Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with the errors! Injection Plastics Company has been operating for three years. At December 31, 2020, the accounting records reflected the following: Cash

Please help with the errors!

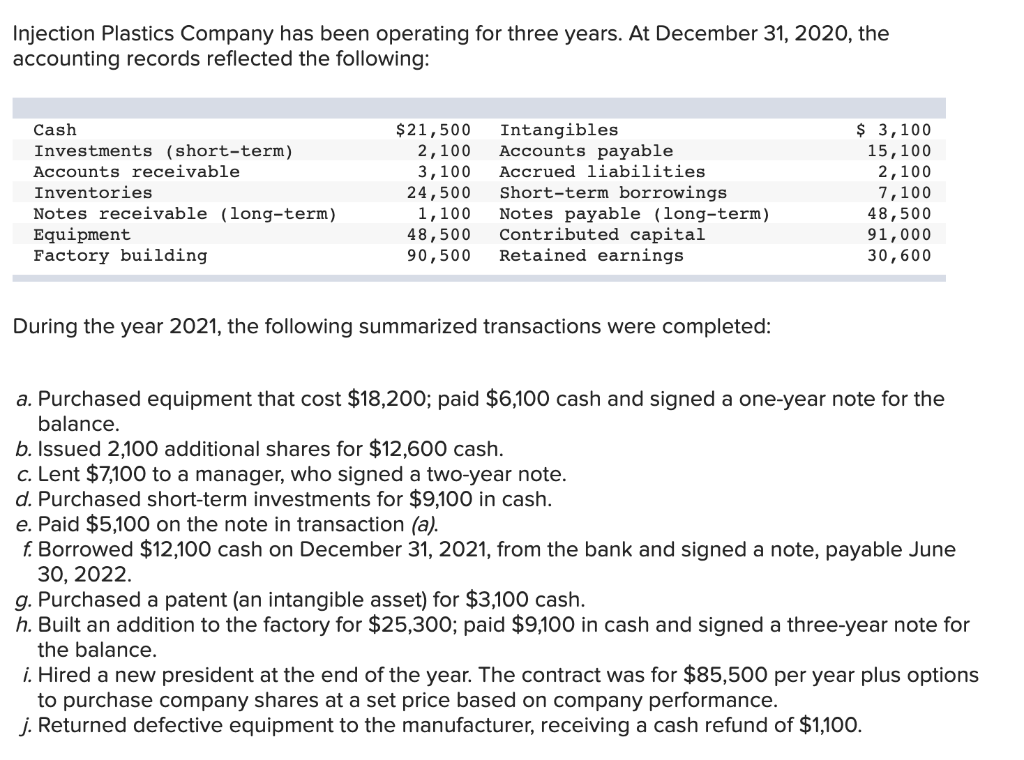

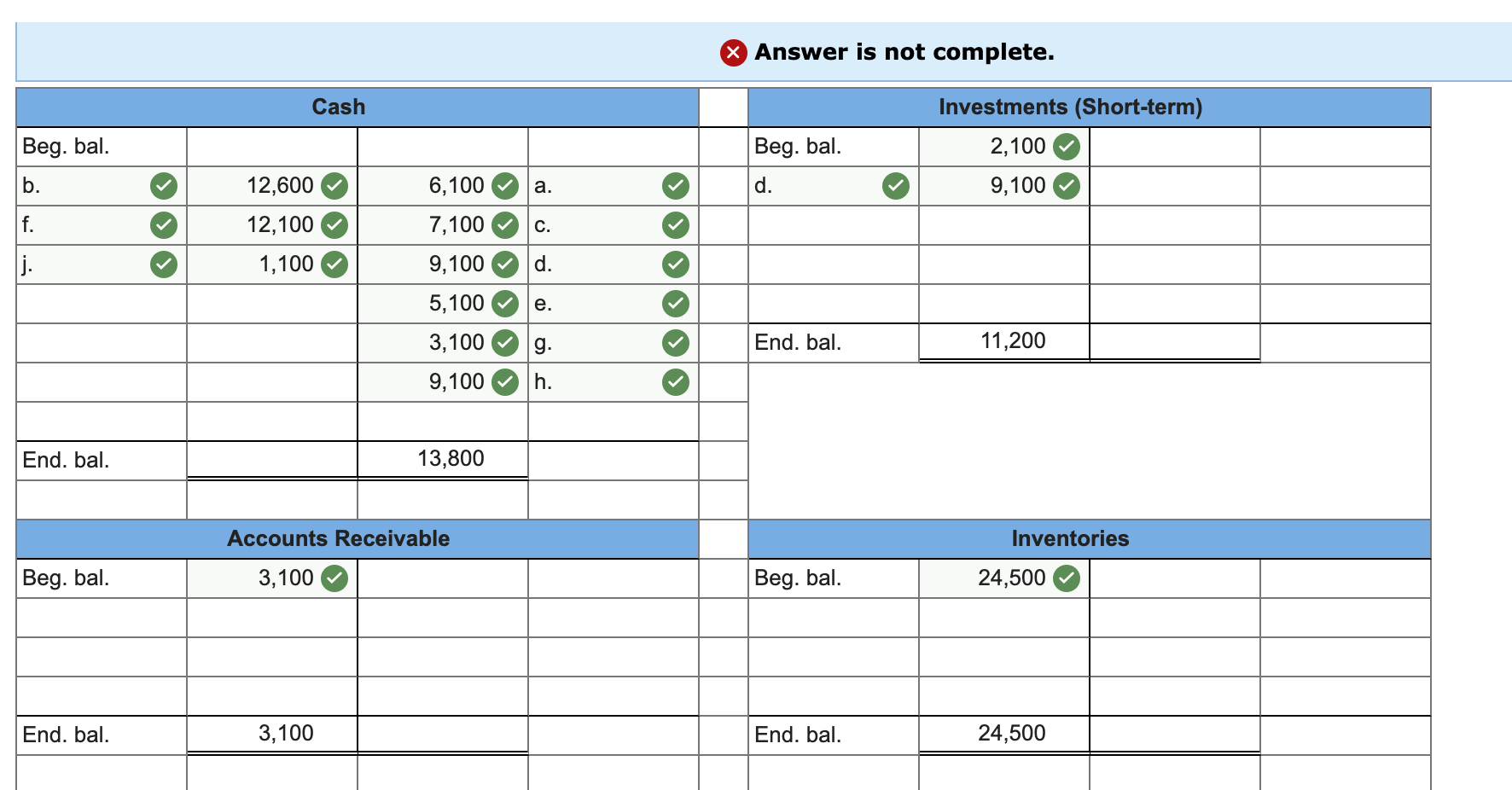

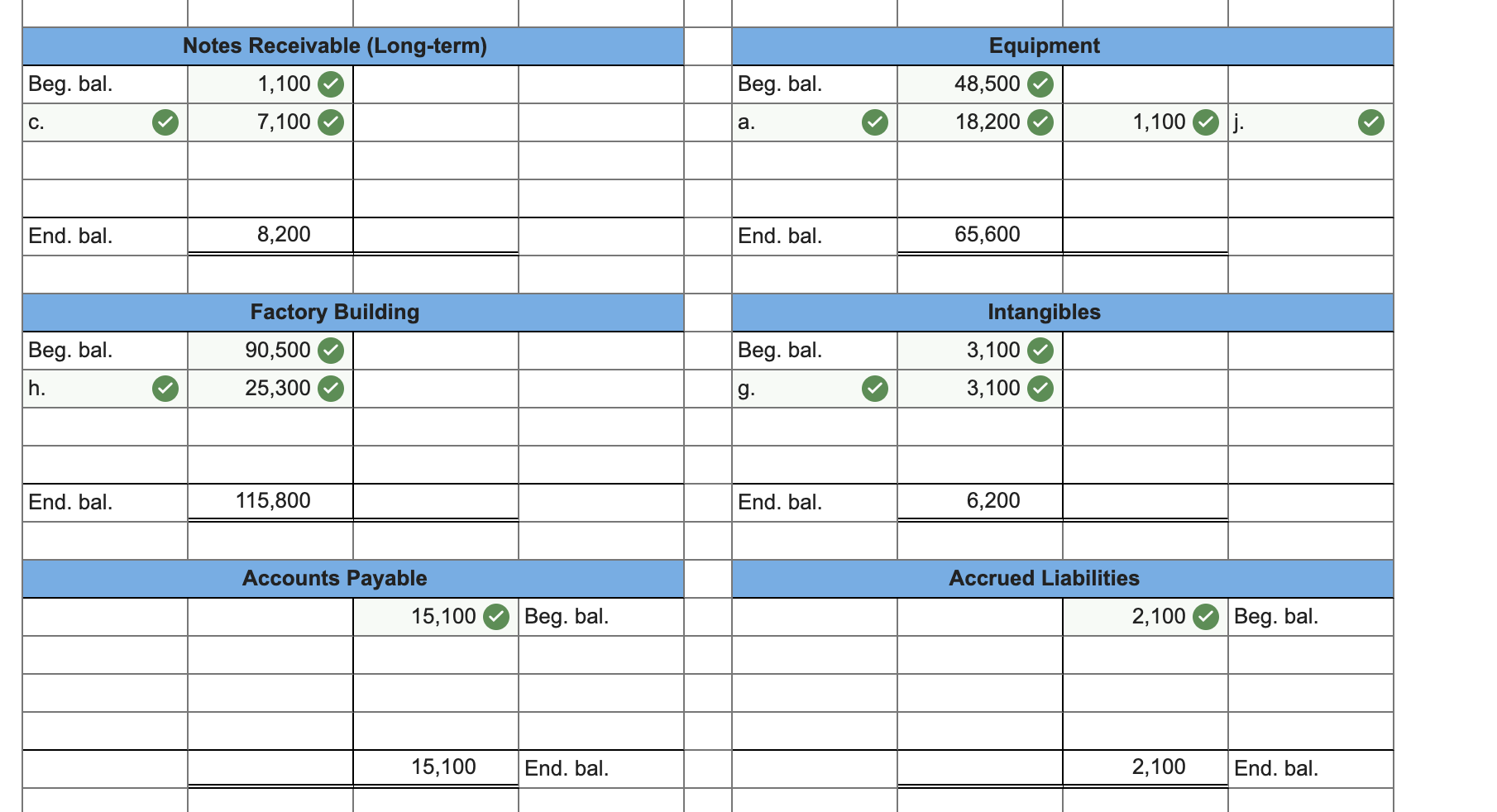

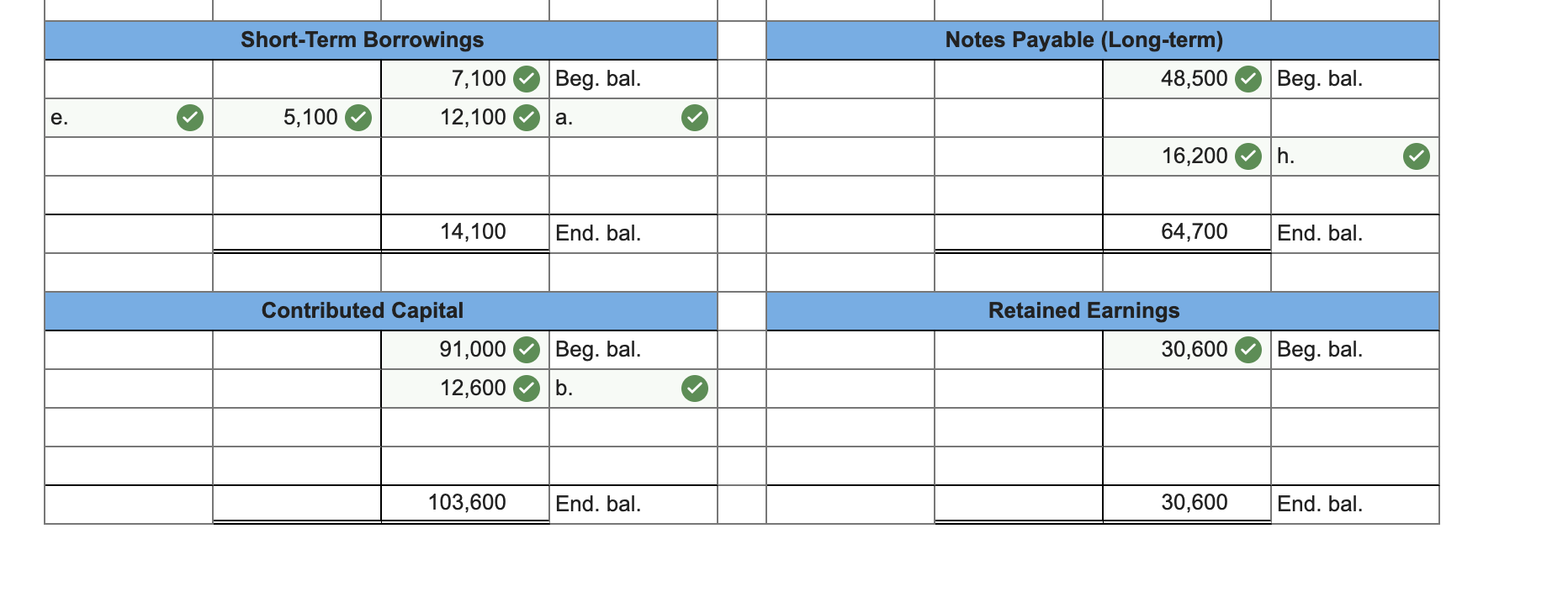

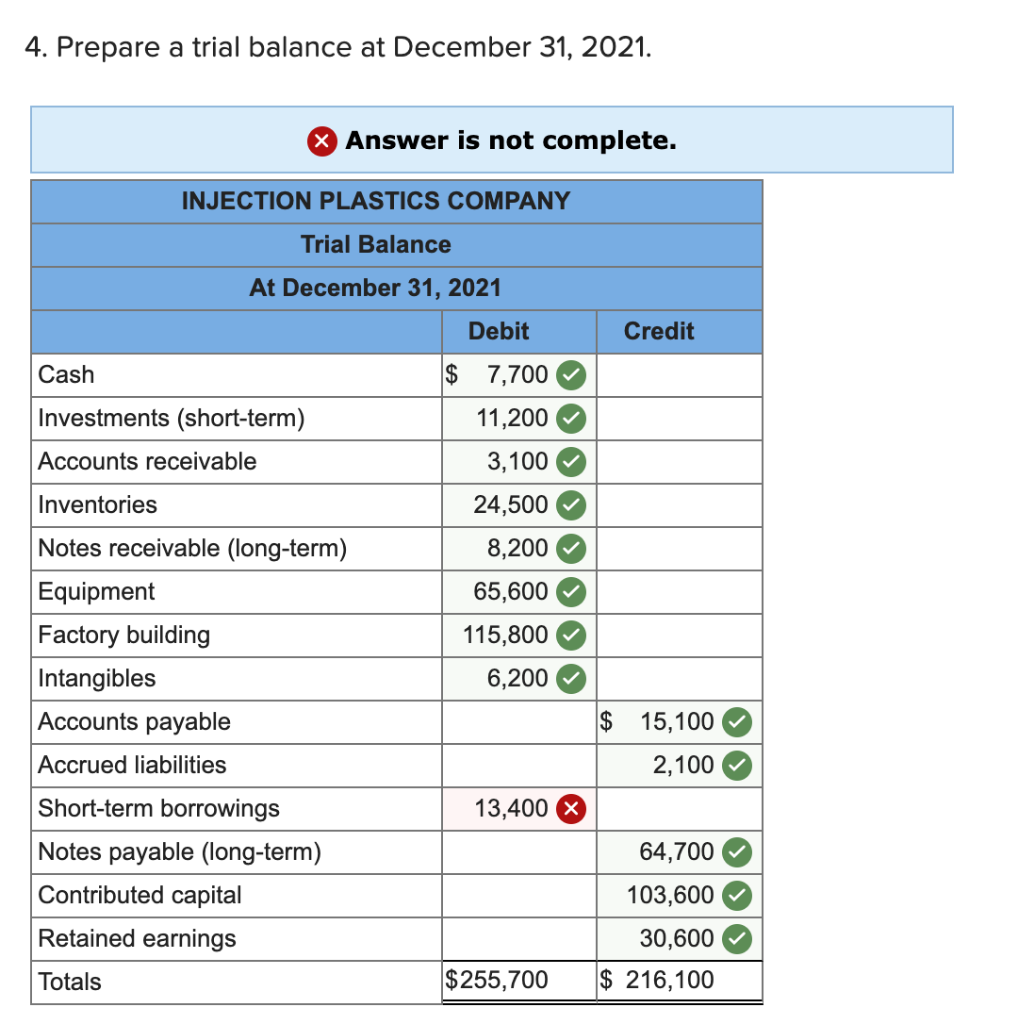

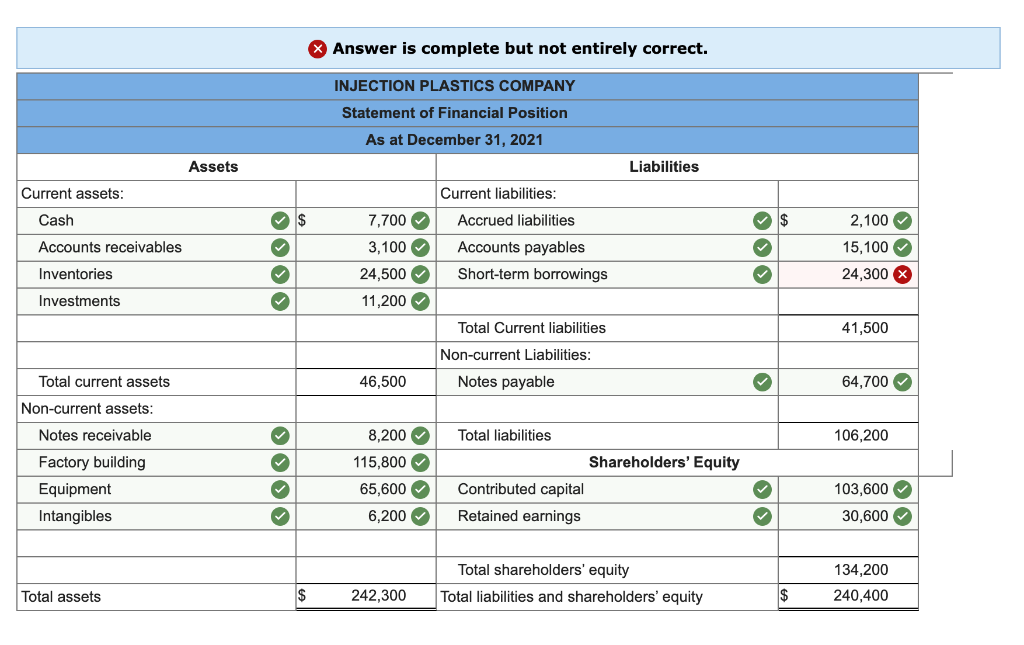

Injection Plastics Company has been operating for three years. At December 31, 2020, the accounting records reflected the following: Cash Investments (short-term) Accounts receivable Inventories Notes receivable (long-term) Equipment