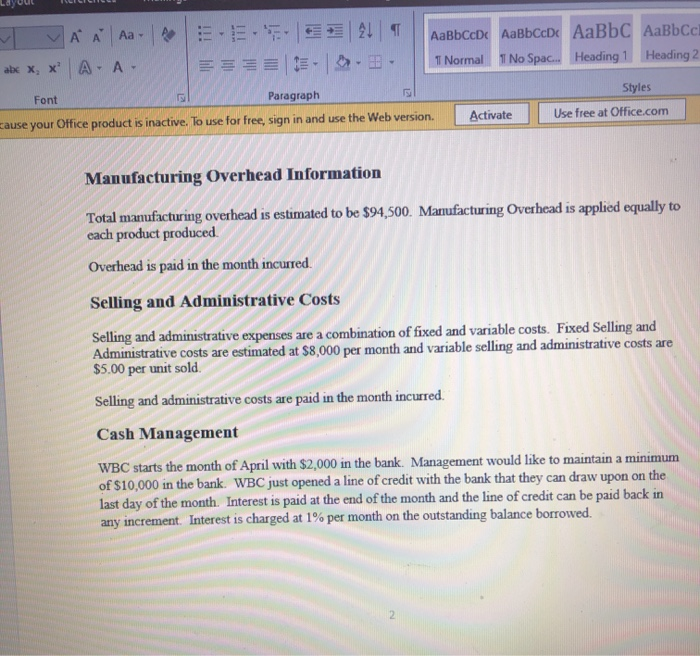

- - - A - FEE Merge Center Conditional Forc Formatting Table - Syed e For SEF CASH BUDGET April I 2,000 Beginning Cash Balance May 10,000 June 10,000 Quarter 2,000 Monthly Cash Receipts 102,000 276,000 346,000 724,000 Total Cash Available 104,000 286,000 356,000 726,000 Cash Payments Raw Materials Purchases Labor Overhead S & A Expenses Interest Total Payments 50,325 22,030 $ 19,250.00 102,575 44,903 $58,000.00 62,975 27,568 $ 46,750.00 215,875 94,500 $124,000.00 Cash from Operations Surplus (Shortage) Borrowing (Repayment) Ending Cash Balance DE F Window Blinds Company Pro Forma Income Statement Second Quarter 2020 REVENUE $ 800,000.00 COST OF GOODS SOLD $ 496,400.00 GROSS PROFIT $ 303,600.00 SELLING, GENERAL & ADMINISTRATIVE EXPENSES $ 124,000.00 NET INCOME $ 179,600.00 CASH BUDGET Anil April May June Total Scheduled Pro 5.725 19.625 Raw Materials xs Amount of Raw Budget 392 27.975 17.175 6870 120 Total raw materials needed for productio Plus: Ending Raw Materials Inventory Less Beginning Raw Materials Inventory Materials for Purchase XS Acquisition Price per foot-Raw Material 58,875 19.000 23,550 11.190 6,820 5,490 19,425 2165 11.685 54,765 300 S 3.00 Cost of Materials Needed to purchase $ 58.275.00 $ 70,965.00 $ 35,055.00 $ 154,295.00 Cash Payments for Raw Materials S 58.275.00 S 70,965.00 $ 35,055.00 S 164,295.00 April May 1 June Total 35 5.75 19.625 Direct Labor Production Completed Units) Direct Labor Per Unit Total Direct Labor Hours required X'S Average Hourly Labor Rate 9325 19625 4575 11.00 S 11.00 S 5725 11.00 S 11.00 Total Direct Labor Cost s 50,325.00 $ 102,575.00 $ 2,975.00 $ 215,875.00 Cash Payments Labor- $ 50,325.00 $ 102,575.00 $ 2,975.00 $ 215,875.00 April 4,575 May 9,325 June 5,725 Total 19.625 Production Competed Units) Sheet1 Ready Title April June Sales Budget Projected Sales X Sales Priceper unit 2,250 May 10,000 $40 Total 20,000 $40 7,750 $40 $40 Total Sales (Budgeted) $ 90,000.00 $ 400,000.00 $ 310,000.00 $ 800,000.00 2 Cash Reciepts Collections Current Month Collections From Prior Month Total Cash Collections for Month $ $ $ 54,000.00 48,000.00 102,000.00 $ 240,000.00 $ 36,000.00 $ 276,000.00 $ $ $ 186,000.00 160,000.00 346,000.00 $ $ $ 480,000.00 244,000.00 724,000.00 June Total 7,750 46 Production Scheduled Sales (Completed Units) Plus: Desired Ending Inventory (Completed Units) 19 Budget Less Beginning Inventory (Completed Units 20 Finished Goods 21 Scheduled Production (Completed Units) 22 April 2,250 3,000 675 May 10,000 2,325 3,000 18 300 2,325 20,000 5,625 6,000 4575 9325 | 5725 19625 23 April May 9,325 June 5,725 Total 19,625 25 4,575 Scheduled Production 26 Raw Materials X's Amount of Raw Material per Completed Unit (in Fee 27 Budget 28 Total raw materials needed for production 29 Plus Ending Raw Materials Inventory Sheet1 Ready to 27,975 17,175 13,725 11 190 58,875 19.440 6870 VAN A abe x, x' A- A E. ==== 9921 I - - - AalbCcD AaBbced AaBb AaBbc 1 Normal 1 No Spac... Heading 1 Heading Font Paragraph Styles ause your Office product is inactive. To use for free, sign in and use the Web version Activate Use free at Office.com Manufacturing Overhead Information Total manufacturing overhead is estimated to be $94,500. Manufacturing Overhead is applied equally to each product produced. Overhead is paid in the month incurred. Selling and Administrative Costs Selling and administrative expenses are a combination of fixed and variable costs. Fixed Selling and Administrative costs are estimated at $8,000 per month and variable selling and administrative costs are $5.00 per unit sold. Selling and administrative costs are paid in the month incurred. Cash Management WBC starts the month of April with $2,000 in the bank. Management would like to maintain a minimum of $10,000 in the bank. WBC just opened a line of credit with the bank that they can draw upon on the last day of the month. Interest is paid at the end of the month and the line of credit can be paid back in any increment. Interest is charged at 1% per month on the outstanding balance borrowed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started