Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with the Discount Cash Flow and IRR Valuation of the company You're an investment banker engaged by Porcupine Tree Company regarding their efforts

please help with the Discount Cash Flow and IRR Valuation of the company

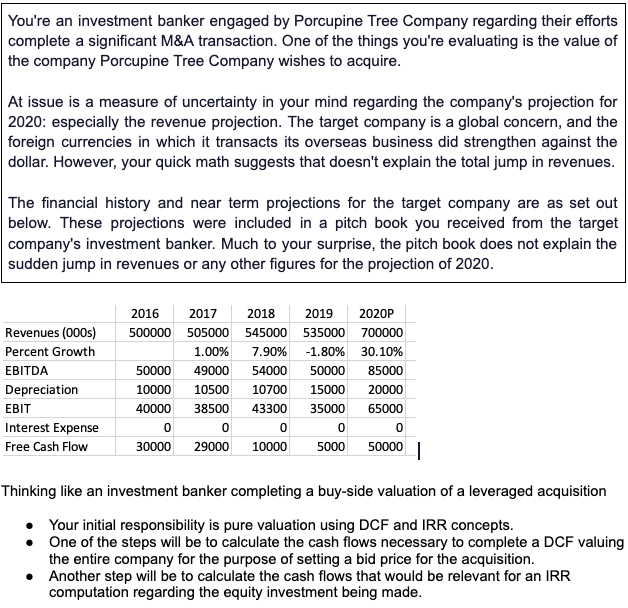

You're an investment banker engaged by Porcupine Tree Company regarding their efforts complete a significant M&A transaction. One of the things you're evaluating is the value of the company Porcupine Tree Company wishes to acquire. At issue is a measure of uncertainty in your mind regarding the company's projection for 2020: especially the revenue projection. The target company is a global concern, and the foreign currencies in which it transacts its overseas business did strengthen against the dollar. However, your quick math suggests that doesn't explain the total jump in revenues. The financial history and near term projections for the target company are as set out below. These projections were included in a pitch book you received from the target company's investment banker. Much to your surprise, the pitch book does not explain the sudden jump in revenues or any other figures for the projection of 2020. Revenues (000s) Percent Growth EBITDA Depreciation EBIT Interest Expense Free Cash Flow 2016 2017 2018 2019 2020P 500000 505000 545000 535000 700000 1.00% 7.90% -1.80% 30.10% 50000 49000 54000 50000 85000 10000 10500 10700 15000 20000 40000 38500 43300 35000 65000 0 0 0 0 0 30000 29000 10000 5000 50000 | Thinking like an investment banker completing a buy-side valuation of a leveraged acquisition Your initial responsibility is pure valuation using DCF and IRR concepts. One of the steps will be to calculate the cash flows necessary to complete a DCF valuing the entire company for the purpose of setting a bid price for the acquisition. Another step will be to calculate the cash flows that would be relevant for an IRR computation regarding the equity investment being madeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started