Factory building $21,500 2,100 3,100 24,500 1,100 48,500 90,500 Intangibles Accounts payable Accrued liabilities Short-term borrowings Notes payable (long-term) Contributed capital Retained earnings $ 3,100 15,100 2,100 7,100 48,500 91,000 30,600 During the year 2021, the following summarized transactions were completed: a. Purchased equipment that cost $18,200; paid $6,100 cash and signed a one-year note for the balance. b. Issued 2,100 additional shares for $12,600 cash. c. Lent $7,100 to a manager, who signed a two-year note. d. Purchased short-term investments for $9,100 in cash. e. Paid $5,100 on the note in transaction (a). f. Borrowed $12,100 cash on December 31, 2021, from the bank and signed a note, payable June 30, 2022. g. Purchased a patent (an intangible asset) for $3,100 cash. h. Built an addition to the factory for $25,300; paid $9,100 in cash and signed a three-year note for the balance. i. Hired a new president at the end of the year. The contract was for $85,500 per year plus options to purchase company shares at a set price based on company performance. j. Returned defective equipment to the manufacturer, receiving a cash refund of $1,100. Answer is not complete. Cash Beg. bal. Beg. bal. Investments (Short-term) 2,100 9,100 b. 12,600 6,100 a. d. f. 12,100 C. 7,100 9,100 j. 1,100 d. e. 5,100 3,100 g. End. bal. 11,200 9,100 h. End. bal. 13,800 Accounts Receivable Inventories Beg. bal. 3,100 Beg. bal. 