Please help with the general journal and the cash ledger

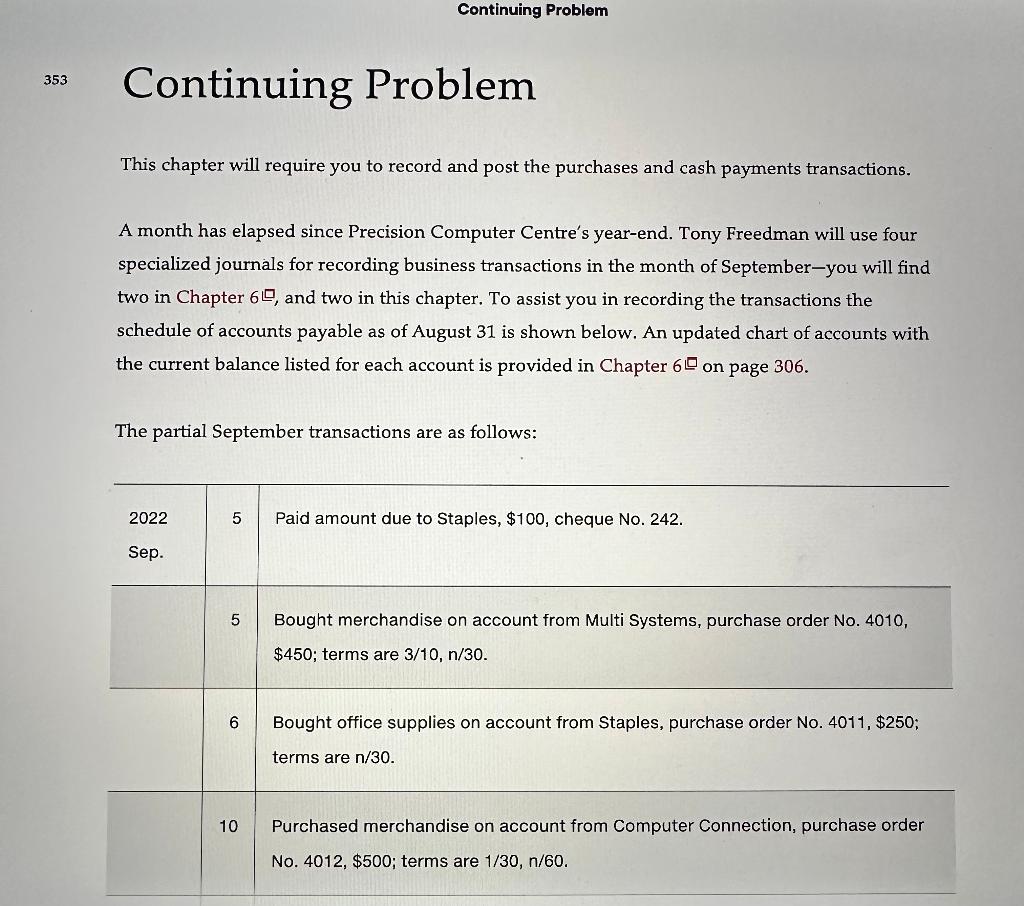

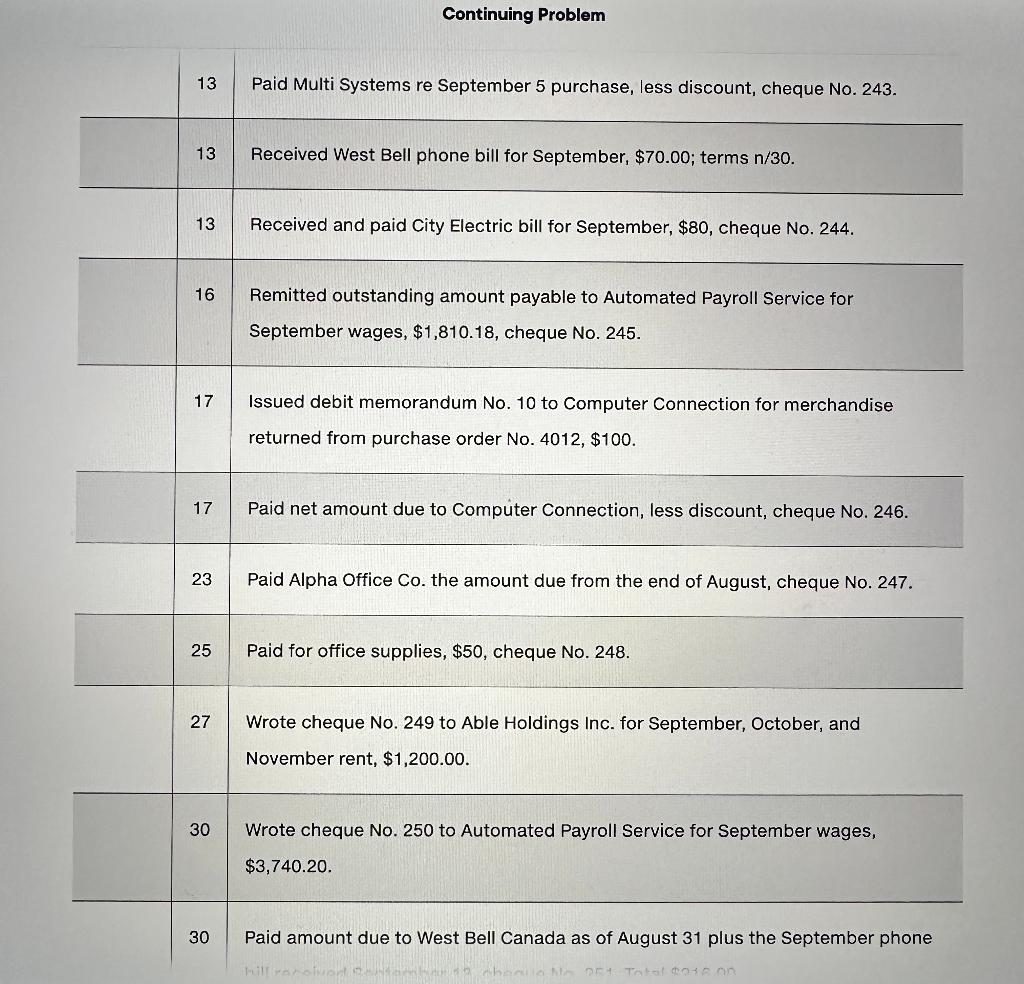

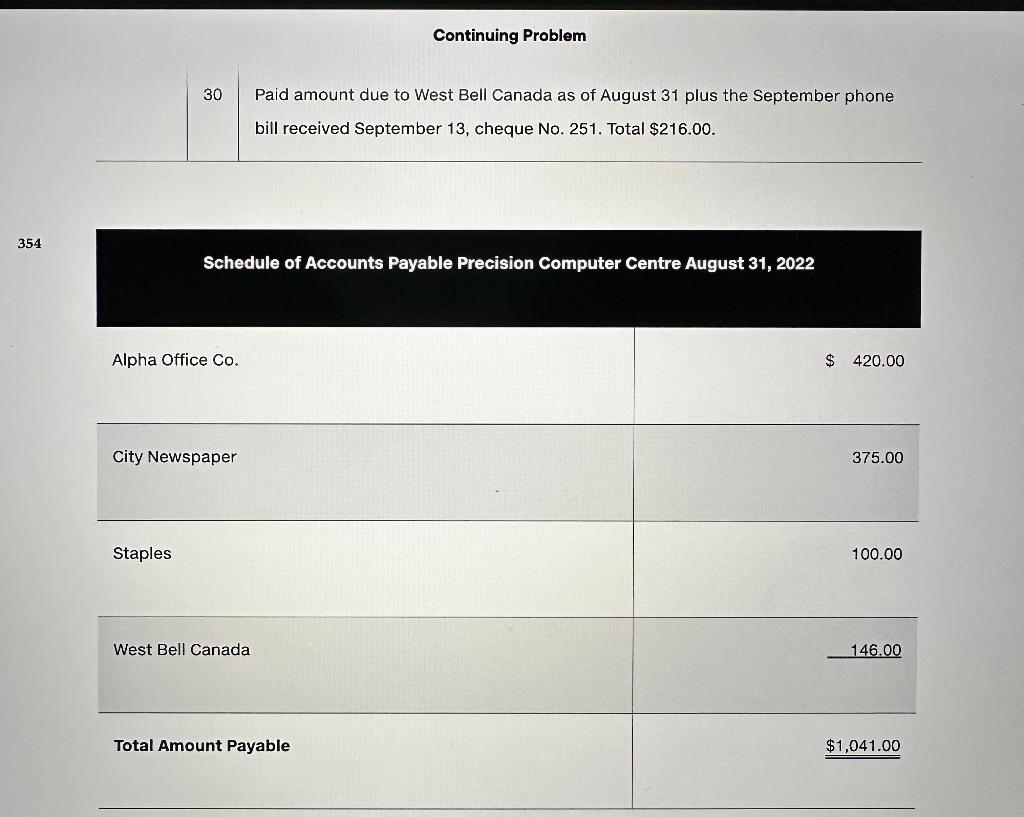

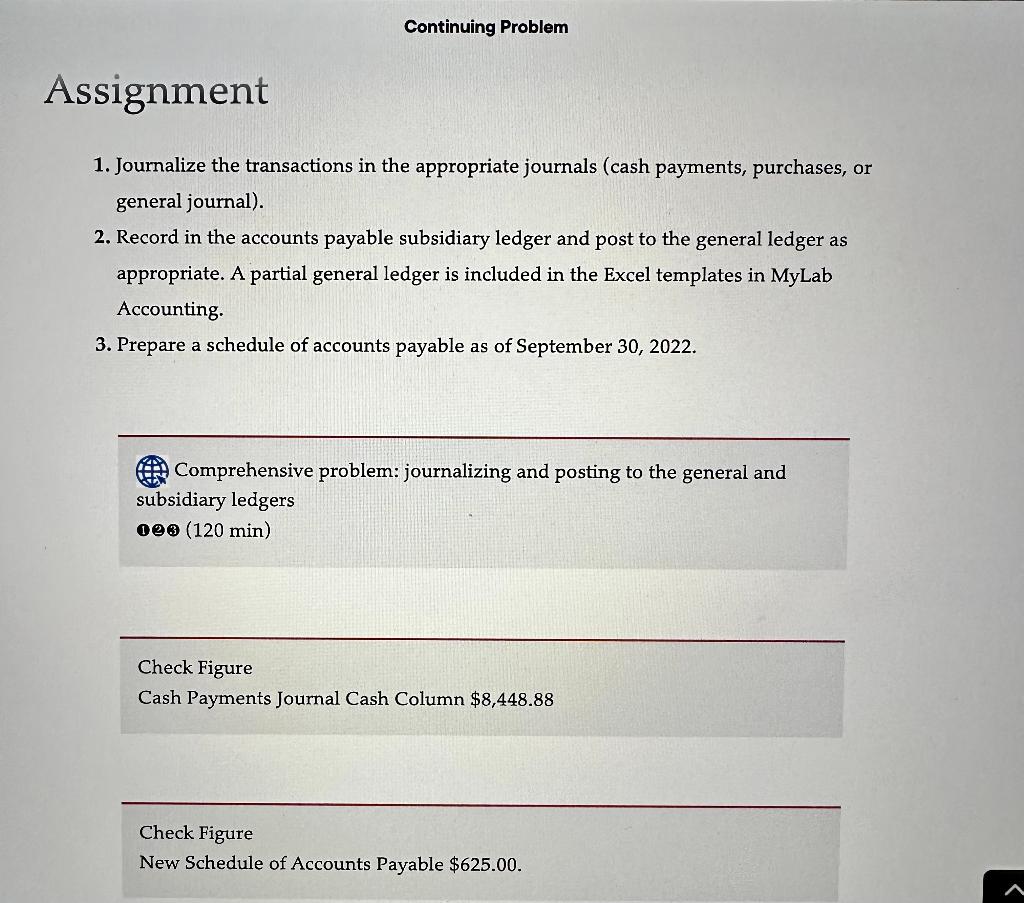

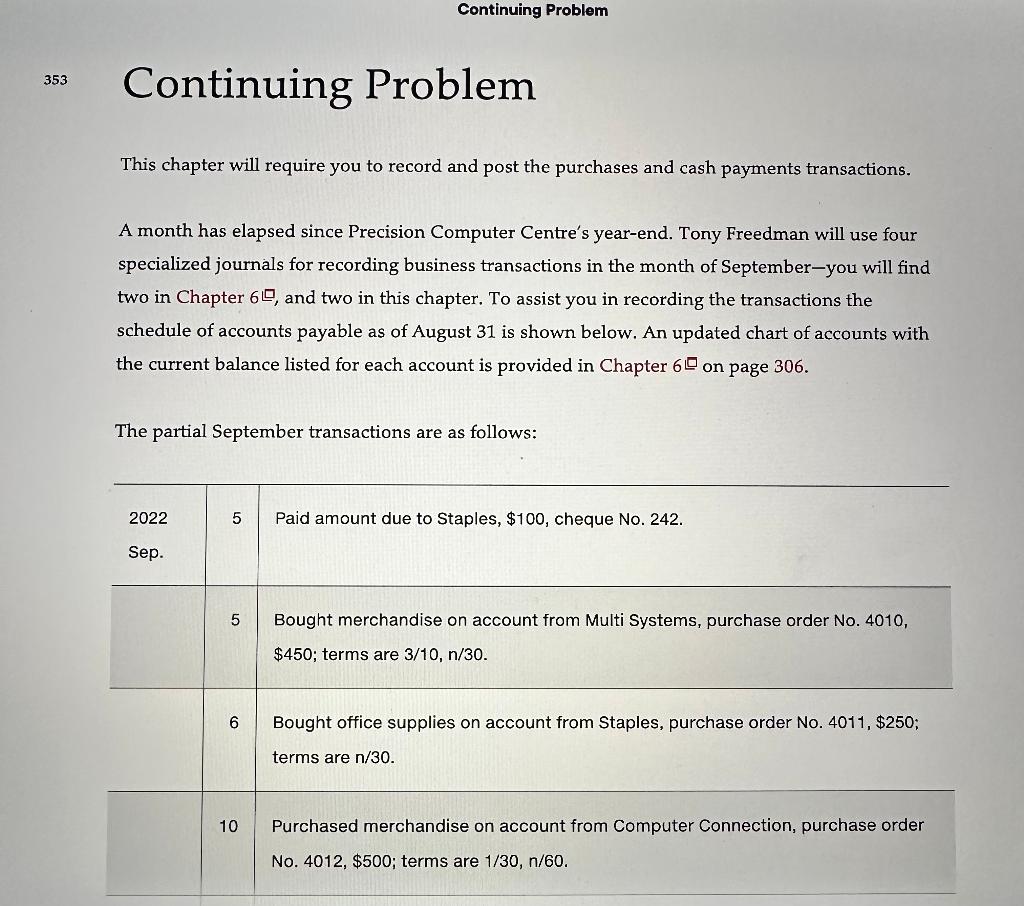

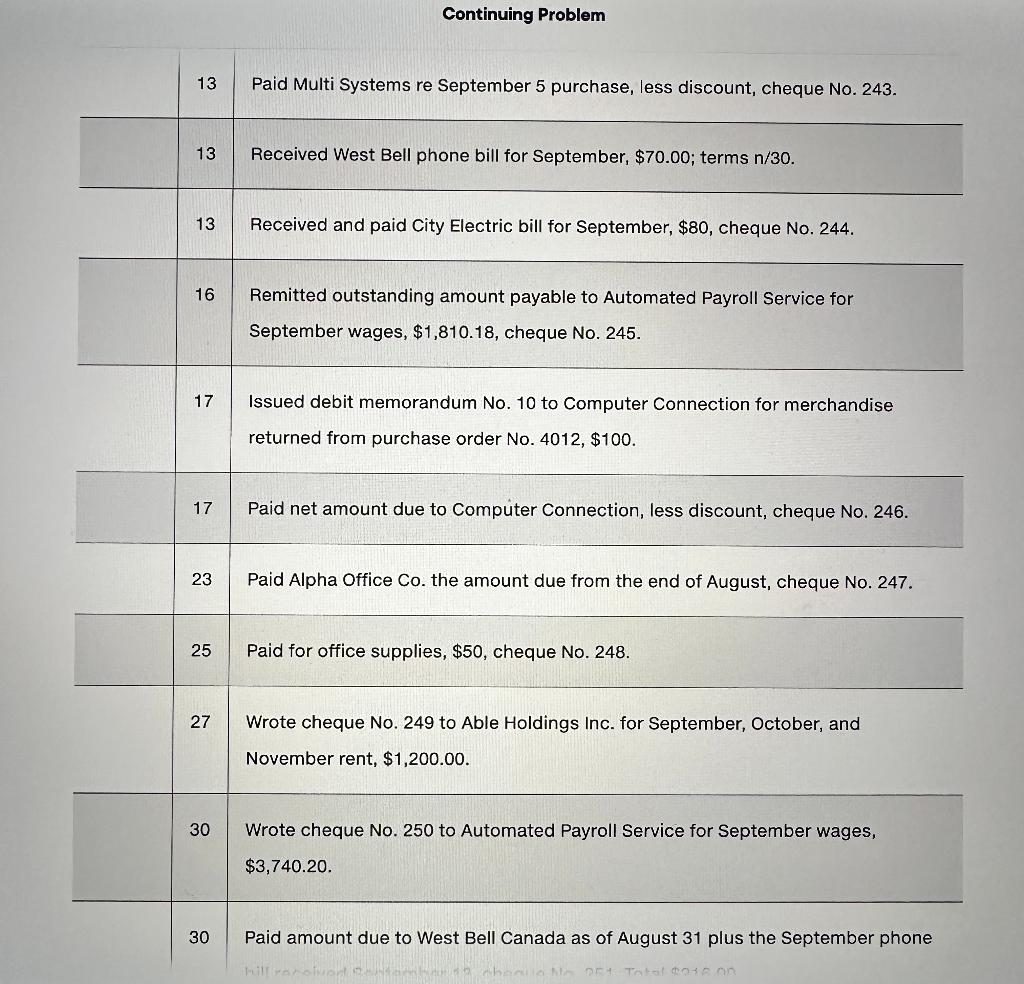

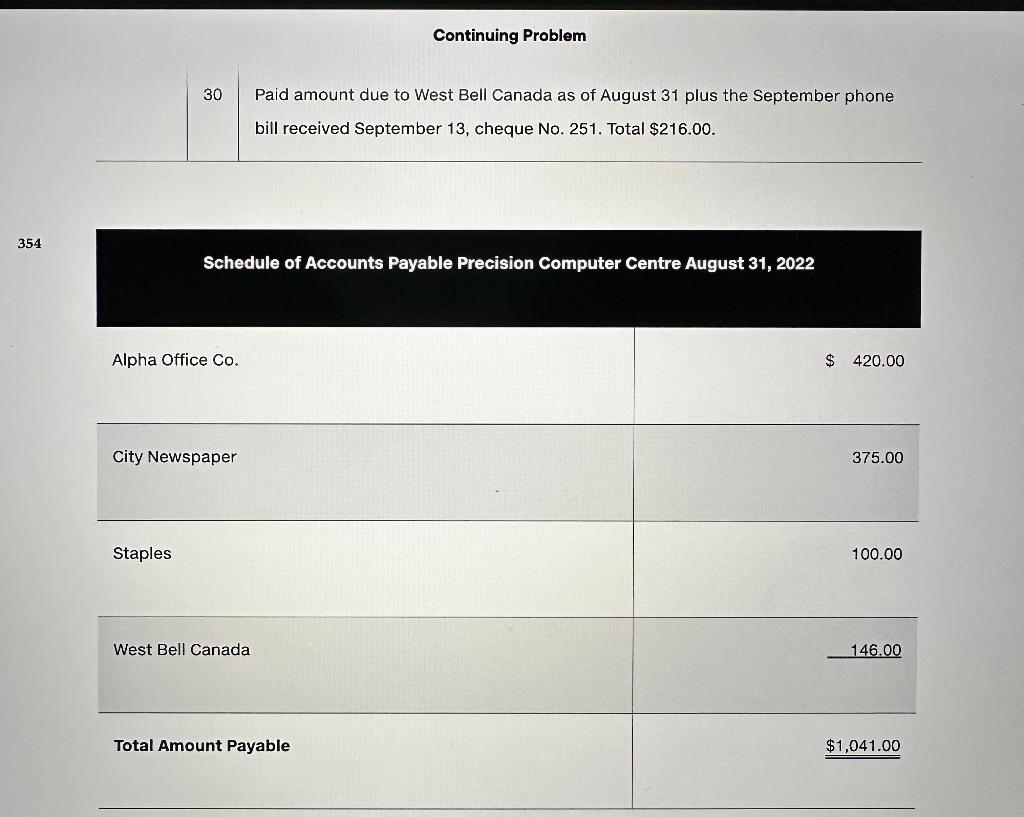

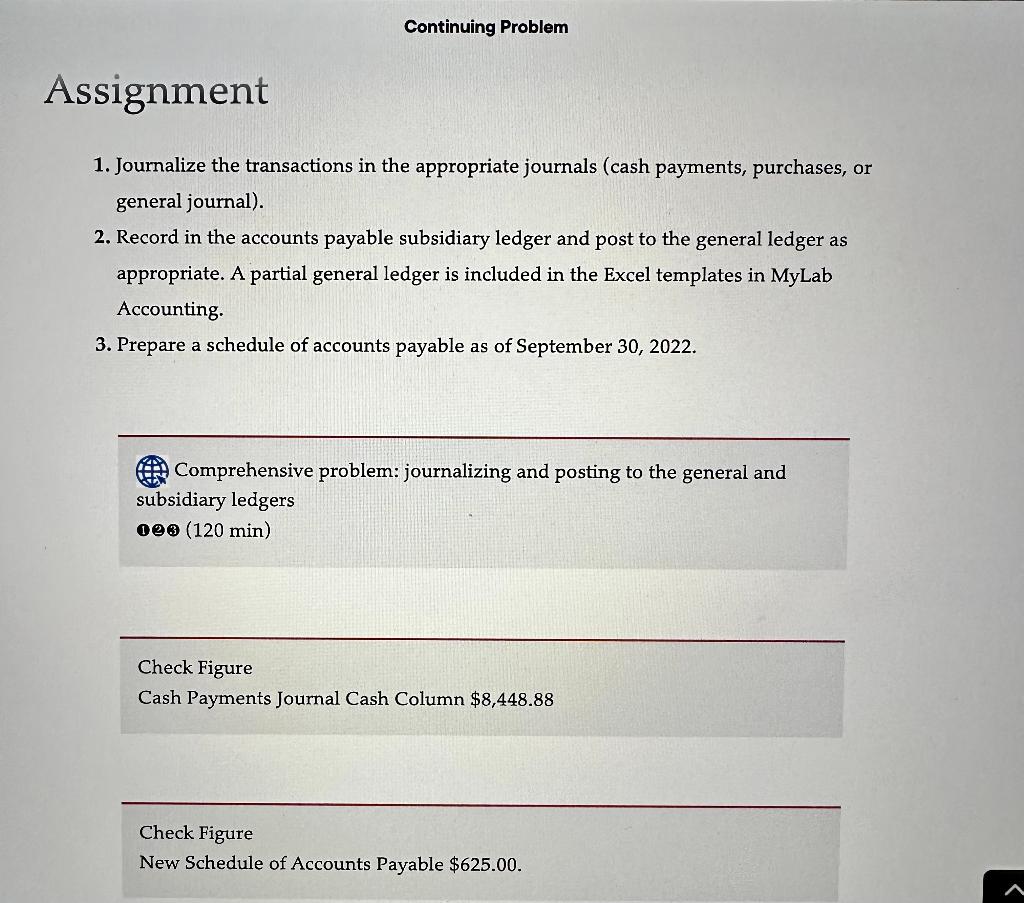

This chapter will require you to record and post the purchases and cash payments transactions. A month has elapsed since Precision Computer Centre's year-end. Tony Freedman will use four specialized journals for recording business transactions in the month of September-you