Answered step by step

Verified Expert Solution

Question

1 Approved Answer

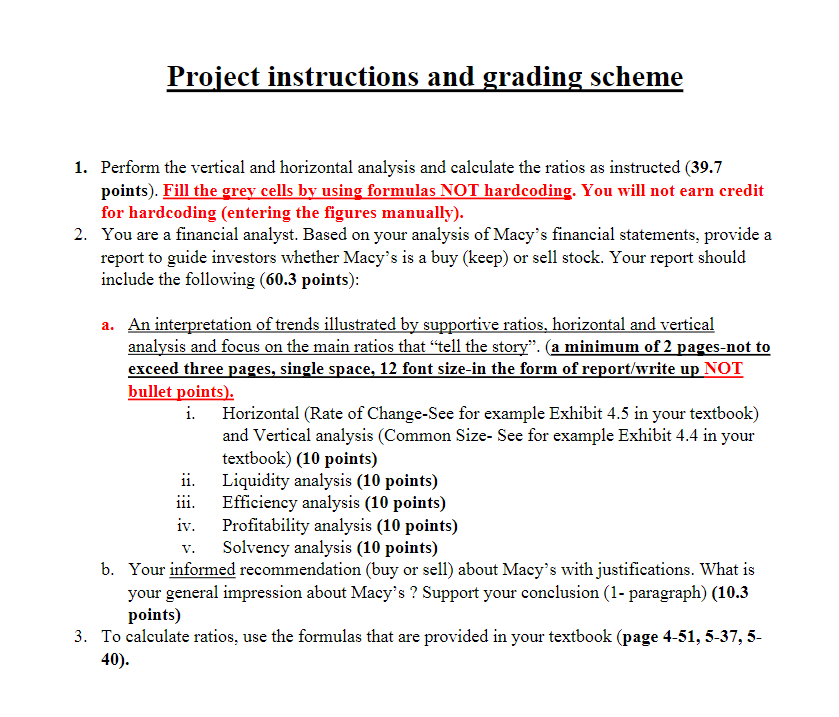

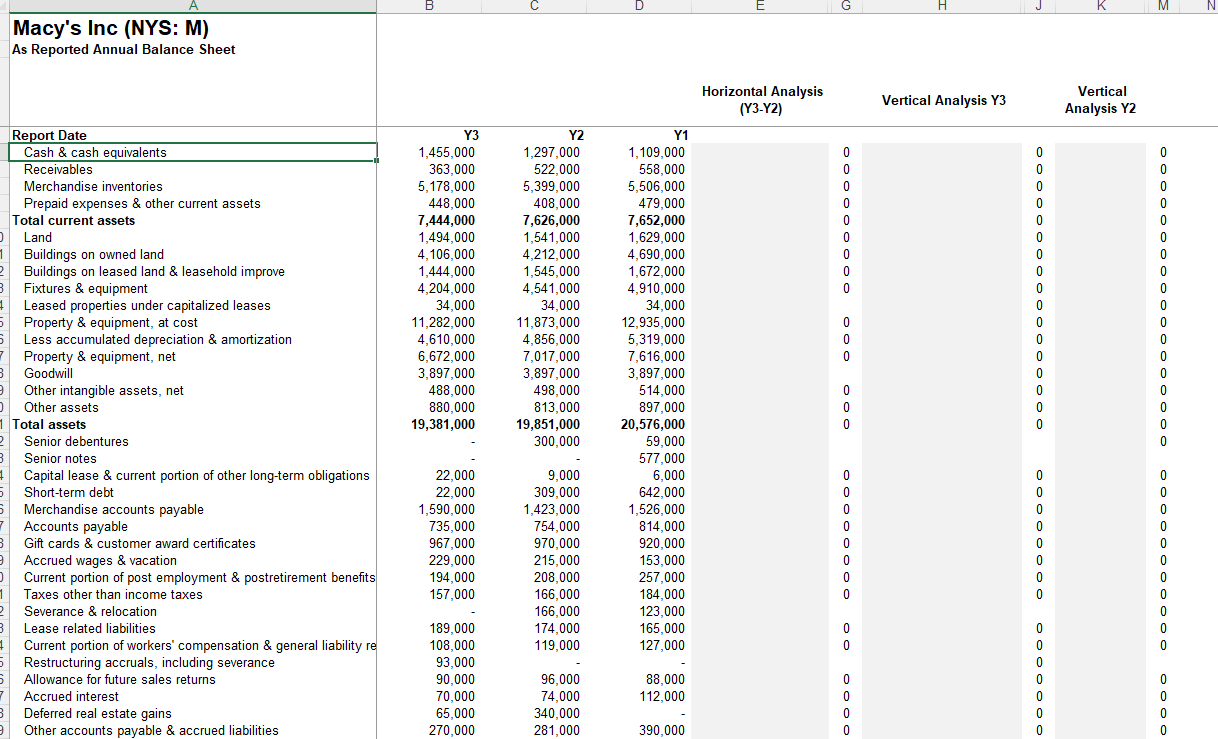

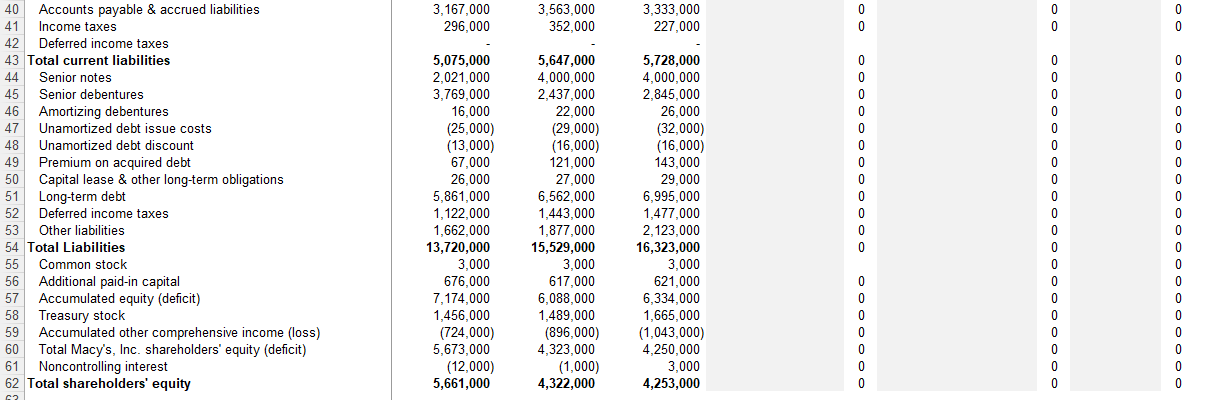

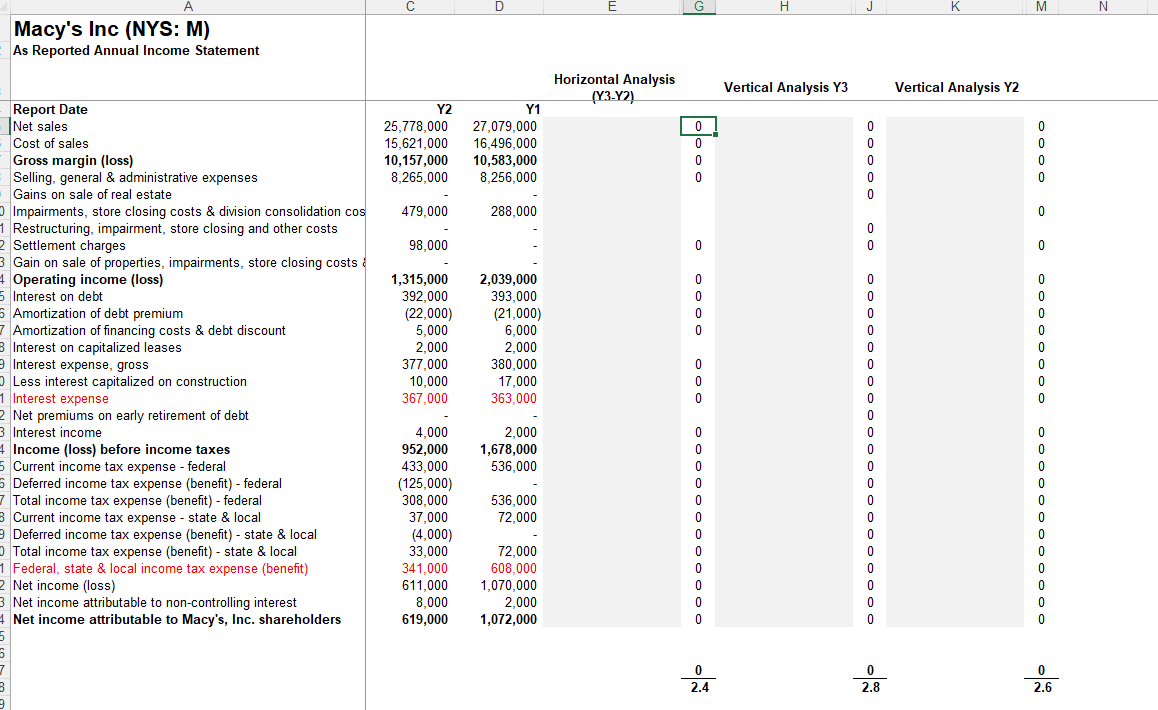

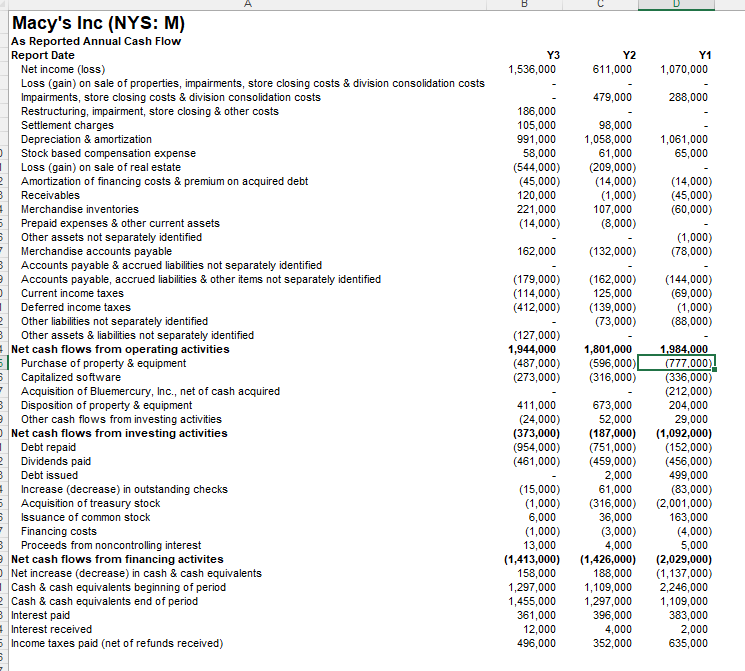

Please help with the formulas for all grey boxes. Project instructions and grading scheme 1. Perform the vertical and horizontal analysis and calculate the ratios

Please help with the formulas for all grey boxes.

Project instructions and grading scheme 1. Perform the vertical and horizontal analysis and calculate the ratios as instructed (39.7 points). Fill the grey cells by using formulas NOT hardcoding. You will not earn credit for hardcoding (entering the figures manually). 2. You are a financial analyst. Based on your analysis of Macy's financial statements, provide a report to guide investors whether Macy's is a buy (keep) or sell stock. Your report should include the following ( 60.3 points): a. An interpretation of trends illustrated by supportive ratios, horizontal and vertical analysis and focus on the main ratios that "tell the story". (a minimum of 2 pages-not to exceed three pages, single space, 12 