Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with the cash budget please help with the cash budget Complete the following budgets 1 Production Budget Planned Sales Desired Ending Inventory of

please help with the cash budget

please help with the cash budget

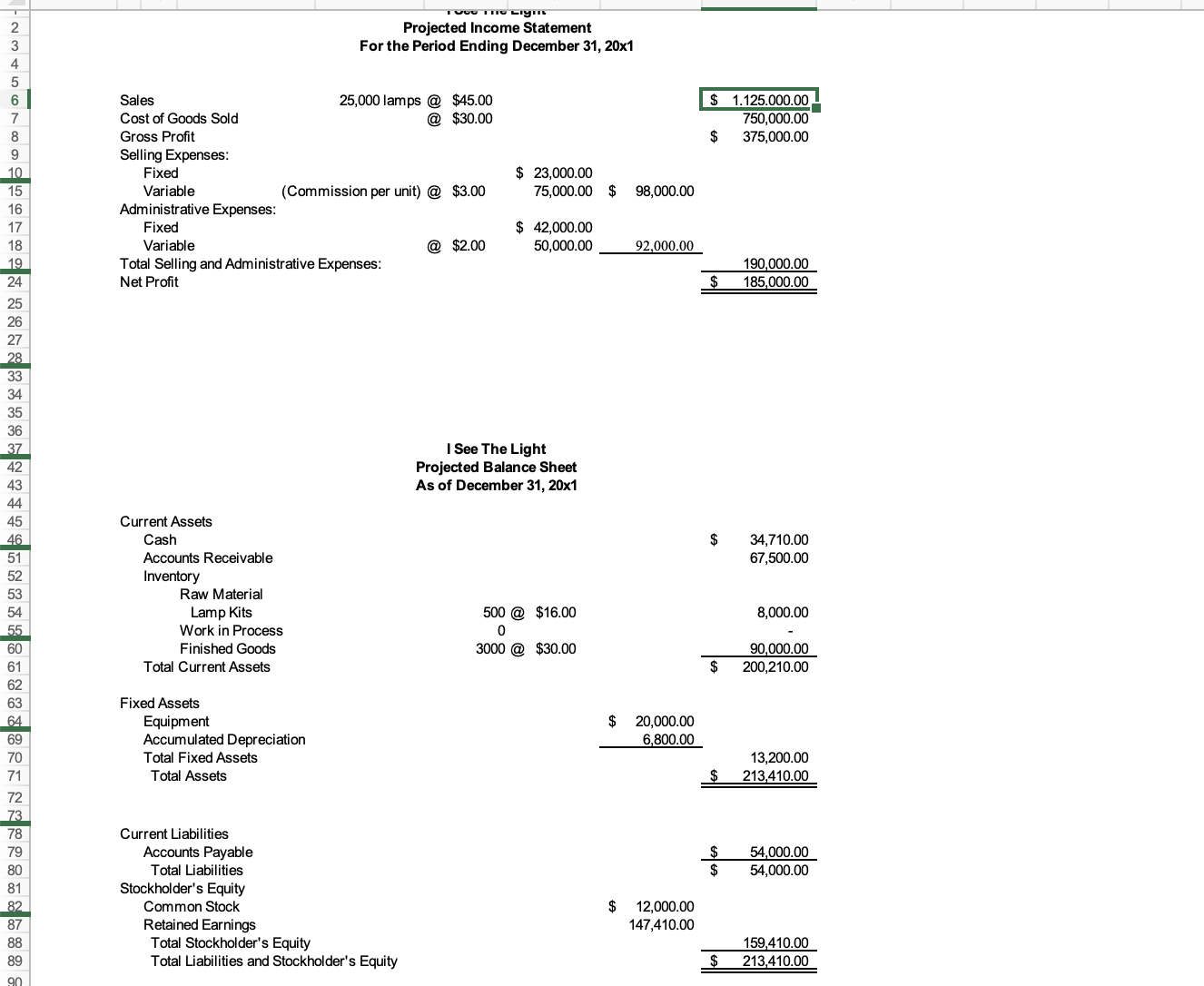

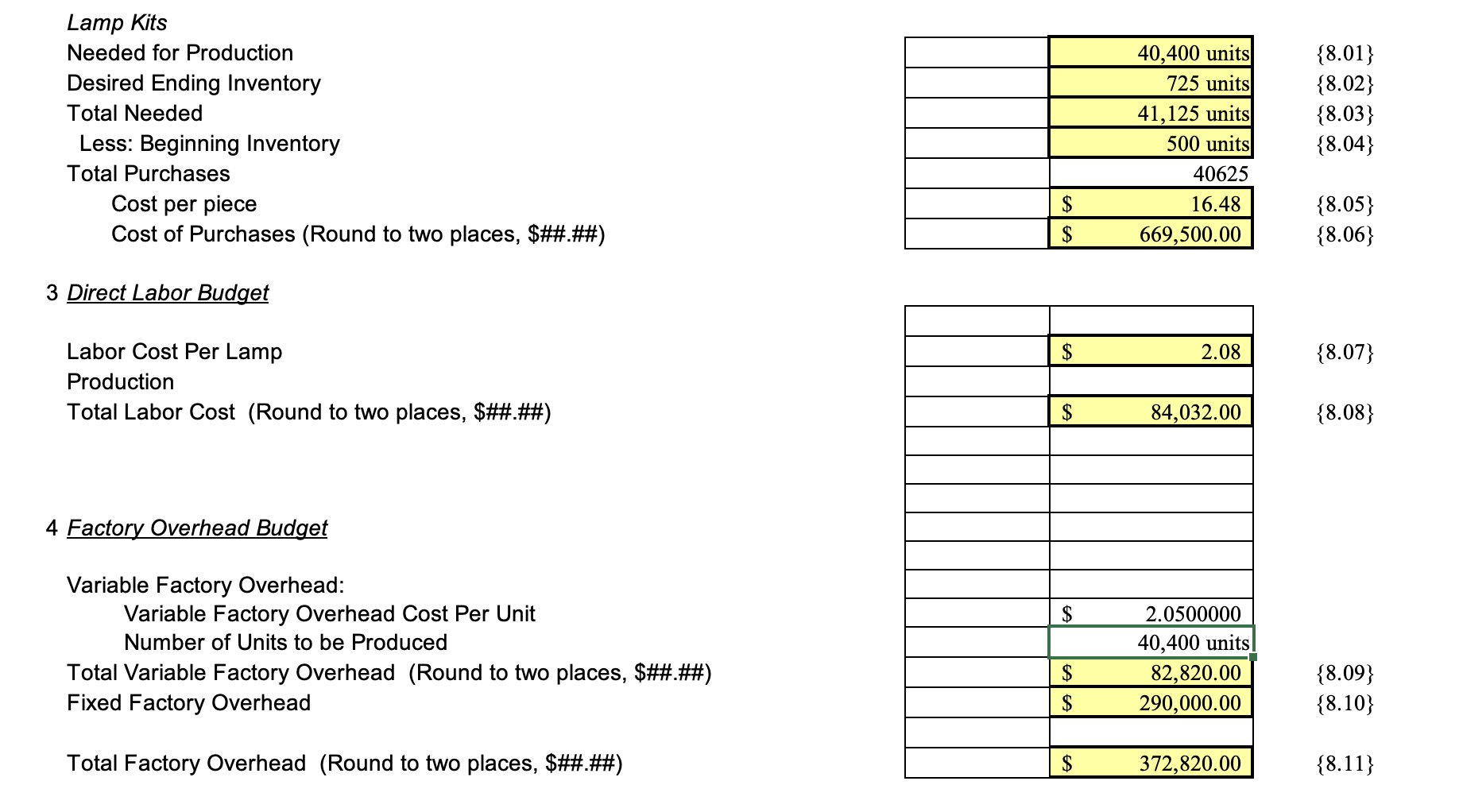

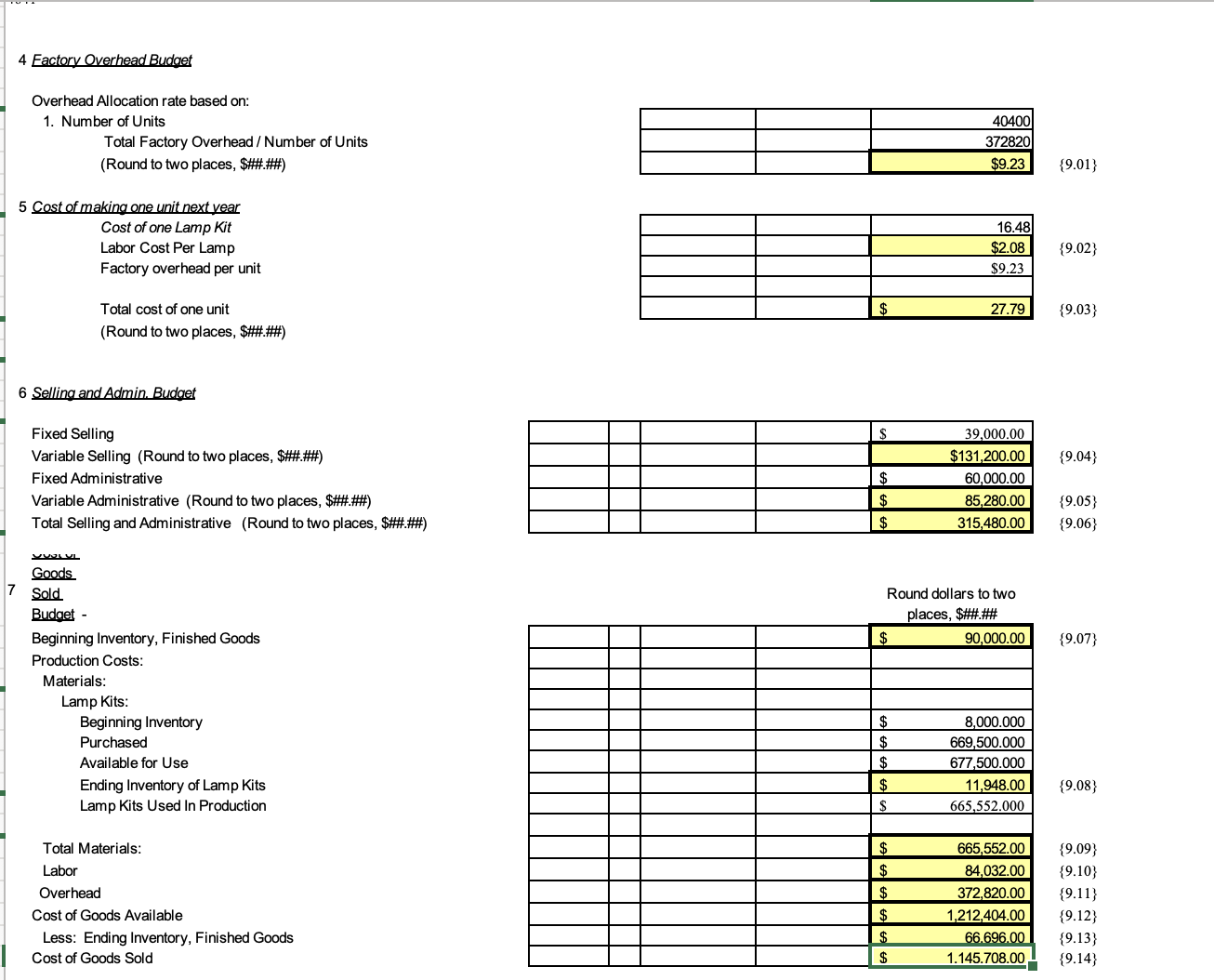

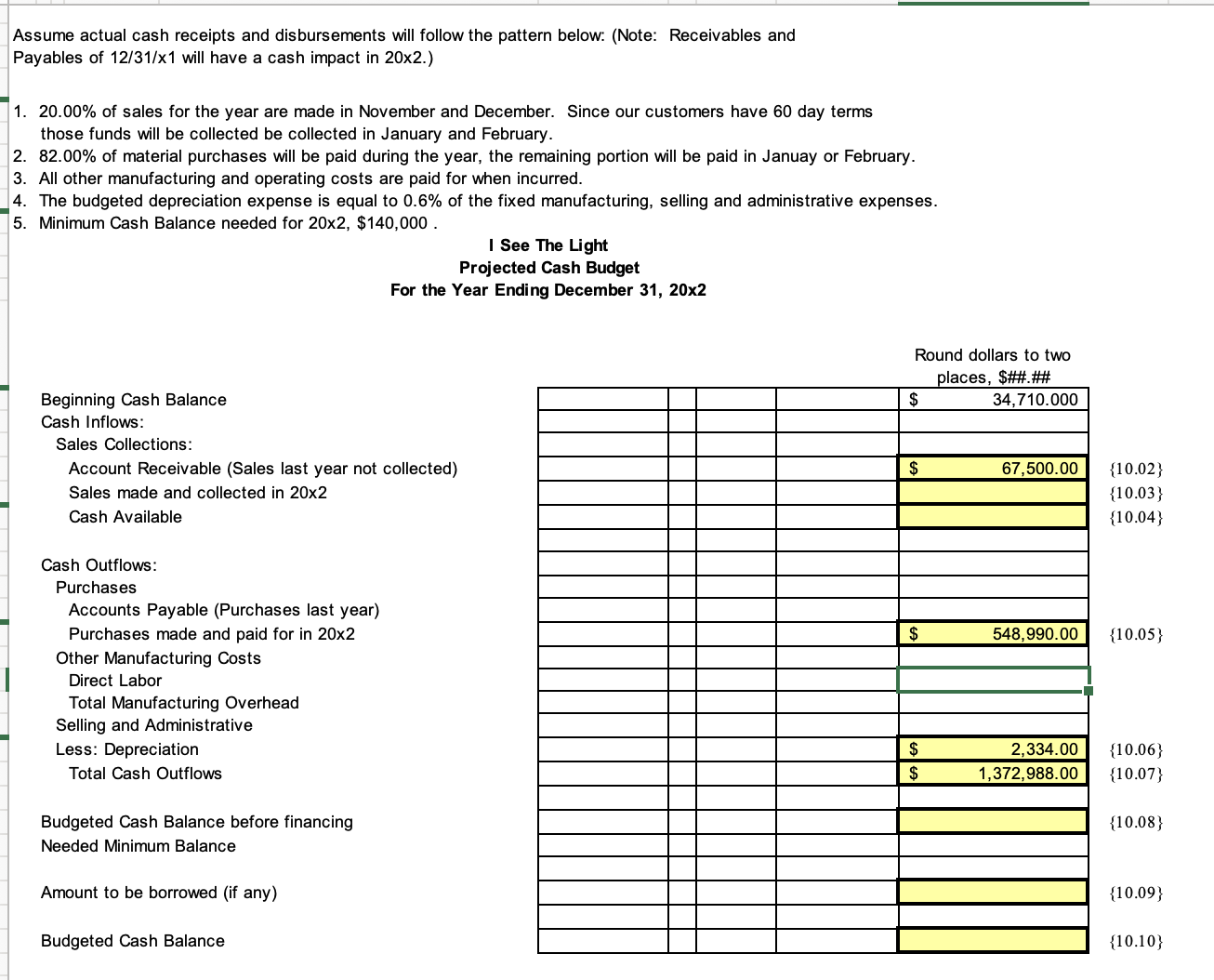

Complete the following budgets 1 Production Budget Planned Sales Desired Ending Inventory of Finished Goods Total Needed Less: Beginning Inventory Total Production \begin{tabular}{|r|} \hline 41000 \\ \hline 2400 \\ \hline 43400 \\ \hline 3000 \\ \hline \\ \hline 40,400 units \\ \hline \end{tabular} {7.01} Assume actual cash receipts and disbursements will follow the pattern below: (Note: Receivables and Payables of 12/31/1 will have a cash impact in 202.) 