will find two in Chapter 6, and two in this chapter. To assist you in recording the transactions the schedule of accounts payable as of August 31 is shown below. An updated chart of accounts with the current balance listed for each account is provided in Chapter 6 on page 306. Continuing Problem 13 Paid Multi Systems re September 5 purchase, less discount, cheque No. 243. Received and paid City Electric bill for September, $80, cheque No. 244. Remitted outstanding amount payable to Automated Payroll Service for September wages, $1,810.18, cheque No. 245 . 17 Issued debit memorandum No. 10 to Computer Connection for merchandise returned from purchase order No. 4012,$100. 17 Paid net amount due to Computer Connection, less discount, cheque No. 246. 23 Paid Alpha Office Co. the amount due from the end of August, cheque No. 247. 25 Paid for office supplies, $50, cheque No. 248. 27 Wrote cheque No. 249 to Able Holdings Inc. for September, October, and November rent, $1,200.00. 30 Wrote cheque No. 250 to Automated Payroll Service for September wages, $3,740.20 30 Paid amount due to West Bell Canada as of August 31 plus the September phone 30 Paid amount due to West Bell Canada as of August 31 plus the September phone bill received September 13 , cheque No. 251. Total $216.00. 1. Journalize the transactions in the appropriate journals (cash payments, purchases, or general journal). 2. Record in the accounts payable subsidiary ledger and post to the general ledger as appropriate. A partial general ledger is included in the Excel templates in MyLab Accounting. 3. Prepare a schedule of accounts payable as of September 30,2022. Comprehensive problem: journalizing and posting to the general and subsidiary ledgers (1) 8(120min) Check Figure Cash Payments Journal Cash Column $8,448.88 Check Figure New Schedule of Accounts Payable $625.00. This chapter will require you to record and post the purchases and cash payments transactions. A month has elapsed since Precision