Answered step by step

Verified Expert Solution

Question

1 Approved Answer

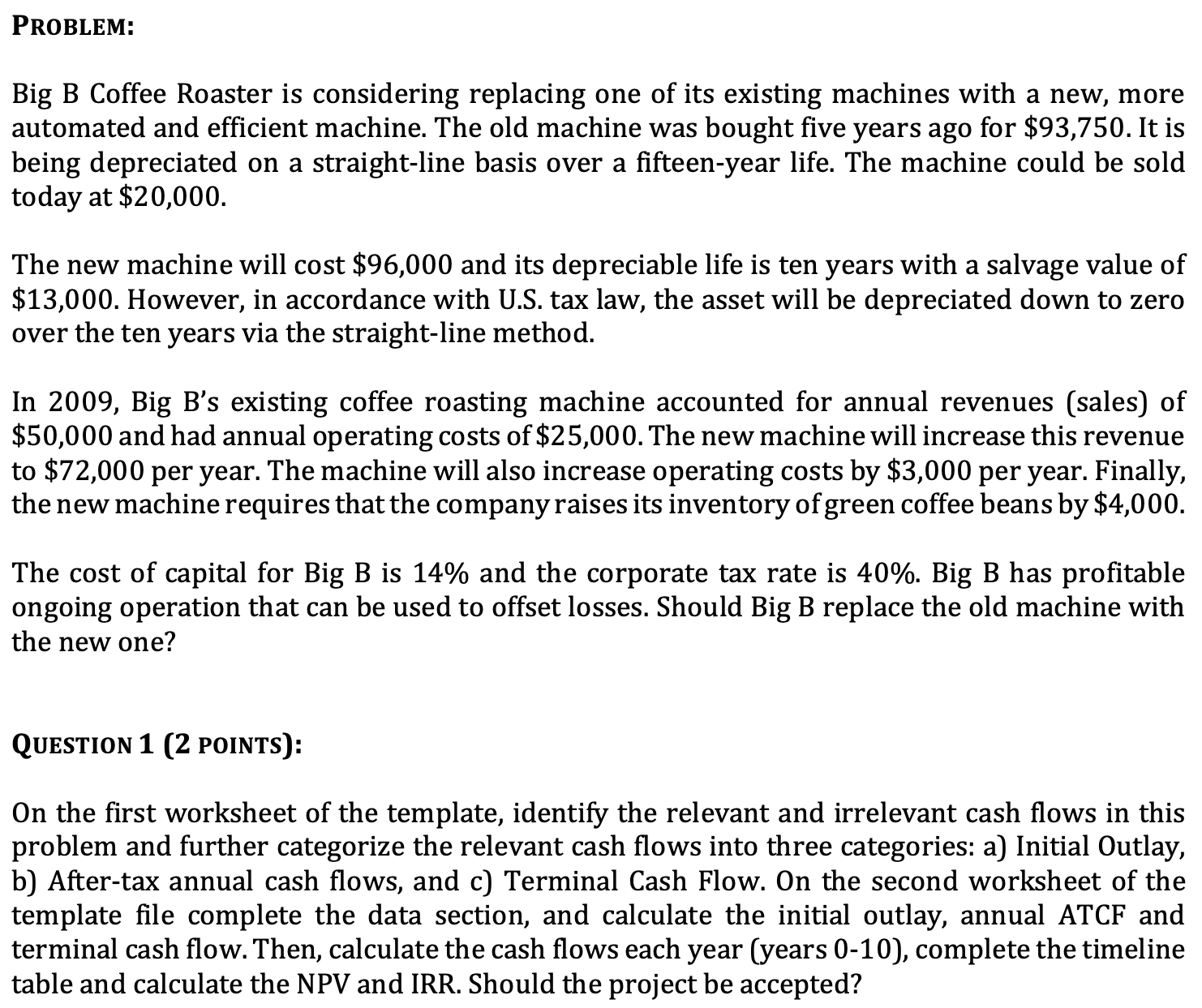

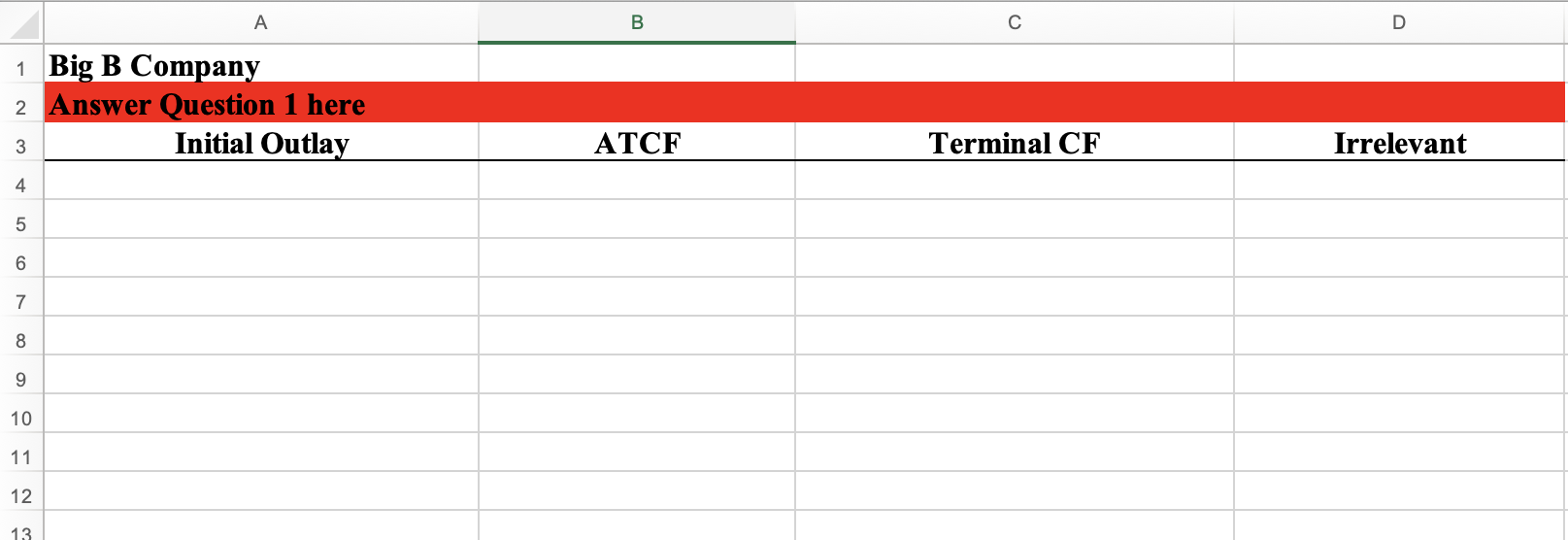

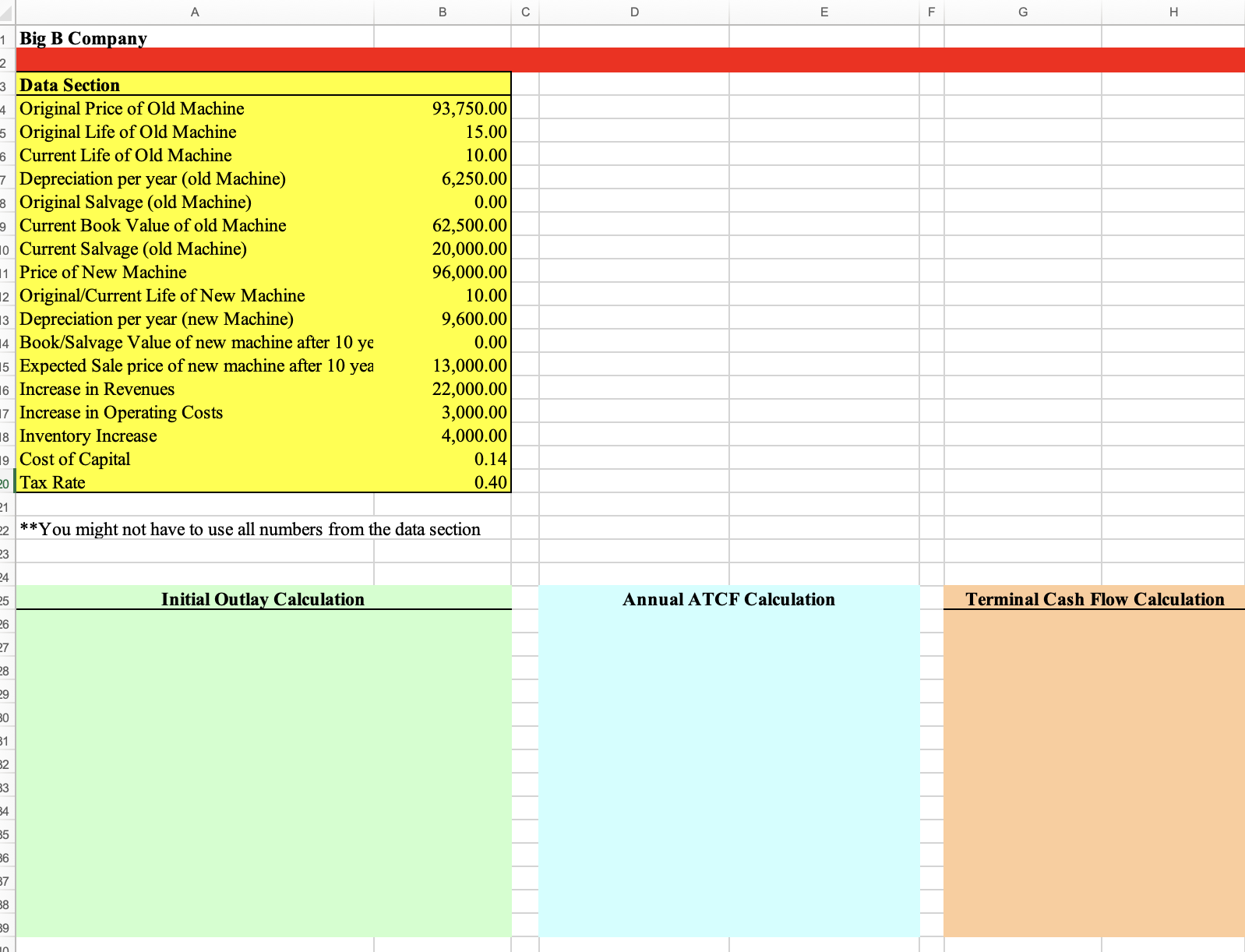

Please help with the following problem, I have been struggling with this one all day. Your hopes will be greatly appreciated it. All information is

Please help with the following problem, I have been struggling with this one all day. Your hopes will be greatly appreciated it. All information is given through the three pictures provided. Please let me know if you need any additional information you should not, but please let me know. Answer the question FULLY. Thanks again. The first pic is the question, the second pic is the chart that is the first part of question one, and the last pic is the template page that needs to be filled out.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started