font size-in the form of report/write up NOT bullet points). i. Horizontal (Rate of Change-See for example Exhibit 4.5 in your textbook) and Vertical analysis (Common Size- See for example Exhibit 4.4 in your textbook) (10 points) ii. Liquidity analysis (10 points) iii. Efficiency analysis (10 points) iv. Profitability analysis (10 points) v. Solvency analysis ( 10 points) b. Your informed recommendation (buy or sell) about Macy's with justifications. What is your general impression about Macy's ? Support your conclusion (1- paragraph) (10.3 points) 3. To calculate ratios, use the formulas that are provided in your textbook (page 4-51, 5-37, 540). Macy's Inc (NYS: M) As Reported Annual Balance Sheet Macy's Inc (NYS: M) As Reported Annual Income Statement 2.40 2.80 2.60 Ne F 4 C Ce Ne [ 11 H F F Ne Ne Ca Ca Inte Inte Inc Project instructions and grading scheme 1. Perform the vertical and horizontal analysis and calculate the ratios as instructed (39.7 points). Fill the grey cells by using formulas NOT hardcoding. You will not earn credit for hardcoding (entering the figures manually). 2. You are a financial analyst. Based on your analysis of Macy's financial statements, provide a report to guide investors whether Macy's is a buy (keep) or sell stock. Your report should include the following ( 60.3 points): a. An interpretation of trends illustrated by supportive ratios, horizontal and vertical analysis and focus on the main ratios that "tell the story". (a minimum of 2 pages-not to exceed three pages, single space, 12 font size-in the form of report/write up NOT bullet points). i. Horizontal (Rate of Change-See for example Exhibit 4.5 in your textbook) and Vertical analysis (Common Size- See for example Exhibit 4.4 in your textbook) (10 points) ii. Liquidity analysis (10 points) iii. Efficiency analysis (10 points) iv. Profitability analysis (10 points) v. Solvency analysis ( 10 points) b. Your informed recommendation (buy or sell) about Macy's with justifications. What is your general impression about Macy's ? Support your conclusion (1- paragraph) (10.3 points) 3. To calculate ratios, use the formulas that are provided in your textbook (page 4-51, 5-37, 540). Macy's Inc (NYS: M) As Reported Annual Balance Sheet Macy's Inc (NYS: M) As Reported Annual Income Statement 2.40 2.80 2.60 Ne F 4 C Ce Ne [ 11 H F F Ne Ne Ca Ca Inte Inte Inc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started