Computer Centre's year-end. Tony Freedman will use four specialized journals for recording business transactions in the month of September-you will find two in Chapter 6, and two in this chapter. To assist you in recording the transactions the schedule of accounts payable as of August 31 is shown below. An updated chart of accounts with the current balance listed for each account is provided in Chapter 6 on page 306. Continuing Problem 13 Paid Multi Systems re September 5 purchase, less discount, cheque No. 243. Received and paid City Electric bill for September, $80, cheque No. 244. Remitted outstanding amount payable to Automated Payroll Service for September wages, $1,810.18, cheque No. 245 . 17 Issued debit memorandum No. 10 to Computer Connection for merchandise returned from purchase order No. 4012,$100. 17 Paid net amount due to Computer Connection, less discount, cheque No. 246. 23 Paid Alpha Office Co. the amount due from the end of August, cheque No. 247. 25 Paid for office supplies, $50, cheque No. 248. 27 Wrote cheque No. 249 to Able Holdings Inc. for September, October, and November rent, $1,200.00. 30 Wrote cheque No. 250 to Automated Payroll Service for September wages, $3,740.20 30 Paid amount due to West Bell Canada as of August 31 plus the September phone 30 Paid amount due to West Bell Canada as of August 31 plus the September phone bill received September 13 , cheque No. 251. Total $216.00. 1. Journalize the transactions in the appropriate journals (cash payments, purchases, or general journal). 2. Record in the accounts payable subsidiary ledger and post to the general ledger as appropriate. A partial general ledger is included in the Excel templates in MyLab Accounting. 3. Prepare a schedule of accounts payable as of September 30,2022. Comprehensive problem: journalizing and posting to the general and subsidiary ledgers (1) 8(120min) Check Figure Cash Payments Journal Cash Column $8,448.88 Check Figure New Schedule of Accounts Payable $625.00