1. 20.00% of sales for the year are made in November and December. Since our customers have 60 day terms those funds will be collected be collected in January and February. 2. 82.00% of material purchases will be paid during the year, the remaining portion will be paid in Januay or February. 3. All other manufacturing and operating costs are paid for when incurred. 4. The budgeted depreciation expense is equal to 0.6% of the fixed manufacturing, selling and administrative expenses. 5. Minimum Cash Balance needed for 202,$140,000. I See The Light Projected Cash Budget For the Year Ending December 31, 20x2 Round dollars to two Lamp Kits Needed for Production Desired Ending Inventory Total Needed Less: Beginning Inventory Total Purchases Cost per piece Cost of Purchases (Round to two places, \$\#\#\#\#) 3 Direct Labor Budget Labor Cost Per Lamp Production Total Labor Cost (Round to two places, \$\#\#\#\#) 4 Factory Overhead Budget Variable Factory Overhead: Variable Factory Overhead Cost Per Unit Number of Units to be Produced Total Variable Factory Overhead (Round to two places, \$\#\#\#\#) Fixed Factory Overhead Total Factory Overhead (Round to two places, \$\#.\#\#) 1000 1 110 kiy'it 4 Eactory Overhead Budget Overhead Allocation rate based on: 1. Number of Units Total Factory Overhead / Number of Units (Round to two places, \$\#.\#\#) 5 Cost of making one unit next year Cost of one Lamp Kit Labor Cost Per Lamp Factory overhead per unit Total cost of one unit (Round to two places, \$\#.