24,500 End. bal. 3,100 End. bal. 24,500 Notes Receivable (Long-term) 1,100 7,100 Equipment 48,500 Beg. bal. Beg. bal. C. a. 18,200 1,100 j. End. bal. 8,200 End. bal. 65,600 Factory Building 90,500 25,300 Intangibles 3,100 Beg. bal. Beg. bal. h. g. 3,100 End. bal. 115,800 End. bal. 6,200 Accrued Liabilities Accounts Payable 15,100 Beg. bal. 2,100 Beg. bal. 15,100 End. bal. 2,100 End. bal. Short-Term Borrowings 7,100 Notes Payable (Long-term) 48,500 Beg. bal. Beg. bal. e. 5,100 12,100 a. 16,200 h. 14,100 End. bal. 64,700 End. bal. Contributed Capital 91,000 12,600 Retained Earnings 30,600 Beg. bal. Beg. bal. b. 103,600 End. bal. 30,600 End. bal. 4. Prepare a trial balance at December 31, 2021. Answer is not complete. INJECTION PLASTICS COMPANY Trial Balance At December 31, 2021 Debit Credit Cash $ 7,700 Investments (short-term) Accounts receivable Inventories Notes receivable (long-term) Equipment Factory building Intangibles Accounts payable Accrued liabilities Short-term borrowings Notes payable (long-term) Contributed capital Retained earnings 11,200 3,100 24,500 8,200 65,600 115,800 6,200 $ 15,100 2,100 13,400 X 64,700 103,600 30,600 $255,700 $ 216,100 Totals Answer is complete but not entirely correct. INJECTION PLASTICS COMPANY Statement of Financial Position As at December 31, 2021 Assets Liabilities Current assets: Cash S 7,700 Current liabilities: Accrued liabilities Accounts payables Short-term borrowings Accounts receivables Inventories 3,100 24,500 11,200 2,100 15,100 24,300 X Investments Total Current liabilities 41,500 Non-current Liabilities: Notes payable Total current assets 46,500 > 64,700 Non-current assets: Notes receivable 106,200 Factory building Equipment Intangibles 8,200 115,800 65,600 6,200 Total liabilities Shareholders' Equity Contributed capital Retained earnings 103,600 30,600 Total shareholders' equity Total liabilities and shareholders' equity 134,200 240,400 Total assets $ 242,300 $ 6. Compute the current ratio at December 31, 2021. (Round the final answer to 2 decimal places.) Answer is complete but not entirely correct. Current ratio 1.50 XStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started