\#\#) \begin{tabular}{|r|r|r|} \hline & & 40400 \\ \hline & & 372820 \\ \hline & & $9.23 \\ \hline \end{tabular} {9.01} \begin{tabular}{|l|r|r|} \hline & & 16.48 \\ \hline & & $2.08 \\ \hline & & $9.23 \\ \hline & & 27.79 \\ \hline \end{tabular} {9.02} {9.03} 6 Selling and Admin. Budget Fixed Selling Variable Selling (Round to two places, \$\#.\#) Fixed Administrative Variable Administrative (Round to two places, \$\#.\#\#) Total Selling and Administrative (Round to two places, \$\#.\#\#) Goods 7 Sold Budget - Beginning Inventory, Finished Goods Production Costs: Materials: Lamp Kits: Beginning Inventory Purchased Available for Use Ending Inventory of Lamp Kits Lamp Kits Used In Production Total Materials: Labor Overhead Cost of Goods Available Less: Ending Inventory, Finished Goods Cost of Goods Sold \begin{tabular}{|r|r|r|r|rr|} \hline & & & & $ & 39,000.00 \\ \hline & & & & & $131,200.00 \\ \hline & & & & $ & 60,000.00 \\ \hline & & & & $ & 85,280.00 \\ \hline & & & & $ & 315,480.00 \\ \hline \end{tabular} {9.04} {9.05} {9.06} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{\begin{tabular}{l} Round dollars to two \\ places, \$\#.\# \end{tabular}} \\ \hline & & & $ & 90,000.00 \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & $ & 8,000.000 \\ \hline & & & $ & 669,500.000 \\ \hline & & & $ & 677,500.000 \\ \hline & & & $ & 11,948.00 \\ \hline & & & $ & 665,552.000 \\ \hline & & & & \\ \hline & & & $ & 665,552.00 \\ \hline & & & $ & 84,032.00 \\ \hline & & & $ & 372,820.00 \\ \hline & & & $ & 1,212,404.00 \\ \hline & & & $ & 66.696 .00 \\ \hline & & & $ & 1.145 .708 .00 \\ \hline \end{tabular} {9.07} {9.08} {9.09} {9.10} \{9.11\} {9.12} {9.13} {9.14}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started